Search results for "STETH"

Lido stVaults Launches to Boost Ethereum Staking Efficiency

Lido has launched stVaults on Ethereum, allowing customizable staking setups while maintaining stETH liquidity. This modular approach enhances security and flexibility, although concerns about centralization persist. stVaults may redefine Ethereum staking and attract more institutional users.

Coinfomania·01-31 09:21

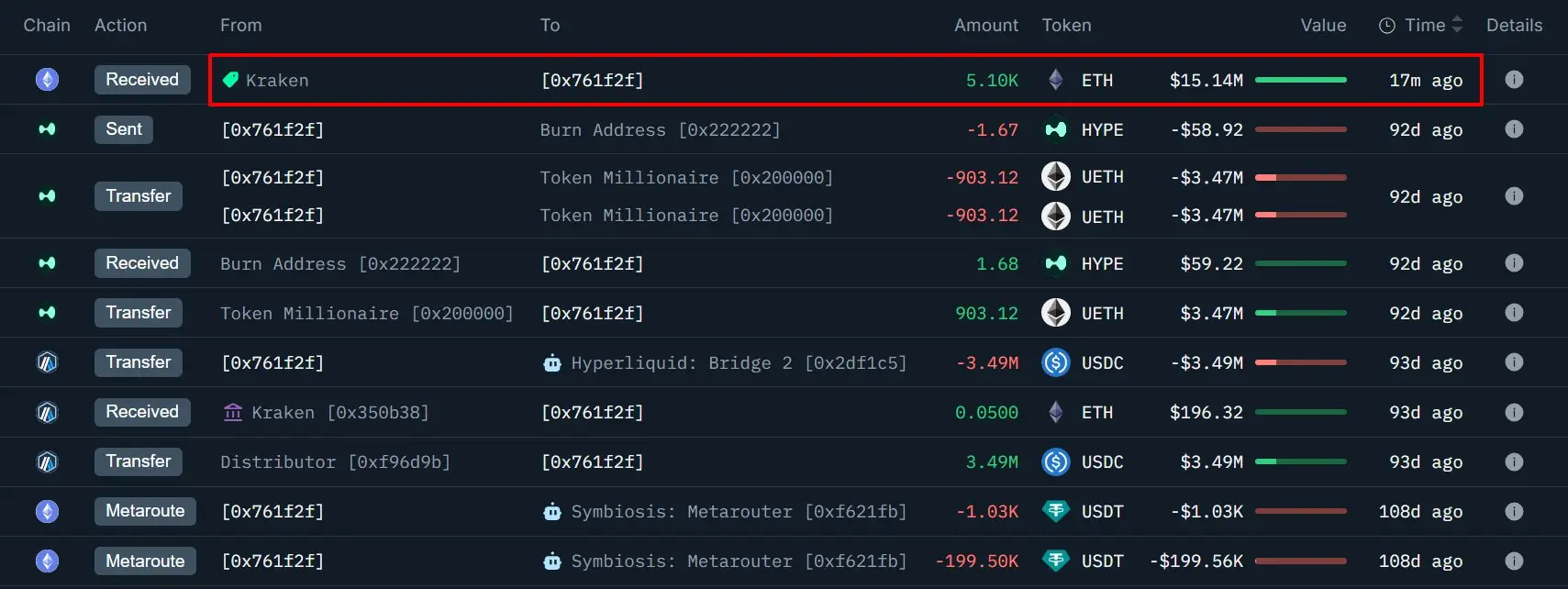

Ethereum Whale Breaks Three-Month Silence With $15 Million ETH Withdrawal on Kraken, and Goes All In - U.Today

An anonymous Ethereum whale recently returned, depositing 5,099 ETH worth $15.17 million into Kraken, then staking it into Lido for stETH. This occurs as ETH trades near critical support, hinting at long-term bullish intentions and potential influence on the staking market.

UToday·01-22 15:55

Ethereum Whale Goes All-In: Massive Leverage Bet on stETH Raises Eyebrows

A major Ethereum whale withdrew 32,395 ETH from Binance, indicating a leveraged strategy involving stETH and Aave. This approach amplifies staking rewards but carries risks, particularly if ETH prices decline. The move signals strong bullish sentiment in the market.

Coinfomania·01-19 11:55

stETH Holds $3,138 in Tight Range as Bitcoin Pair Strength Steals Focus

stETH was stuck between support and resistance at $3,091.14 and $3,164.64, which strengthened a technically balanced, low-volatility session.

Profits against Bitcoin (0.6 percent at 0.03433 BTC) were compared to zero performance against Ether (0.9991 ETH), which perfects the strength of

CryptoNewsLand·01-15 16:41

stETH Holds $3,138 in Tight Range as Bitcoin Pair Strength Steals Focus

stETH was stuck between support and resistance at $3,091.14 and $3,164.64, which strengthened a technically balanced, low-volatility session.

Profits against Bitcoin (0.6 percent at 0.03433 BTC) were compared to zero performance against Ether (0.9991 ETH), which perfects the strength of

CryptoNewsLand·01-14 16:31

ETH Trader Recovers $3.5M Loss, Gains Over $208M on Hyperliquid

_Ethereum trader gains $208M after $3.5M loss on Hyperliquid, holding $125M in stETH and $350M in USDC, using OTC trades._

An anonymous Ethereum trader has gained over $208 million in total profits after years of swing trading on Hyperliquid.

Despite suffering a $3.5 million loss on a recent t

LiveBTCNews·01-10 04:20

Place a big bet! A certain Hyperliquid whale is long 2,070 Bitcoin, betting on Bitcoin's rebound to $93,300.

A certain whale deposited 15.5 million USD in USDC into the perpetual contract trading platform Hyperliquid and opened large long positions, totaling 2,070 Bitcoin in the past 12 hours, equivalent to an investment of 191 million USD.

(Background recap: Memecoin rebounds first, is this the prelude to a bull market or a trap set by the whale?)

(Additional background: MicroStrategy's first new year increase! Invested an additional 116 million USD in 1,283 Bitcoin, with USD reserves expanding to 2.25 billion USD)

According to the latest data from blockchain monitoring platform MLM, a cryptocurrency "whale" has been active recently, attracting market attention. Specifically, this whale currently holds about 30,060 stETH (worth approximately 97 million USD) and has provided liquidity on the decentralized lending platform Aave.

HYPE-1.66%

動區BlockTempo·01-07 14:00

The USPD protocol suffered an advanced attack, resulting in the loss of approximately 232 stETH, and the attacker minted 98 million USPD tokens.

USPD Protocol issues a security alert, suffering a severe vulnerability attack. The attacker used advanced techniques to gain administrator privileges, mint approximately 98 million USPD tokens, and steal 232 stETH. The team has cooperated with law enforcement agencies, marked the attack address, and proposed a white-hat rescue plan.

STETH-8.68%

DeepFlowTech·2025-12-05 06:26

Lido Introduces stRATEGY Vault, Offering Curated DeFi Exposure Focused On stETH

In Brief

Lido has launched the stRATEGY Vault, allowing users to gain diversified DeFi exposure centered around stETH with simplified management, enhanced rewards, and Mellow point accrual.

Decentralized finance (DeFi) platform, Lido introduced the stRATEGY Vault, designed to offer a simplified

MpostMediaGroup·2025-11-07 07:13

VanEck submits an application for approval of the stETH ETF in America - a major step for ethereum staking activities.

VanEck has submitted an S-1 registration statement to the Securities and Exchange Commission (SEC) for the "VanEck Lido Staked ETH ETF." This fund aims to provide investors with a managed opportunity to access Ethereum (ETH) staked through the Lido protocol, represented by the stETH token.

If approved, this will be the first ETF

TapChiBitcoin·2025-10-20 12:29

VanEck Moves First With Bid for Lido Staked Ethereum ETF

VanEck is the first to file an ETF linked to Lido’s stETH, using MarketVector’s Lido Staked Ethereum index.

The SEC’s Generic Listing Standards shorten the review period from 240 days to 75 days for eligible crypto ETFs.

stETH fell more than 3% after the filing as traders showed limited

CryptoFrontNews·2025-10-18 11:46

Ethereum $11 billion withdrawal stuck for 42 days! Timed bomb may trigger DeFi crisis

The Ethereum staking withdrawal queue has soared to the third highest in history, with 2.44 million ETH (worth $10.5 billion) stuck for 42 days before being unlocked. Analysts warn that this is a systemic flaw, and the risk of stETH depeg may trigger a bank run in DeFi, threatening the $13 billion liquid staking market. Vitalik insists this is a secure design, but who is right and who is wrong? This article provides an in-depth analysis of the Ethereum staking crisis and the chain risks in DeFi.

MarketWhisper·2025-10-09 01:22

A certain WLFI whale address is suspected of dumping 2000 ETH, still holding 9850 ETH.

According to Mars Finance news, on September 30, on-chain analyst Ai Yi (@ai\_9684xtpa) monitored that the WLFI large investor address 0xe8b is suspected of dumping 2000 ETH, worth 8.32 million USD. This address unstaked 6,845 ETH from Lido 2 hours ago and then deposited 2000 ETH into Kraken. Currently, he still holds 9,850 ETH and stETH. In addition, he also has WLFI worth 10.3 million USD on Debank.

MarsBitNews·2025-09-30 12:26

Lido Proposes Development Of NEST Mechanism For LDO Buybacks

In Brief

Lido Finance has proposed the NEST modular mechanism, which enables stETH-to-LDO swaps for buybacks, redirects LDO to the DAO Treasury, and formalizes surplus allocation.

Decentralized finance (DeFi) platform Lido Finance, which provides liquid staking solutions for proof-of-stake

MpostMediaGroup·2025-09-26 07:23

Hex Trust Integrates stETH Custody And Liquid Staking In Partnership With Lido

In Brief

Hex Trust has integrated stETH custody and liquid staking with Lido to provide institutional investors secure access to staking rewards, liquidity, and DeFi applications while simplifying infrastructure management.

Digital asset financial

MpostMediaGroup·2025-09-17 08:07

Ethereum's tokenization variants: from wrapped tokens to liquid staking tokens

Author: Tanay Ved

Source: Coin Metrics

Compiled by: Shaw Golden Finance

Key points

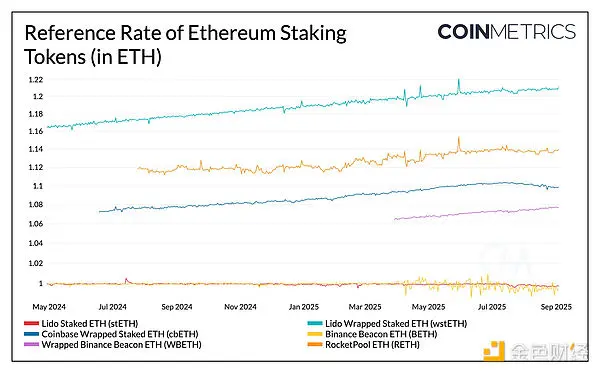

Tokenized versions of ETH (such as WETH, LST, and LRT) enable ERC-20 compatibility, greater interoperability, and higher on-chain capital efficiency.

Approximately 24% of ETH is staked through Lido, and stETH along with its wrapped form wstETH has become a widely used form of DeFi collateral, often employed in looping strategies to enhance yield.

The pricing and reward mechanisms of these tokens vary; some use a rebalancing design, while the wrapped versions appreciate in value as the exchange rate with ETH rises.

As the scale of these assets expands, monitoring the validator queue, secondary market liquidity, and the premium of LST over ETH.

ETH-8.74%

TechubNews·2025-09-10 08:52

Ethereum's tokenization variants: from wrapped tokens to liquid staking tokens

Author: Tanay Ved, Source: Coin Metrics, Translated by: Shaw Jinse Finance

Key Points

The tokenized versions of ETH (such as WETH, LST, and LRT) enable ERC-20 compatibility, greater interoperability, and higher on-chain capital efficiency.

Approximately 24% of ETH is staked through Lido, with stETH and its wrapped form wstETH becoming widely used forms of DeFi collateral, often employed in looping strategies to enhance yields.

The pricing and reward mechanisms of these tokens vary, with some adopting a rebalancing design, while the wrapped versions appreciate in value as the exchange rate with ETH rises.

As the scale of these assets expands, monitoring the validator queue, secondary market liquidity, and the premium/discount of LST to ETH will become very important for assessing redemption and liquidity risks.

ETH-8.74%

金色财经_·2025-09-10 07:40

Lido launches GG Vault: automated DeFi yields on ETH, WETH, stETH, and wstETH in the Earn tab

On September 3, 2025, Lido activated GG Vault (GGV), a vault that automates the allocation of ETH, WETH, stETH, and wstETH across at least seven protocols (Uniswap, Aave, Euler, Balancer, Gearbox, Fluid, Morpho), centralizing everything in the new Earn tab and reducing the operational

TheCryptonomist·2025-09-04 16:32

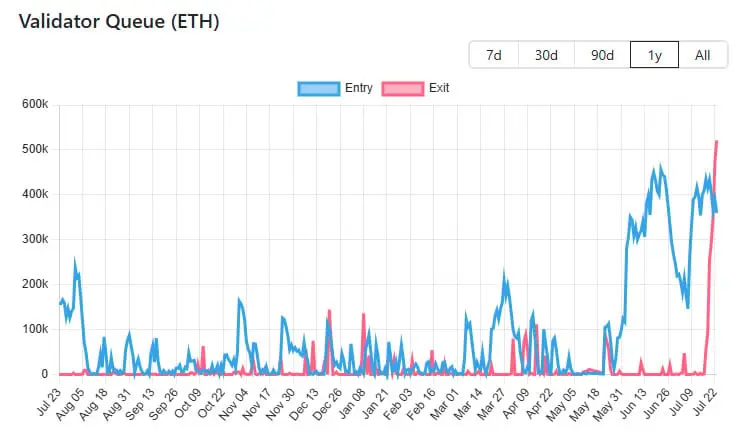

The Ethereum staking market continues to expand! 1.07 million ETH are queued for unstaking, 730,000 ETH are waiting to enter, but there is one point worth following.

The Ethereum staking market continues to expand: currently, there are 734,256 ETH waiting to get on board, valued at approximately 3.3 billion USD; while there are 1,071,108 ETH waiting to unstake, valued at approximately 4.9 billion USD. (Background: 890,000 ETH unstaking has been waiting too long) Large Investors prefer to Cut Loss by 50,000 USD, accelerating the cashing out of 4,242 stETH. (Additional Background: The Ethereum staking market is heavily congested! 520,000 ETH are queued for unstaking, and 360,000 ETH are pouring into staking... is it related to Sun Yuchen?) Since July, the Ethereum staking market has shown an extreme phenomenon of dual expansion, with both the number of ETH waiting to unstake and the number of ETH waiting to get on board soaring. However, the continuous pressure of the unstaked amount on the number of ETH waiting to enter has become one of the important reasons for the repeated spikes and subsequent sell pressure drops in Ethereum over the past month.

ETH-8.74%

動區BlockTempo·2025-08-28 13:32

How to Instantly Buy Lido DAO (LDO) Anonymously Without KYC

Lido DAO (LDO) is a decentralized autonomous organization (DAO) that provides staking infrastructure for a variety of blockchain networks. The platform’s main purpose is to provide a liquid staking solution for Ethereum’s network, allowing users to stake ETH and receive stETH tokens in exchange,

LDO-2.88%

TheCryptonomist·2025-08-26 13:00

ETH Staking Powers Corporate Treasury DeFi Movement

Ethereum corporate treasuries are stepping up in a way that feels like a turning point for institutional DeFi. ETH Strategy’s partnership with Lido is a perfect example. It allows companies to stake treasury funds in stETH, providing them with verifiable on-chain custody while earning a yield.

Coinfomania·2025-08-22 05:34

Ethereum's unstaking queue hits a record high! 855,158 ETH awaiting release, 3.7 billion USD sell pressure alarm sounded.

The number of Ethereum validators exiting the queue soared to 855,158 ETH (approximately $3.7 billion) last Friday, setting a historical record. Bitwise analysts warn that this batch of ETH set to be unstaked may create sustained selling pressure, especially when staking derivatives (such as stETH) trade at a discount, triggering leveraged strategy closures and spot selling. This wave of unlocks coincides with ETH's pullback after hitting a historical high, with geopolitical risks and inflation data exacerbating market fluctuations; the unlock queue is expected to take 15 days to clear.

ETH-8.74%

MarketWhisper·2025-08-18 06:22

Ethereum Whale Moves $47M to Kraken After Two Year Stake

A significant Ethereum whale transferred 10,564 ETH ($46.55M) from Mantle staking to Kraken, while another swapped stETH for ETH, incurring a loss. Despite market outflows, ETH price surged from $3,200 to $4,800, supported by key demand zones.

ETH-8.74%

CryptoFrontNews·2025-08-17 10:01

Lido Holds Key Support As TVL Reaches $41B, Targets 30% Upside

Lido's price rebounded from a low of $1.32, supported by strong buying momentum and Ethereum's rally, boosting its total value locked to $41 billion. Governance is considering a buyback program using stETH to support LDO value by decreasing circulating supply.

CryptoNewsLand·2025-08-16 22:53

Ethena Treasury Strategy: The Rise of Stablecoin Third Empire

> Capital stimulation is a pacemaker, while real adoption is erythropoietin.

Written by: Zuo Ye

In August 2023, the MakerDAO ecosystem lending protocol Spark offered an annual yield of 8% on $DAI. Subsequently, Sun entered in batches, accumulating an investment of 230,000 $stETH, which accounted for more than 15% of Spark's deposit volume, forcing MakerDAO to urgently propose a reduction of the interest rate to 5%.

The original intention of MakerDAO was to "subsidize" the usage rate of $DAI, almost turning into Sun Yuchen's Solo Yield.

In July 2025, Ethena will play with the "currency - stock - bond" treasury strategy, and the APY of $sUSDe will rapidly rise to 12%.

ENA-2.44%

ForesightNews·2025-07-29 23:43

Ethereum Faces Pressure as Validator Exit Queue Surges to $2.3B - Crypto News Flash

Ethereum unstaking by validators led to short-term sell pressure with analysts saying the moves likely reflect restaking and operator rotation rather than fear-driven exits.

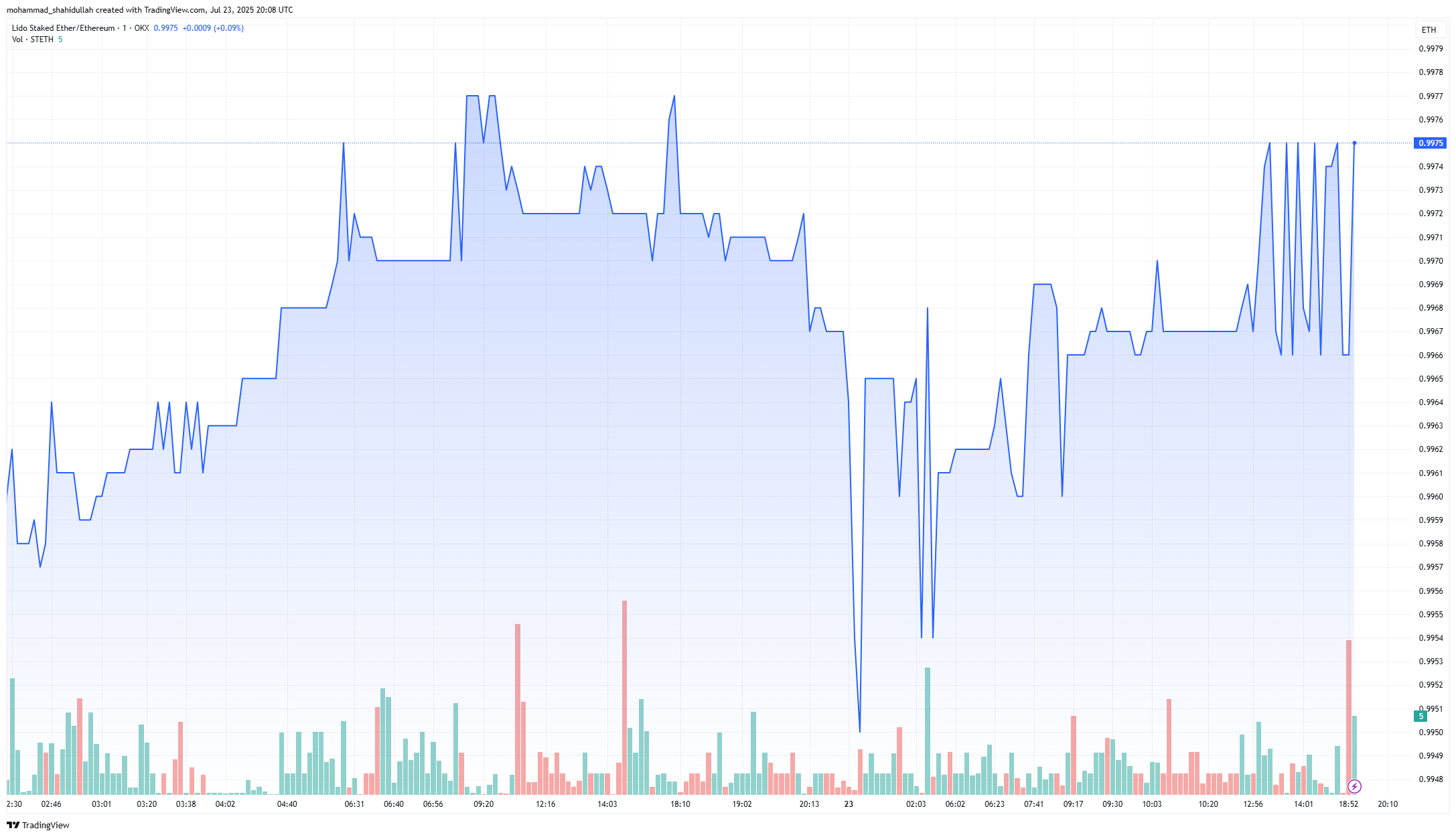

10x Research attributed the pullback to the unwinding of leveraged DeFi positions, which destabilized the stETH peg.

---

E

ETH-8.74%

CryptoNewsFlash·2025-07-24 11:20

In the past week, $1.7 billion worth of ETH flowed out of Aave, causing stETH to decouple and triggering fluctuations in the DeFi market.

In the past week, approximately $1.7 billion worth of ETH flowed out of Aave, and members of the Aave community believe that the founder of Tron withdrew at least $600 million, triggering a series of market reactions. This massive outflow of funds led to a sharp decline in ETH liquidity on Aave. The continuous outflow of whales from Aave caused ETH borrowing rates to skyrocket, while also boosting the usage rate of Aave. This change prompted DeFi users relying on leveraged staking strategies to start closing positions. Among them, the strategy that was hit the hardest is the popular stETH/ETH leveraged loop strategy. Data shows that the price gap between stETH and ETH widened sharply in the short term before recovering.

MarketWhisper·2025-07-24 03:02

Important Ethereum Signal: ETH Whale Exits Aave with $1.7 Billion, Triggering Panic of stETH Depegging

In the past week, $1.7 billion worth of Ethereum (ETH) was withdrawn from the Aave platform, triggering a series of market reactions, and this large-scale exit led to a sharp decline in ETH liquidity on Aave.

MarketWhisper·2025-07-24 01:35

Top Decentralized Finance (DeFi) Coins By Market Cap: StETH, WSTETH, and HYPE in Focus

Lido Staked Ether (stETH) remained stable around the $3,000 mark, an indication of consolidation ready to continue the uptrend Market .

Wrapped stETH proved to be a hardy investment, trading upwards of 3,600 early and late after noon rally in trade on consistent liquidity and staking

CryptoNewsLand·2025-07-15 00:23

Lido DAO approves dual governance granting veto power to holders

Lido, the largest Ethereum staking protocol, has enacted a dual governance system allowing stETH holders to delay or veto LDO token decisions. Supported by a near-unanimous vote, this change protects stakers from harmful governance decisions, with backing from Vitalik Buterin.

CHO-1.71%

TapChiBitcoin·2025-07-06 01:15

Lido DAO Enables Dual Governance, stETH Holders Can Trigger ‘Rage-Quit’ Mode - Unchained

Lido DAO has approved a dual governance system that empowers ETH stakers with veto power over proposals. StETH holders can freeze decisions if dissent reaches 10%, enhancing checks and balances in governance.

UnchainedCrypto·2025-06-30 05:18

Lido DAO voted to approve the dual governance structure proposal, granting stakers the right to delay or veto.

According to a report from The Block on June 29, the Ethereum staking protocol Lido DAO voted to pass a dual governance structure proposal, granting stakers (users holding stETH tokens) the power to delay or veto governance decisions made by LDO token holders. The main voting phase concluded with nearly unanimous approval, with 53.6 million LDO tokens voting in favor, just barely exceeding the required threshold of 50 million LDO votes, with only 1.18 LDO voting against. In the new model, stakers can express objections by depositing stETH into a custody contract. If the deposits reach 1% of Lido's total staked ETH, the proposal will be delayed for 5 days; if it reaches 10%, the proposal will be frozen. The final voting results will be confirmed on June 30 at 10:00 Eastern Time, unless in the "opposition" phase.

LDO-2.88%

DeepFlowTech·2025-06-29 00:07

A Major Update and Change Has Arrived in Important Altcoin! Vitalik Buterin Also Made a Statement!

Lido, the largest liquid staking protocol of Ethereum, is undergoing a fundamental change in its governance structure. Lido DAO members are granting stakers the authority to delay or veto governance proposals to (stETH holders through a dual governance model.

B-3.34%

Bitcoinsistemi·2025-06-28 23:29

Pier Two Joins Lido’s Curated Operator Set to Strengthen Ethereum

Pier Two joins Lido curated operator set as its newest node operator, expanding the global network of stETH staking. The announcement reinforces Pier Two’s role in Ethereum staking infrastructure. Since April 2024, Pier Two has supported Lido via Distributed Validator Technology. As an Australian no

ETH-8.74%

Coinfomania·2025-06-13 02:54

Maple Finance Rolls Out stETH-Backed Stablecoin Lending for Institutions

Maple Finance has introduced stablecoin lending using stETH as collateral, enabling institutions to gain liquidity while earning staking rewards. This enhances treasury management strategies, showcasing the increasing integration of DeFi tools in institutional finance.

STETH-8.68%

Coinpedia·2025-06-12 22:56

Is Altcoin Season 2025 Around the Corner? Key Indicators Signal a Potential Breakout

Altcoin Momentum Unbalanced: Whilst Hyperliquid (HYPE) is picking up momentum, stETH, LINK and XLM are showing diverging.

Volume divergence is a sign of opportunity: The higher the trading volume of individual tokens, including HYPE, the more investors seem to be gaining interest.

Altcoin Season U

A-3.09%

CryptoNewsLand·2025-06-12 21:34

Crypto Lender Maple Partners with Liquid Staking Specialist Lido Finance

Cryptocurrency lending firm Maple Finance has partnered with crypto staking specialist Lido Finance to offer stablecoin credit lines backed by collateral in the form of Lido’s liquid staking token (stETH), the companies said on Thursday.

The collaboration gives institutions the ability to borrow st

YahooFinance·2025-06-12 18:14

Maple Finance launches Stablecoin lending service supported by stETH for institutions.

Maple Finance has added stETH as collateral for institutional stablecoin loans, enabling liquidity access without giving up staking rewards. This development highlights the importance of liquid staking tokens in modern fund management and reflects a trend towards decentralized financial solutions.

TapChiBitcoin·2025-06-12 16:15

Oracle Machine invasion triggers emergency DAO vote, Lido security

The Oracle Machine of the Ethereum staking protocol Lido has been attacked, resulting in a loss of 1.5 ETH. Chorus One stated that this is an isolated incident, and Lido is not under threat. The attacker extracted 1.46 ETH, and an investigation is underway. Lido's operations are not under threat, but in the worst-case scenario, it may affect stETH holders. The Lido DAO voted to rotate the Address, but the quorum was not reached. The Oracle Machine plays an important role in Decentralized Finance, and Lido has taken multiple measures to ensure security.

ETH-8.74%

TokenInsight·2025-05-12 10:57

Security Violation Warning for Altcoins Listed on Binance and Coinbase: Is the Money Safe?

Lido Finance, one of the largest staking protocols on Ethereum, has announced that the private key belonging to Chorus One, which operates within the oracle infrastructure of this protocol, has been compromised.

After the development process, Lido DAO announced that they will initiate an emergency voting process to replace the related oracle node.

The official statement of the protocol states that despite the security threat, Lido's operations continue uninterrupted and users' funds remain safe. Lido's oracle system is structured as a multi-signature that requires signatures from 5 out of 9 participants. No security breaches have been detected in the eight oracle nodes other than Chorus One.

The DAO declaration includes the following contents:

"Emergency voting notice for Lido DAO: Due to the compromise of the private key of the oracle belonging to Chorus One, the Lido oracle node being referred to will be rotated."

Authorities stated that the leaked key does not directly control the coins and there are no flaws in the oracle software. The oracle system being referred to is responsible for transferring data from the Ethereum consensus layer to the smart contract. This information includes the income of validators and potential penalties.

According to the assessment, even if the entire oracle system is compromised, there will be no significant damage other than the limited deviation in the value of stETH, thanks to the security limits of the system. It is reported that in this incident, the attacker only stole transaction fees amounting to 1.4 ETH and this amount is not directly related to the protocol.

Blotienso·2025-05-12 04:21

Grant stETH holders "veto power"! Lido's new proposal may restructure the governance power framework of Decentralized Finance.

Lido Finance has proposed the LIP-28 dual governance proposal, granting stETH holders veto power to strengthen the DeFi governance model. The proposal will have a profound impact on the entire DeFi ecosystem, incorporating mechanisms such as "time locks" and "rage-quit," providing opportunities to vote against decisions. Although the implementation process may face challenges, success will enhance the healthy development of the Lido protocol and user trust. This reform will hold significant meaning for Decentralization governance and is worth the market's long-term attention.

動區BlockTempo·2025-05-11 05:26

CoinVoice has learned that, according to on-chain analyst Yu Jin's monitoring, the Whale "silentraven" currently has unrealized gains exceeding 10 million by going long on HYPE with 3x leverage. He went long on 801,000 HYPE at a price of $12.9 on April 9, and now the price of HYPE has doubled to $26. His unrealized gains amount to $10.62 million.

Additionally, in the past half hour, he exchanged 100 WBTC for 4071.6 stETH. The exchange rate was 0.0245.

CoinVoice·2025-05-11 03:00

The Whale "silentraven" is currently go long on HYPE with 3x leverage and has unrealized gains of 10.62 million USD.

Whale "silentraven" is using 3x leverage to go long on $HYPE, currently with unrealized gains exceeding 10 million USD. Additionally, he recently exchanged 100 $WBTC for 4071.6 stETH, with an exchange rate of 0.0245.

HYPE-1.66%

PANews·2025-05-11 00:51

According to Deep Tide TechFlow news, on May 11th, on-chain analyst Yu Jin monitored that the whale "silentraven" who went long on HYPE with 3x leverage currently has unrealized gains exceeding 10 million. He went long on 801,000 HYPE at a price of $12.9 on April 9th, and now the price of HYPE has doubled to $26. His unrealized gains have also reached $10.62 million.

Additionally, he exchanged 100 WBTC for 4071.6 stETH in the past half hour. The exchange rate is 0.0245.

DeepFlowTech·2025-05-11 00:48

Lido unveils Dual Governance plan to give stETH holders a voice in protocol decisions

The leading Ethereum liquid staking platform, Lido, has released the proposal for its Dual Governance mechanism, which is meant to be the next phase in the evolution of the protocol. Lido DAO contributors published an outline proposal on May 8, describing it as a work that has been years in the

STETH-8.68%

Cryptopolitan·2025-05-10 09:52

Whale Makes Massive AAVE Move—A Long-Term Staking Strategy or a Market Play?

In a bold move in the cryptocurrency market, a prominent multi-signature wallet identified as 0xa92 has swapped 10,090 STETH, valued at $26.5 million, for 102,259 AAVE in the past four hours.

This purchase was made at an average price of $259.13 per token, and it appears to strengthen the whale’s

TheMerkleNews·2025-02-07 04:42

Trump Family Crypto Project World Liberty Financial (WLF) Continues to Stack Coins Amid Market Co...

World Liberty Financial (WLF) bought 10.61M TRX for $2.65M USDT today amid a cryptocurrency market correction. Trump-linked WLF also purchased another 3,079 ETH for $10M USDC in the past six hours.

World Liberty Financial also swapped 4,700 ETH worth $15.68M into 4,700 stETH and stacked it with

Cryptopolitan·2025-01-24 07:40

Lagent: AI-driven lending platform

Source: PermaDAO

AI-driven decentralized lending platform Lagent is about to go live, activating over 600 million dollars of idle assets. Users can customize lending rules, achieve automated management, optimize returns and risks, and fully unleash AO ecological liquidity.

The AO mainnet is about to go live. It has already attracted over $600 million worth of stETH and DAI bridged assets, and also brought back a large amount of wAR assets for AO minting. Meanwhile, with the help of the AOX cross-chain bridge and numerous token launch tools, the AO ecosystem has introduced the stablecoin wUSDC, and new assets are constantly being launched. Therefore, the current situation is that there are a large number of idle assets in the AO ecosystem, and liquidity has not been fully released.

Adapting to the trend, we are about to usher in a brand new lending platform Lagent, thus filling the gap in the AO ecosystem DeFi

金色财经_·2025-01-17 06:37

Load More