Search results for "UNI"

Uniswap, Chainlink, and Ethereum Show Potential Rebounds Amid Market Sentiment

Extreme retail fear for UNI and LINK may indicate potential price rebounds, while Ethereum tests key levels around $3,000. Monitoring sentiment and support can reveal short-term trading opportunities in the crypto market.

CryptoFrontNews·01-28 11:56

3 DeFi Altcoins to Accumulate in 2026 — DOT, UNI, AAVE

DOT: Connects multiple blockchains, enabling interoperability and scalable Web3 development.

UNI: Decentralized trading platform with automated liquidity and community governance.

AAVE: Allows crypto lending and borrowing with innovative features like flash loans.

Decentralized finance c

CryptoNewsLand·01-25 13:36

BlockchainFX App Goes Live In January As Analysts Reassess Top Crypto To Invest In 2026 With TON, SHIB, DOT, And UNI

Is the search for the top crypto to invest in 2026 driven by real-world usage, platform readiness, or long-term adoption potential? This guide reviews BlockchainFX (BFX), Toncoin (TON), Shiba Inu (SHIB), Polkadot (DOT), and Uniswap (UNI), with a clear focus on utility-backed growth rather

CaptainAltcoin·01-23 20:35

Whale 0x9671 Sells High and Rebuys Lower, Locking $600K Profit in UNI

Whale 0x9671 sold 798K UNI at $5.33, capturing liquidity at local highs without reducing market exposure.

Re-entered UNI at $4.83, 9.4% lower, using structured tranches to optimize gains and timing.

Profit of $600K realized while keeping nearly all previous UNI h

CryptoFrontNews·01-23 19:15

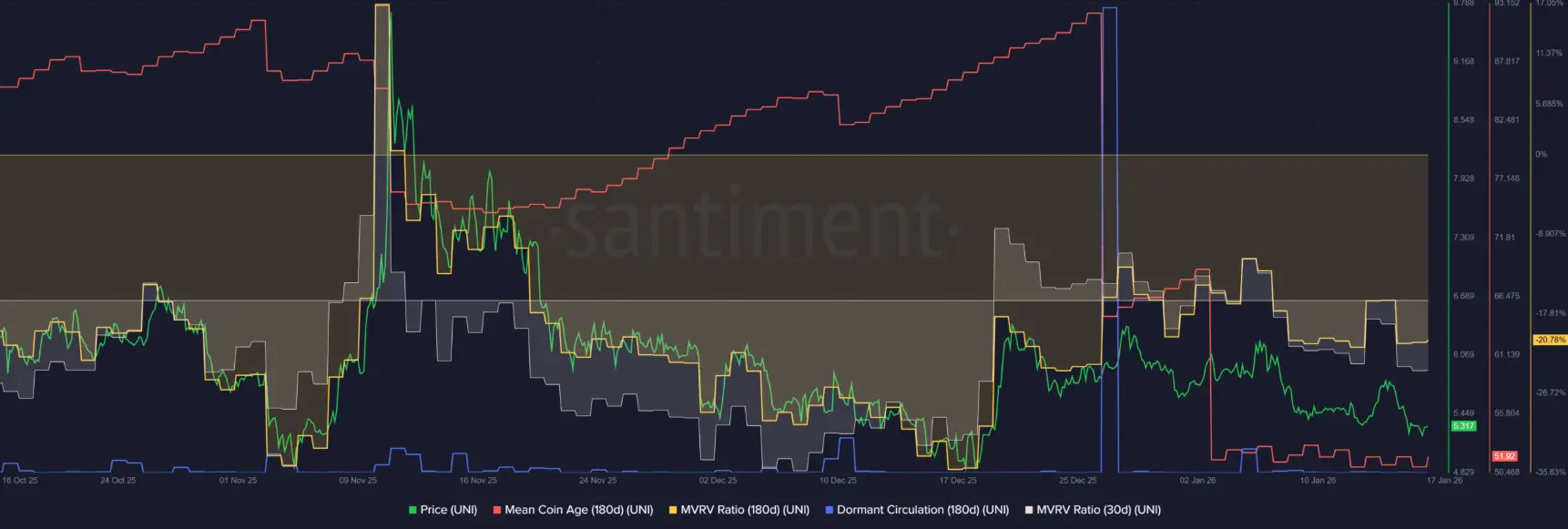

UNI Faces Resistance Below $6 Amid Growing Whale Purchases

UNI struggles below $6 despite strong whale accumulation over the past eight weeks.

Recent on-chain metrics show weak network-wide demand and short-term profit-taking.

Key support at $4.73 is crucial for confirming a bullish reversal.

Uniswap’s UNI has been struggling to maintain

CryptoNewsLand·01-23 08:41

Whale 0x9671 Sells High and Rebuys Lower, Locking $600K Profit in UNI

Whale 0x9671 sold 798K UNI at $5.33, capturing liquidity at local highs without reducing market exposure.

Re-entered UNI at $4.83, 9.4% lower, using structured tranches to optimize gains and timing.

Profit of $600K realized while keeping nearly all previous UNI h

CryptoFrontNews·01-22 19:11

Digitap ($TAP) Vs. $5.23 Uniswap (UNI): Future of Digital Nomads and Global Payments Vs. DeFi

The way people work and earn is changing. More professionals now live as digital nomads, freelancers, and remote workers, earning in one place and spending in another. At the same time, crypto has grown into two very different worlds. One is focused on trading, liquidity, and decentralized

BlockChainReporter·01-20 14:05

Uniswap (UNI) struggles below the $6 mark, even as “whales” quietly accumulate.

Uniswap (UNI) has gone through a challenging period on the price chart over the past three weeks. While many altcoins have made strong breakthroughs alongside Bitcoin (BTC)'s rally in the first week of January — with some tokens even maintaining an upward trend — UNI has appeared to be quite “out of sync” compared to the rest of the market.

TapChiBitcoin·01-18 02:05

Uniswap Whales Quietly Bought 12.4M UNI: What’s Next for Price?

_Uniswap’s top 100 wallets added 12.41 million UNI tokens in just eight weeks._

_A rare bullish divergence has formed where the price stays flat while large holders continue to buy aggressively._

_Breaking the $7.0 resistance level could open the door for a rally toward the $10.0

LiveBTCNews·01-17 20:45

The 100 Biggest Wallets Are Loading Uniswap (UNI) Again And The Chart Is Starting To Respond

Uniswap has quietly slipped out of most market conversations, yet on-chain data suggests something different is unfolding beneath the surface. While UNI price has trended lower for weeks, a fresh data update hints that positioning may already be shifting. That contrast between price action

UNI-5.48%

CaptainAltcoin·01-17 16:35

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-16 06:51

Momentum Is Building — 4 Altcoins Showing 40%+ Upside Potential in the Coming Weeks

Altcoin momentum has been gradually rebuilding through stable support structures and improving volume behavior.

AVAX, CRO, DOT, UNI, and MNT show elite technical positioning without excessive speculative pressure.

Current setups suggest potential 40% upside, though

CryptoNewsLand·01-15 23:31

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-15 06:46

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-14 06:41

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-13 06:36

Ethereum Eyes $9K, Uniswap Holds $5.48, but Milk Mocha’s Presale Is Where Attention Is Shifting

It is 2026, and analysts are closely tracking established assets as the latest Ethereum price prediction models suggest a climb toward $9,000, fueled by record staking and network utility. Simultaneously, the Uniswap price faces pressure after UNI failed to hold its $5.70 resistance,

CaptainAltcoin·01-12 19:05

ETH’s $9K Target & UNI’s $5.48 Price Point: What’s Drawing Investors to Milk Mocha’s Viral Presale?

It’s 2026, and traders are watching established assets closely, with the latest Ethereum price prediction models suggesting potential highs near $9,000, supported by rising staking levels and on-chain activity. The Uniswap price struggles are also coming into light, after UNI failed to reclaim

BlockChainReporter·01-12 19:03

Uniswap Market Watch: 5M UNI Token Move Could Trigger Volatility

5M UNI token move sparks market watch and speculation on potential price volatility.

UNI holds key support near $5.70, with $6.25 as next resistance target.

Institutional activity, token burns, and new listings may influence UNI’s near-term price moves.

Uniswap — UNI, is showing signs

CryptoNewsLand·01-12 08:42

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-12 06:36

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-11 06:31

Uniswap ($UNI) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

_Date: 10 Jan 2026, 06:25 AM GMT_

The broader cryptocurrency market is taking a breather after a strong start to the year. Bitcoin (BTC), which

CoinsProbe·01-10 06:27

UNI price increases by 5% after Galaxy Digital shifts 5 USD

UNI – the flagship digital asset of the Uniswap ecosystem – has recorded a 5% increase in the past 24 hours. This upward momentum occurred immediately after Galaxy Digital transferred $5 million worth of UNI across two exchanges, Binance and

UNI-5.48%

TapChiBitcoin·01-07 06:10

Digitap ($TAP) Vs UNI: Which Asset Has More Utility?

In decentralized finance (DeFi), few projects carry the weight and reputation of Uniswap (UNI). As the world’s largest decentralized exchange by trading volume and total value locked, Uniswap has become foundational infrastructure for crypto markets.

However, as crypto adoption matures in 2026,

BlockChainReporter·01-06 12:04

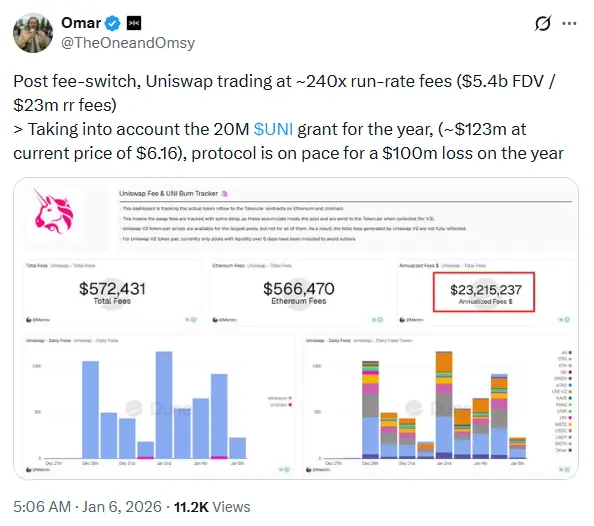

New Uniswap Proposal Outlines Fee Activation, UNI Burns, and Governance Overhaul

Uniswap founder and CEO Hayden Adams unveiled the “UNIfication Proposal,” a sweeping governance initiative aimed at turning on protocol fees, burning UNI, and aligning incentives across the decentralized exchange’s ( DEX) growing ecosystem.

Uniswap Moves Toward Unified Governance

Uniswap is

UNI-5.48%

Coinpedia·01-05 18:40

Zero Knowledge Proof Seals NRL Dolphins Deal As 100M UNI Burn Reshapes UNI Forecasts and Solana S...

As December wraps up, crypto sentiment remains uncertain. The Uniswap price prediction saw improvement following a 5% surge and a governance proposal to burn 100M UNI, while the Solana price prediction remains cautious despite Brazil gaining regulated institutional access. Both reflect growing

BlockChainReporter·01-05 17:04

Binance Listing Alert: Three Major Crypto Pairs to Be Added to Lineup - U.Today

Binance is set to list new trading pairs for Avalanche (AVAX), Bitcoin Cash (BCH), and Uniswap (UNI) on January 6, 2026, while simultaneously delisting 14 margin pairs. Users are advised to manage their positions before the delisting.

MAJOR0.82%

UToday·01-05 15:07

$5.95 UNI Vs Digitap ($TAP): the Best Crypto to Buy Comparison for Smart Investors

Whenever markets become silent, smart money begins to move early. Uniswap’s UNI token has been trading around $5.95. While the token consolidates, investors are turning from mature protocols toward infrastructure that integrates crypto with the real-world financial ecosystem.

This shift explains

BlockChainReporter·01-05 12:05

Uniswap Fee Switch Fallout: Is UNI Ready to Bounce or Break?

UNI Support: Bulls defend $5.50 demand zone, showing short-term resilience despite weak volume.

Protocol Upgrade: Fee switch and UNI burn strengthen fundamentals and boost market confidence.

Resistance Levels: $6.25-$6.55 and $6.65-$8.25 zones may limit gains; drop below $5.30 risks

CryptoNewsLand·01-04 12:41

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-5.48%

CoinsProbe·01-03 06:26

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-5.48%

CoinsProbe·01-02 06:25

Bitwise Targets AAVE, UNI, SUI and More in New Wave of Crypto ETF Filings

Bitwise files with the SEC for 11 new crypto ETFs, providing exposure to tokens like AAVE, TRX, UNI, and others.

The proposed ETFs use a hybrid structure with up to 60% in underlying crypto assets and 40% in derivatives and ETPs.

Crypto asset manager Bitwise has filed applications with the U

CryptoNewsFlash·01-01 13:46

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-5.48%

CoinsProbe·01-01 06:20

Bitwise Targets AAVE, UNI, SUI and More in New Wave of Crypto ETF Filings

Bitwise files with the SEC for 11 new crypto ETFs, providing exposure to tokens like AAVE, TRX, UNI, and others.

The proposed ETFs use a hybrid structure with up to 60% in underlying crypto assets and 40% in derivatives and ETPs.

Crypto asset manager Bitwise has filed applications with the U

CryptoNewsFlash·2025-12-31 13:45

Bitwise Files 11 New Altcoin ETF Applications With SEC

Bitwise Asset Management has filed for SEC approval of 11 new cryptocurrency ETFs, targeting assets like AAVE and UNI, with plans to allocate 60% directly to tokens. This follows previous ETF approvals, aiming for an effective date of March 16, 2026.

CryptoFrontNews·2025-12-31 13:16

PA Daily | Bitcoin ETF shifts from 7 days of net outflows to net inflows; Bitwise submits applications for 11 crypto ETFs

Today's News Highlights:

Trump Mobile, a subsidiary of the Trump Group, delays the launch of the gold-colored smart phone originally scheduled for this year.

Delin Holdings: Delin Securities approved to provide virtual asset trading services, upgraded to a Category 1 license.

Bitcoin spot ETF saw a total net inflow of $355 million yesterday, switching from seven consecutive days of net outflows to net inflows.

NEO's two founders publicly split: Da Hongfei and Zhang Zhengwen accuse each other of monopolizing financial control and lacking transparency.

Bitwise submits applications to the US SEC for 11 new cryptocurrency ETFs, including tokens like AAVE and UNI.

Macro

Trump Mobile, a subsidiary of the Trump Group, delays the launch of the gold-colored smart phone originally scheduled for this year.

According to Jin10 citing the Financial Times, Trump Mobile, a mobile phone company launched by the Trump Group, has postponed its plan to deliver the gold-colored smart phone originally scheduled for the end of this year. The company

PANews·2025-12-31 10:06

Bitwise proposes 11 hybrid-structure ETFs tracking AAVE, ZEC, TRX, among others

Bitwise has filed with the SEC to launch 11 new crypto ETFs focused on individual altcoins like AAVE, UNI, and TRX. The hybrid ETFs will allocate up to 60% in the actual tokens and 40% in derivatives, providing regulated investment exposure.

Cryptonews·2025-12-31 07:48

Uniswap Burns 100M UNI and Launches Ongoing Protocol Burn

Uniswap has burned 100 million UNI tokens, reducing the supply by 16%. This move, part of the UNIfication proposal, introduces a continuous burn model funded by transaction fees, aimed at enhancing long-term value appreciation.

CryptoNewsFlash·2025-12-30 10:30

Shiba Inu Price Prediction as Uniswap UNI Burn Sparks Intelligence Hunt and DeepSnitch AI Nears $1 Million

Uniswap just passed a major unification proposal that clears the path for a 100M UNI burn and protocol fees. This shift makes market interpretation a vital requirement for success. And points to DeepSnitch AI as giving traders an edge in any market environment.

DeepSnitch AI has already raised

CaptainAltcoin·2025-12-29 15:35

Uniswap Burns 100M UNI and Launches Ongoing Protocol Burn

Uniswap has burned 100 million UNI tokens, reducing the supply by 16%. This move, part of the UNIfication proposal, introduces a continuous burn model funded by transaction fees, aimed at enhancing long-term value appreciation.

CryptoNewsFlash·2025-12-29 10:26

Uniswap Cuts Token Supply by $596 Million as UNIfication Proposal Goes Live on Ethereum Mainnet

Uniswap burned 100 million UNI after a decisive vote reducing supply and activating protocol fees across core pools.

Governance support reached total backing which triggered fee switches, zeroed interface costs and enabled value capture.

Protocol fees now flow to UNI burns linking

UNI-5.48%

CryptoNewsLand·2025-12-29 10:21

Uniswap Burns $596M in UNI Following Fee Switch Vote—What’s Next?

Uniswap Executes Historic Token Burn Following Governance Approval

Uniswap has carried out a significant token burn, removing 100 million UNI tokens valued at approximately $596 million from its treasury. This move follows the recent approval of its long-anticipated fee burning proposal, marking a

UNI-5.48%

CryptoBreaking·2025-12-29 07:55

Gate Research Institute: Structural Recovery During Holiday Window | UNI Deflation Mechanism Implementation

Cryptocurrency Asset Overview

BTC (+0.69% | Current Price: 88,358 USDT)

After two days of sideways movement over the weekend, BTC experienced a slight increase to around $88,300, returning above the MA5, MA10, and MA30 moving averages. The short-term structure has shifted from weak to stable, with the moving averages showing a recovery from bearish to bullish. From a key price level perspective, the $88,800–$89,500 range above is a zone of short-term previous highs with dense trading activity and resistance from long upper shadows, which may require repeated digestion in the near term. It is important to note that we are currently in the Christmas holiday period overlapping with the New Year’s Day, during which participation from European, American, and Asian institutions has decreased, and overall liquidity is relatively weak. Prices are more susceptible to amplified fluctuations under low trading volume conditions. However, the credibility of a trend breakout remains limited, so short-term movements are more likely to oscillate within a range.

GateResearch·2025-12-29 07:09

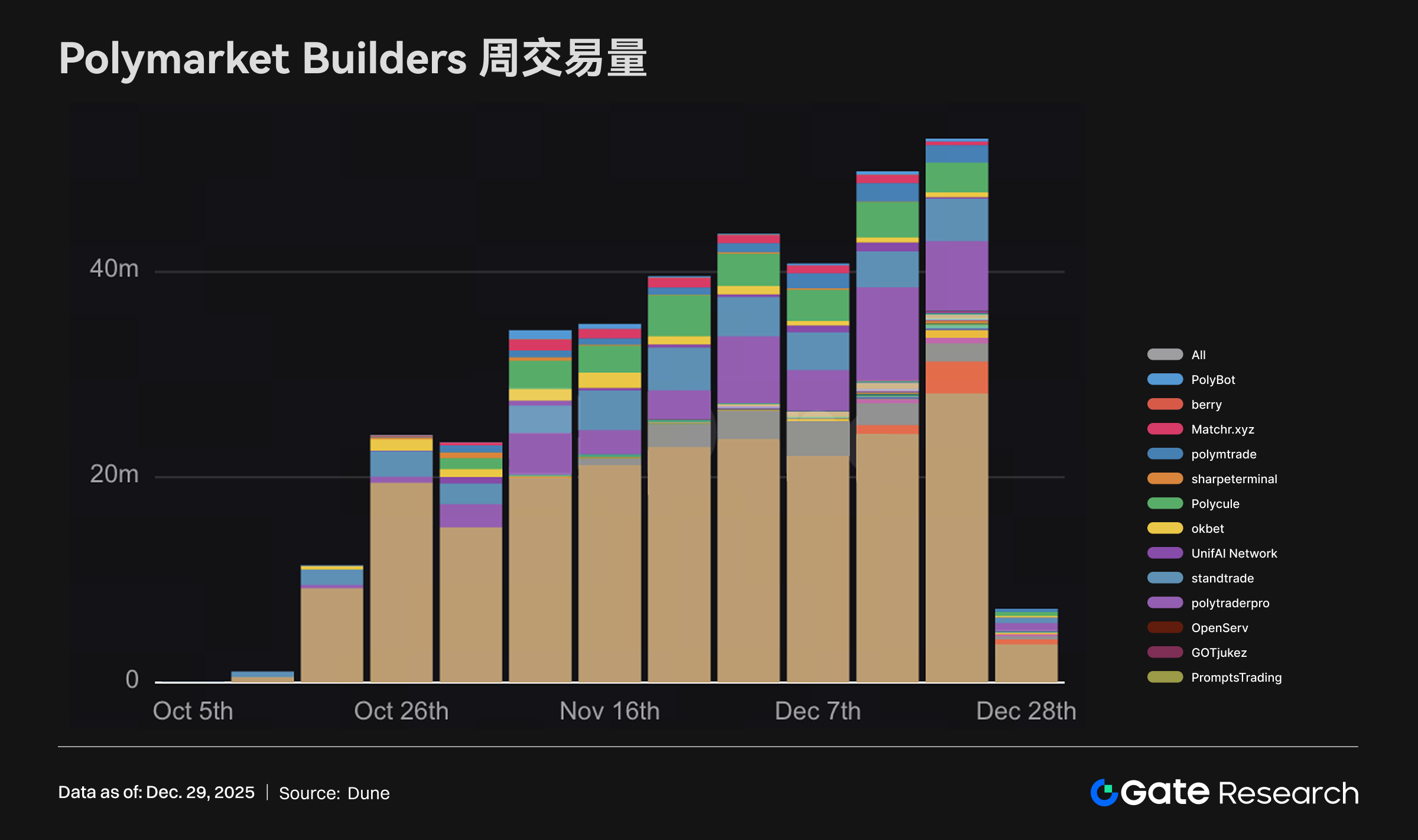

Gate Research Institute: Holiday window leads market rhythm | Polymarket Builders hit new high

Gate Research Institute Daily Report: On December 29, under the combined effects of the Christmas holiday and the low liquidity environment before and after New Year's Day, the crypto market continued its structural recovery trend. BTC rebounded above $88,000, while ETH hovered around the $3,000 mark, with market sentiment remaining cautious. In terms of daily hot topics, TOKEN, TAKE, and RIVER showed active performance driven by speculation, staking incentives, and product mechanisms. On the Alpha side, Polymarket Builders' weekly trading volume surpassed $50 million, reaching a new high, Uniswap completed the historic burn of 100 million UNI tokens and advanced the fee rebate mechanism, and Solana co-founder Toly expressed optimism with a prediction that the stablecoin market cap will surpass one trillion dollars.

GateResearch·2025-12-29 06:56

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-5.48%

CoinsProbe·2025-12-29 06:15

Uniswap enters the deflationary era! $600 million token burn mechanism permanently activated

Uniswap Labs executed the largest token burn in history on December 27, permanently removing 100 million UNI tokens, with a market value of approximately $600 million at the time. This move implements the core mechanism of the UNIfication governance proposal, shifting the protocol from a fee accumulation model to a deflationary-driven framework. Protocol fees generated by Uniswap v2 and v3 will continue to be used for market repurchases and burning of UNI, gradually reducing the circulating supply.

UNI-5.48%

MarketWhisper·2025-12-29 01:45

UNI rallies after Uniswap removes $596M worth of tokens from supply

Uniswap recently executed a 100 million UNI token burn, permanently removing approximately $596 million worth of tokens from circulation.

Summary

Uniswap permanently burned 100M UNI after a 99.9% governance vote passed UNIfication.

Protocol fees are now live while interface fees remain zero

U

Cryptonews·2025-12-28 14:54

Uniswap Burns 100M UNI Worth $591M After Fee Proposal

Uniswap’s “UNIfication” burn removes 100M UNI, transforming the token from governance-only to value-accruing asset.

Over 125M votes supported fee burns, now directly tying protocol usage to token supply reduction.

UNI wallet holds $1.7B, mainly in UNI; smaller transfers of ETH, USDC,

CryptoFrontNews·2025-12-28 14:41

Uniswap Burns 100M UNI Worth $596M After Fee-Burn Approval

_Uniswap executes historic UNI burn after governance approval, reducing supply, activating protocol fees, and strengthening the token’s deflationary model._

Uniswap has completed a landmark token burn that reshapes its economic structure. The protocol burned 100m UNI. The value was almost $596 m

UNI-5.48%

LiveBTCNews·2025-12-28 12:50

PA Daily | Silver's market cap jumps to the third largest globally; Flow suffers a $3.9 million loss due to hacking attack

Today's News Highlights:

1. Next Week's Macro Outlook: FOMC Minutes Focus Amid Low Liquidity

2. Silver Market Cap Surpasses Apple, Ranks Third in Global Assets

3. Analyst: Bitcoin Has Historically Deviated from Correlation with US Stocks and Gold; Last Time This Happened, BTC Price Increased 10x

4. Flow Suffered $3.9 Million Loss from Hacker Attack, User Deposits Unaffected

5. 100 Million UNI Burned from Uniswap Treasury, Valued at $596 Million

6. Bitmine Staked 343,000 ETH in Two Days, Worth $1 Billion

Macro

Next Week's Macro Outlook: FOMC Minutes Focus Amid Low Liquidity

Despite the Christmas holiday in the external markets, gold, silver, and platinum prices all surged to record highs, continuing the historic end-of-year rally in precious metals. Looking ahead to next week, with New Year's Day approaching, there are virtually no major macroeconomic data releases.

PANews·2025-12-28 09:21

Uniswap Burns $596M in UNI Following Fee Switch Vote—What’s Next?

Uniswap Executes Historic Token Burn Following Governance Approval

Uniswap has carried out a significant token burn, removing 100 million UNI tokens valued at approximately $596 million from its treasury. This move follows the recent approval of its long-anticipated fee burning proposal, marking a

UNI-5.48%

CryptoBreaking·2025-12-28 07:50

Load More