Search results for "STRIKE"

Night of panic for risk assets, under what conditions would the United States go to war with Iran?

The fleet the United States deployed to Iran is much larger than the one in Venezuela some time ago, which also means that this asset crash is even more severe.

A few hours ago, Trump and Iran began exchanging harsh words frequently.

(Background recap: Trump "temporarily halts attack on Iran" but still deploys US troops: they assured me they would stop persecuting protesters)

(Additional background: Trump orders bombing of Venezuela's capital! Bitcoin drops below 90,000 MGB, ETH holds steady at 3100)

The fleet the United States deployed to Iran is much larger than the one in Venezuela some time ago, which also means that this asset crash is even more severe.

A few hours ago, Trump and Iran began exchanging harsh words frequently. Meanwhile, rumors circulated in the community that the US "Lincoln" aircraft carrier and its strike group deployed in the Middle East have entered "full blackout" communication mode, indicating that actions against Iran may be imminent.

All financial market investors' hearts

動區BlockTempo·01-30 03:40

Why did Bitcoin drop today? GameStop sells off 4,710 BTC, US aircraft carrier strike group arrives in the Middle East

Bitcoin drops to $88,700, and GameStop transferring 4,710 BTC to exchanges sparks selling rumors. Safe-haven funds flood into precious metals, with gold surpassing $5,000 and silver rising to $106. The Middle East situation escalates, with the US aircraft carrier strike group arriving in the Middle East. $88,000 becomes a key support level for Bitcoin.

BTC-4.76%

MarketWhisper·01-26 00:34

Predictive History Host Warns Iran Strike Could Pull Multiple Powers Into a Global War

A potential U.S. military strike on Iran could trigger prolonged regional conflict and significant global economic disruption, according to geopolitical commentary shared in a recent Youtube interview with the host of the Predictive History channel.

Xueqin Jiang Argues Iran Conflict Would Ripple A

Coinpedia·01-25 16:40

MasterZ and IOTA Launch Europe-Wide Web3 Hackathon for Next-Gen Builders

IOTA and MasterZ are initiating a Web3 hackathon with live learning and real-world use cases across Europe, culminating in a final Demo Day in Berlin.

Applications are open until January 31; winners to receive grants, incubation, and strike partnerships with other leading projects.

IOTA is c

CryptoNewsFlash·01-22 11:15

Hong Kong Set to Issue First Stablecoin Licenses in Q1 2026

In brief

The Hong Kong Monetary Authority will issue licenses to stablecoin providers in the first quarter of 2026.

Hong Kong brought in its stablecoin regime in August last year.

The city is trying to strike a balance between welcoming providers and protecting investors.

Hong Kong will

Decrypt·01-21 17:35

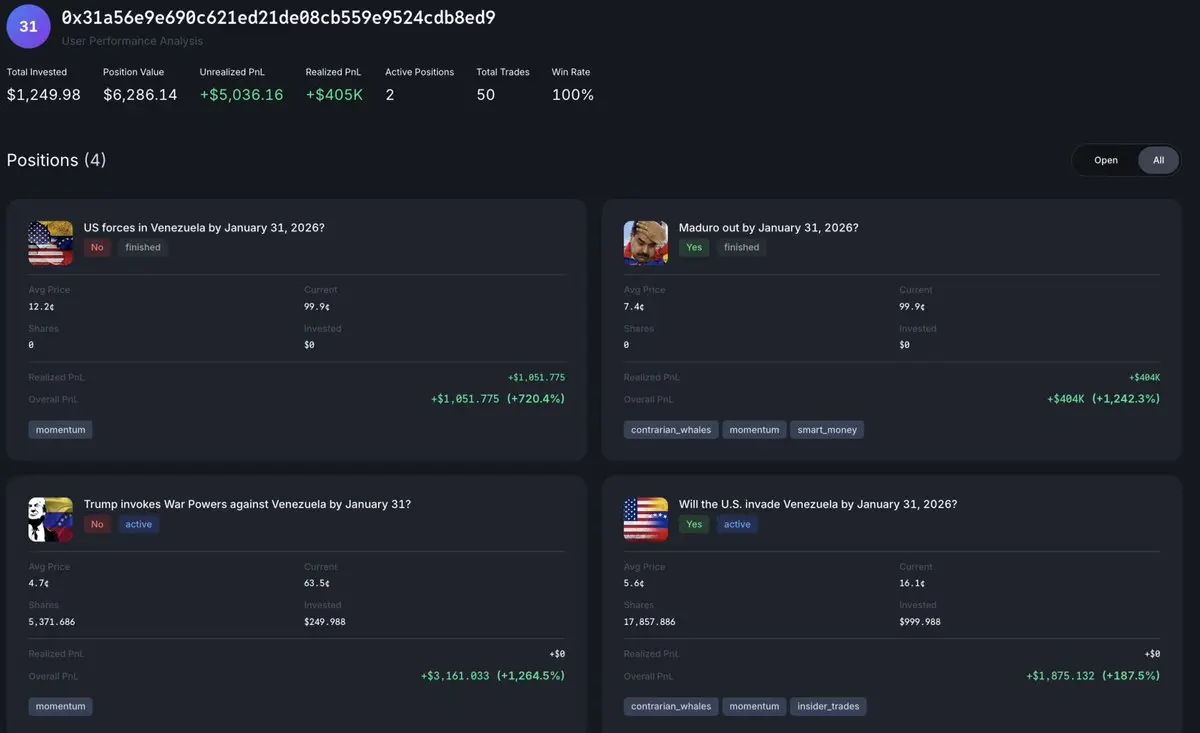

Suspicious Polymarket Activity Sparks US-Iran Strike Speculation

A new Polymarket account placed a $160k bet on a US strike against Iran, raising concerns about insider trading as market odds shifted dramatically. Speculation intensified due to a Tehran explosion rumor and unusual air activity, while the trader ended the day down $40k, fueling debates about manipulation and strategy.

CryptoFrontNews·01-16 12:11

Supreme Court Tariff Ruling Could Shake Markets: Analysts Warn Crypto May Become “Exit Liquidity”

A pivotal verdict is expected today—one that could reshape market sentiment. The U.S. Supreme Court is set to rule on the legality of Trump-era tariffs, and traders on the prediction platform Polymarket assign a 73% probability that the court will strike them down. At first glance, that sounds

DEFI-9.59%

Moon5labs·01-14 20:01

What the movies taught me: The American TV prophecy of the Trump administration swiftly arresting the Venezuelan president action

Have you ever had this feeling, when a major international event happens, the first thing that comes to mind is not the news, but this scene that seems so familiar? A well-known millionaire YouTuber "Things I Learned from Movies" discovered a chilling coincidence: the American TV series Jack Ryan (Tom Clancy’s Jack Ryan) almost perfectly predicted the dramatic script of the United States quickly arresting Venezuelan President Maduro many years ago.

Jack Ryan's divine prediction of the US swiftly arresting Maduro shocks the world

On January 3, 2026, the United States suddenly launched a surprise operation in Venezuela codenamed "Operation Absolute Resolve." In less than 2.5 hours, the US military assembled from 20 bases, deploying about 150 aircraft to precisely strike the Venezuelan military.

ChainNewsAbmedia·01-14 06:18

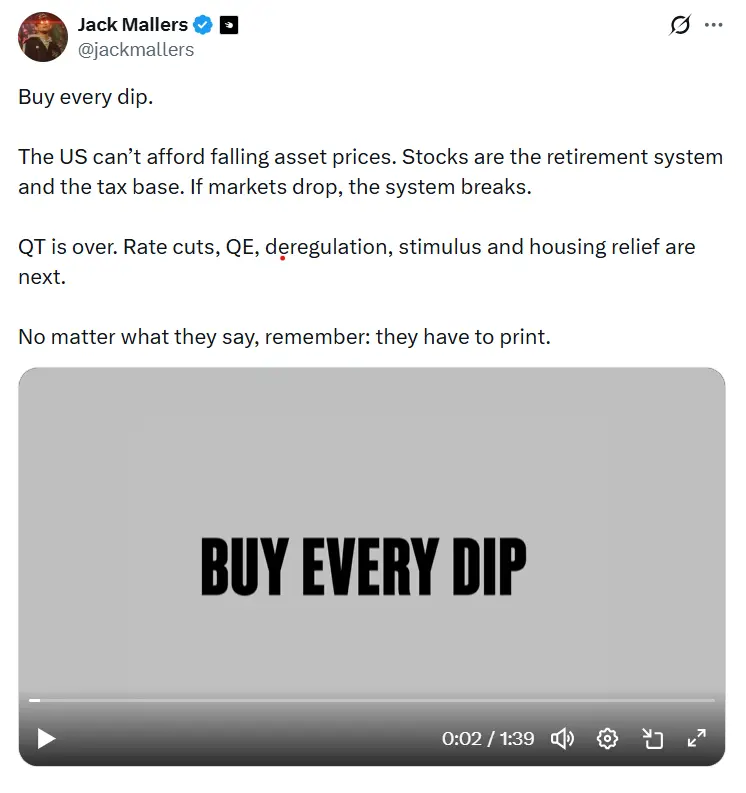

Mallers Bitcoin Prediction Sparks Optimism for Record Rally

Jack Mallers, CEO of Strike, predicts the next Bitcoin bull market could be historic, driven by institutional adoption and upcoming catalysts like Bitcoin ETFs. The crypto community reacts with mixed excitement, emphasizing the importance of long-term trends over short-term gains.

BTC-4.76%

Coinfomania·01-13 08:23

Crypto Taxation CRS is Coming: Three Practical Tips for Crypto Enthusiasts

Written by: Lawyer Liu Honglin

Recently, many friends in the crypto circle have been asking me the same question: "I heard that Hong Kong is starting to report encrypted asset information. Are my crypto assets on overseas exchanges still safe? Will the mainland tax authorities find out? Do I need to pay additional taxes?"

This kind of anxiety is not unfounded.

By 2025, global tax transparency is set to launch a targeted "precision strike" against cryptocurrencies. As a legal professional deeply involved in Web3, today Lawyer Honglin will discuss the so-called "Crypto Circle CRS" CARF (Crypto Asset Reporting Framework), and what it really means for each of our wallets.

What is CARF?

Over the past decade, the traditional financial world has a powerful tool called CRS (Common Reporting Standard). Simply put, if you are a Chinese citizen with deposits in overseas banks, foreign banks will report...

TechubNews·01-13 07:10

$2 Trillion Bank Giants Strike! Wells Fargo Accepts Bitcoin Collateral, Shocking the Market

Wells Fargo, with an asset size of nearly $2 trillion, announced that it will offer Bitcoin-backed loan services to institutional and wealth management clients. Clients can pledge Bitcoin or approved spot Bitcoin ETFs as collateral to obtain liquidity without selling their holdings. This move marks a significant shift in traditional financial institutions' views on digital assets and aligns with the increasingly clear regulatory environment in the United States by 2025, potentially prompting other major banks to follow suit.

ETH-5.52%

MarketWhisper·01-12 01:33

Exclusive Interview with Charlie | Correcting 3 Major Misconceptions: The US Crypto Market is Not a "White People’s Game," and the Breakthrough Point for Chinese Teams Is Here

Interviewee: Alma/Techub News

Interviewee: Charlie/former macro investor at Franklin Templeton, Adyen global payments, Strike cryptocurrency payments, currently Venture Partner at Generative Ventures.

In the lobby of Franklin Templeton in Silicon Valley, we had an in-depth conversation with seasoned investor Charlie. He previously served as Vice President of Adyen global payments and Strike cryptocurrency payments, and is now a Venture Partner at Generative Ventures. As a veteran professional spanning traditional finance and the cryptocurrency space, Charlie also holds multiple roles as a content creator and startup advisor.

TechubNews·01-10 03:00

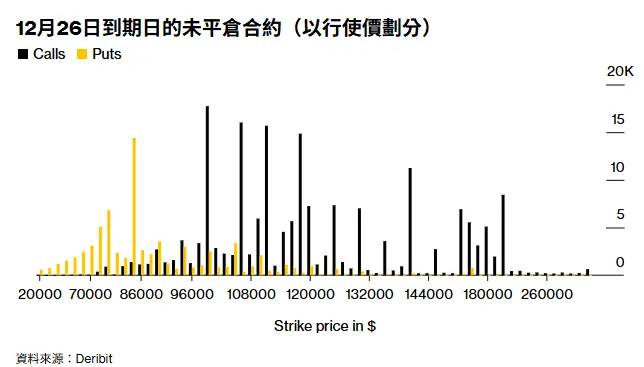

Bitcoin Options Show Heavy Betting on a $100,000 Price Level

Options data shows strong interest at the $100,000 Bitcoin strike price, indicating trader confidence in Bitcoin's recovery after a 24% loss in Q4 2025. With recent price rallies and institutional ETF inflows, analysts foresee potential upward movement, though caution remains regarding market support.

BTC-4.76%

ICOHOIDER·01-08 12:00

Dormant Polymarket Trader With a Strong Record on Israel–Iran Strike Bets Returns to Wager on War Again

A long-dormant Polymarket trader has resurfaced with a series of wagers tied to the possibility of an Israeli military strike on Iran.

The return has attracted attention not only because of the sensitive geopolitical context, but also due to the trader’s past performance. Consequently, those

TheCryptoBasic·01-07 08:40

Polymarket Sees Rising Bets on Potential U.S. Strike Against Iran as Pentagon Pizza Index Surges 1250%

Prediction markets and open-source intelligence signals are once again converging on a sensitive geopolitical flashpoint. On January 6, 2026, on-chain monitoring tool PolyBeats reported a 1250% spike in the so-called “Pentagon Pizza Index” over the past 24 hours—an indicator historically associated with heightened U.S. military activity.

CryptopulseElite·01-06 08:37

Bullish rally! Traders bet on Bitcoin breaking $100,000 at the start of 2026

In the first week of 2026, the cryptocurrency market is filled with bullish sentiment. As Bitcoin stabilizes above the $90,000 mark, derivatives traders are holding strong expectations for the new year's market, increasingly betting that Bitcoin will further surge past the $100,000 milestone.

According to data from Deribit, the world's largest cryptocurrency options exchange, since last Friday (the 2nd), demand for Bitcoin call options with a strike price of $100,000 expiring at the end of January has surged rapidly, indicating that the market is not only optimistic about January's行情 but also targeting the highly significant "six-figure" milestone.

A call option is a contract that gives the buyer the right (but not the obligation) to purchase the underlying asset at a predetermined price within a specific period in the future. The recent surge in demand for the $100,000 strike price options suggests that the market is betting that Bitcoin's price will be able to hold steady or even break through this level before or at the time of the contract's expiration.

区块客·01-05 14:39

Why a Bitcoin ‘Correction’ May Be Unlikely Post US Venezuela Strike: Analyst Insights

Bitcoin's price remains stable following US military strikes on Venezuela, showing resilience amidst geopolitical tensions. Analysts expect minimal short-term impacts, highlighting Bitcoin's historic ability to remain firm during conflicts.

BTC-4.76%

CryptoBreaking·01-05 11:35

Crypto Markets on Edge After Trump Floats Colombia Strike

Trump spoke about possible military interventions by the USA in Colombia.

Markets were not visibly affected by headlines of high risks.

Historical conflicts reveal that the volatility of crypto comes first, followed by adoption in the affected area.

Crypto markets entered a heightened level of c

TheNewsCrypto·01-05 10:01

US Strike on Venezuela Puts Bitcoin in Focus as Oil Slides

In brief

U.S. forces captured Nicolás Maduro, framing the action as a law-enforcement operation.

Oil fell as markets priced in higher supply, while Chevron shares jumped 11%.

Crypto is expected to play a larger role in payments and settlement in Venezuela as sanctions disrupt

Decrypt·01-05 03:21

Bitcoin Likely to Stay Above $90K Following Venezuela Military Strike

_Bitcoin stays above $90K post-US military strike on Venezuela, showing resilience to geopolitical tensions and stable market confidence._

Bitcoin’s price is expected to remain stable above $90,000 despite the recent US military strike on Venezuela.

While geopolitical tensions often

BTC-4.76%

LiveBTCNews·01-04 17:40

Why a Bitcoin ‘Correction’ May Be Unlikely Post US Venezuela Strike: Analyst Insights

Bitcoin's price remains stable following US military strikes on Venezuela, showing resilience amidst geopolitical tensions. Analysts expect minimal short-term impacts, highlighting Bitcoin's historic ability to remain firm during conflicts.

BTC-4.76%

CryptoBreaking·01-04 11:30

Venezuela Attack: US Lawmaker To Introduce Prediction Market Bill Targeting Insider Trading | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

The US strike on Venezuela represents the largest headline event of the new year so far. In several developments spinning off this incident, Representative Ritchie Torres is reportedly moving to

US3.84%

Bitcoinistcom·01-04 11:02

Maduro is sanctioned, and Venezuela's legendary "60 billion in Bitcoin" has the US swallowed?

With the dramatic change in Venezuela's political situation, Maduro was detained by the US military, and the shadow reserves of Bitcoin worth up to $60 billion have become a mystery. These crypto assets accumulated through gold swaps and oil transactions—who actually controls them? Who holds the key private keys? This article is based on "Maduro's 'Lightning Strike' by the United States: Where Will Venezuela's 'Legendary $60 Billion Bitcoin' Go?" by Ye Huiwen from Wall Street Insights, reorganized by律動.

(Previous summary: Data: Predictive market 'spoils' Maduro's fall with $10 million in advance)

(Background supplement: US lawmakers propose legislation to ban government officials from insider trading in prediction markets! Polymarket suspected of leaks in Maduro arrest plan)

Table of Contents

Digital Assets of the Shadow Financial Empire

Gold Swap and Crypto Channels

The Role of Key Figure Alex Saab

Crude Oil

動區BlockTempo·01-04 07:40

Venezuela's upheaval impacts the world: oil supply cuts, gold surges, 60/40 model collapses

On January 3, 2026, in the early morning, the U.S. military successfully captured Venezuelan President Maduro in an operation codenamed "Southern Spear Operation," triggering the most intense geopolitical upheaval in Latin America since the U.S. invasion of Panama in 1989. This 30-minute targeted strike not only marked the return of Monroe Doctrine in a highly militarized form but also triggered a chain reaction across the global oil markets, financial systems, and safe-haven asset allocations, with impacts expected to last throughout 2026.

MarketWhisper·01-04 06:24

Polymarket Traders Profit Millions from Insider Bets on Maduro Capture – Prediction Markets Face "Insider Trading" Scrut

Prediction market platform Polymarket saw explosive trading activity hours before President Donald Trump announced the capture of Venezuelan President Nicolás Maduro in a U.S. military strike on January 3, 2026. Several accounts placed large bets on Maduro's ouster, earning millions in profits—sparking accusations of insider trading on prediction markets.

BTC-4.76%

CryptopulseElite·01-04 06:13

Bitcoin Dips Below $90K as Trump Announces Capture of Venezuela's Maduro

Bitcoin fell below $90,000 on January 3 after President Donald Trump announced that U.S. forces had captured Venezuelan President Nicolás Maduro in a large-scale military strike.

CryptopulseElite·01-04 06:07

Trump Press Conference: 150 fighter jets raid Venezuela, arrest Maduro and send him to the United States for trial

U.S. President Trump announced at a press conference on January 3rd that the U.S. military successfully arrested and transported Venezuelan President Maduro for trial. This operation, codenamed "Absolute Resolve," involved over 150 aircraft and took 3 hours to complete the targeted strike. Trump warned Cuba and Colombia to "be careful," emphasizing that the Western Hemisphere's dominance is non-negotiable, and announced that American oil companies will take over Venezuela's energy infrastructure.

MarketWhisper·01-04 02:33

U.S. military launches large-scale attack on Venezuela: Trump confirms Maduro couple's arrest, Delta Force involved in the mission

CBS reports that the U.S. military launched a large-scale military strike against Venezuela on the morning of Saturday, January 3rd. President Trump immediately announced on Truth Social that he had captured Venezuelan President Nicolás Maduro and his wife. He stated: "The United States has carried out a large-scale operation against Venezuela and its leader Nicolás Maduro (President). Maduro and his wife have been arrested and taken out of the country." This operation was conducted in cooperation with U.S. law enforcement agencies. Further details will be announced later.

Trump is expected to hold a press conference at 11 a.m. Eastern Time at Mar-a-Lago in Florida to provide more details.

Foreign media: U.S. special forces Delta team abducts Maduro

CBS reports that U.S. elite special forces Delta team

ChainNewsAbmedia·01-03 11:23

Who is Jack Mallers? The Man Chosen to Run a 36 Billion Dollar Bitcoin Fund

In a significant move bridging Bitcoin entrepreneurship with traditional finance, Jack Mallers, the renowned founder of Strike, has been appointed CEO of Twenty One Capital (21 Capital). Backed by Tether, SoftBank, and Cantor Fitzgerald, this new entity launches with a massive treasury of 36 billion dollars worth of Bitcoin, positioning it as a major publicly-traded Bitcoin holding vehicle. Mallers, a key figure in Bitcoin’s adoption in El Salvador, will lead the company’s mission to provide ins

BTC-4.76%

MarketWhisper·2025-12-29 07:28

Web3 Wallet Security Practical Guide: Recently, well-known wallets have been frequently hacked. What should ordinary users do?

Written by: Yue Xiaoyu

If you want to survive longer in the cryptocurrency industry, you must choose the right wallet and use the right wallet!

Wallets are the most important infrastructural products in our industry, and it's not an overstatement to emphasize their importance.

Hackers often strike during bear markets. Previously, the longstanding wallet Trust Wallet under Binance was hacked for 7 million USD, and recently, the well-known trading bot DeBot also reported a theft.

As ordinary users, what should we do?

As a product manager who has been working on wallets for many years, I want to share a few important principles:

1. When choosing a wallet, you must prioritize top-tier platforms, and especially look for whether there is a compensation guarantee!

It's not that wallets from small teams can't be used, but top platforms like Binance, OKX, and Bitget generally have dedicated security compensation funds.

Just like this time, Trust

TechubNews·2025-12-29 02:57

What Are Intent-Based Transactions in DeFi

Introduction

Risk, volatility, uncertainty, liquidation are a few words that strike our minds when we talk about decentralized finance (DeFi). The innovation that claimed to liberate humanity from the shackles of conventional banking can be hazardous for users in its own way. Due to these very

BlockChainReporter·2025-12-27 14:34

The Japanese yen "black swan" could strike at any time! Japan's finance minister strongly warns currency market speculators.

Japanese Finance Minister Katsuyuki Kitagawa issued a strong warning to currency market speculators on Monday, stating that Japan has ample room to take bold actions against speculative exchange rate fluctuations. Kitagawa clearly indicated that these trends are evidently the result of speculative behavior and has made it clear that bold actions will be taken. This statement suggests that Japan could launch interventions in the currency market amounting to tens of billions of dollars at any time. The yen strengthened upon hearing this news, breaking the 1 dollar to 157 yen barrier, and the black swan risk in the currency market has surged.

MarketWhisper·2025-12-23 01:40

Why did the Bank of Japan's interest rate hike strike Bitcoin first?

Author: David, Deep Tide TechFlow

On December 15, Bitcoin fell from $90,000 to $85,616, a single-day drop of over 5%.

There are no significant incidents or negative events on this day, and on-chain data does not show any unusual selling pressure. If you only look at news from the cryptocurrency sphere, it’s hard to find a "reasonable" explanation.

On the same day, the gold price was $4,323 per ounce, down only $1 from the previous day.

One dropped by 5%, while the other barely moved.

If Bitcoin is truly "digital gold" and a tool for hedging against inflation and fiat currency devaluation, then its performance in the face of risk events should resemble that of gold. However, this time its trend clearly resembles that of high beta tech stocks in the Nasdaq.

What is driving this round of decline? The answer may lie in Tokyo.

The Butterfly Effect of Tokyo

BTC-4.76%

区块客·2025-12-21 06:14

Under global easing expectations, ETH has entered the value "strike zone".

Author: Trend Research

Since the market crash in 1011, the entire cryptocurrency market has been lackluster, with market makers and investors suffering heavy losses. Recovery of funds and sentiment will take time.

But what the cryptocurrency market lacks the least is volatility and opportunities, and we remain optimistic about the future.

The trend of the integration of crypto assets and traditional finance into a new business model has not changed; rather, it has rapidly accumulated a moat during periods of market downturn.

1. Strengthening the Wall Street Consensus

On December 3rd, Paul Atkins, the chairman of the SEC, stated in an exclusive interview with FOX at the New York Stock Exchange that "the entire U.S. financial market may migrate to on-chain in the coming years."

Atkins said:

2. The core advantage of tokenization is that if an asset exists on the blockchain, the ownership structure and asset attributes will be highly transparent. And currently,

ETH-5.52%

区块客·2025-12-21 06:02

Under global easing expectations, ETH has entered the "strike zone" of value

Author: Trend Research

Since the market crash on 1011, the entire cryptocurrency market has been dull, with market makers and investors suffering heavy losses. Recovery of funds and sentiment takes time.

But the crypto market is never short of volatility and opportunities, and we remain optimistic about the future.

Because the trend of integrating crypto assets with traditional finance into new business models has not changed; in fact, it has rapidly built up a moat during market downturns.

1. Strengthening of Wall Street Consensus

On December 3, US SEC Chairman Paul Atkins stated in an exclusive interview with FOX on the NYSE: "In the next few years, the entire US financial market may migrate onto the blockchain."

Atkins said:

2. The core advantage of tokenization is that if assets are on the blockchain, ownership structures and asset attributes will be highly transparent. Currently

ETH-5.52%

区块客·2025-12-20 05:56

Under global easing expectations, ETH has entered the "strike zone" of value

Author: Trend Research

Since the market crash on 1011, the entire cryptocurrency market has been dull, with market makers and investors suffering heavy losses. Recovery of funds and sentiment takes time.

But the crypto market is never short of volatility and opportunities, and we remain optimistic about the future.

Because the trend of integrating crypto assets with traditional finance into new business models has not changed; in fact, it has rapidly built up a moat during market downturns.

1. Strengthening of Wall Street Consensus

On December 3, US SEC Chairman Paul Atkins stated in an exclusive interview with FOX on the NYSE: "In the next few years, the entire US financial market may migrate onto the blockchain."

Atkins said:

2. The core advantage of tokenization is that if assets are on the blockchain, ownership structures and asset attributes will be highly transparent. Currently

ETH-5.52%

区块客·2025-12-19 08:58

Under global easing expectations, ETH has entered the "strike zone" of value

Author: Trend Research

Since the market crash on 1011, the entire cryptocurrency market has been dull, with market makers and investors suffering heavy losses. Recovery of funds and sentiment takes time.

But the crypto market is never short of volatility and opportunities, and we remain optimistic about the future.

Because the trend of integrating crypto assets with traditional finance into new business models has not changed; in fact, it has rapidly built up a moat during market downturns.

1. Strengthening of Wall Street Consensus

On December 3, US SEC Chairman Paul Atkins stated in an exclusive interview with FOX on the NYSE: "In the next few years, the entire US financial market may migrate onto the blockchain."

Atkins said:

2. The core advantage of tokenization is that if assets are on the blockchain, ownership structures and asset attributes will be highly transparent. Currently

ETH-5.52%

区块客·2025-12-19 05:55

$23 billion in options set to expire! Bitcoin faces a $1.4 billion short squeeze crisis

Bitcoin plummeted from $89,000 to a low of $84,450, with $550 million worth of positions liquidated within 24 hours. Behind this decline, the options market is brewing a bigger storm. Approximately $23 billion in contracts will expire on December 26, accounting for more than half of Deribit's open interest. Around $1.4 billion in put options are concentrated near the $85,000 strike price.

ETH-5.52%

MarketWhisper·2025-12-19 00:51

Under global easing expectations, ETH has entered the "strike zone" of value

Author: Trend Research

Since the market crash on 1011, the entire cryptocurrency market has been dull, with market makers and investors suffering heavy losses. Recovery of funds and sentiment takes time.

But the crypto market is never short of volatility and opportunities, and we remain optimistic about the future.

Because the trend of integrating crypto assets with traditional finance into new business models has not changed; in fact, it has rapidly built up a moat during market downturns.

1. Strengthening of Wall Street Consensus

On December 3, US SEC Chairman Paul Atkins stated in an exclusive interview with FOX on the NYSE: "In the next few years, the entire US financial market may migrate onto the blockchain."

Atkins said:

2. The core advantage of tokenization is that if assets are on the blockchain, ownership structures and asset attributes will be highly transparent. Currently

ETH-5.52%

区块客·2025-12-18 05:30

Fitch warns: Banks holding too much Bitcoin may face credit rating downgrades

Fitch warns that US banks may face credit rating downgrades and increased funding cost pressures due to aggressive blockchain deployment. The report points out that the volatility and compliance risks of crypto assets cannot be offset by stable fee income, and the rapid expansion of stablecoins may erode bank liquidity. Banks need to strike a balance between innovation and credit maintenance, or risk affecting their market position.

動區BlockTempo·2025-12-09 02:32

JPMorgan Chase Dimon: Current regulations force banks to close accounts, not political or religious factors

The United States has recently reignited the debate over debanking (Debanking). Members of the Trump camp, Jack Mallers, CEO of blockchain payment startup Strike, and several crypto industry professionals have accused JP Morgan (JP Morgan) of unexpectedly closing accounts, raising public concerns about whether banks are exhibiting political or industry bias. In response, JP Morgan CEO Jamie Dimon made a rare public statement, emphasizing that account closures are not based on political or religious grounds, but are compelled by current regulations. He also revealed that he has been advocating for reforming the system for 15 years.

Trump camp and crypto industry professionals frequently accuse banks of account closures, fueling political and industry concerns

Before Dimon’s interview, Trump Media (Trump Media) CEO Devin Nunes, Strike CEO Jack Ma

ChainNewsAbmedia·2025-12-08 09:14

Buy every dip? How pro hodlers blend surgical DCA with rules-based crypto buys

“Buy every dip.” That’s the advice from Strike CEO Jack Mallers. According to Mallers, with quantitative tightening over, and rate cuts and stimulus on the horizon, the great print is coming. The US can’t afford falling asset prices, he argues, which translates into a giant wall of liquidity ready t

Cointelegraph·2025-12-05 14:21

ETH Traders Turn Bold as $6,500 Calls Take Over Deribit

The crypto derivatives market heats up again as traders chase higher ETH levels. Sentiment shifts fast in this market, and the ETH price outlook changes with every major options build-up. Deribit now shows a powerful wave of bullish bets, even as ETH trades far below the aggressive strike levels

ETH-5.52%

Coinfomania·2025-12-03 09:19

Binance Joins EU Agencies in Major Crackdown on Crypto-Fueled Digital Piracy Networks

Global crypto enforcement power surged as a sweeping multinational crackdown used blockchain intelligence to strike directly at the profitable Illegal Internet Protocol Television (IPTV) piracy networks long fueled by digital payments.

Binance, EU Agencies Target IPTV Piracy Networks

Crypto

Coinpedia·2025-11-28 06:38

North Korean hackers strike again! The Lazarus Group steals 30.6 million, and South Korean exchanges suffer for the third time.

The notorious North Korean cybercrime group Lazarus is suspected of orchestrating a major crypto assets attack that resulted in losses of approximately $30.6 million for South Korea's largest cryptocurrency exchange. The exchange operator Dunamu confirmed that assets related to Solana worth 44.5 billion won were transferred to an unauthorized wallet on Thursday, and the company stated it would use its own reserves to fully compensate users.

MarketWhisper·2025-11-28 06:36

Analyst Murphy: The resistance for BTC to return to $90,000 is relatively small, with the key resistance level at $92,000.

According to Mars Finance news, analyst Murphy pointed out that based on current data observations, it is not difficult for BTC to return to $90,000, as $90,000 is not a strong resistance level. The average cost of short-term holders indicates that BTC may only encounter significant sell pressure when it enters the range of $92,000 to $99,000. At the same time, options market data shows that Call activity at the $92,000 strike price is significantly higher than at $90,000, especially the sell Call at $92,000 far exceeds that at $90,000, which will lead to the formation of strong resistance in the market. Murphy emphasized that the key battle for BTC above $92,000 is the core area that determines the trend, especially close to the $98,000 position, which is the "fair price" line for BTC over the past decade. However, recent market confidence has been undermined due to massive realized losses, making it difficult to form effective buying pressure in the short term.

BTC-4.76%

MarsBitNews·2025-11-26 08:36

Strike CEO faces account closure by JPMorgan, US senators warn that Chokepoint 2.0 may resurface

Strike CEO Jack Mallers announced that his account was closed by JPMorgan without warning, raising concerns about the restart of "Chokepoint 2.0." U.S. Senator Cynthia Lummis and Custodia founder Caitlin Long warned that this situation could last until 2026 and undermine public trust in banks. The related controversy has been ongoing since 2023, involving questions about regulatory operations.

ChainNewsAbmedia·2025-11-26 07:44

JPMorgan Chase again closes encryption industry accounts, ShapeShift executives' business and personal accounts have been terminated.

JPMorgan Chase closed the commercial bank accounts related to ShapeShift DAO on November 22 and notified that personal accounts would also be closed within this week. The balance was about $40,000 when the account was frozen, and the bank did not specify the reason, only stating it was to "protect the financial system." A week before this incident, the account of Strike's CEO was also closed.

WuSaidBlockchainW·2025-11-26 01:42

JPMorgan Chase closes ShapeShift's business account and notifies that personal accounts will also be closed.

JPMorgan has closed the business account of Houston Morgan, the marketing head of the decentralized trading platform ShapeShift, raising concerns about the risks of account closures. Previously, Strike CEO Jack Mallers faced a similar situation, highlighting the "de-banking" issue in the U.S. Crypto Assets industry.

BTC-4.76%

DeepFlowTech·2025-11-26 01:36

ShapeShift Leader Debanked by JPMorgan

JPMorgan's recent debanking of ShapeShift leader Houston Morgan, following the case of Strike CEO Jack Mallers, highlights a troubling trend targeting key crypto figures. Morgan emphasizes that this reflects ongoing attempts to silence the crypto sector, contradicting the belief in a pro-crypto regulatory environment.

BitcoinInsider·2025-11-25 14:39

Load More