Search results for "YFI"

2025 YFI coin Investment Strategy: Decentralized Finance Yield Aggregators and Passive Income Strategies

This article discusses investment strategies for YFI coin, focusing on the potential of DeFi yield aggregators and the advantages of smart contract automation, emphasizing the economic model and governance rights of YFI token, and presenting risk management techniques to help investors achieve stable returns in a highly fluctuating market.

YFI5.62%

幣圈動態·2025-12-01 19:04

Data: AT 24 hours fall over 24%, multiple Tokens have experienced a surge and then a pullback.

According to Mars Finance, Binance Spot data shows that the market has experienced significant fluctuations. The 24-hour decline reached 24.86%, with COMP, YFI, EDU, and RESOLV also showing a "high-to-low" state, with declines of 5.22%, 9.88%, 8.62%, and 9.87% respectively. At the same time, CYBER, W, EIGEN, and CRV hit new lows today, with declines of 5.32%, 8.17%, 8.93%, and 5.17% respectively.

AT1.33%

MarsBitNews·2025-12-01 10:00

Yearn Finance yETH Exploit Drains Millions in Single Transaction

Yearn Finance’s yETH pool lost millions in a single hack, but V2 and V3 Vaults stayed safe.

Hackers minted near-infinite yETH, profiting $3M, and used Tornado Cash to hide funds.

YFI price spiked briefly after the exploit due to short-covering and low liquidity.

DeFi platform Yearn Finance

IN0.01%

CryptoFrontNews·2025-12-01 08:02

Data: COW rise over 7%, DASH fall over 7%

According to Mars Finance, Binance's spot data shows that the market has experienced significant fluctuations. COW has risen by 7.54% in 24 hours and reached a new high for today, while COW has slightly increased by 3.28% within 5 minutes. Meanwhile, DASH has fallen by 7.83% in 24 hours, and FUN has decreased by 6.22%, both showing a "high and then a fall" state. KAVA, NMR, and STORJ have all reached new lows for today, with declines of 5%, 6.85%, and 5.09%, respectively. YFI has also reached a new low for the week, with a decline of 5.95%.

MarsBitNews·2025-11-27 03:54

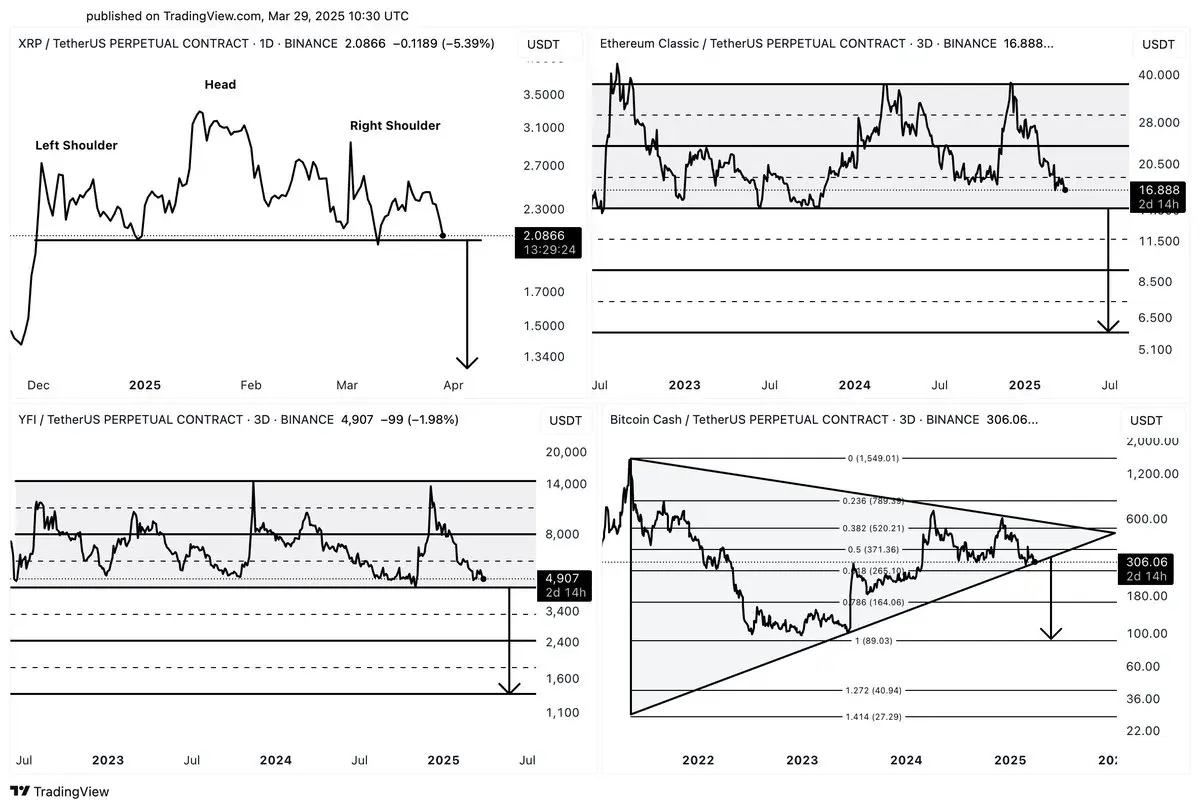

XRP and Three Other Altcoins Could Witness Another Sell-Off Event, According to Crypto Strategist - The Daily Hodl

Crypto analyst warns of potential collapse for XRP, ETH, ETC, YFI, and BCH while signaling bullish trends for ALGO and XLM with TD Sequential indicator.

GateUser-299f2bac·2025-04-01 09:22

The father of Decentralized Finance returns, can FlyingTulip continue the legend of YFI?

> The market is cold, the players are disheartened, and AC is back with his new project.

Author: Scof, ChainCatcher

On March 10, Sonic Labs, Yearn Finance, and Keep3rV1 founder Andre Cronje updated his personal social platform profile to include the title of 'flyingtulip founder'.

As a competitor to Hyperliquid, FlyingTulip has attracted much attention as soon as it was launched. It adopts an Adaptive Curve AMM, offering lower funding rates, better loan-to-value ratios, and higher LP returns, and relies on SonicLabs to achieve higher TPS.

Andre

ForesightNews·2025-03-12 12:04

SNX & YFI Losing Steam? BitLemons ($BLEM) Emerges As the Next Major GambleFi Opportunity

By TokenIntel on February 11, 2025 | Market Insights

The crypto market has witnessed significant volatility lately, with established DeFi protocols Synthetix (SNX) and yearn.finance (YFI) facing headwinds. Meanwhile, BitLemons ($BLEM) continues to make waves in the GambleFi sector, having already

CryptoNewsLand·2025-02-11 15:21

Yearn Finance Founder Andre Cronje Explains SEC Pressure and Decision to Step Back

Yearn Finance founder Andre Cronje said he left the crypto space due to intense scrutiny and inquiries from the U.S. Securities and Exchange Commission.

New SEC Approach Prompts Cronje to Speak Out

Andre Cronje, the founder of the decentralized finance (defi) platform Yearn Finance (YFI), said

S5.12%

Coinpedia·2025-01-29 07:31

Best Yield Farming Cryptos to Maximize Your DeFi Profits

Aave simplifies decentralized lending by offering flash loans and reduced fees, empowering users with governance through AAVE tokens.

Yearn.finance streamlines yield farming for investors, maximizing profits from DeFi projects via an easy-to-use aggregator with YFI tokens.

Uniswap resolves

CryptoFrontNews·2024-12-20 22:31

Market Overview: OG, YFI, PNUT Facing Sharp Decline

The cryptocurrency market is undergoing a strong price correction, with many major tokens experiencing significant declines recently. The main drivers of the downward trend include YFI, PNUT, ACT, KEY, and KDA. However, this also creates an opportunity for long-term investors to participate at a discounted price. To execute an effective strategy, traders need to closely monitor support levels, assess market psychology, and apply a balanced approach. Keeping updated and exercising caution will be crucial in overcoming the current market turmoil.

Blotienso·2024-12-09 08:19

Review of the YFI plunge and dYdX liquidation and liquidation events: these six points are worth paying attention to

How does an "attack" occur, and what can be done to prevent similar incidents from happening again?

星球日报·2023-11-21 01:54

On-chain data: How attackers manipulate the YFI price on dYdX to make a profit

Author: Lookonchain, Encrypted Data Monitoring Platform, Translation: Golden Finance xiaozou

How is the YFI price manipulated to profit from dYdX? Here are some on-chain findings.

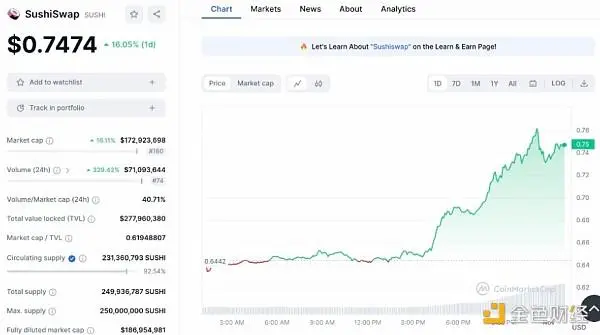

We have previously posted that some people are trying to make money by manipulating the price of SUSHI. This time, it was the same person who manipulated the price of YFI in the same way.

The current price of SUSHI has increased by 16%. It seems that someone is manipulating the price of SUSHI and going long SUSHI to make a profit. We found out that a new wallet bought SUSHI on the DEX and deposited USDC into a perpetual exchange like dYdX through multiple addresses (most likely long USDC).

On November 14th and 15th, the wallet "0xCCb6" and the wallet "0xB017" deposited a large amount of USDC to dYdX through multiple addresses, most likely in order to go long YFI. Since that...

金色财经_·2023-11-20 04:57

dYdX responded to a $9 million liquidation with swift insurance action

dYdX deployed its insurance fund after a $9 million liquidation event, sparking a major investigation into potential market manipulation.

DYdX, a well-known decentralized exchange, has deployed its insurance fund to mitigate the impact of a severe liquidation event that resulted in $9 million worth of user positions being affected. Antonio Juliano, the founder of dYdX, attributed these liquidations to what he described as a "targeted attack" against the platform.

On November 17, the digital asset space experienced wild volatility, especially the Yearn.Finance (YFI) token. The value of YFI plummeted by 170% after surging more than 43% in the previous weeks. This sudden downturn has led to a lot of speculation within the cryptocurrency community about potential market manipulation or exit scams.

dYdX's v3 insurance fund was quickly used...

奔跑财经·2023-11-19 07:37

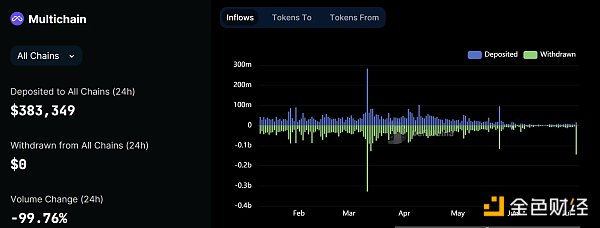

How can users save themselves when cross-chain bridge accidents occur one after another?

Author: how the husband

On July 7, tokens worth more than 100 million U.S. dollars were withdrawn from the Multichain bridge on the Fantom network. The transferred tokens included stablecoin USDC worth 58 million U.S. dollars, 1020 WBTC (approximately 30.9 million U.S. dollars), 7,200 WETH (about 13.7 million U.S. dollars) and 4 million U.S. dollars of stable currency DAI (the above four tokens are worth more than 100 million U.S. dollars), which also includes Chainlink, CurveDAO, YFI, WootradeNetwork and other tokens and the total supply of UniDex nearly a quarter of. Assets also appear to be moving on Multichain’s Moonriverbridge, including 4.8 million USDC and 1 million USDT. Dogechain also experienced abnormal capital flows, at least 660,000 US...

金色财经_·2023-07-09 01:51

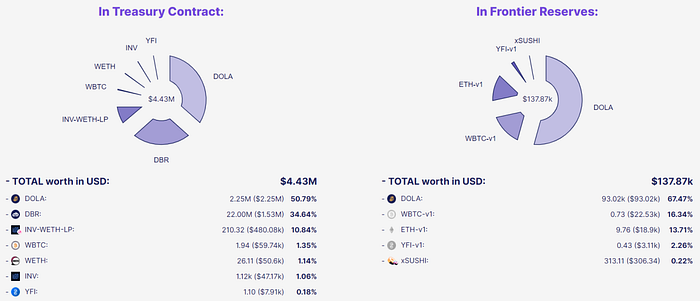

Inverse Finance: Put it to death and survive?

1. Project Introduction

Inverse Finance is a CDP lending product based on Ethereum, which lends the stablecoin DOLA by staking cryptocurrency. Founded in 2020, the project was recommended by YFI founder AC and attracted market attention. At that time, the product of the project provided lossless investment around the stable currency Dai. Users deposited Dai in the agreement vault and received the deposit certificate inDai at a ratio of 1:1, and then the vault put Dai into the income aggregation agreement such as Yearn to obtain ETH , YFI and other token rewards.

But unfortunately, the project suffered two consecutive malicious attacks in 2022 and the product was deactivated. In October 2022, it transformed into a fixed-rate lending market.

2. Team

The currently public member profile is Nour Haridy, the founder of the project, from Egypt, who has been working as a Web3 development project since 2018...

金色财经_·2023-07-07 02:18

Load More