Search results for "UNIBOT"

The Retreat of Web3 Star Projects and the Rise of Broken Bound: A New Era of Decentralized Finance Innovation

Web3 projects have experienced periodic rises and falls of stars, with projects like FriendTech and Unibot once leading the trend. However, Broken Bound demonstrates strong vitality with its cross-chain financial solutions and Decentralization philosophy, becoming a market maker in the new era of Web3. Some projects like FriendTech have shut down, while Broken Bound continues to innovate, showcasing its resilience, indicating that it will occupy an important position in the crypto market in the future.

TechubNews·2025-04-25 05:38

Narrative tide recedes, where are the once star Web3 projects now?

Written by: Stacy Muur

Compiled by: Odaily Planet Daily Golem

First comes the stage of Web3, and then the protagonist will emerge.

When a protocol becomes popular, we can see people talking about it endlessly on social media, and all other projects either start to "cater to" it or begin to imitate it. You should understand that feeling; you can definitely feel it on Pump.fun. If you have been around for a while, you can also find the same sensation on platforms like FriendTech, Farcaster, Bananagun, and Unibot, each with its own cycle.

The harsh reality is that the stage of Web3 is always there, the hype will continue, but the protagonists are always frequently changing. Not because the products failed, but because people discovered something more dazzling. In this field, people are attracted to novelty.

UNIBOT1.94%

DeepFlowTech·2025-04-24 09:20

As the narrative fades, where are the once-celebrated Web3 projects now?

> The essence of failure is not due to the loss of funds or users, but rather the loss of narrative momentum.

Written by: Stacy Muur

Compiled by: Odaily Planet Daily Golem (@web3\_golem)

First there is the stage of web3, and then the main character will be born.

When a protocol becomes popular, we can see people talking about it endlessly on social media, while other projects either start to "cater" to it or begin to imitate it. You should understand that feeling, as it is definitely felt on Pump.fun. If you are experienced, you can also find the same feeling on platforms like FriendTech, Farcaster, Bananagun, and Unibot, each having their own cycles.

The harsh reality is that web3's

UNIBOT1.94%

ForesightNews·2025-04-23 14:15

How are the once-popular superstar protocols of Web3 doing now?

Author: Stacy Muur Translator: Shan Ouba, Golden Finance

People rarely leave because of issues with a protocol. More often, they leave because the story is no longer evolving—there are no new beliefs to follow, and no new direction to align with.

Web3 is a world, while the "Web3 protagonist halo" is another level.

In those moments, a protocol suddenly becomes popular, and the timeline is filled with news about it. Every project is either integrating it or copying it. You must know that feeling.

FriendTech has had those moments. Pump.fun definitely has too. Farcaster, Bananagun, and Unibot have all experienced it, each in their own cycles and for different reasons.

That feeling is direct, rapid, and noisy.

But the harder truth to accept is: the popularity will always

UNIBOT1.94%

金色财经_·2025-04-23 07:56

Announcing Its New Solana-Based Token, It Gave Airdrop News to Altcoin Investors! The price is on the rise!

The team of cryptocurrency trading platform Unibot made a new announcement today regarding the Solana-based UNISOL token.

At this point, Unibot, which initially emerged as a part of the Ethereum (ETH) ecosystem, has now adopted the Solana ecosystem and launched a new token, UNISOL

Bitcoinsistemi·2024-01-29 10:06

Unibot fully compensates users after the hacking incident

Unibot, a popular Telegram bot, bore a total of about $600,000 in damages and compensated affected users.

In response to the major hacking incident that occurred on October 31, the decentralized exchange Unibot has confirmed that it will fully compensate the users affected by the incident.

Despite the recent decline in the value of the Unibot token, the company remains confident of a strong recovery.

Unibot allows traders to return with a full load

The attack reportedly caused about $600,000 in damage, which Unibot fully covered, resulting in a massive loss of $1.78 million to the company. The vulnerability targeted a newly deployed router contract and resulted in unauthorized withdrawals of tokens from approximately 600 affected wallets.

As soon as an attack was detected, the Unibot team acted quickly, including suspending the...

奔跑财经·2023-11-04 03:21

What security problems of bot products are exposed by the Unibot attack?

Golden financial journalist Jessy

On October 31, Unibot was attacked, and Unibot officially issued an announcement saying: "The reason for the attack is that there is a vulnerability in token approval in the new router, and any loss of funds due to the error of the new router will be compensated; The user's key and wallet are secure. "

It is understood that the attack caused more than $600,000 in damage. Although the team has promised to pay it all out. However, this attack has exposed the problems of Unibot and even Telegram Bot itself.

In this incident, some professionals pointed out that the attack was more like a premeditated ghost act: because the contract was not open sourced, hackers easily found vulnerabilities, and a week after Unibot was launched, hackers deployed the attack, which hibernated for half a year.

And from this incident,...

金色财经_·2023-11-03 11:49

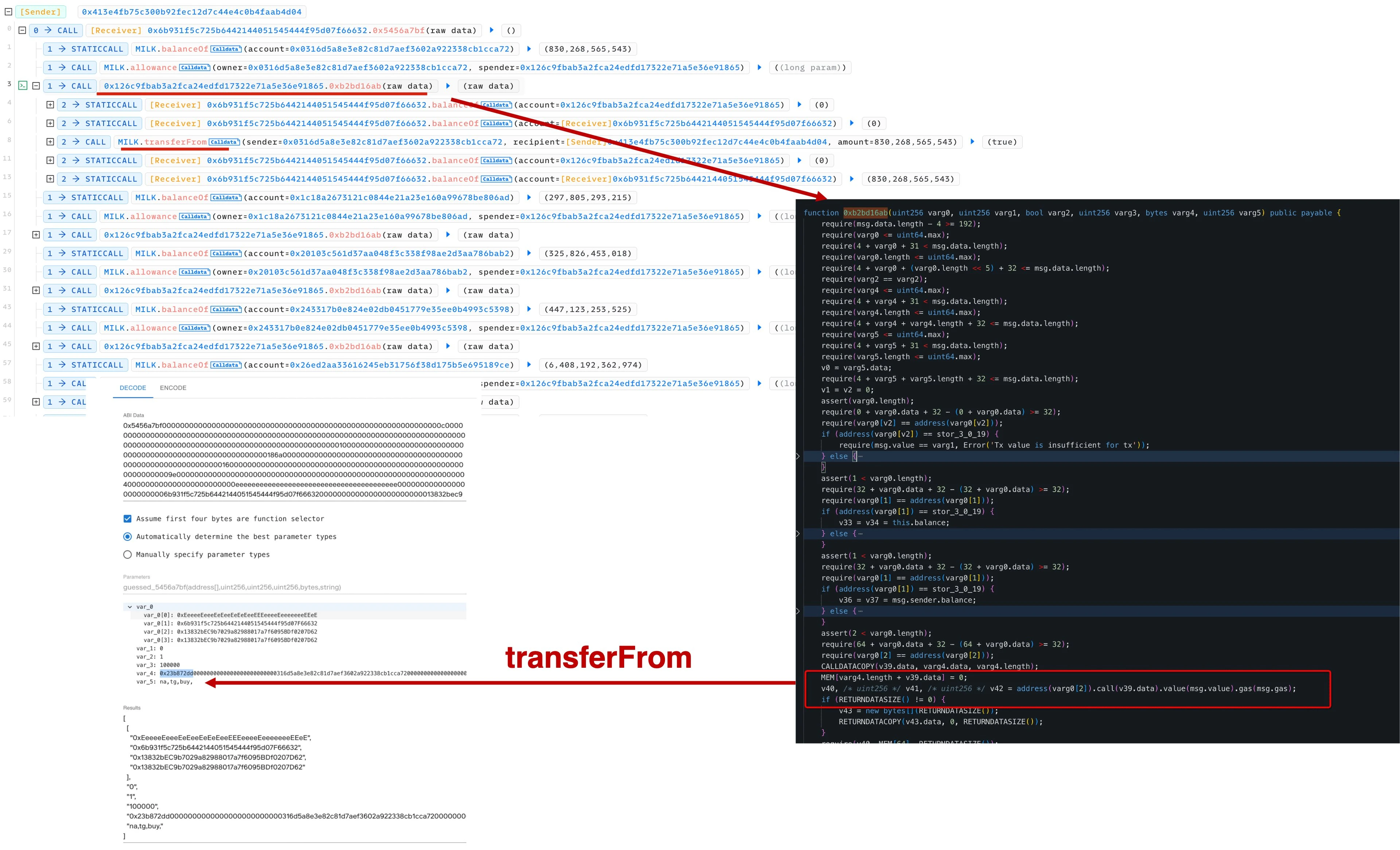

Unibot Attack Incident Analysis: After Maestrobot, the Telegram Bot project has been maliciously exploited again

At 12:39:23 on October 31, 2023, Beijing time, Unibot was maliciously exploited and lost $640,000 in assets. Let's take a look at the vulnerability analysis and attack process of this incident.

星球日报·2023-11-02 10:05

Unibot was attacked and lost more than $600,000, and the security of TG BOT was questionable

The official promises to compensate users for their losses.

星球日报·2023-10-31 07:45

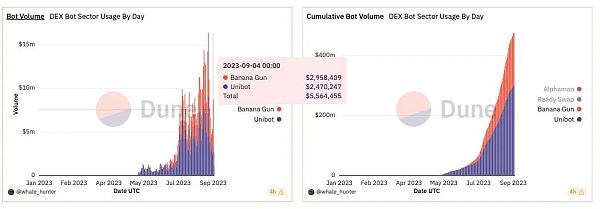

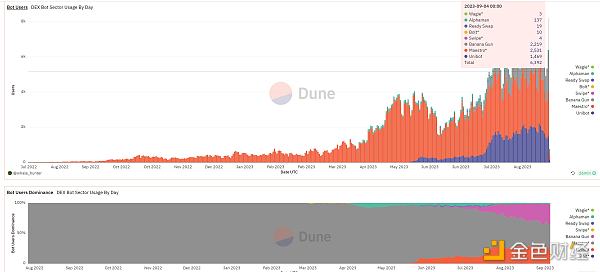

BananaGun Presale Analysis: The Rise of Trading Bots

@BananaGunBot surges in popularity after announcing token pre-sale. The latest figures show that BananaGun has a user base and transaction volume comparable to Unibot, intensifying the competition between the two. In this article, GryphsisAcademy takes an in-depth look at BananaGun’s pre-sales status and key metrics.

Introduction

Banana Gun is a Telegram trading bot that offers a unique sniper buying feature that enables users to quickly purchase newly launched tokens. This provides an advantage to early adopters seeking to participate in new projects.

Pre-sale

The pre-sale fundraising target is 800E, and a single person can allocate up to 1E. The pre-sale and release price is set at $0.65. The starting market cap is $1.56 million and the FDV is $6.5 million. The pre-sale includes four rounds, token issuance...

金色财经_·2023-09-07 14:00

Banana Gun token pre-sale is about to start, here are the key information you need to know

Author: 0xSun, Source: Author Twitter @0xSunNFT

Banana Gun @BananaGunBot announced the token pre-sale details. This is one of my most anticipated projects in the near future. Here is the information you need to know:

1. Basic introduction

Banana Gun is a TG trading Bot. Its most famous function is to snipe the market opening. Judging from the latest data (Figure 1), the number of users and transaction volume of Banana are close to that of @TeamUnibot, while the leading @MaestroBots has no plans to issue coins in the near future. The battle between Banana and Unibot is intensifying.

2. Token Economics

The token distribution of $Banana is shown in Figure 2, of which the pre-sale accounted for 20%, the liquidity pool accounted for 3%, the airdrop accounted for 1.2%, and the team reserved 10%, half of which was locked for 2 years and linearly for 3 years Released, the other half was locked for 8 years...

金色财经_·2023-09-06 01:11

Five pictures predict the future direction of the "trading bot" track

Competing products are emerging and the leaders are divided. What does Unibot rely on to build barriers?

星球日报·2023-09-04 10:12

How to prevent phishing and scams related to Telegram bots?

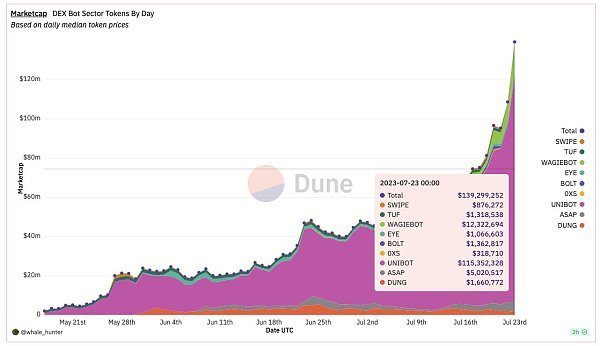

After $UNIBOT's market capitalization surged from $30 million to $185 million (currently at $110 million), players in the crypto market started FOMOing Telegram bots and related tokens. $UNIBOT is a token issued by UNIBOT. UNIBOT is a Telegram trading robot. Users can interact with the robot to monitor liquidity pools, trade tokens and copy other people's transactions.

As UNIBOT gained more and more attention in the cryptocurrency market, various types of bots appeared: LootBot is a bot that automatically searches for Airdops on different EVM chains. Bridge Bot is designed to bridge users' funds faster and more securely. The MEVFree robot is designed to help users avoid MEV attacks when trading.

Today we're going to keep it simple...

金色财经_·2023-08-04 09:30

Are the Unibot and Telegram Bot tracks worth starting after suddenly becoming popular?

Author of the original text: 2Lambro Compilation of the original text: Bai Ze Research Institute

The Telegram Bot track has exploded recently, Unibot tokens have skyrocketed from $2.46 to $143 two months ago, and the maximum supply market value (total market value) has increased from $30 million to $140 million within 30 days.

Is the bot just a meme?

Can Unibot prove that its $140M combined market cap is more valuable than smaller DeFi apps like Trader Joe ($JOE) and Kyber ($KNC)?

I didn't catch the $unibot opportunity early, can I still buy now?

What is Telegram Bot?

In a nutshell, Telegram Bot is a part of Telegram...

金色财经_·2023-07-24 08:20

Load More