Search results for "YIELD"

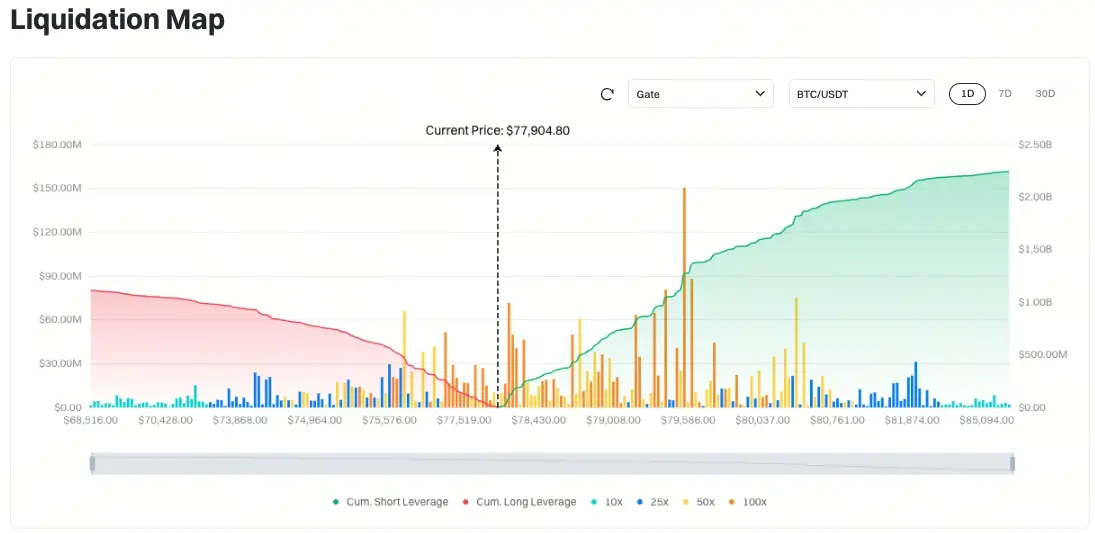

Japan's 40-year government bond yield breaks 4%! Yen arbitrage trading triggers $2.5 billion in Bitcoin liquidations

The era of "free funds" that Japan has maintained for decades has officially come to an end. On January 23, the Bank of Japan kept the policy rate at 0.75% but hinted that it will raise interest rates in the future. The 40-year government bond yield broke through 4%, and liquidity indicators rose to a record high. Forced liquidations of yen arbitrage trades triggered a chain reaction, with Bitcoin plummeting from $89,398 to $75,500, and daily liquidation amounts exceeding $2.5 billion.

MarketWhisper·7h ago

Gate Daily (February 2): Bitcoin sell-off causes IBIT yield to turn negative; FTX announces new round of payouts starting at the end of March

Bitcoin (BTC) experienced a slight rebound after a weekend crash, currently around $77,400 as of February 2. After U.S. President Trump announced the nomination of Kevin Waugh as the next Federal Reserve Chair, risk assets fluctuated and declined. The Bitcoin sell-off caused the dollar-weighted yield of BlackRock IBIT to turn negative. FTX stated that the next round of fund distribution is expected on March 31, with total claims amounting to approximately $9.6 billion.

MarketWhisper·7h ago

Market Quiet, Smart Money Buying: 5 Altcoins With 50–300% Upside Potential in the next 3 Months

Accumulation phases are being reported across several altcoins with tightening price ranges and stable volume floors.

Meme and infrastructure tokens are both appearing in high-risk, high-yield watchlists.

Breakout potential is being linked to liquidity return, not

CryptoNewsLand·11h ago

Tom Lee's Bitmine Ethereum unrealized losses exceed $6 billion, reaching a new high, as two whales cut losses during ETH decline.

The world's largest Ethereum reserve company, Bitmine, holds over 4.24 million ETH, but due to market downturns, unrealized losses have reached $6 billion. The company has staked a total of 2 million ETH, with an expected annual yield of approximately $150 million. Despite challenges, Chairman Tom Lee stated that Wall Street's attitude towards cryptocurrencies has shifted and now considers them core assets.

動區BlockTempo·02-01 04:45

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-31 15:35

Bit Digital Exits Bitcoin Mining and Shifts Core Strategy Toward Ethereum Staking and AI Infrastructure

Bit Digital exits Bitcoin mining to focus on Ethereum staking and AI infrastructure for steady long term yield.

Ethereum becomes the core balance sheet asset as staking rewards support active participation model shift ahead.

WhiteFiber IPO boosts AI compute exposure and positions Bit Digi

CryptoNewsLand·01-31 11:36

Amboss launches RailsX, the Lightning-native DEX for swapping Bitcoin and stablecoins

Amboss Technologies has launched RailsX, the first decentralized exchange on the Lightning Network, enabling peer-to-peer swaps between bitcoin and stablecoins. It utilizes Lightning payment channels for atomic swaps while allowing users to self-custody their assets. RailsX integrates Amboss's Magma liquidity market with Taproot Assets technology, aiming for a full ecosystem for liquidity providers. The platform works alongside the self-custodial bitcoin yield product, Rails, and includes partnerships with Magnolia and Bringin to connect to traditional banking infrastructures. The announcement comes as the Lightning Network grows, having surpassed 500 million USD in total capacity.

BTC-2.43%

TapChiBitcoin·01-31 00:27

Falcon Finance Launches $50M Fund to Scale Tokenized RWA Yield

Editor’s note: Falcon Finance has announced a $50 million ecosystem fund aimed at accelerating the development of structured yield products built on tokenized real-world assets. The initiative targets teams working on infrastructure that allows assets such as U.S. Treasuries, precious metals, and ot

CryptoBreaking·01-30 18:10

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-30 15:35

21Shares Lists Solana Staking ETP on Euronext Offering Regulated Access to JitoSOL Yield

21Shares listed a Solana staking ETP on Euronext offering regulated access to JitoSOL yield for European investors.

Europe continues to lead the market for staking ETPs as US approval for liquid staking products remains delayed.

The product lets investors earn Solana staking rewards

SOL-3.78%

CryptoNewsLand·01-30 10:21

21Shares Lists JitoSOL ETP (JSOL) on Euronext to Expand Solana Yield Exposure

21Shares has launched the JitoSOL ETP on Euronext, enabling European investors to access Solana’s staking yields via traditional banks. This innovation bridges decentralized finance with traditional markets, offering exposure to SOL while simplifying staking management.

SOL-3.78%

TheNewsCrypto·01-30 10:11

Vitalik finalizes Ethereum's ultimate goal! No developer intervention needed for operation, the stablecoin revolution is imminent

Vitalik envisions 2026: Ethereum aims to achieve "protocol finality" that can operate autonomously without developer intervention through "letting go of testing." Seven major tasks are proposed, including quantum resistance, scalability, state management, account abstraction, and more. Criticizing decentralized stablecoins, it is necessary to address issues such as dollar dependence, oracle security, and staking yield conflicts to challenge USDT and USDC.

MarketWhisper·01-30 06:17

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-29 15:30

VanEck launches the first AVAX ETF in the US! Featuring a dual engine of "price exposure + staking yield"

Asset management firm VanEck launches the first ETF in the US tracking Avalanche's native token AVAX, called the "VanEck Avalanche ETF" (ticker VAVX), allowing investors to participate in price fluctuations and earn staking rewards. Avalanche aims to address the three major pain points of blockchain and supports smart contracts. VAVX offers management fee discounts, with full management fee waivers for initial assets under management within $500 million.

AVAX-2.47%

区块客·01-29 11:35

Sui Group Plans Stablecoin-Driven SUI Buybacks With SuiUSDE Launch

Nasdaq-listed Sui Group has revealed that its priority for 2026 is to accumulate SUI and build yield-generating platforms for shareholders.

The company is set to launch a new stablecoin, SuiUSDE, with 90% of the fees channelled to token buybacks or DeFi projects.

Sui Group, a publicly-listed

CryptoNewsFlash·01-29 08:50

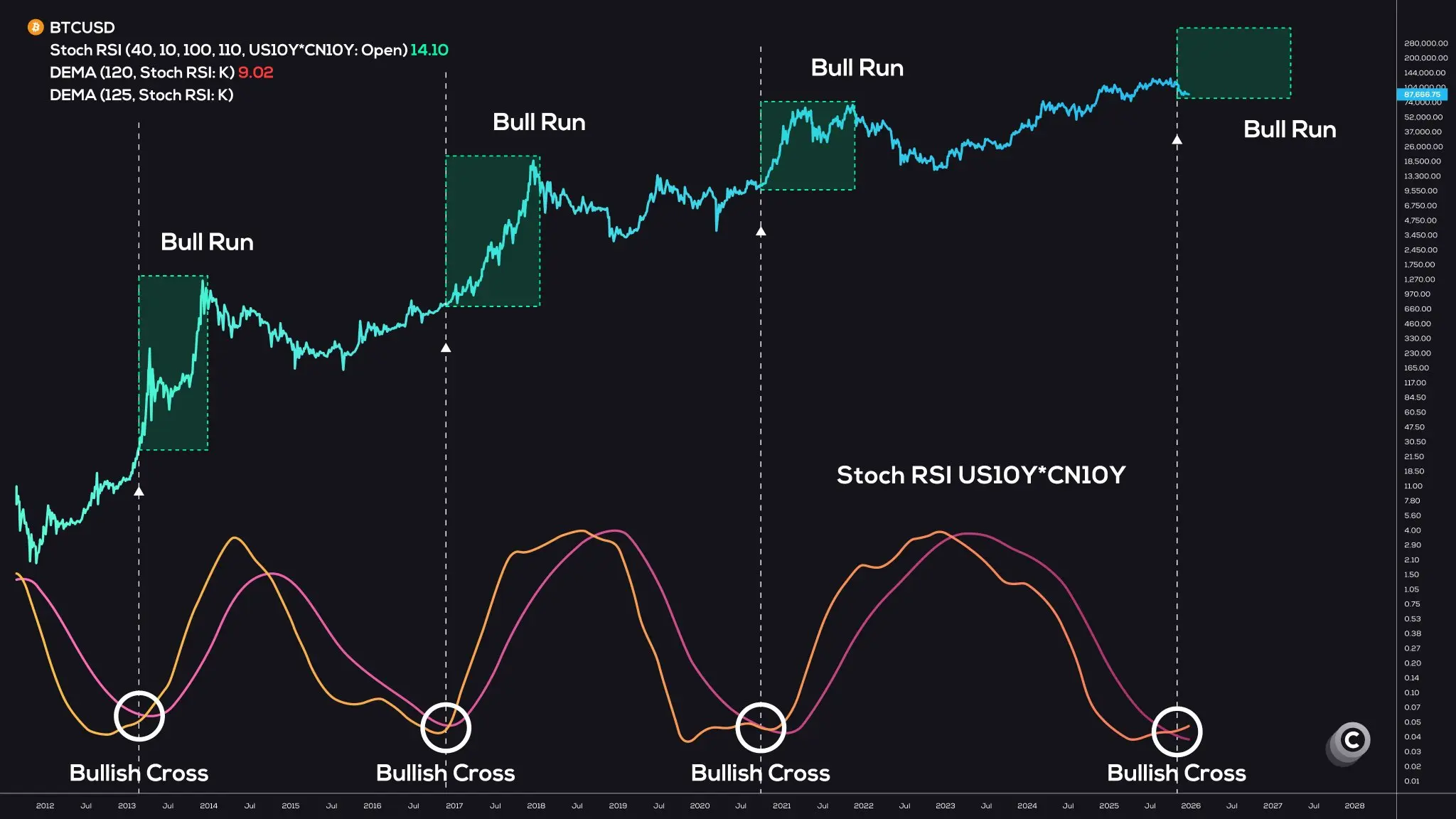

The 10-year US-China government bond yield spreads cross! Bitcoin bull market signals are coming

Multiple analysts have pointed out that the "most accurate bull market signal for Bitcoin" has appeared. The Stochastic RSI of the 10-year US and Chinese government bond yields has experienced a bullish crossover, triggering for the fifth time. The previous four times all led to significant Bitcoin rallies, indicating that improved liquidity will drive a rebound in risk assets. However, after rate cuts, gold surged dramatically while Bitcoin did not rise but instead fell.

MarketWhisper·01-29 03:38

$193 million political donations! Crypto giants attempt to "hijack" the US midterm elections

Fairshake PAC has raised $193 million, just 10 months before the US midterm elections. The White House convened banking and crypto executives on Monday to address the CLARITY Act stablecoin yield controversy. Standard Chartered warned that stablecoins could drain $500 billion in deposits from banks. Fairshake's support for candidates in 2024 has a win rate of over 80%.

CFG-1.32%

MarketWhisper·01-29 02:49

OpenEden Launches Governance Framework to Guide Protocol Decisions

From its founding, OpenEden set out to build regulated, institutional-grade infrastructure capable of bringing real-world assets on-chain without compromising compliance or risk discipline. As the platform has grown, its tokenization protocol has expanded to support multiple asset classes, yield pro

ICOHOIDER·01-28 11:02

Most Reliable Bitcoin Price Signal Points to a 2026 Bull Run

Bitcoin (CRYPTO: BTC) traders were watching a confluence of momentum signals that historically foreshadow sizable moves, but on-chain data suggests a cautious path ahead as market participants lean defensive. A fresh cross between momentum indicators tied to major yield curves has rekindled

CryptoBreaking·01-28 10:30

Sui Group Plans Stablecoin-Driven SUI Buybacks With SuiUSDE Launch

Nasdaq-listed Sui Group has revealed that its priority for 2026 is to accumulate SUI and build yield-generating platforms for shareholders.

The company is set to launch a new stablecoin, SuiUSDE, with 90% of the fees channelled to token buybacks or DeFi projects.

Sui Group, a publicly-listed

CryptoNewsFlash·01-28 08:45

Galaxy Digital leads a $7 million investment! Tenbin disrupts tokenization with CME futures

Galaxy Digital leads a $7 million seed round for Tenbin Labs. Tenbin uses CME futures for token pricing, enabling fast settlement and returning futures basis gains to users. The plan includes launching tokenized gold and high-yield foreign exchange tokens such as the Brazilian real and Mexican peso.

MarketWhisper·01-28 01:46

Unveiling the giant of US stock market crypto accumulation! MicroStrategy invests 53.9 billion with leverage, BitMine earns 590 million annually through staking

BTC hovers around $89,000, ETH approximately $3,200. MicroStrategy holds 710,000 BTC (invested $53.9 billion) in a leveraged mode, while BitMine holds 4.2 million ETH with an annual staking yield of $590 million in cash flow. The two major crypto giants have vastly different strategies.

MarketWhisper·01-28 00:58

According to the launch of the yield-generating gold token designed to 'operate within DeFi'

Theo has launched thGOLD, a new tokenized gold product designed to track gold prices and generate yields, developed in collaboration with Libeara and built on the MG999 fund. The product will be deployed on multiple major DeFi platforms.

TapChiBitcoin·01-27 14:30

BitMine Acquires 40,302 ETH, Lifts Total Ethereum Holdings to 4.24 Million Worth Over $12 Billion

BitMine now holds over 4.24 million ETH and controls more than 3% of total Ethereum supply.

Ethereum staking now drives BitMine treasury income with over 2 million ETH earning steady onchain rewards.

Public firms continue shifting toward Ethereum treasuries as staking yield reshapes

CryptoNewsLand·01-27 13:36

VanEck Launches First US Avalanche ETF With AVAX Price Tracking and Staking Exposure

VanEck launches the first US listed Avalanche ETF giving investors regulated access to AVAX price and staking yield.

The VAVX fund targets institutions and wealth managers seeking crypto exposure without direct token custody risk.

The Avalanche ETF launch signals growing demand for yield

AVAX-2.47%

CryptoNewsLand·01-27 12:41

VanEck launches the first AVAX ETF in the US! Featuring a dual engine of "price exposure + staking yield"

Asset management firm VanEck launches the first ETF in the US tracking Avalanche's native token AVAX, called the "VanEck Avalanche ETF" (ticker VAVX), allowing investors to participate in price fluctuations and earn staking rewards. Avalanche aims to address the three major pain points of blockchain and supports smart contracts. VAVX offers management fee discounts, with full management fee waivers for initial assets under management within $500 million.

AVAX-2.47%

区块客·01-27 11:49

XRP Treasury Firm Evernorth Uses AI to Enhance Yield Generation on XRPL

Evernorth plans to raise $1B+ to expand an institutional XRP treasury using lending, liquidity and DeFi yield on XRPL.

t54 partnership adds AI agents to run XRP treasury strategies on XRPL with verification, risk checks and compliance.

Evernorth has announced a strategic collaboration with t

XRP-4.49%

CryptoNewsFlash·01-27 11:40

Most Reliable Bitcoin Price Signal Points to a 2026 Bull Run

Bitcoin (CRYPTO: BTC) traders were watching a confluence of momentum signals that historically foreshadow sizable moves, but on-chain data suggests a cautious path ahead as market participants lean defensive. A fresh cross between momentum indicators tied to major yield curves has rekindled

CryptoBreaking·01-27 10:25

Sui Group Plans Stablecoin-Driven SUI Buybacks With SuiUSDE Launch

Nasdaq-listed Sui Group has revealed that its priority for 2026 is to accumulate SUI and build yield-generating platforms for shareholders.

The company is set to launch a new stablecoin, SuiUSDE, with 90% of the fees channelled to token buybacks or DeFi projects.

Sui Group, a publicly-listed

CryptoNewsFlash·01-27 08:45

Bitwise Brings Wall Street Style Yield to DeFi Vaults

_Bitwise partners with Morpho to launch non custodial DeFi vaults, targeting 6% yield through structured, transparent onchain lending strategies._

Bitwise has entered decentralized finance with a move that signals growing institutional comfort with onchain yield strategies. The digital asset

LiveBTCNews·01-27 07:05

New BlackRock Filing Signals Shift Toward Bitcoin Yield Strategies

_BlackRock moves deeper into Bitcoin ETFs as strong early inflows clash with sharp outflows and weaker BTC prices._

BlackRock has taken another step in expanding its crypto ETF lineup. A new filing shows growing interest in income-based Bitcoin products, even as market flows remain mixed.

LiveBTCNews·01-27 03:35

BlackRock Aims to Unlock Bitcoin Yield with New iShares Income ETF Filing

BlackRock, the world's largest asset manager, has filed with the SEC to launch an innovative iShares Bitcoin Premium Income ETF. This proposed fund seeks to combine direct spot Bitcoin exposure with a yield-generating "covered call" options strategy, marking a significant evolution beyond its existing passive Bitcoin ETF (IBIT).

The move signals a maturing institutional approach to Bitcoin, treating it not just as a speculative asset but as a productive holding capable of generating regul

BTC-2.43%

CryptopulseElite·01-27 01:09

BitMine earns $164 million annually! Staking 2 million ETH to dominate the market

BitMine Immersion Technologies Ethereum staking volume surpasses 2 million coins, with a total holding of 4.24 million coins, accounting for 3.5% of the circulating supply. Based on an overall staking rate of 2.81%, the annualized yield is $164 million. If all staked assets generate daily earnings of over $1 million, self-operated validators will be launched in 2026 to achieve internalized operations.

ETH-7.32%

MarketWhisper·01-27 00:51

Falcon Finance Adds Tokenized Mexican Sovereign Bills to Diversify USDf Collateral

The Falcon Finance protocol has integrated tokenized Mexican sovereign bills into its multi-collateral framework for its stablecoin, USDf, through a partnership with real-world-asset platform Etherfuse.

Bridging Emerging Market Yield to DeFi Liquidity

Falcon Finance has integrated CETES—the token

Coinpedia·01-26 18:46

XRP Treasury Firm Evernorth Uses AI to Enhance Yield Generation on XRPL

Evernorth plans to raise $1B+ to expand an institutional XRP treasury using lending, liquidity and DeFi yield on XRPL.

t54 partnership adds AI agents to run XRP treasury strategies on XRPL with verification, risk checks and compliance.

Evernorth has announced a strategic collaboration with t

XRP-4.49%

CryptoNewsFlash·01-26 11:35

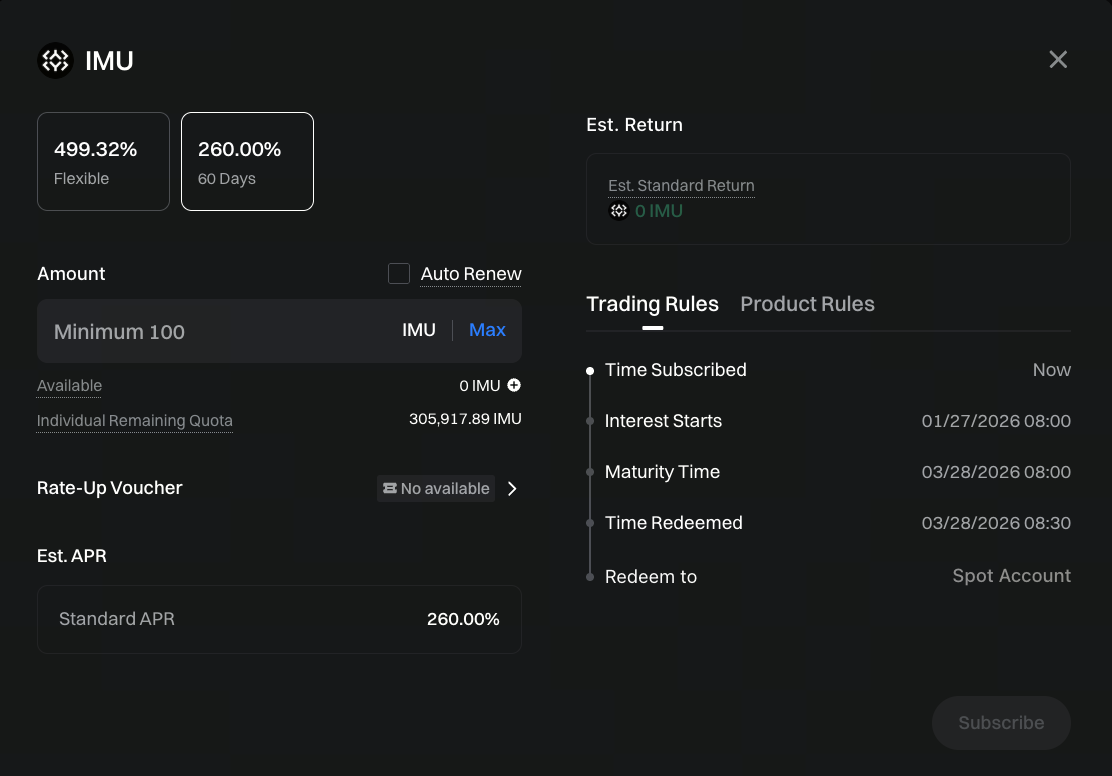

IMU 60-Day Fixed-Term Wealth Management Launch, Gate's Yubi Bao Limited Time Offer of 260% Annualized Return

Gate Yubi Bao launches IMU 60-day high-annualized fixed-term financial product, with an annualized yield of up to 260%. The product adopts a 60-day lock-up mechanism, with a subscription limit of 46 million IMU, suitable for users who are long-term optimistic about the IMU project. Participants should be aware of risks and subscription rules.

IMU2.18%

GateLearn·01-26 02:07

Missed the first wave of $SKR airdrops? It's not too late! Check out the Solana Seeker Season 2 Interactive Guide all at once

The second season of Solana Seeker has launched, with lowered task thresholds, emphasizing sustainability and the SKR staking mechanism. Participants are required to enable diagnostic functions and actively interact with DApps on-chain to earn higher airdrop weights. The newly introduced SKR staking offers up to 24% annualized yield, serving as a loyalty indicator to encourage user engagement.

区块客·01-25 13:04

When Ethereum pays interest to TradFi: staking rate hits a new high, is ETH approaching a structural inflection point?

GrayScale Ethereum Staking ETF begins distributing staking rewards to holders, marking the first time Ethereum's native yields enter the traditional financial system, lowering the barrier to staking for non-crypto-native investors. Ethereum's staking rate hits a new high, indicating it is transforming into a "yield-generating asset" accepted by long-term capital. This series of changes demonstrates the maturity of the Ethereum staking market and may attract more traditional capital to participate.

区块客·01-24 15:10

Why Digitap’s ($TAP) 124% Staking APY Beats NexChain ($NEX) as the Best Crypto to Buy

https://presale.digitap.app?&utm_campaign=jan&utm_content=com&utm_medium=sa&utm_source=cap-sa&utm_term=3049High-yield staking has become one of the most dominant filters for traders seeking altcoins to buy. This is evidenced by Ethereum’s all-time staking record of 30%, driven by large

WHY5.68%

CaptainAltcoin·01-24 08:05

Why are gold prices hitting new highs while Bitcoin stalls? Delphi Digital: It's all due to the surge in U.S. Treasury yields putting pressure on the global market

The rise in Japan's 10-year government bond yield has become a global financial market stress indicator, affecting the performance of gold and Bitcoin. Gold is absorbing increased pressure, indicating its strength as a safe-haven asset, while Bitcoin is performing relatively weaker. If the Bank of Japan intervenes to stabilize yields, it may lead to consolidation in gold prices, providing an opportunity for Bitcoin to recover. The market is focused on Japan's policy risks, and the changes between the two are important signals.

動區BlockTempo·01-23 17:50

David Sacks Says Banks Will Enter Crypto After Rules Pass

David Sacks said banks will enter crypto after Congress passes market structure rules, merging traditional finance and digital assets.

Sacks noted banks want to issue stablecoins but await legal clarity, saying regulation, not technology, is holding back adoption.

Stablecoin yield

CryptoFrontNews·01-23 17:21

When Ethereum pays interest to TradFi: staking rate hits a new high, is ETH approaching a structural inflection point?

GrayScale Ethereum Staking ETF begins distributing staking rewards to holders, marking the first time Ethereum's native yields enter the traditional financial system, lowering the barrier to staking for non-crypto-native investors. Ethereum's staking rate hits a new high, indicating it is transforming into a "yield-generating asset" accepted by long-term capital. This series of changes demonstrates the maturity of the Ethereum staking market and may attract more traditional capital to participate.

区块客·01-23 15:06

Restaking Promises Yield, Yet Deliver Only Stacked Risk

Introduction

Restaking has been pitched as a breakthrough for DeFi yields, promising higher returns by reusing already-staked assets to secure additional networks. Yet the rhetoric often masks a delicate risk calculus. Validators shoulder more responsibilities and potential slashing events across m

CryptoBreaking·01-23 13:40

Bank of Japan maintains interest rates! Bitcoin stays steady at 90,000, and 2.3 billion in crypto market options expire

The Bank of Japan maintained the interest rate at 0.75% with an 8 to 1 vote on January 23, marking the first decrease in four months. However, the central bank hinted at the possibility of further rate hikes this year. Bitcoin remained stable at $89,800 to avoid a sell-off, with $2.3 billion worth of Bitcoin and Ethereum options expiring today. Japan's 40-year bond yield fell to 3.939%, and the Japanese yen strengthened to 158.54.

ETH-7.32%

MarketWhisper·01-23 06:22

Senate Banking Committee's 《CLARITY Act》 delayed for several weeks of review! The White House urgently calls on Coinbase to compromise

The Digital Asset Market Clarity Act (CLARITY Act) review has been postponed due to Coinbase withdrawing support, leading to a lack of consensus between traditional financial institutions and cryptocurrency industry players. The White House hopes that the crypto industry can negotiate with banks on the "Stablecoin Yield Terms," but this policy has significant industry implications. In the short term, the Banking Committee will prioritize housing market issues, while the Agriculture Committee is attempting to introduce its own bill but faces difficulties gaining party support. Advisors warn against missing the current opportunity and call for compromise to advance the bill.

区块客·01-23 05:30

Sanae Takashi approves dissolution of the House of Representatives: "The Yen will come down soon!" Nomura: The yen exchange rate will only be intervened when it falls to 165

Japanese Prime Minister Sanae Takaichi announces dissolution of the House of Representatives and early elections, triggering the "Takaichi trading" trend, leading to the yen's continuous depreciation against the US dollar, approaching 159. Market analysis indicates that Takaichi's expansionary fiscal policies will keep the yen weak.

(Background recap: After record-breaking demand during internal testing, Bitget officially opens TradFi trading to all users)

(Additional background: Japan's 40-year government bond yield surpasses 4%, hitting a new high; 20-year auction demand remains weak)

Table of Contents

Yomiuri Shimbun reports: Takaichi Cabinet plans to call early elections for 465 House seats

Sanae Takaichi confirms on January 19: Dissolution of the House of Representatives on the 23rd, election on February 8

"Takaichi trading" continues to ferment: yen weakens, stock market oscillates at high levels

Exchange rate: Yen

Under pressure, the

動區BlockTempo·01-23 04:15

David Sacks Says Banks Will Enter Crypto After Rules Pass

David Sacks said banks will enter crypto after Congress passes market structure rules, merging traditional finance and digital assets.

Sacks noted banks want to issue stablecoins but await legal clarity, saying regulation, not technology, is holding back adoption.

Stablecoin yield

CryptoFrontNews·01-22 17:16

Nomura’s Laser Digital Launches Tokenized Bitcoin Yield Fund

_Laser Digital launches Bitcoin Diversified Yield Fund offering tokenized strategies targeting 5% annual returns above Bitcoin._

Nomura’s digital arm, Laser Digital, launched the Bitcoin Diversified Yield Fund (BDYF) for professional investors. The fund is a hybrid of long-term exposure to Bitco

LiveBTCNews·01-22 16:50

White House Advisor Slams Coinbase Retreat as Crypto Bill Fight Heats Up

Lawmakers increase pressure to pass the crypto market structure bill during a narrow political window

Coinbase’s withdrawal deepens tensions between Washington policymakers and major crypto firms

Stablecoin yield treatment emerges as the most contentious issue shaping the bill’s future

Washington

CryptoBreaking·01-22 14:15

Will yield-bearing stablecoins force banks into the crypto industry? David Sacks offers new insights

White House advisor David Sacks says banks, stablecoins and crypto will merge into one digital asset industry as U.S. rules evolve and stablecoin yields go mainstream.

Summary

David Sacks predicts crypto, stablecoins and banks will converge into a single digital asset industry once

Cryptonews·01-22 13:00

Load More