Search results for "PT"

Noya.ai Research Report: The Revolution of Prediction Market Agents under the AI×DeFi Narrative

Author: 0xjacobzhao

In our previous Crypto AI series reports, we consistently emphasized the following point: the most practically valuable scenarios in the current crypto space are mainly focused on stablecoin payments and DeFi, while Agents are the key interface between AI industry and users. Therefore, in the trend of integrating Crypto and AI, the two most valuable paths are: in the short term, AgentFi based on existing mature DeFi protocols (such as lending, liquidity mining, and other basic strategies, as well as advanced strategies like Swap, Pendle PT, and funding rate arbitrage), and in the medium to long term, Agents centered around stablecoin settlement and relying on protocols like ACP/AP2/x402/ERC-8004.

DEFI0.08%

PANews·01-06 03:18

RateX smashed 44.18 million tokens for the community! Solana yield protocol 10x leverage play decrypted.

The Solana ecological yield protocol RateX has announced the RTX tokenomics, with a total supply of 100 million tokens, of which 44.18% is allocated to the community. RateX splits yield products into principal tokens (PT) and yield tokens (YT), allowing users to trade YT to speculate on yield rate changes, with a maximum support of 10x leverage. The protocol was launched on Solana in 2024.

USDE-0.04%

MarketWhisper·2025-12-22 05:57

Robinhood enters Indonesia's market of 270 million people! Dual acquisitions cause stock price to drop 3.74%

Robinhood (HOOD) officially announced on December 8 that it has signed agreements to acquire Indonesian local brokerage Buana Capital Sekuritas and licensed digital asset trader PT Pedagang Aset Kripto. Following the announcement, HOOD's stock price dropped by 3.74%, closing at around $22.50, with trading volume increasing by 25%.

ETH-2.15%

MarketWhisper·2025-12-08 06:33

Exclusive Interview with the Founder of Pendle: The Road to the Empire of Yield Trading

Author: Jonathan Ma, founder of Artemis; Translated by: Golden Finance xiaozou

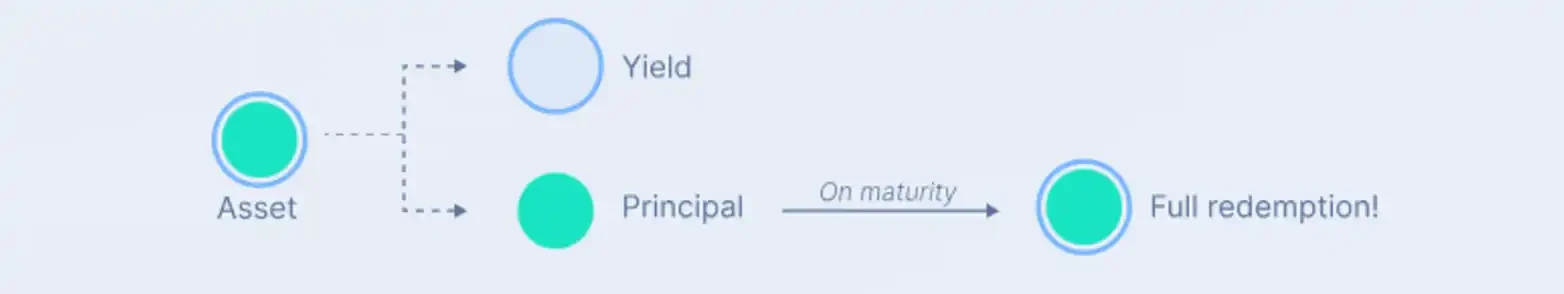

Recently, we interviewed Pendle founder TN Lee. Pendle has become one of the fastest-growing fixed income and yield trading protocols in the DeFi space, with a total locked value (TVL) surpassing billions of dollars, and stablecoins accounting for over 80% of the liquidity. By splitting assets into principal tokens (PT) and yield tokens (YT), Pendle has created a bilateral market that satisfies both risk-averse investors seeking predictable returns and risk-seeking traders chasing points and excess returns.

This article will delve into the development history of Pendle, future opportunities, and the strategic layout for seizing the $140 trillion global fixed income market.

1. Hello TN! Pendle was founded in 2020. Could you share your entrepreneurial story with us? You founded Pend

金色财经_·2025-12-02 00:06

Kamino announces an increase of $10 million in PT-eUSX deposit capacity

According to Mars Finance, on November 6th, the Solana ecosystem liquidity protocol Kamino announced an increase of 10 million USD in PT-eUSX deposit capacity, with eUSX being a liquid staking Token under Solstice.

MarsBitNews·2025-11-06 01:20

The PT of USDe and sUSDe under Ethena Labs has been launched on Aave Plasma.

According to Mars Finance news, on October 20, Ethena Labs officially announced on social media that the PT tokens of USDe and sUSDe have been launched on the Aave Plasma platform, with a supply limit of 200 million USD for each token. Given that the borrowing interest rate for USDT remains around 4%, Plasma has now become the best on-chain place for users to obtain leveraged PT positions through Aave. Multiple rounds of quota increases are expected in the near future.

MarsBitNews·2025-10-20 12:06

Exclusive Interview with Pendle Founder: The Road to the Empire of Yield Trading

Author: Jonathan Ma, Founder of Artemis; Translator: Jinse Finance xiaozou

Recently, we interviewed TN Lee, the founder of Pendle. Pendle has become one of the fastest-growing fixed income and yield trading protocols in the DeFi space, with a total locked value (TVL) surpassing several billion dollars, and stablecoins accounting for over 80% of liquidity. By splitting assets into principal tokens (PT) and yield tokens (YT), Pendle has created a bilateral market that satisfies both risk-averse investors seeking certain returns and risk-seeking traders chasing points and excess returns.

This article will delve into the development history of Pendle, future opportunities, and the strategic layout for seizing the 140 trillion US dollar global fixed income market.

1. Hello TN! Pendle was established in 2020. Could you share with us the story of how you started Pendle?

PENDLE-1.81%

金色财经_·2025-10-20 04:52

Coinbase Maintenance Falls on XRP ETF Decision Day, Is This Coincidence

XRP analyst ChartNerd has drawn attention to a curious overlap between Coinbase’s scheduled system upgrade and an expected SEC decision date for spot XRP ETFs.

Coinbase Announces Maintenance Window

Additionally, futures and derivatives trading will be unavailable from 4:00 AM to 1:00 PM PT due to

XRP0.73%

TheCryptoBasic·2025-10-15 08:21

Coinbase Exchange will carry out a system upgrade as scheduled on October 25.

Coinbase Markets has announced a system upgrade on October 25 at 7:00 AM PT, during which all trading functions will be temporarily suspended for up to four hours to improve performance and user security.

TapChiBitcoin·2025-10-14 03:16

Pendle is suspected of being attacked by a token minting dumping, the official: the protocol is safe and not hacked.

The decentralized yield tokenization protocol Pendle has reported that an on-chain wallet has been cleared out, with someone suspected of minting and dumping a large amount of PT/YT tokens, causing the price of PENDLE to experience a big dump. However, the officials emphasized that the protocol itself has not been hacked, and funds are still safe.

Suspected vulnerability behavior exposed: attackers are minting and dumping coins on a large scale.

Pendle announced on September 30th (Monday) via X that an on-chain Wallet had been emptied, and the attacker is suspected of continually minting Principal Tokens (PT) and Yield Tokens (YT) in the Pendle protocol, quickly dumping these Tokens for profit.

This behavior has raised market alertness, with users questioning whether there are minting vulnerabilities in the protocol or if there has been some kind of internal operation.

Official clarification: The protocol has not been hacked, and the funds are safe.

Facing community panic, Pen

PENDLE-1.81%

ChainNewsAbmedia·2025-10-01 01:45

Gate Decentralized Finance Daily ( September 16 ): Base "Exploring Issue Coin" Ignites Market Enthusiasm; DEX volume increases by 25%

As of September 16, the total DeFi TVL across the network remains firmly above $160 billion, with DEX trading volume exceeding $19.4 billion, a significant increase of 25% compared to the previous day. The trading activity of Solana and Ethereum has significantly increased, while the DEX trading volume within the Base ecosystem has also surged due to the potential Favourable Information from "exploring issue coin". On the other hand, the Pump protocol fees have soared to the second highest across the network, Pendle has launched cross-chain PT, and Ethena is preparing to switch fees, all indicating that core protocols are continuously iterating in terms of functional expansion and revenue models. The overall market is experiencing a turbulent consolidation, with some DeFi blue-chip tokens strengthening.

MarketWhisper·2025-09-16 09:28

Scheduled Maintenance Notice – September 18, 2025

XTZ deposits and withdrawals will be temporarily suspended on September 18, 2025, at 1:00 AM (PT) for a protocol upgrade. Transactions should be completed before this time; Buy/Sell services may continue unless assets are affected. Further updates will be provided.

BitcoinInsider·2025-09-15 19:46

Pendle: Building the Blueprint for DeFi Fixed Income in the Era of Yield Splitting and Restaking

Pendle has evolved from a niche experiment into a DeFi blue chip, using PT/YT yield-splitting to bring fixed income markets on-chain and driving its TVL from millions to billions.

LSDfi and LRTfi turned Pendle into a yield hub, where users hedge or leverage staking and restaking rewards, with

CoinRank·2025-09-10 10:23

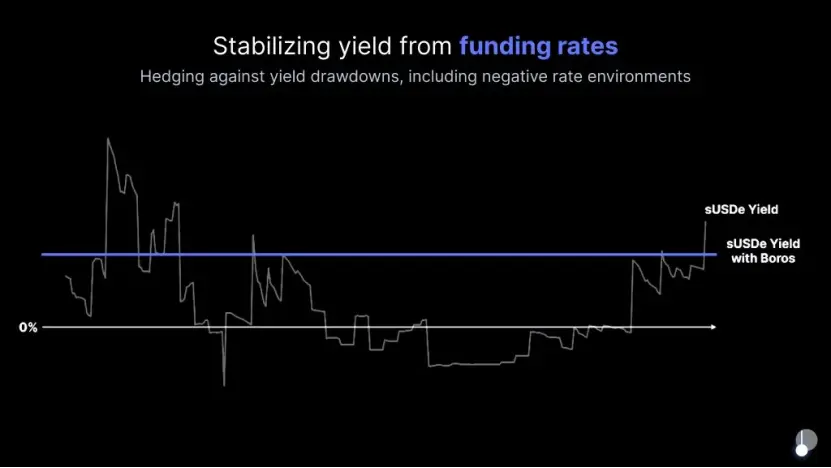

Pendle's strategic transformation: Boros emerges, innovating the funding rate trading paradigm.

Author: J.A.E, PANews

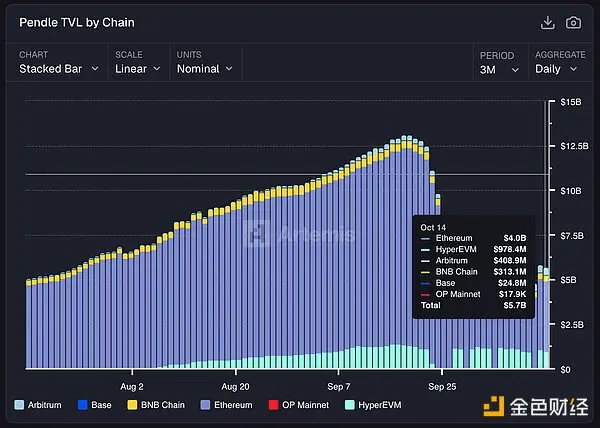

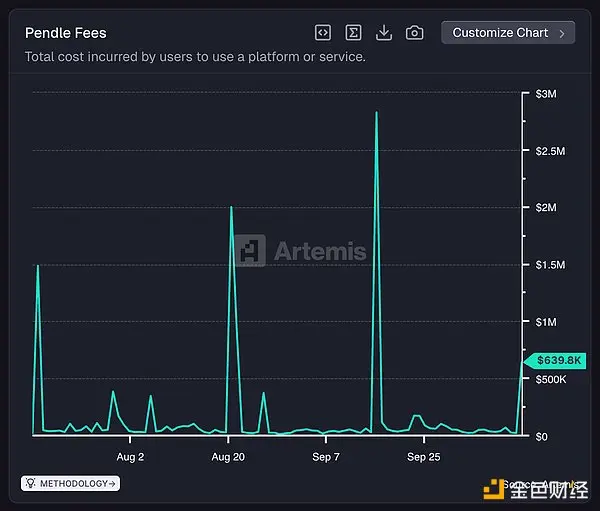

Pendle, which innovates on-chain yield trading with the PT/YT mechanism, is expanding its territory into the trillion-dollar derivatives market. On August 6, 2025, its new product Boros will launch, achieving on-chain tokenization and hedging of perpetual contract funding rates for the first time, marking a key strategic shift for Pendle from a "yield management protocol" to "DeFi interest rate infrastructure."

In the past year, Pendle has achieved explosive growth, with TVL surpassing 10 billion USD, and it is no longer limited to splitting existing yields but is committed to building a complete on-chain yield curve.

Nansen once pointed out: "Pendle is becoming the interest infrastructure in the DeFi space." The birth of Boros is a core piece in realizing that ambition.

Boros Core Mechanism: The "Interest Rate Derivatives" Market for Funding Rates

PENDLE-1.81%

PANews·2025-08-11 12:37

KKI & NTU Partnership: Boosting Crypto Education & Digital Innovation in Indonesia!

PT Kliring Komoditi Indonesia (KKI) collaborates with Nanyang Technological University (NTU) to enhance crypto literacy among youth, blending academic learning with hands-on experience in digital finance, aiming to create innovative leaders for Indonesia's crypto sector.

IN-0.78%

Coinstagess·2025-08-10 12:01

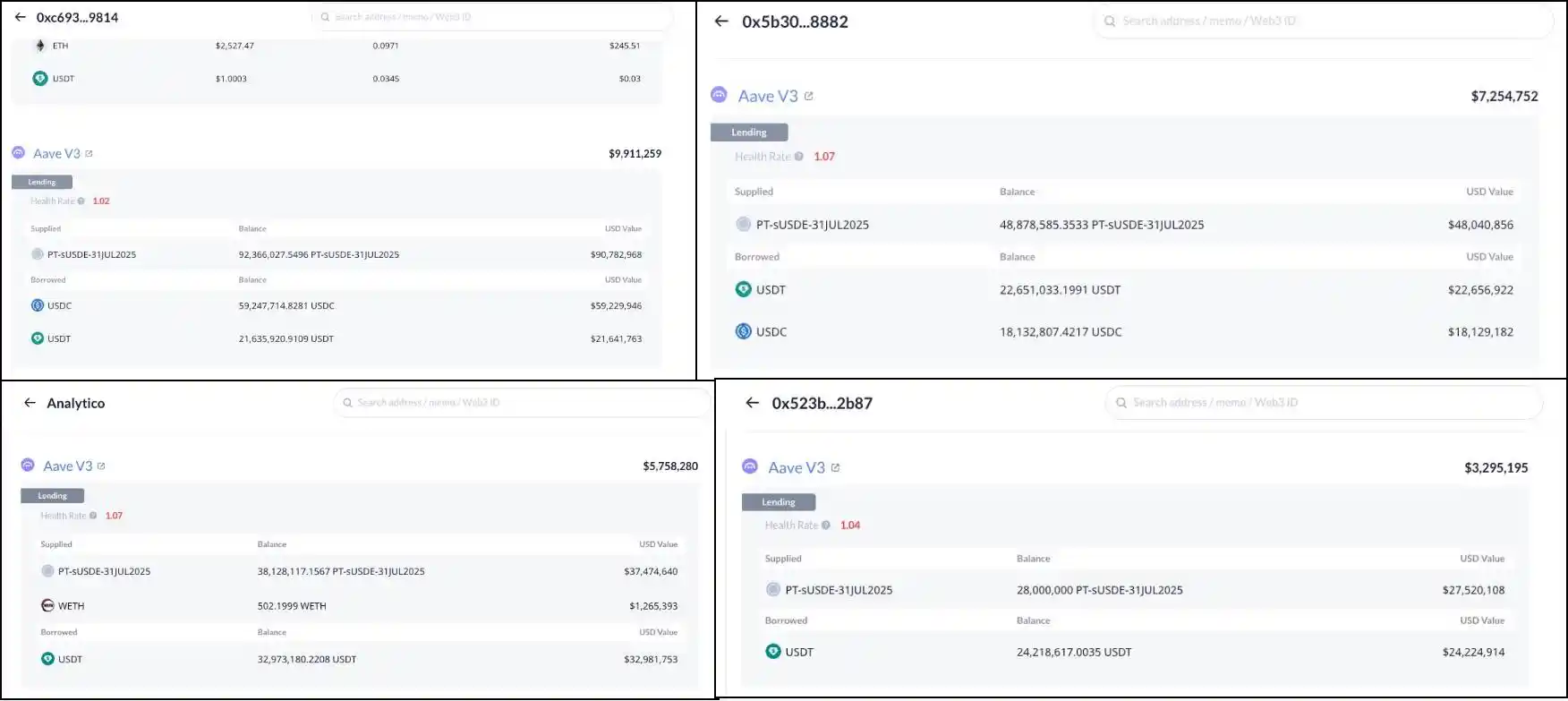

Decentralized Finance Lego Game: Unveiling the Billion Rise Flywheel of Ethena, Pendle, and Aave

Original text: Shaunda Devens, Blockworks Research analyst

Compiled by: Yuliya, PANews

In the past 20 days, the supply of Ethena's decentralized stablecoin USDe has increased by approximately $3.7 billion, mainly driven by the Pendle-Aave PT-USDe cyclical strategy. Currently, Pendle has locked approximately $4.3 billion (60% of the total USDe supply), while Aave has about $3 billion in deposits. This article will break down the PT cyclical mechanism, growth drivers, and potential risks.

PANews·2025-08-07 07:10

Yield Magnetism and System Elasticity: How to Rationally View Ethena × Pendle's YT Arbitrage

Author: TEDAO

Introduction:

With the rising popularity of Ethena, a crowded arbitrage chain is operating at high speed: collateralizing (e/s) USDe to borrow stablecoins on Aave, buying Pendle's YT/PT to earn returns, and partially supplying PT back to Aave to leverage the position, in order to gain Ethena points and other external incentives. The results are evident: the collateral exposure of PT on Aave has sharply increased, with the utilization rate of mainstream stablecoins pushed to over 80%, making the entire system more sensitive to any fluctuations.

This article will deeply analyze the operation of this capital chain, its exit mechanism, and the risk control designs of Aave and Ethena. However, understanding the mechanisms is just the first step; true mastery lies in analyzing the upgrades of the framework. We often tend to use data to segment.

TechubNews·2025-07-31 02:36

How to Rationally View the YT Arbitrage of Ethena × Pendle

Introduction:

As the popularity of Ethena rises, a crowded arbitrage chain is operating at high speed: collateralizing (e/s) USDe to borrow stablecoins on Aave, buying Pendle's YT/PT to gain returns, and partially supplying PT back to Aave to cycle and leverage, in order to earn Ethena points and other external incentives. The results are obvious: the collateral exposure of PT on Aave has sharply increased, the utilization rate of mainstream stablecoins has been pushed to a high of over 80%, and the entire system has become more sensitive to any fluctuations.

This article will delve into the operation of this capital chain, the exit mechanism, and the risk control design of Aave and Ethena. However, understanding the mechanism is just the first step; true mastery lies in analyzing the upgrades of the framework. We often tend to use data analysis tools (such as

金色财经_·2025-07-30 11:37

The core token PT of the GOUT "Phoenix Project" is launched, and the MemeFi value flywheel officially starts.

On July 8, after successfully completing the global Node hot subscription, the highly anticipated Meme community project GOUT (GT) ecosystem officially announced that its core value Token PT of the "Phoenix Project" has been successfully launched and the channel for ordinary users to participate in stake has been fully opened. This is not only a decisive milestone in the development history of the GOUT ecosystem but also marks that its grand MemeFi strategy has officially entered a new stage of value realization from theoretical conception.

PT, as the core Token of the Phoenix Plan, is designed to ensure fairness from the ground up. A total of 21 billion PT has been 100% injected into the DEX liquidity pool, with no team reserves or private placement shares, achieving complete community-oriented and decentralized governance.

MEMEFI-3.75%

TechubNews·2025-07-13 16:42

Coinbase System Upgrade, New Timelines to Keep in Mind - Coinspeaker

Key Notes

Coinbase system upgrade rescheduled to August 2, 2025, at 7:00 AM PT.

Services like trading, deposits, and withdrawals may face disruptions.

New tokens QCAD, SKY and USDS added to roadmap and Wormhole is now live.

Coinbase will perform a system upgrade on Saturday, August 2, 2025, st

Coinspeaker·2025-07-04 07:42

Coinbase Issues Upgrade Alert, Adds Two New Cryptos: Details

Major crypto exchange Coinbase has issued an upgrade alert while adding two new cryptocurrencies to its ever-expanding lineup.

In a recent tweet, Coinbase announced an imminent platform upgrade. A Coinbase systems upgrade is scheduled for 7:00 a.m. PT on Saturday, July 19, 2025, with a duration

UToday·2025-06-25 13:47

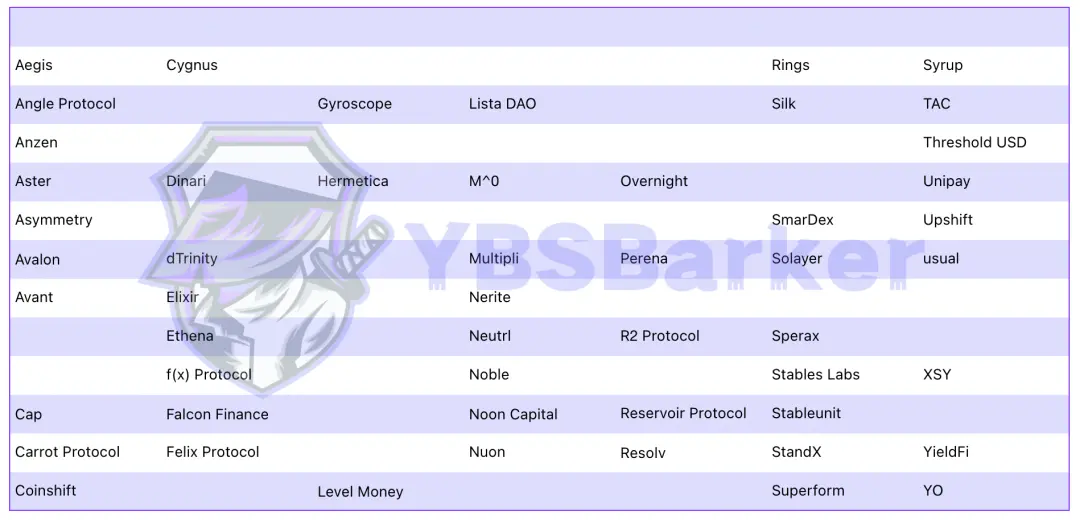

After researching 100 yield-generating stablecoins, we found 5 Promising Cryptos.

Stablecoins are becoming the market Consensus.

The acquisition of Bridge by Stripe is just the beginning. Huma uses stablecoins to replace the intermediary role of banks, and Circle has become the new darling of the coin industry after Coinbase with USDC. All of the above are poor imitations of USDT.

Ethena takes the lead, MakerDAO rebranded to Sky to pivot towards earning stablecoins, with Pendle, Aave, and others quickly moving into USDC–PT/YT–USDe.

GateUser-6bbdc2fc·2025-06-12 03:05

Crypto market——a utopia invaded by macroeconomics

> Crypto Assets will once again become a part of the macro economy, no longer independent of the traditional market's Fluctuation.

Written by: Musol

Introduction: I still remember when Bitcoin first became popular; it was an exhilarating time, and everyone in the circle was talking about the "decentralization revolution," as if holding the key to the future. But now, how things have changed. Open any Crypto Assets community, and you are greeted with discussions about "how many basis points the Federal Reserve will raise interest rates" and "how the CPI data exceeded expectations."

How did the crypto market we once envisioned turn from a technological utopia into an echo of the macroeconomy?

An asset class that boasts of wanting to overturn the old world now seems like a spineless follower, daily hanging on Powell's every word to make a living, which is truly sad and laughable.

Pt.1. Where does the macro color of the Crypto Assets market come from?

We all know that the Crypto Assets market

BTC-0.14%

ForesightNews·2025-05-29 00:13

A Deep Dive into the Real Yield of Pendle YT Leveraged Yield Strategies

Author: @Web3Mario

Abstract: In the previous article, we elaborated on the interest rate risk of leveraging yield strategies using AAVE's Pendle PT, and many friends provided positive feedback; we thank everyone for their support. Recently, I have been researching market opportunities within the Pendle ecosystem, so this week I would like to continue sharing an observation about the Pendle ecosystem, namely the real yield and risks of the YT leveraged points strategy. Overall, using Ethena as an example, the current potential return rate of the Pendle YT leveraged points strategy can reach 393%, but it is still important to pay attention to the investment risks involved.

Utilize the leverage property of YT assets to speculate on the potential return rate of Point.

First, it is necessary to briefly introduce this profit strategy. In fact, at the beginning of 2024, as the

PENDLE-1.81%

金色财经_·2025-05-26 12:04

Annualized 393%: A Deep Dive into the Real Yield and Risks of Pendle YT Leverage Points Strategy

Author: @Web3Mario

Abstract: In the previous article, we discussed the exposure rate risk of leveraging yield strategies using AAVE's Pendle PT, and many friends provided positive feedback. Thank you all for your support. Recently, I have been researching market opportunities within the Pendle ecosystem, so this week I hope to continue sharing an observation about the Pendle ecosystem, namely the actual yield and risk of the YT leveraged points strategy. Overall, taking Ethena as an example, Pendle.

PENDLE-1.81%

DeepFlowTech·2025-05-26 05:04

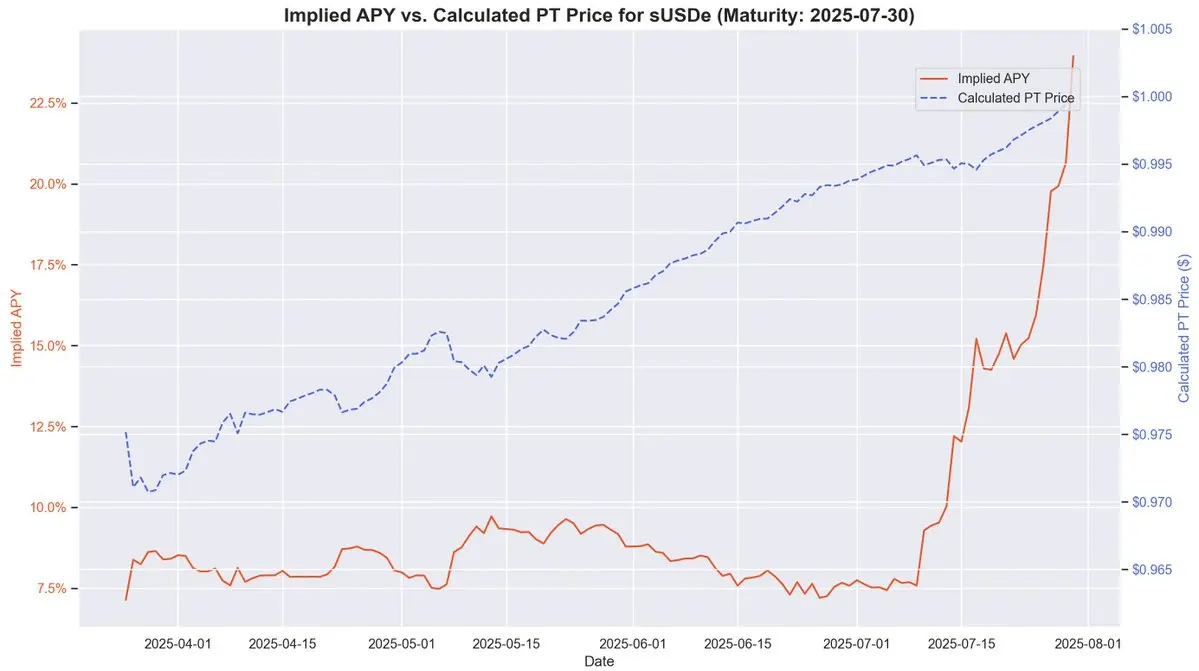

Analyze the mechanism and risks of the PT leverage yield flywheel of AAVE, Pendle, and Ethena.

> Original Title: "Beware of Discount Rate Risks: The Mechanisms and Risks of the PT Leverage Yield Flywheel of AAVE, Pendle, Ethena"

> Original author: @Web3\_Mario

Abstract: Recently, work has been a bit busy, so the updates have been delayed for a while. Now we are resuming the weekly update frequency, and I would like to thank all dear friends for their support. This week, I discovered an interesting strategy in the DeFi field that has received widespread attention and discussion, which is to use Ethena's staking yield certificate sUSDe in Pendle's fixed yield certificate PT-sUSDe as the source of yield, and leverage the AAVE lending protocol as the source of funds to conduct interest rate arbitrage and obtain leveraged returns. In some DeFi on platform X.

世链财经_·2025-05-21 13:15

Beware of discount rate risks: the mechanisms and risks of the PT leverage yield flywheel of AAVE, Pendle, and Ethena.

> The PT leveraged mining strategy of AAVE+Pendle+Ethena is not a risk-free arbitrage strategy, and the discount rate risk of PT assets still exists. Therefore, participating users need to objectively assess, control the leverage ratio, and avoid getting liquidated.

Written by: @Web3\_Mario

Summary: Recently, work has been a bit busy, which has delayed updates for a while. We are now resuming the weekly update frequency, and I would also like to thank all my dear friends for their support. This week, I found that in

ForesightNews·2025-05-21 05:30

Indonesia suspends Worldcoin and WorldID services due to violations of electronic system regulations.

The Indonesian Ministry of Communication and Information Technology has temporarily revoked the operating licenses of Worldcoin and WorldID service providers, and is investigating PT. Terang Bulan Abadi and PT. Sandina Abadi Nusantara for suspicious activities. The companies involved are not registered as PSE and do not have the necessary certificates. The department plans to summon these two companies to investigate the violations.

WLD0.77%

DeepFlowTech·2025-05-05 01:39

Pendle Weekly Overview: Pendle has launched Sonic, and external protocols will deploy the Pendle market through Community Launch on their own.

Pendle has announced the Community Launch, allowing external protocols to deploy their own Pendle markets, and has also introduced the dedicated UI for Pendle Prime. Last week, Pendle TVL hit an all-time high, and lvlUSD was launched on Pendle. Pendle has gone live with Sonic, offering high APY pools. Current Top PT APY includes wstkscUSD and wstkscETH.

世链财经_·2025-03-03 16:08

Monster Hunter Wilds Extends the Open Beta Test 2’s Second Week By 24 Hours After PSN Outage

Capcom’s Monster Hunter Wilds announced the extension of the game’s open beta test 2’s second week by 24 hours on all platforms to compensate for the PlayStation Network (PSN) outage experienced on February 7. The developers revealed the new dates for the OBT 2 second week as February 13, 7 PM PT /

Cryptopolitan·2025-02-10 17:22

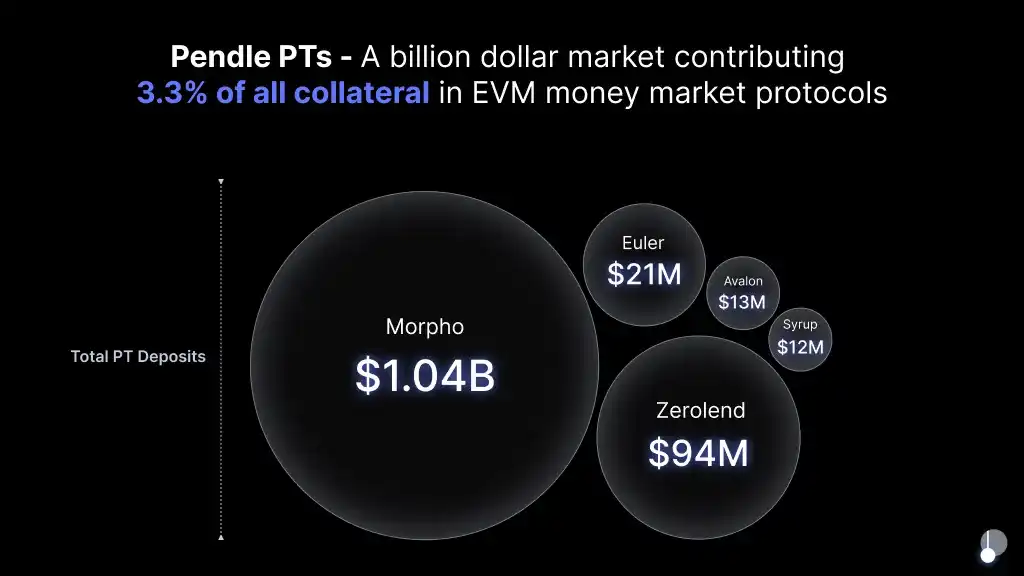

Pendle 2024 Annual Summary and Future Outlook

1. **Pendle's rise and milestones**: Since its establishment in 2020, the Pendle team has been committed to introducing fixed Interest Rate into the Decentralized Finance field. 2024 is a milestone year for Pendle, with the Total Value Locked (TVL) rising from $230 million to $4.4 billion, and the daily trading volume rising nearly 100 times.

2. **Decentralized Finance Engine and Market Expansion**: Pendle has launched nearly 200 multi-asset, multi-term liquidity pools on 5 different chains, serving as the launch engine for emerging tracks and protocols, while PT (Principal Token) has developed into a sub-economy worth $1.2 billion.

3. **V2 Upgrade**: Pendle plans to fundamentally improve through the V2 version, including opening up the ecological protocol, optimizing dynamic fees, and improving vePENDLE to further expand market share.

4. **Fortress Building Plan**: Pendle aims to reach a trillion-dollar scale, break through the boundaries of the EVM ecosystem through the "Fortress" plan, including expanding PT to non-EVM ecosystems, laying out traditional finance (TradFi) PT, and creating a "Fortress" in accordance with Shariah principles.

5. **Boros New Project**: The Boros project envisioned by Pendle aims to utilize blockchain technology to achieve functionalities that are beyond the reach of traditional financial sectors, especially in the funding rate market. Through Boros, Pendle can significantly expand market coverage and reshape the possibilities in the realm of yield.

律动·2025-02-04 18:00

The post Tesla PT raised to $430 by Morgan Stanley amid AI progress appeared first on Tokenist.

Morgan Stanley raises Tesla's price target to $430 due to progress in autonomous driving and artificial intelligence, emphasizing Tesla's unique capabilities in AI and Robotics. Meanwhile, TikTok denies selling U.S operations to Elon Musk amid debates over restricting foreign apps. Tesla's share price opened and closed at $383.21 and $403.79, respectively on Jan 14th, 2025.

MAJOR-0.1%

CompassInvestments·2025-01-14 14:33

Top five application innovations in 2024

Author: Donovan Choy, Blockworks; Translation: Baishui, Gold Finance

Pendle

The existence of Pendle is due to the speculation of cryptocurrencies.

In the brief history of Pendle, the team has continuously reiterated its yield trading products, using stablecoins and the notorious 'DeFi 2.0' (Olympus DAO) narrative from the bull market in 2021, to liquidity staking tokens, real-world assets on Arbitrum, and liquidity re-staking during 2021.

It wasn't until early 2024 that Pendle's points exploded, and Pendle achieved remarkable success, with its TVL soaring from millions of dollars to tens of billions of dollars. Pendle's Principle Tokens (PT) and

金色财经_·2024-12-30 06:42

The Game Awards 2024: What to Expect From This Year’s Nominations

The Game Awards 2024 nomination announcement will be made later today, November 18, at noon ET, 9 AM PT, and 5 PM GMT. The announcement will include the names of gaming titles for 29 categories, with Game of the Year being the most anticipated category.

Geoff Keighley, an acclaimed video game

GMT3.45%

Cryptopolitan·2024-11-18 14:24

The New Era of Decentralized Finance: Innovative Gaming with Cryptocurrency Trading and Chip Turnover - ChainCatcher

1. Introduction

With the advancement of technology and market adaptation, Decentralized Finance is expected to further change the traditional financial market structure and provide market participants with more efficient, safer, and transparent trading options. This Bing Ventures research outlook looks at the potential impact of Decentralized Finance technology in the future, particularly in improving market inclusiveness, dropping transaction costs, and enhancing market efficiency, with a focus on examples such as following PENDLE and pre-market trading.

Pendle introduces traditional Intrerest Rate trading and financial Derivatives into the blockchain through Tokenization, innovating financial products that separate principal and yield, such as PT and YT. In this way, Pendle not only provides a flexible way of Intrerest Rate trading, but also promotes Liquidity and efficiency in the Decentralized Finance market. Pendle's technical practice separates principal tokens and yield tokens

链捕手·2024-07-12 02:21

In-depth analysis of 'Brother Sun's Arbitrage Method': Buy 33,000 ETH to enjoy a return rate of nearly 20% on PT tokens

TRON founder Justin Sun purchased Pendle PT tokens and achieved nearly 20% annualized return through low-risk arbitrage based on yield trading protocol, which has drawn widespread attention from the community. The protocol generates income by packaging interest-bearing tokens into SY tokens and then splitting SY into PT and YT components. Purchasing PT allows redemption of underlying assets at maturity and can be sold at any time. Borrowing funds to buy PT for stable income is a capital preservation strategy that mitigates price risk.

星球日报·2024-06-06 04:39

Market Volatility Regression Analyzes the Arbitrage Opportunities Existing in Pendle GLP YT

Author: Sleeping in the rain

From the perspective of revenue expectations, YT is very likely to follow the rise of GLP APR, usher in a wave of rebound, and then return to normal levels (higher than the current level), which is also an opportunity in my opinion.

Are there some opportunities at the current price of Pendle GLP YT?

In the following content, I will analyze the logic of this asset opportunity from the following two perspectives:

How Pendle PT YT works

The reasons for the sluggish APR of GLP and whether there is data support for bottoming out

How Pendle PT YT works

The value of the original asset (currency-based principal + currency-based income) within a specific time interval = PT+YT

PT stands for principal and YT stands for yield. Because at the beginning, the value of the original asset in a specific time has been fixed, so PT and YT...

金色财经_·2023-08-22 07:00

Load More