Search results for "SBR"

US Treasury Confirms Seized Bitcoin Will Build National Reserve

The U.S. Treasury will retain all seized Bitcoin in the Strategic Bitcoin Reserve (SBR) instead of selling it. This budget-neutral approach prioritizes asset forfeitures to grow the reserve, aiming to secure digital wealth and stabilize the market.

BTC-0.39%

CryptoFrontNews·01-21 20:41

American hamburger chain Steak’n Shake expands BTC strategic reserves, increases Bitcoin holdings by millions of dollars

American burger chain brand Steak'n Shake announces increased holdings of approximately $10 million in Bitcoin and fully accepts Bitcoin payments. This move has driven sales growth, improved customer service, and created a self-reinforcing cycle. Steak'n Shake's strategic Bitcoin reserve (SBR) is used to manage cryptocurrency income, demonstrating the potential application of Bitcoin in the physical dining industry.

BTC-0.39%

ChainNewsAbmedia·01-19 02:47

CoinShares: The Digital Asset Treasury "bubble has basically burst," the next generation of DAT cannot blindly issue debt to hoard tokens

James Butterfill, Head of Research at digital asset management firm CoinShares, stated that the speculative bubble of Digital Asset Treasuries (DAT) has indeed burst from many perspectives.

(Previous context: Texas spent $5 million to purchase BlackRock IBIT: After DAT fizzles out, can SBR take over and reignite the Bitcoin bull market?)

(Background supplement: Wall Street resists DAT? MSCI considers excluding "crypto treasury companies" like MicroStrategy from index components)

James Butterfill, Head of Research at digital asset management firm CoinShares, published a lengthy blog post on December 5, directly pointing out: Digital Asset T

動區BlockTempo·2025-12-05 16:43

Thai homeowner sells house for only 3.88 Bitcoins! Net comments: betting on BTC's high fluctuation.

A brand new riverside luxury apartment in Bangkok, Thailand, has been listed for sale with shocking conditions: no Thai Baht, no US Dollars, only Bitcoin accepted, and the price firmly locked at 3.88 BTC, leading to a flurry of comments from netizens. (Background: After spending 5 million USD to acquire BlackRock IBIT: DAT has cooled down, can SBR take over and reignite the Bitcoin bull run?) (Additional context: Swiss crypto bank Sygnum partners with Debifi to launch the Bitcoin lending platform MultiSYG, focusing on allowing users to retain control of their assets.) Threads user Edward Lai recently shared a property listing: a brand new luxury riverside apartment in the center of Bangkok, where the owner insists on "only accepting Bitcoin" and has firmly set the price at 3.88 BTC. The post indicates that this transaction was initially valued at about 126,000 USD when Bitcoin reached its historical high this year.

動區BlockTempo·2025-11-27 16:50

The Bitcoin four-year cycle has ended, replaced by a more predictable two-year cycle.

The core of the new cycle is the cost basis and profit and loss situation of ETF holders. Fund managers face annual performance pressure, which may trigger concentrated buying and selling actions, forming a price turning point. This article is derived from a piece by Jeff Park, organized, translated, and written by ForesightNews. (Background: Texas in the U.S. invested $5 million to buy BlackRock's IBIT: DAT has cooled down, can SBR take over to reignite the Bitcoin bull run?) (Additional Background: Nobel Prize-winning economist warns: Trump's trades are failing, and the big dump of Bitcoin is the reason.) Bitcoin has historically followed a four-year cycle, which can be described as a combination of mining economics and behavioral psychology. Let's first review the implications of this cycle: each Halving mechanically reduces new supply and tightens miner profit margins, forcing weaker participants out of the market, thus reducing sell.

動區BlockTempo·2025-11-27 15:19

Texas purchases $5 million in BlackRock IBIT: Can SBR take the baton and reignite after DAT goes silent?

Author: Yangz, Techub News

After experiencing two consecutive "Black Friday" crashes, Bitcoin has nearly erased the gains of the past six months, and the market has plunged into a bone-chilling cold. However, the warming forces seem to be coming from all directions: from the continued warming of expectations for interest rate cuts in December to the successive approvals of various altcoin ETFs, this wave of warmth has now extended to the state-level "Strategic Bitcoin Reserve" (SBR) in the United States.

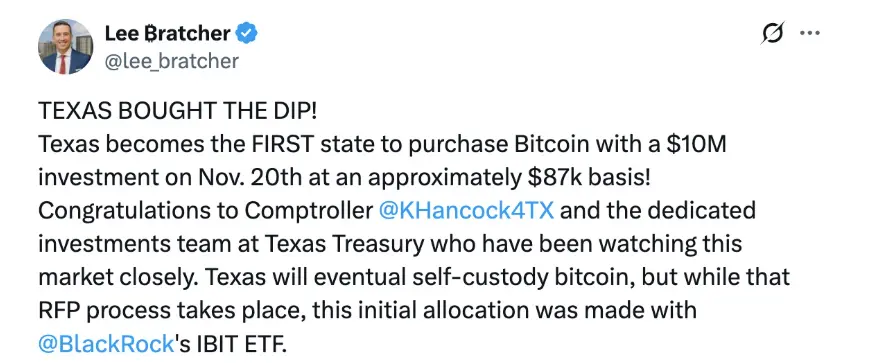

Early this morning, Lee Bratcher, chairman of the Texas Blockchain Association, announced that the state has officially launched a Bitcoin Reserve Program and has completed its first purchase of a $5 million BlackRock Bitcoin Spot ETF (IBIT). At this moment, the cold market sentiment seems to have heard the crisp echo of ice cracking.

Texas Breaks the Ice: $5 Million "Leads" Bitcoin Reserves Strategy Among U.S. States

When the market is still short

BTC-0.39%

PANews·2025-11-27 11:12

Cynthia Lummis: Bitcoin is the only solution to save U.S. Treasury bonds! Supports Trump's "BTC Strategic Reserve"

U.S. Senator Cynthia Lummis yesterday addressed the record-long government shutdown, stating that the idea of Bitcoin reserves is "the only way for the U.S. to handle its trillions of dollars in national debt."

(Background: The U.S. government shutdown lasted 35 days, tying the longest record, draining liquidity and causing a sharp decline in Bitcoin and the stock market.)

(Additional context: Arthur Hayes predicts that uncontrolled U.S. debt will force the Fed to activate covert QE, igniting a Bitcoin bull market.)

In March, President Trump issued an executive order requiring the Treasury Department to establish a "Strategic Bitcoin Reserve" (SBR) and authorized the long-term holding of cryptocurrencies confiscated by law enforcement.

Wyoming Senator Cynthia Lummis yesterday expressed support for the idea of Bitcoin reserves as a solution to the ongoing government shutdown and the broader debt crisis.

動區BlockTempo·2025-11-05 17:13

Why is Bitcoin Price Up Today?

Bitcoin continues to dominate headlines as it breaks past $124,000, fueled by renewed optimism surrounding the U.S. Strategic Bitcoin Reserve (SBR). This excitement follows Senator Cynthia Lummis’s remarks that funding for the reserve “can start anytime,” a move widely seen as a major step toward le

BTC-0.39%

BitcoincomNews·2025-10-07 08:22

Alex Thorn: The United States is highly likely to establish a strategic Bitcoin reserve this year, and the market seriously underestimates the prospects.

Alex Thorn, the research director at Galaxy Digital, recently stated that the market has "completely underestimated" the possibility of the U.S. government announcing the establishment of a strategic Bitcoin reserve (SBR) by the end of this year. Although some industry insiders are skeptical about this, recent legislative and policy trends seem to be paving the way for this historic initiative.

BTC-0.39%

MarketWhisper·2025-09-15 02:01

US Rules Out Direct Bitcoin Purchases for Strategic Reserve, Sparking Debate

Treasury Secretary Scott Bessent states the US won't buy Bitcoin for its Strategic Bitcoin Reserve, relying instead on legally seized assets. Senator Cynthia Lummis proposes the BITCOIN Act to revalue gold reserves for SBR expansion, offering a budget-neutral alternative to enhance the US's position in the digital asset race.

BTC-0.39%

ICOHOIDER·2025-08-15 08:22

Bitcoin Reserve Plan Gets Federal Reserve Review In Report

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

A new Federal Reserve research note has given the most detailed official assessment to date of proposals to finance a US Strategic Bitcoin Reserve (SBR) by

Bitcoinistcom·2025-08-07 11:18

Texas Bitcoin Reserve Might Pass Without the Governor's Signature

Texas Governor Greg Abbott has yet to sign Senate Bill (SB) 21, which would establish a Strategic Bitcoin Reserve (SBR) for the state.

BTC-0.39%

BeInCrypto·2025-06-21 04:30

Connecticut Lawmakers Pass Bill Banning State Investments In Crypto

Connecticut passed a bill to ban the state from holding or investing in cryptocurrencies and impose several new provisions for money transmitters, joining the list of US states opting out of a Strategic Bitcoin Reserve (SBR).

Connecticut Bans State Crypto Investments

On Tuesday, Connecticut

BitcoinInsider·2025-06-12 04:30

US Military Backs Bitcoin Reserve To Counter China: Lummis

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

United States Senator Cynthia Lummis (R-Wyo.) says elements of the nation’s uniformed leadership are now “big supporters” of plans to build a Strategic Bitcoin Reserve (SBR), marking the first

BTC-0.39%

Bitcoinistcom·2025-06-04 15:04

Bitcoin Report Delayed: US Treasury Silent After Deadline

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Two months after US President Donald J. Trump signed an executive order to establish a Strategic Bitcoin Reserve (SBR), the US Treasury Department has missed its most consequential deadline yet,

BTC-0.39%

Bitcoinistcom·2025-05-07 05:04

According to Techub News, the Satoshi Action Fund posted on X stating that New Hampshire has officially signed HB 302, becoming the first state in the nation to pass legislation for a "Strategic Bitcoin Reserve" (SBR). The bill authorizes the state treasurer to purchase Bitcoin or digital assets with a market capitalization of over $500 billion, setting a holding limit of 5% of total reserve funds. Reserve assets must be custodied through a multi-signature mechanism or exchange products compliant with U.S. regulations, ensuring transparency and security. The bill will officially take effect in 60 days.

TechubNews·2025-05-07 02:23

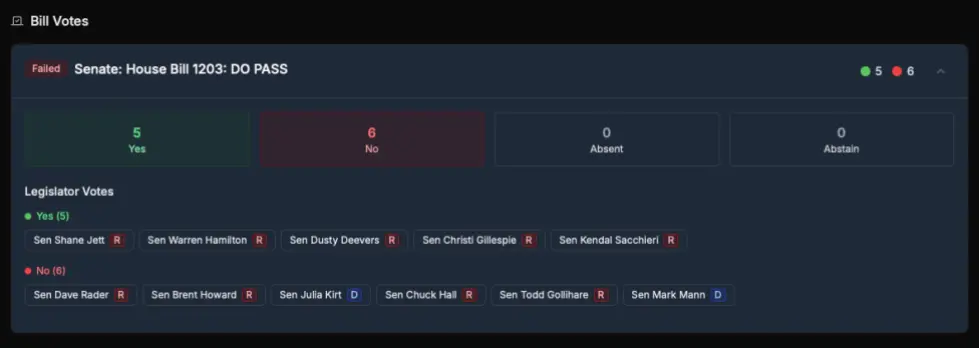

Oklahoma Out Of Bitcoin Reserve Race As Senate Rejects Bill

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Oklahoma’s Senate has voted against the Strategic Bitcoin Reserve (SBR) bill introduced in January, leaving it out of the race to establish crypto-based reserves at the state level in the

Bitcoinistcom·2025-04-17 15:08

Bitcoin Reserve: Lummis Confirms Treasury Probes Direct Buys

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

In an interview with Bitcoin commentator Natalie Brunell, Senator Cynthia Lummis (R-WY) reaffirmed her commitment to establishing a US Strategic Bitcoin Reserve (SBR), disclosing that the Treasury D

Bitcoinistcom·2025-04-02 12:38

Bitcoin Critical to American Nation's Prosperity: Michael Saylor

Michael Saylor emphasizes the importance of the Bitcoin Strategic Reserve (SBR) for US prosperity, envisioning it as crucial for digital supremacy and a $10 trillion annual revenue by 2045. He highlights Bitcoin's significance as a global superpower asset and its potential to shape the future economy.

UToday·2025-03-13 09:55

Head of Research, Bitwise: A sober reflection on the over-optimism of the US Bitcoin strategic reserve

Author: Jeff Park

Compilation: Deep Tide TechFlow

Since last November, I have been one of the few voices to be cautious about SBR (Strategic Bitcoin Reserve). So it's not surprising to me to see that we're currently experiencing one of the fastest declines in Bitcoin history.

However, for those with a vision, now is a rare opportunity. Next, I will share with you the specifics of this opportunity. But before we can do that, we need to figure out the root cause of the problem before we can get the right solution.

SBR's failure is that its hastily launched announcement did not pave the way for Bitcoin to become the eventual adoption of a global store of value (SoV).

This is because an SBR in the true sense of the word must rely on multilateral cooperation. And it is this lack of cooperation that has led to today

DeepFlowTech·2025-03-11 07:43

Standard Chartered's Extraordinary Proposal to Fill the U.S. Strategic Bitcoin Reserve!

Geoff Kendrick, head of digital assets research at Standard Chartered, proposed a budget-neutral approach to (SBR) financing the newly formed U.S. Strategic Bitcoin Reserve by acquiring Bitcoin by selling some of the country's gold holdings.

The U.S. government currently has about 760

Bitcoinsistemi·2025-03-08 01:00

How The US Could Buy Bitcoin In A 'Budget-Neutral' Way

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

US President Donald Trump has signed an Executive Order creating a Strategic Bitcoin Reserve (SBR)—a first-of-its-kind program to hold BTC as part of

Bitcoinistcom·2025-03-07 22:31

Bitcoin Now Equivalent to Gold, Says Samson Mow

The Strategic Bitcoin Reserve (SBR) is established in the U.S. through an executive order, sparking mixed reactions in the crypto community. Samson Mow highlights the significance of the SBR equating Bitcoin with gold, despite market uncertainties and price slumps.

UToday·2025-03-07 09:32

Peter Schiff: Trump’s SBR is due to pressure from his donors and conflicted cabinet members

Chief Economist and Global Strategist at Euro Pacific Capital Peter Schiff has revealed that Trump signed an executive order to create a Strategic Bitcoin Reserve while under pressure from his donors and conflicted cabinet members. He argued that Trump wants to create

CryptosHeadlines·2025-03-07 06:41

Bitcoin’s Trojan Horse: Florida Bill Could Turn The GOP Orange

Florida’s Strategic Bitcoin Reserve (SBR) bill could put the cryptocurrency on the state’s balance sheet—while also potentially reshaping the Republican Party’s stance. The bill, officially known as “SB 550: Investments of Public Funds in Bitcoin,” has gained momentum in Tallahassee and drawn

Bitcoinistcom·2025-02-25 10:01

Ouke Cloud Chain: 21 states in the United States have proposed legislation related to BTC strategic reserves, and Utah may be the first to land

The United States has had 21 states propose BTC Strategic Reserve (SBR) related legislative proposals, with Utah making the fastest progress. Its BTC reserve bill has passed the state House Economic Development Committee for review and is awaiting review by the Senate. Oklahoma and Arizona are also following up, with a similar legislative process that may take effect on May 7 this year.

DeepFlowTech·2025-02-12 17:09

$1K to $100K? These New Coins Are Ready for a Massive Breakout

Emerging crypto tokens like Minotaurus (MTAUR), Book of Meme (BOME), ONDA, and SBR are attracting investors in the volatile market, but their long-term stability is uncertain. Thorough research is crucial before investing due to the high price volatility observed among speculative tokens. The emergence of meme-based cryptocurrencies like BOME highlights the market's interest in internet culture digital assets.

CryptoNewsLand·2025-02-09 02:50

South Dakota Likely To Have First Bitcoin Reserve: State Rep

South Dakota Representative Logan Manhart declared on February 4 that his state may soon become the first in the nation to pass a strategic Bitcoin reserve (SBR) bill, citing South Dakota’s notably short legislative session and an imminent deadline in mid-March. “South Dakota has one of the

Bitcoinistcom·2025-02-06 07:32

Analyst Reveals Eye-Opening Facts About US Bitcoin Reserves – Is It Priced In?

The financial market stands at a crucial juncture with the absence of any executive order by US President Donald Trump regarding cryptocurrency or a strategic Bitcoin reserve (SBR). A well-known crypto analyst MacroScope (@MacroScope17) has reignited the discussion through X, questioning whether

CryptoBreaking·2025-01-23 11:00

Your condensed text: Post-Trump, Polymarket reflects reality's impact.

The odds of President Trump creating a Strategic Bitcoin Reserve (SBR) have risen to 41% after falling to 28% on his inauguration day due to no mention of cryptocurrencies. Expectations were high, but change takes time.

CompassInvestments·2025-01-22 15:37

Bitcoin could hit $150,000 or $400,000 by 2025, depending on SBR and Fed interest rates - Blockware - Coinedict

Reports show that cryptocurrency mining firm Blockware Solutions predicts Bitcoin’s price to increase by 58% or quadruple by 2025, based on Donald Trump’s Bitcoin Reserve Plan and Federal Reserve policies. Three main factors affect Bitcoin’s price action, including Trump not following through on his strategic Bitcoin reserve, increasing the adoption of Bitcoin by businesses, and the US government holding a strategic Bitcoin reserve. Eventually, the US government must accumulate more Bitcoin to hit the $400,000 price mark.

Coinedict·2025-01-10 17:01

Trump's policies are not very OK! Experts oppose 'US reserves BTC': fear weakening the US dollar

Recently, the concept of Strategic Bitcoin Reserve (SBR) has started to attract widespread attention. Trump advocates continued holding of the BTC confiscated by the US government, but some proposals go further, such as Senator Lummis' recent legislative proposal to suggest that the US government purchase 100 BTC within five years.

CryptoCity·2024-12-28 03:08

Bitcoin policy org crafts exec order re strategy prep w/Trump admin.

Article in this post:The Bitcoin Policy Institute has drafted an executive order on bitcoin strategic reserves for President Trump.

The order aims to increase the diversity of assets held in the SBR to safeguard the national economy. LINE\_. BREAK Strategic bitcoin reserves are subject to regular

CompassInvestments·2024-12-18 11:21

Trump's BTC reserve strategy is accelerating

Source: Carbon Chain Value

According to Dennis Porter, the founder of the Satoshi Act Fund, US President-elect Donald Trump is considering establishing a Strategic Bitcoin Reserve (SBR) through executive order.

On December 15th, Porter shared on social media platform X that Trump plans to implement this strategy using the Treasury Department's Exchange Stabilization Fund (ESF) after taking office.

Porter said, "Through the foreign exchange stabilization fund, the Ministry of Finance has the right to stabilize the US dollar by purchasing currency. Trump will use this fund to buy Bitcoin."

ESF is usually used to stabilize financial markets during crises, and as of October 2024, its total assets exceeded $200 billion. Historically, the fund has been effective during the 2008 financial crisis and

金色财经_·2024-12-17 06:48

Russia Contemplating Strategic Bitcoin Reserve Amid Growing Crypto Appeal

Anton Tkachev, a State Duma deputy from the New People party, has formally proposed establishing a Strategic Bitcoin Reserve (SBR) amid the asset’s growing popularity

According to reports in Russian State media, the proposal was submitted to the Russian Minister of Finance, Anton

CryptoDaily·2024-12-10 14:04

Strategic Bitcoin Reserve Proposed By Russian State aDeputy

Anton Tkachev, a State Duma deputy from the “New People” party, has formally proposed the establishment of a Strategic Bitcoin Reserve (SBR). Tkachev submitted an appeal to the Russian Minister of Finance, Anton Siluanov, advocating for the creation of a Bitcoin reserve analogous to the country’s

Bitcoinistcom·2024-12-10 07:01

Is it a fantasy for the United States to make a strategic BTC reserve?

Author: Liu Jiaolian

Overnight, BTC pulled back, piercing the 5-day moving average at 96.8k. After briefly breaking through 96k, it rebounded and pulled back to the 5-day moving average at 97.4k this morning. It seems to be a carefully designed hunting operation to liquidate long leveraged positions lying in ambush below 96k.

Today we're going to talk about the US's plan to establish a national strategic BTC reserve (SBR, Strategic Bitcoin Reserve).

In fact, regarding the strategic reserve of BTC, it was first proposed by Little Kennedy in his speech at the Bitcoin2024 conference in July this year. The Education Chain on 2024.7.27

TechubNews·2024-11-25 09:23

Is it a fantasy for the United States to establish a strategic BTC reserve?

Author: Liu Jiaolian

Overnight, BTC pulled back and pierced the 5-day moving average at 96.8k. After briefly breaking through 96k, it rebounded and pulled back to the 5-day moving average at 97.4k this morning. It seems like a well-designed hunting operation to liquidate the long leveraged positions lying in ambush below 96k.

Today let's talk about the US's plan to establish a Strategic Bitcoin Reserve (SBR) as a national strategy.

In fact, the matter of strategic reserve BTC was first proposed by President Kennedy in his speech at the Bitcoin2024 conference in July this year. In the article 'BTC will definitely enter the era of national reserves' published by Jiaolian on July 27, 2024, President Kennedy said that if he is elected as the President of the United States, he will sign an executive order for the US Treasury to purchase 550 every day.

DeepFlowTech·2024-11-25 08:45

Is it a fantasy for the United States to have a strategic BTC reserve?

Let's do a thought experiment.

Author: Liu Jiaolian

Overnight, BTC pullback pierced the 5-day moving average of 96.8k, and once broke through 96k, Rebound rallied and pulled back to the 5-day moving average of 97.4k this morning. It seems to be a well-designed hunting operation to burst the long positions leveraged by lying in ambush below 96k.

Today we're going to talk about the United States' plan to establish a national strategic BTC reserve (SBR, Strategic Bitcoin Reserve).

Actually, the issue of strategic reserve BTC was first raised by Xiao Kennedy during the Bitcoin2024 conference in July of this year. Jiao Chain on 2024.7.27

AICoinOfficial·2024-11-25 06:16

Can Trump Order A Strategic Bitcoin Reserve? Exploring The Law

At the Bitcoin 2024 conference in Nashville, Donald Trump unveiled his proposal to establish a Strategic Bitcoin Reserve (SBR) for the United States upon his return to office. The plan has swiftly captured widespread attention, particularly in the wake of Trump’s US electoral victories securing

Bitcoinistcom·2024-11-16 02:06

3 New Cryptos Launched This Week to Keep an Eye On

HAPPY, SBR, and MAJOR, are new cryptocurrencies gaining attention. HAPPY on Solana has a market cap of $25 million, while SBR on Ethereum reached $10 million.

BeInCrypto·2024-11-10 01:00

Load More