Search results for "btc etf"

Bitcoin’s Current Consolidation Mirrors a Previous Bullish Fractal — Is a $BTC Reversal Ahead?

Key Takeaways

Bitcoin is consolidating within a horizontal range after correcting from recent highs

Current price structure closely

BTC-4.76%

CoinsProbe·1h ago

VistaShares Launches BTYB, a Bitcoin-Linked Treasury ETF

The article discusses the launch of VistaShares' Bitcoin-linked Treasury ETF, BTYB, highlighting its significance in the cryptocurrency market.

BTC-4.76%

CryptoBreaking·2h ago

DOGE Price Stays Range-Bound Near $0.1125 as Monthly Pattern Repeats

Dogecoin trades near monthly support at $0.1125, maintaining its position within a long-term rising channel.

The current monthly structure closely matches Dogecoin’s previous market cycle, based on chart data.

DOGE/BTC holds at 0.051350 BTC, reinforcing structural alignment across both

CryptoNewsLand·2h ago

Bitcoin Struggles to Reclaim $80K as Gold and Silver Rally

Bitcoin (BTC CRYPTO: BTC) drifted in a narrow corridor on Tuesday as bullion attempts to reclaim losses and risk sentiment remains mixed. The session underscored a cautious stance among traders who are weighing whether the traditional gold narrative can coexist with a staunchly range-bound crypto ma

BTC-4.76%

CryptoBreaking·3h ago

Bitcoin Could Drop Below $60K, Says Galaxy Analyst—Here's Why

In brief

Bitcoin has firmly entered a downward price trend, and may be headed below $60,000, according to analysis from Galaxy.

Structural weakness in Bitcoin's price could send it towards its 200-week moving average of $58,000.

BTC has fallen around 1.4% on Tuesday, recently changing h

BTC-4.76%

Decrypt·3h ago

Analyst Explains Why Michael Saylor’s Bitcoin Holdings Shape the Market

Michael Saylor's holdings of 713,502 BTC, about 3.57% of total supply, make him a market focal point. His near-cost position increases market sensitivity and scrutiny, with risks amplified by funding structures. The dynamics of size and visibility may dictate broader market movements.

CryptoFrontNews·4h ago

Gold and Silver Are Pumping Again: Why BTC Could Follow This Time

Gold and silver prices saw a sharp decline followed by a quick recovery, prompting discussions on their influence on Bitcoin. Analyst James Bull connects these metals' price movements to Bitcoin trends, suggesting historical patterns where metals lead Bitcoin during risk appetite shifts. He emphasizes the importance of unfilled CME gaps in Bitcoin’s price movement, indicating that a bounce in metals could trigger a rise in Bitcoin.

CaptainAltcoin·5h ago

Institutions Shift Focus to XRP: Why Bitcoin and Ethereum Might Be Falling Out of Favor

January ETF data set the tone early, and the numbers stood out immediately. X Finance Bull on X laid it out clearly after reviewing the latest flow data. Bitcoin ETFs recorded outflows of $1.61B. Ethereum ETFs followed with $353M in net exits.

XRP moved the opposite way with $15.6M in

CaptainAltcoin·6h ago

Xapo Bank Data Reveals Bitcoin-Backed Loans Tilt Toward Long-Term

Bitcoin (CRYPTO: BTC)-backed borrowing at the Gibraltar-based Xapo Bank is increasingly being used for long-term financial planning rather than short-term liquidity, according to the bank’s 2025 Digital Wealth Report. Shared with Cointelegraph, the study reveals that 52% of Bitcoin-backed loans

CryptoBreaking·7h ago

VC data is bleak, and the narrative around new coins has dried up. After a year, what can be traded in the crypto space?

Author: Mandy, Azuma, Odaily Planet Daily

This weekend, amid internal and external troubles, the cryptocurrency market was once again bloodied. BTC is currently hesitating around the Strategy holding cost basis of $76,000, while competing coins are even more eager to self-destruct at the slightest price movement.

Behind the current downturn, after recent conversations with projects, funds, and exchanges, a question repeatedly came to mind: What exactly is the cryptocurrency market trading one year from now?

And the more fundamental question is: if the primary market no longer produces "the future of the secondary," then what is the secondary market trading one year from now? What changes will exchanges undergo?

Although the idea that competing coins are dead has long been old news, the past year has not been short of projects. Every day, projects are still lining up for TGE. As media, it’s quite intuitive that we continue to frequently connect with project teams for marketing and promotion.

(Note: in this

区块客·7h ago

Wall Street Can’t Control Bitcoin: Custodia CEO Explains Why

_Decentralized Bitcoin ownership restricts Wall Street control, unlike gold held in banks and central vaults._

_On-chain data shows over 70% of BTC sits with long-term holders, reducing daily tradable supply._

_Negative funding rates reflect defensive sentiment as markets wait for

BTC-4.76%

LiveBTCNews·7h ago

Satoshi Never Sold: On-Chain Data Squashes Speculation of 10,000 BTC Sale - U.Today

Arkham refutes claims that Bitcoin creator Satoshi Nakamoto sold BTC, confirming his stash of 1.096 million BTC remains untouched since 2010. Recent speculation about a sale is false, as Satoshi has not moved any Bitcoin in 16 years.

UToday·7h ago

Bitcoin Traders Bet on Rebound as BTC Targets $85K Liquidity Grab

The flagship cryptocurrency has been forming a cautious rebound after sliding to a nine-month low near $74,500 earlier in the week, trading roughly 5% higher as buyers test the fence at the $78,000 region with eyes on the potential climb toward the $85,000 zone. Market participants are weighing a mi

CryptoBreaking·8h ago

Three New Cardano ETFs Coming to Wall Street: Details - U.Today

Cardano (ADA) is attracting significant institutional interest, highlighted by Volatility Shares' plans to file for three exchange-traded funds (ETFs) linked to Cardano. These include a spot ETF, a 2x leveraged ETF, and a 3x leveraged ETF, which would provide traditional investors with varying degrees of exposure to ADA. This move suggests increasing legitimacy for Cardano in the financial sector and may drive liquidity and price growth.

ADA-2.23%

UToday·9h ago

How will Federal Reserve Chair Jerome Powell's contradictory strategy of "interest rate cuts + balance sheet reduction" affect the stock and bond markets, the US dollar, and the crypto market?

Donald Trump nominates a hawkish candidate, Warsh, to lead the Federal Reserve. He advocates for "cutting interest rates but shrinking the balance sheet." This article analyzes what potential impacts this could have on the stock market, bond market, US dollar, and the crypto market.

(Background: Will Warsh promote capital flow into Bitcoin? After being nominated by Trump, gold prices fell below $5,000, and BTC briefly rebounded to $83,700.)

(Additional context: Trump-appointed Federal Reserve Chair Kevin Warsh on Bitcoin: It is not a substitute for the dollar but a "supervisor" of monetary policy.)

Table of Contents

- From Hawkish to "Pragmatic": A Shift in Monetary Policy Beliefs

- "Cutting Rates + Shrinking the Balance Sheet": A Dangerous Balancing Act

- "Good Cop" and "Software": Warsh's Bitcoin Paradox

- Era of Liquidity Tightening: The Survival Rules of Cryptocurrency

- The Ghost of CBDC: The Perspective of Warsh

動區BlockTempo·9h ago

$521,196,758 Bitcoin Moved Anonymously As Price Remains Under $80,000 - U.Today

A massive Bitcoin transaction worth over $521 million was reported, involving 6,632 BTC moved between anonymous wallets. Tim Draper discussed his investment strategy, emphasizing funding disruptive ideas, including Bitcoin, which he views as a pivotal innovation challenging traditional banking.

UToday·9h ago

Gate Research Institute: Silver experiences its biggest decline in history, Moltbook sparks social media frenzy | Gate VIP Weekly Report (January 26 – February 1, 2026)

Last week, the market showed a weakening trend for BTC, with ETH underperforming, and trading volume decreasing during the rebound, indicating cautious bottom-fishing. STABLE surged by 32.56%, performing remarkably, and Base attracted over $110 million in capital inflows, becoming a focal point. The report will provide a detailed analysis of these trends and data.

GateResearch·10h ago

$700 Billion Has Been Wiped Out From the Crypto Market in 2 Weeks, Will 2026 Be Bearish?

$700 billion has been wiped out from the crypto market in 2 weeks.

Will 2026 be bearish, or will the market recover?

Reputed analyst expects BTC to drop to $54,000 – $44,000 and trigger a bear market.

The crypto community has experienced a brutal two weeks of declining crypto market

BTC-4.76%

CryptoNewsLand·10h ago

Gate Research Institute: Wosh is expected to accommodate interest rate cuts in the short term | The market may experience a technical rebound

Cryptocurrency Market Overview

BTC (+1.74% | Current Price $77,765 USDT): Bitcoin has experienced a sharp sell-off and is currently trading between $77,000 and $78,000. Over the past two weeks or so, Bitcoin's price has dropped approximately 20%, during which over $1.6 billion in leveraged crypto positions were forcibly liquidated. After the de-leveraging phase, macro policies are the primary driver behind the current revaluation of Bitcoin prices. If the market shifts towards more cautious rate cut expectations, the policy environment will be unfavorable for assets that rely on low-cost leverage and abundant liquidity. From a technical perspective, there is strong resistance above $90,000, while strong support is seen around $73,000. If this level is broken, the next target for the price is likely around $72,000, which corresponds to 2024.

GateResearch·11h ago

Bitcoin Crashes to 2026 Low — What Could Come Next for $BTC?

_Key Takeaways_

_Bitcoin is trading inside a consolidation range that closely mirrors a previous bullish fractal._

_Price action suggests B

BTC-4.76%

CoinsProbe·13h ago

MicroStrategy BTC holdings cost once breached! Terra crisis repeats, panic spreads

MicroStrategy holds 713,502 Bitcoins, accounting for 3.57% of the supply, with a cost basis of $76,052. This week, the price dropped below $74,500, causing a 7% decline in stock price. Recently, purchasing 855 BTC at $87,974 increased the cost basis. If the coin price remains weak, it could trigger a negative cycle: falling stock prices limit financing, weaken purchasing power, and eliminate demand support.

MarketWhisper·13h ago

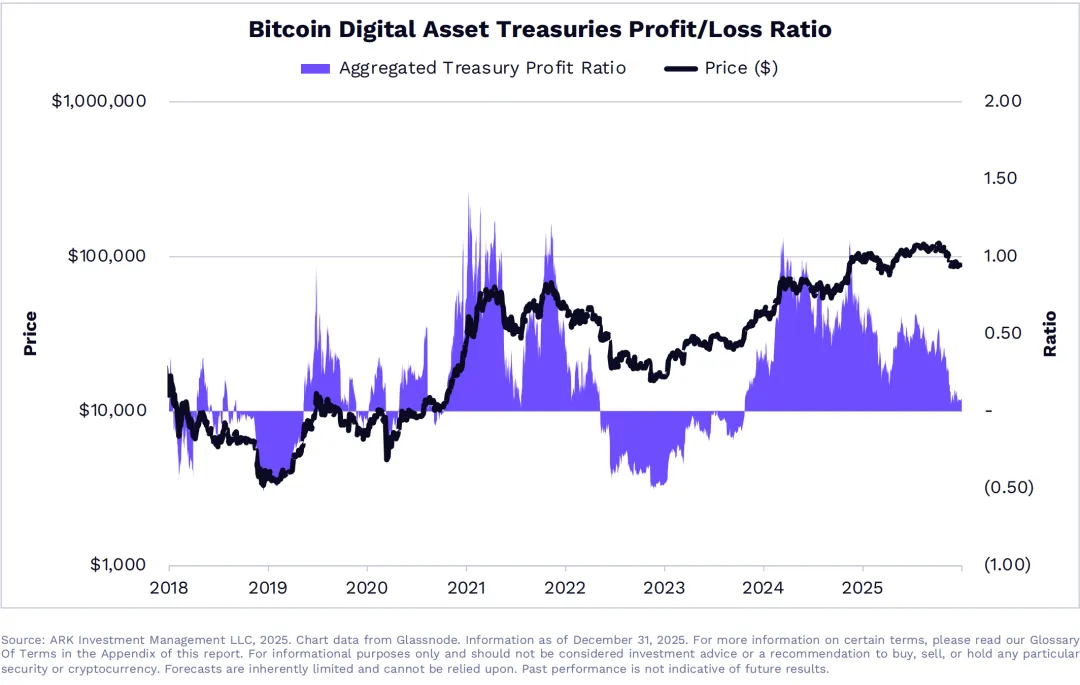

Cryptocurrency asset fund profits turn to zero! DAT profit and loss ratio compressed by 93%, fear of selling off Bitcoin

ARK Invest data shows that the Crypto Asset Fund (DAT) profit and loss ratio has compressed by 93% over the past year to break-even point. Bitcoin has fallen back to support at the ETF cost basis, but if the debt-based DAT's share price falls below net asset value (NAV), it may be forced to sell Bitcoin to buy back shares. At the same time, Bitcoin futures long positions account for 58% of total closed positions, indicating an oversold condition compared to the normal state over the past three years.

MarketWhisper·13h ago

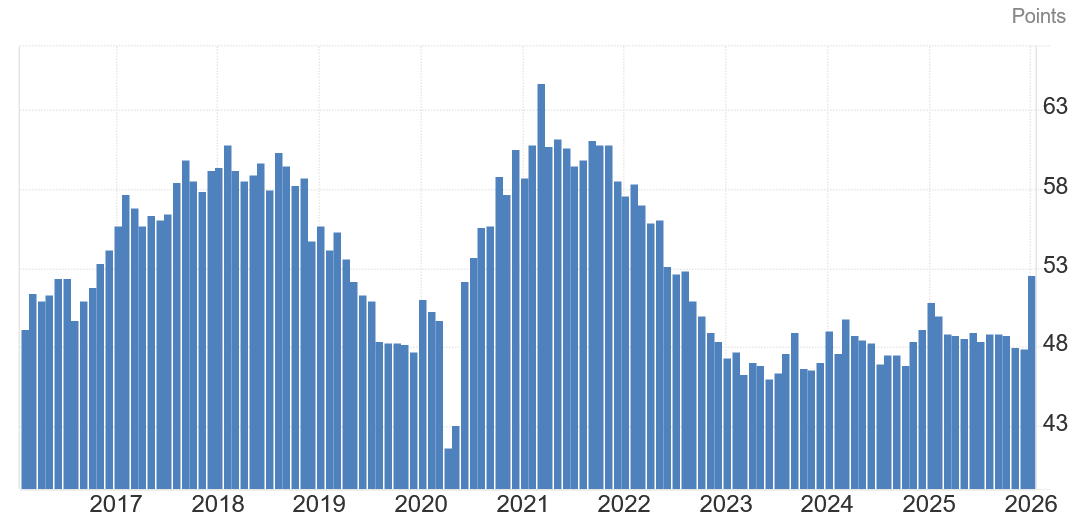

ISM Manufacturing PMI Index reaches its highest level in 40 months: Analysts believe BTC could benefit

An important indicator reflecting the "health" of the US economy has just recorded its highest monthly level since August 2022. Cryptocurrency analysts believe this signal could open up the possibility of a reversal for Bitcoin, which is currently trading around $78,000.

According to the report released on Monday by the Institute of Management

BTC-4.76%

TapChiBitcoin·13h ago

VC funding is bleak, new coin narratives are exhausted—what can the crypto market trade in a year?

Author: Mandy, Azuma, Odaily Planet Daily

This weekend, under internal and external pressures, the crypto market was once again bloodied. BTC is currently hesitating around the Strategy holding cost basis of $76,000, while altcoins are so volatile that just a glance at their prices makes traders want to gouge their eyes out.

Behind this current downturn, after chatting with projects, funds, and exchanges recently, a question kept recurring in my mind: What exactly is the crypto market trading a year from now?

And the more fundamental question behind this is: if the primary market no longer produces the "future of the secondary," then what is the secondary market trading a year from now? What changes will occur in exchanges?

Although the idea that altcoins are dead has long been a cliché, the past year has not been short of projects. Every day, projects are still lining up for TGE. As media, it’s quite straightforward—we continue to frequently coordinate with project teams for market promotion.

(Note: In this context

PANews·14h ago

Bitcoin Spot ETF Slumps in January- Key Bullish Fractal To Watch Out in February for $BTC

_Key Takeaways_

_Bitcoin ended January on a weak note after falling from $97,000 to near $75,722, setting a fresh yearly low._

_U.S. Bitcoi

BTC-4.76%

CoinsProbe·14h ago

Critic Schiff Mocks Saylor’s 855 BTC Purchase as Bitcoin Slips Below $78K

_Strategy bought 855 BTC at $87,974 as Bitcoin fell below $78,000, drawing criticism from Peter Schiff over the timing of the purchase._

Bitcoin dropped below $78,000 during a volatile trading period as Strategy completed another large purchase.

The timing of the buy attracted criticism from e

BTC-4.76%

LiveBTCNews·14h ago

Bitcoin Price Prediction 2026: Is the Crash Over? Hidden Bullish Signals Emerge

Bitcoin's sharp correction below \$80,000 has ignited a fierce debate among analysts: is this a healthy washout of leverage or the beginning of a deeper crisis of conviction? The sell-off, triggered by a global liquidity squeeze following the nomination of a hawkish Federal Reserve Chair, saw BTC briefly touch nine-month lows near \$74,500.

However, beneath the surface volatility, intriguing bullish signals are emerging. Michael Saylor's Strategy made a major \$75 million purchase during

CryptopulseElite·14h ago

Gold and Silver See Their Biggest Crash in Decades — Is Bitcoin (BTC) Ready to Shine?

Key Takeaways

_Gold and silver suffered their largest crash in decades, wiping out over $7 trillion in market value within 36 hours._

BTC-4.76%

CoinsProbe·14h ago

Tether Debuts MiningOS: Open-Source Bitcoin Mining Platform

Stablecoin issuer Tether has introduced MiningOS, an open-source software stack designed to streamline Bitcoin (CRYPTO: BTC) mining while broadening decentralization. Portrayed as a modular, scalable operating system, MOS is aimed at users spanning from hobbyists to multi-geography institutions.

CryptoBreaking·15h ago

Epstein's dossier reveals a "secret battle" between the Bitcoin maximalist camp and Ripple + Stellar

An email from over a decade ago is reigniting the debate over whether projects like Ripple were once considered a threat to Bitcoin's development or simply competitors that some BTC supporters wanted to eliminate.

The email dated July 31, 2014, is believed to show Austin

TapChiBitcoin·16h ago

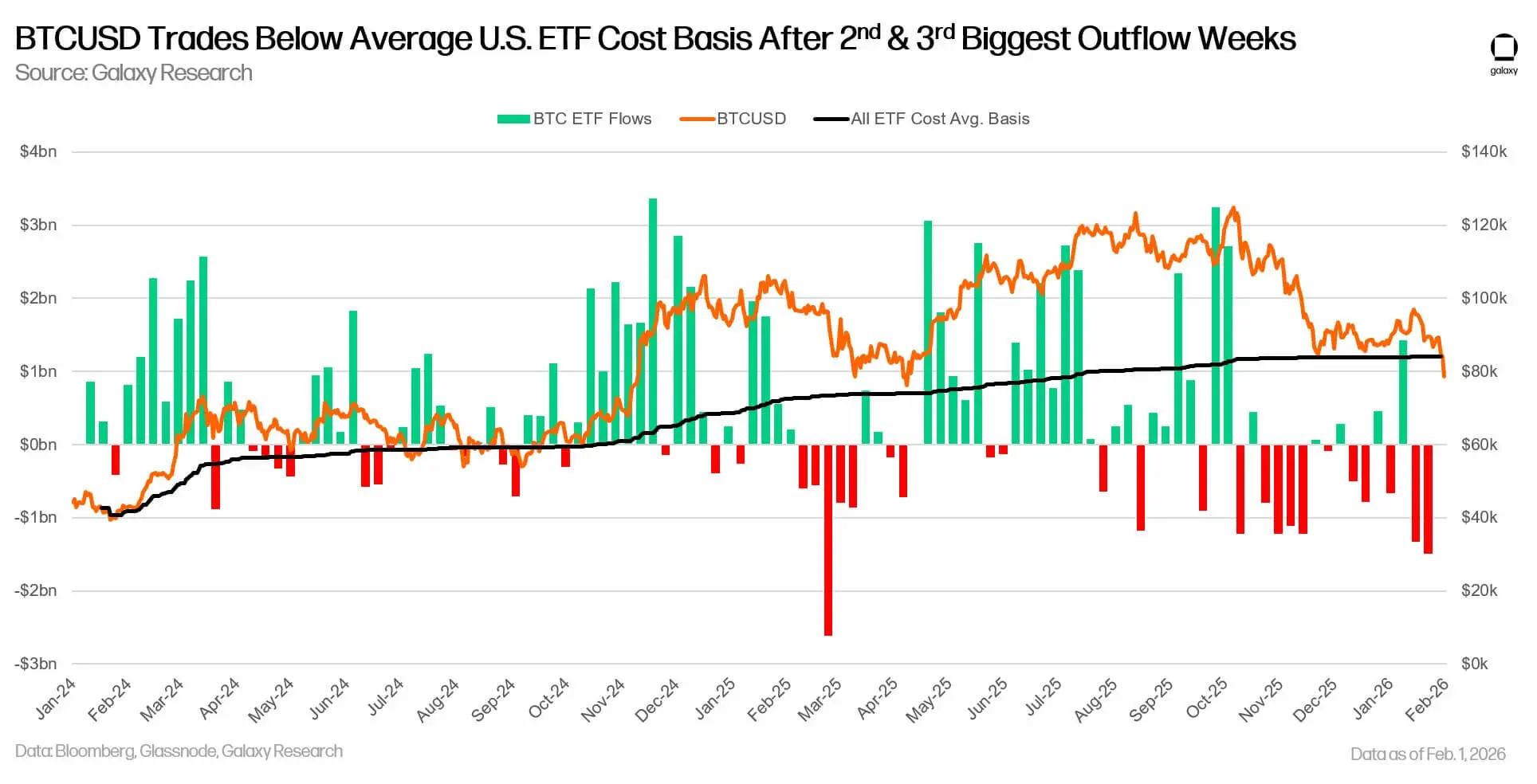

Bitcoin ETFs Face $7 Billion Dilemma: Is a Drop to $65,000 Next?

The recent Bitcoin price correction below \$80,000 has plunged a significant portion of US spot Bitcoin ETF investors into a collective \$7 billion paper loss, raising critical questions about market stability.

Data reveals that the average ETF buyer entered at approximately \$90,200 per Bitcoin, nearly 16% above current levels, with 62% of all ETF inflows now underwater. This is occurring alongside a sustained capital exodus, marking the longest monthly outflow streak since the funds' i

CryptopulseElite·16h ago

Groundhog Day Curse Arrives! Phil Sees the Shadow, Bitcoin Winter Hits Before the FOMC

Bitcoin welcomes Groundhog Day, as Phil sees a shadow signaling six weeks of winter. Bitcoin briefly dropped to $74,000. Over $2 billion was liquidated over the weekend, and on January 29, ETF outflows reached a record $817.8 million. The actual yield increased to 1.93%, suppressing risk assets. Bitcoin may remain subdued ahead of the March 17-18 FOMC meeting.

MarketWhisper·16h ago

The $70,000 Stress Test: How Miner Shutdowns Could Reshape Bitcoin’s Market Structure

Bitcoin’s descent toward \$70,000 is triggering a fundamental market phase shift, moving beyond trader sentiment to directly stress-test the network’s physical and economic bedrock: its miners.

With leading rigs like the Antminer S21 series nearing breakeven, a sustained price below this threshold risks forced machine shutdowns and BTC reserve selling, adding a new, potent source of downward pressure atop existing ETF outflows and leveraged unwinds. This mining stress zone represents a c

CryptopulseElite·16h ago

Bitcoin fears of crashing to 65,000? ETF holders suffer a loss of 7 billion, MicroStrategy faces profit crisis

Bitcoin drops below $80,000, ETF buyers face a paper loss of $7 billion. Over the weekend, it fell to $74,609, now rebounding to $77,649. The ETF average cost is $90,200, with a 15% loss. 62% of capital inflow is at a loss. MicroStrategy's cost is $76,020, with profits shrinking to $1.17 billion. If outflows continue, the next support level is $65,500.

BTC-4.76%

MarketWhisper·17h ago

Cryptocurrency Market Crash Diverges! Retail Investors Suffer Heavy Losses and Flee, 1,303 Whales Buy Back Against the Trend

Cryptocurrency market clears over $5 billion in four days. Glassnode shows super whales "lightly accumulating," retail investors selling for over a month. Holders of 1,000+ BTC increased to 1,303 entities, with 96 new giant whales. Ethereum's daily new addresses hit a record high of 427,000, Solana's active growth increased by 24.3%, on-chain activity diverges from price.

MarketWhisper·18h ago

Bitcoin Price Prediction 2026: How a 40% Drawdown Tests Crypto’s New Institutional Era

Galaxy Digital's analysis, revealing Bitcoin's potential descent toward its 200-week moving average near \$58k, is not merely a price prediction but a stress test for crypto's post-ETF era.

This 40% drawdown from all-time highs, accompanied by record-breaking leverage unwinds and ETF outflows, signals a pivotal shift: Bitcoin is no longer trading on pure speculative narrative but is being repriced by the cold, mechanistic logic of institutional capital structures, on-chain cost bases, an

CryptopulseElite·18h ago

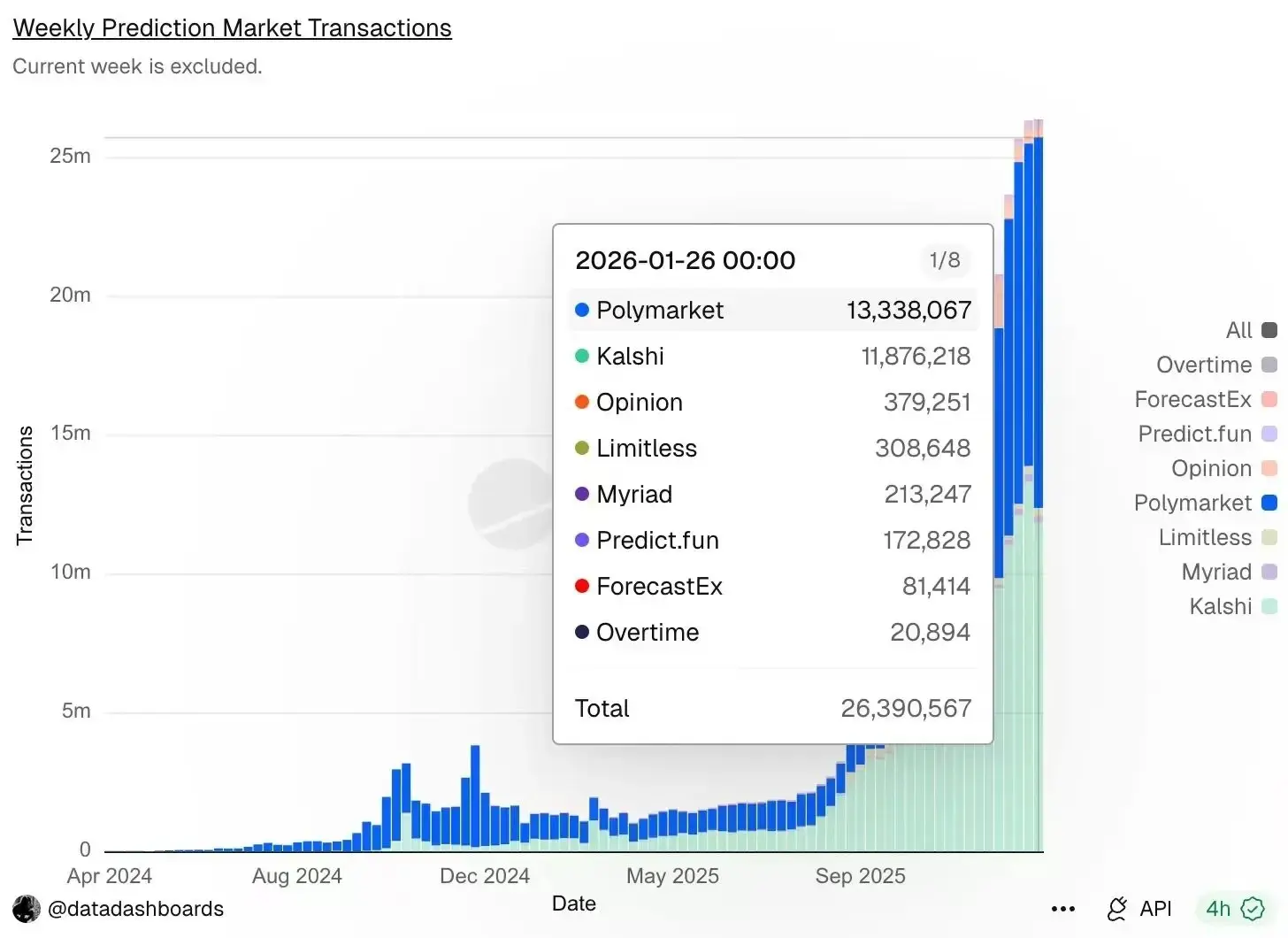

Gate Daily (February 3): Bitcoin ETF withdraws $2.8 billion in two weeks; CBOE plans to launch "Binary Options Contracts"

Bitcoin (BTC) has experienced a strong rebound, currently around $78,960 as of February 3. Major derivatives exchange CBOE is targeting the prediction market and plans to relaunch the "all or nothing" options product. After investors withdrew $2.8 billion within two weeks, the average purchase price of Bitcoin ETFs has decreased. White House officials met with representatives from the cryptocurrency and banking industries to discuss stablecoin issues.

MarketWhisper·18h ago

(no title)

Alex Thorn from Galaxy Digital suggests that Bitcoin's recent weakness indicates possible further declines, potentially reaching a 200-week moving average around $58,000. He notes that 46% of BTC supply is currently "underwater," reflecting market pressure. The lack of institutional demand hampers sustainable gains, and Bitcoin's role as an inflation hedge has diminished. However, long-term technical levels remain attractive for investors.

BTC-4.76%

TapChiBitcoin·18h ago

Bitcoin falls below "this price" causing mining industry to potentially collapse! Mining cost threshold triggers a selling wave

Bitcoin prices are approaching the critical level of $70,000, which is the life-and-death dividing line for global mining. The mainstream Antminer S21 series has shutdown prices ranging from $69,000 to $74,000. Falling below this range will force mining companies to shut down or sell off reserves. Coupled with current global liquidity tightening, ETF capital outflows, and derivatives liquidation pressures, this could trigger a wave of forced selling, leading to disorderly market declines.

MarketWhisper·19h ago

Why did Bitcoin rebound today? White House stablecoin summit kicks off, MicroStrategy adds to its position against the trend

Bitcoin rebounded on Monday by 2.05% to around $79,000, with RSI dropping to 28 indicating extreme oversold conditions. MicroStrategy purchased 855 BTC, bringing the total holdings to 713,502 BTC. The White House convened a stablecoin summit, injecting policy expectations. Previously, uncertainty was triggered by Trump's nomination of Kevin Warsh as Federal Reserve Chair, causing BTC to drop to $74,532.

BTC-4.76%

MarketWhisper·19h ago

Crypto Market Massacre! Bitcoin drops below $80,000, long liquidation exceeds $1 billion

On February 1st, Bitcoin fell below $80,000, reaching $79,000, resulting in over $270 million in liquidations. Global macroeconomic pressures and geopolitical tensions have intensified the market decline, with analysts warning of further drops to $74,000 to $78,000. Recent ETF outflows and whale sell-offs have also heightened bearish sentiment.

区块客·19h ago

4 Key Data Points That Support This Claim

Bitcoin (CRYPTO: BTC) faced a sharp test as prices slid to around $74,680 on Monday, after a wave of leveraged bets were liquidated to roughly $1.8 billion since Thursday’s downturn. Investors dumped risk assets as tech valuations looked stretched, and many traders stepped into cash or short-term

CryptoBreaking·22h ago

SHIB Holds $0.05769 Support as Price Action Compresses Below $0.05787

SHIB went up by 0.9% in 24 hours and remained above the support zone of $0.057692.

The price action remained within reported range with the resistance limit being held at $0.057871.

SHIB gained 1.1 per cent and 1.2 per cent against BTC and ETH respectively.

Shiba Inu registered a

CryptoNewsLand·02-02 19:41

Relief Rally Pushes Bitcoin & Altcoins Green: Will It Last?

Bitcoin (CRYPTO: BTC) is attempting a relief rally after a sharp pullback, rising from around $74,508 to push back above $79,000 as buyers step in. The next major hurdle sits near $84,000, where historical selling pressure has reasserted itself in this cycle. The mood across the wider market

CryptoBreaking·02-02 18:55

After 13 Years Silent, Satoshi-Era Wallet Sells 10,000 BTC in One Shot

_A Satoshi-era Bitcoin wallet moved and sold 10,000 BTC after 13 years of inactivity, drawing attention from traders and on-chain analysts._

A bitcoin wallet linked to the Satoshi era has moved 10,000 BTC in a single transaction after remaining inactive for 13 years.

The transfer, valued at

BTC-4.76%

LiveBTCNews·02-02 18:35

Bitcoin Sell-Off Drags IBIT Investor Returns Into the Red, CIO Says

Bitcoin’s weekend retreat has amplified a sell-off in the largest spot crypto ETF, with investors in BlackRock’s iShares Bitcoin Trust (IBIT) confronting a challenging reset in the fund’s performance metrics. As BTC traded in the mid-$70,000s after a run to fresh highs earlier in the season, the

CryptoBreaking·02-02 18:35

Bitcoin’s Current Consolidation Mirrors a Previous Bullish Fractal — Is a $BTC Reversal Ahead?

Key Takeaways

Bitcoin is consolidating within a horizontal range after correcting from recent highs

Current price structure closely

BTC-4.76%

CoinsProbe·02-02 18:11

DOGE Price Stays Range-Bound Near $0.1125 as Monthly Pattern Repeats

Dogecoin trades near monthly support at $0.1125, maintaining its position within a long-term rising channel.

The current monthly structure closely matches Dogecoin’s previous market cycle, based on chart data.

DOGE/BTC holds at 0.051350 BTC, reinforcing structural alignment across both

CryptoNewsLand·02-02 17:31

Strategy's Bitcoin Bet Dips Underwater as Firm Adds to $56 Billion BTC Stash

In brief

Strategy’s Bitcoin bet showed losses on paper for the first time in years.

Its shares have fallen 62% over the past six months.

The company recently raised more money than it spent on Bitcoin.

Strategy’s Bitcoin bet showed losses on paper for the first time in years, as the

BTC-4.76%

Decrypt·02-02 17:14

Bitcoin Fuels Bear Market Fears as $49K Target Looms

Bitcoin is trading sub-$50,000 ahead of Sunday’s weekly close, underscoring how bulls have struggled to reverse a slide that has kept the asset near ten-month lows. After a day in which BTC/USD declined more than 6% and failed to reclaim key levels, market participants remain cautious about the near

BTC-4.76%

CryptoBreaking·02-02 16:35

Load More