# 美国证券交易委员会推进数字资产监管框架创新

46.25K

CryptoMiniac

#美国证券交易委员会推进数字资产监管框架创新 Recent contract trends have provided many opportunities. BEAT directly gained nearly 50% this wave, which is satisfying, but more importantly, the execution logic is clear—no chasing highs, no reckless operations. IRYS also benefited accordingly, and the overall position of over 4,000 units was successfully closed and realized.

To be honest, in this kind of market, it's not luck that is tested, but the ability to grasp entry points and take profit points. The crypto market is highly volatile, but volatility also means opportunities. If you're still struggling with "how

To be honest, in this kind of market, it's not luck that is tested, but the ability to grasp entry points and take profit points. The crypto market is highly volatile, but volatility also means opportunities. If you're still struggling with "how

BEAT6.98%

- Reward

- 4

- Comment

- Repost

- Share

#美国证券交易委员会推进数字资产监管框架创新 Can Dogecoin continue its hot streak? The triple logic behind the violent fluctuations in $DOGE market

Last night's market was a roller coaster—opening at 0.13486 at 11:30 PM, soaring instantly to 0.13522, almost breaking through, then a rapid plunge to 0.13200, closing at 0.13239. That large red candle left many feeling anxious.

Behind this intense volatility are three key factors that determine DOGE's trend:

**First, BTC is the anchor**

Currently, BTC is repeatedly testing the $86,000 level. The gains and losses around this line directly determine DOGE's ceiling. As lo

View OriginalLast night's market was a roller coaster—opening at 0.13486 at 11:30 PM, soaring instantly to 0.13522, almost breaking through, then a rapid plunge to 0.13200, closing at 0.13239. That large red candle left many feeling anxious.

Behind this intense volatility are three key factors that determine DOGE's trend:

**First, BTC is the anchor**

Currently, BTC is repeatedly testing the $86,000 level. The gains and losses around this line directly determine DOGE's ceiling. As lo

- Reward

- 3

- 1

- Repost

- Share

#美国证券交易委员会推进数字资产监管框架创新 Feeling FOMO, losing money is tough— but the regret of missing out is even more painful. The situation in 2025 is becoming clearer: a narrative of policy easing, market expectations of Trump's return, and the ongoing craze of Meme culture—these three forces together have created the biggest opportunity window of the year.

Speaking of real opportunities, $SHIB, $DOGE, and $PEPE have already proven their power, and now it's $conan 's turn. Ten months of community building is no joke—this team has previously managed two projects, both of which exceeded a market cap of $50

View OriginalSpeaking of real opportunities, $SHIB, $DOGE, and $PEPE have already proven their power, and now it's $conan 's turn. Ten months of community building is no joke—this team has previously managed two projects, both of which exceeded a market cap of $50

- Reward

- 15

- 10

- Repost

- Share

zkProofGremlin :

:

Missing out on this really feels worse than losing money... Watching others enter a position is just so frustrating. This wave from Conan is indeed interesting, the team background is there, it's not an air project.

View More

#美国证券交易委员会推进数字资产监管框架创新 12.19 Ethereum Morning Technical Observation

From the intraday trend, Ethereum this morning shows a clear pattern of bottoming out and rebounding → rallying and then pulling back for correction. Compared to Bitcoin's performance, ETH's recent upward momentum is indeed stronger, and its short-term bullish characteristics are quite evident.

**Details of Price Evolution**

Initially, it dropped to the 2772.97 level, then did not continue to decline but instead quickly rebounded. During the entire rebound, trading volume kept increasing, and the current price around 2834.99 w

From the intraday trend, Ethereum this morning shows a clear pattern of bottoming out and rebounding → rallying and then pulling back for correction. Compared to Bitcoin's performance, ETH's recent upward momentum is indeed stronger, and its short-term bullish characteristics are quite evident.

**Details of Price Evolution**

Initially, it dropped to the 2772.97 level, then did not continue to decline but instead quickly rebounded. During the entire rebound, trading volume kept increasing, and the current price around 2834.99 w

ETH-0.6%

- Reward

- 9

- 6

- Repost

- Share

TrustlessMaximalist :

:

2840 can't break, feels like it's going to come back to整理 again, I'm tired of this trap.View More

#美国证券交易委员会推进数字资产监管框架创新 $ETH Yesterday, when the CPI data was released, the market collectively turned bullish. However, a calm analysis shows that the resistance level at 3010 remains difficult to break, let alone any rebound trend. On the surface, the data appears favorable, but against the backdrop of the yen's continuous rate hikes, this upward movement seems more like a last burst of false fire—large institutional traders taking advantage of the trend to push prices up and offload positions, thereby lowering their arbitrage costs.

From actual trading cases, traders following a prudent stra

From actual trading cases, traders following a prudent stra

ETH-0.6%

- Reward

- 22

- 7

- Repost

- Share

DeFiGrayling :

:

The 3010 level is really stuck, and the false fire is seen through at a glance. It's the same old story of big players unloading, but luckily I wasn't cut.

Doing less and watching more is indeed reliable; I almost acted impulsively again today.

This policy window does present an opportunity, but we need to stay calm.

With such strong pressure for Yen rate hikes, the rebound might be fake.

A prudent strategy is to make money; frequent trading only invites trouble.

Only traders who know when to stop can survive until the end.

The false fire has dispersed, so following the trend is just foolish.

Institutions have already started unloading; retail investors are still dreaming.

Understanding a single trade thoroughly is much more satisfying than blindly trying seven or eight times.

View More

#美国证券交易委员会推进数字资产监管框架创新 $PEOPLE's liquidity reaches 100%, which means there is no traditional market maker suppression—it's entirely driven by community consensus. At first glance, the trend looks somewhat similar to the SNX wave, but the underlying logic is completely different, and the liquidity structures are vastly different.

From a technical perspective, the support level at 0.00768 still has a chance to be touched. Currently, the market is indeed in a dormant period, and the dullness is palpable. The true bull market cycle won't fully unfold until the end of next year, so the key for this

From a technical perspective, the support level at 0.00768 still has a chance to be touched. Currently, the market is indeed in a dormant period, and the dullness is palpable. The true bull market cycle won't fully unfold until the end of next year, so the key for this

SNX1.9%

- Reward

- 13

- 6

- Repost

- Share

BoredApeResistance :

:

A hundred percent liquidity sounds quite attractive, but what I'm more concerned about is when it can really take off. The current market situation is indeed quite frustrating.View More

#美国证券交易委员会推进数字资产监管框架创新 $DOGE's recent trend has indeed been under significant pressure. It stopped the previous decline at the 0.12 level, but the rebound has been quite weak, and the subsequent momentum simply cannot keep up. Even more frustrating is that the middle band is already pressing downward, forming a difficult-to-break pattern. Looking at the 0.128 to 0.13 range, it has evolved into a strong suppression zone. If the price continues to stay below 0.13, it remains a downward continuation structure. Once trading volume increases, it is very likely to test the previous lows again. This

DOGE16.69%

- Reward

- 21

- 7

- Repost

- Share

TokenomicsTherapist :

:

Dogecoin really can't be pushed up this time. 0.13 feels like the ceiling, crashing down rapidly.View More

#美国证券交易委员会推进数字资产监管框架创新 Friday morning session, there are a few points worth noting in the Bitcoin and Ethereum markets.

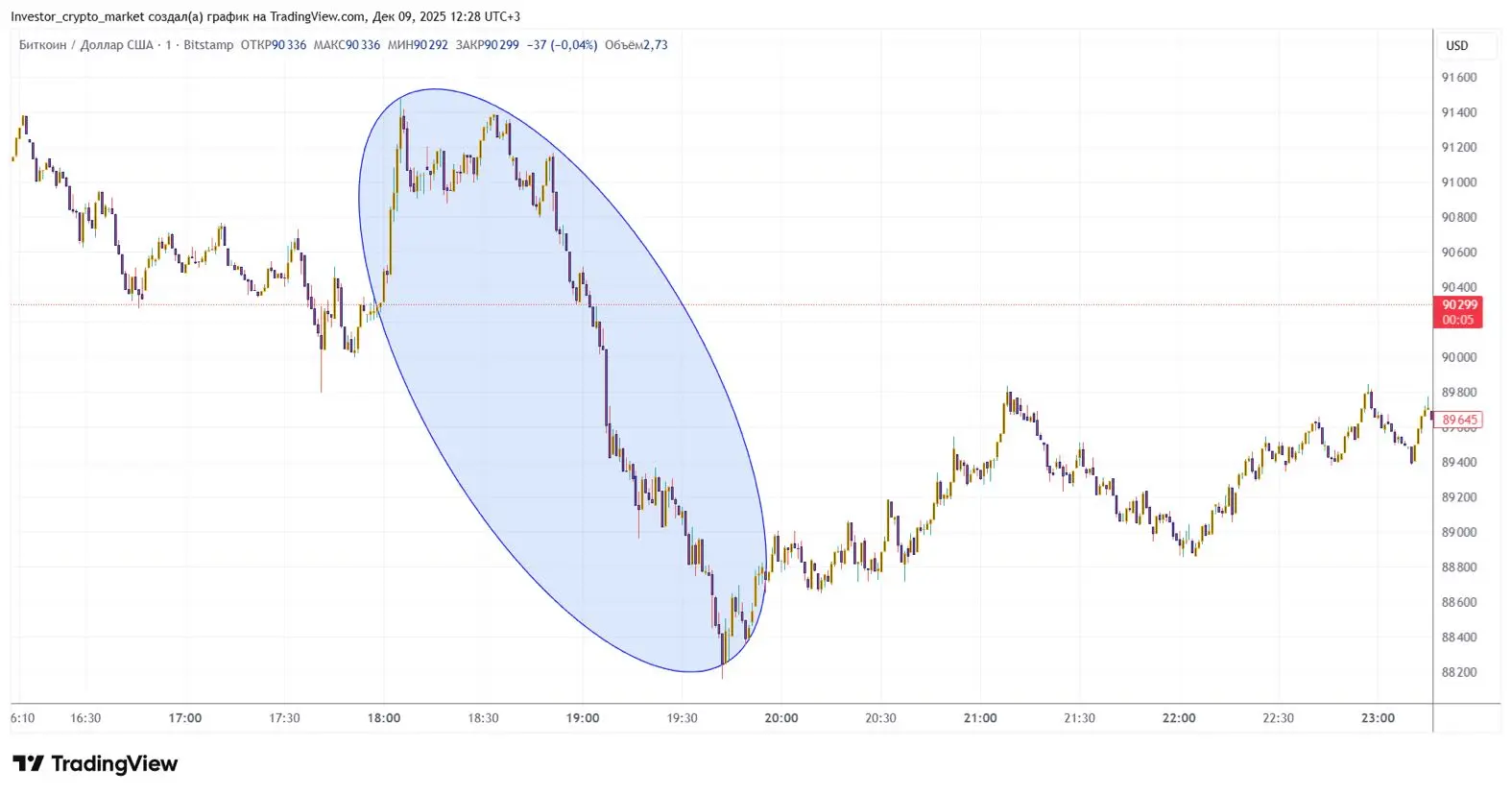

On the Bitcoin side, the daily chart shows that the upward momentum is gradually weakening. Consecutive upper shadows indicate that buying pressure is not very strong, and liquidity has also shrunk. The bears are still in control. Switching to the four-hour chart, after the price rebounded to the upper band of the Bollinger Bands, it started to face resistance, then directly plunged sharply, even breaking below the lower band support. Currently, all moving averages are turni

View OriginalOn the Bitcoin side, the daily chart shows that the upward momentum is gradually weakening. Consecutive upper shadows indicate that buying pressure is not very strong, and liquidity has also shrunk. The bears are still in control. Switching to the four-hour chart, after the price rebounded to the upper band of the Bollinger Bands, it started to face resistance, then directly plunged sharply, even breaking below the lower band support. Currently, all moving averages are turni

- Reward

- 19

- 8

- Repost

- Share

VitalikFanAccount :

:

The short order at the price level of 85800 is full. As soon as the regulatory news comes out, the market reacts like this. Let's wait for the SEC's follow-up actions.View More

#美国证券交易委员会推进数字资产监管框架创新 Japanese Rate Hike Shockwave: Global Liquidity Tightening Puts Crypto Market to the Test

A recent signal worth noting: if the Bank of Japan truly raises interest rates, the 1.2 trillion USD in Japanese government bonds may face restructuring—capital will flow heavily back to Japan from the US, Japanese bond yields will rise, and the Federal Reserve's room to cut rates will be squeezed. In simple terms, the "liquidity flood" that supported the crypto market over the past half-year is turning around.

Don’t think that rate hikes are just a traditional finance issue. Global

View OriginalA recent signal worth noting: if the Bank of Japan truly raises interest rates, the 1.2 trillion USD in Japanese government bonds may face restructuring—capital will flow heavily back to Japan from the US, Japanese bond yields will rise, and the Federal Reserve's room to cut rates will be squeezed. In simple terms, the "liquidity flood" that supported the crypto market over the past half-year is turning around.

Don’t think that rate hikes are just a traditional finance issue. Global

- Reward

- 17

- 6

- Repost

- Share

BearMarketSurvivor :

:

The rhetoric of playing people for suckers is coming again. Every time they say liquidity is shrinking, but what’s the result? Coins are still rising.View More

#美国证券交易委员会推进数字资产监管框架创新 From the daily K-line perspective, Bitcoin has occasionally rebounded, but the upward momentum has clearly weakened. Repeated attempts to break through the resistance levels above have failed, and the chart is full of long upper shadows—indicating strong selling pressure that buyers simply can't absorb. Liquidity is tightening, and the bears have completely dominated the situation.

Switching to the 4-hour chart makes it even clearer. Whenever the price touches the upper Bollinger Band, it gets hammered down, followed by a continuous decline. Trading volume increases acco

View OriginalSwitching to the 4-hour chart makes it even clearer. Whenever the price touches the upper Bollinger Band, it gets hammered down, followed by a continuous decline. Trading volume increases acco

- Reward

- 22

- 5

- Repost

- Share

ForkInTheRoad :

:

Here comes the same old bearish arrangement again. Why have I never seen it hit the mark once? BTC keeps dropping back to this level, it feels like the main players are intimidating retail investors.

Those who shorted at 2830 have been wiped out. Now they want to keep shorting? I don't believe it.

A long upper shadow is a sign of distribution; this analysis isn't anything new.

Let's wait and see. This rhythm feels a bit off.

View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

91.35K Popularity

10.15K Popularity

9.58K Popularity

56.1K Popularity

5.46K Popularity

261.91K Popularity

261.3K Popularity

17.58K Popularity

6.34K Popularity

5.07K Popularity

5.23K Popularity

5.09K Popularity

5.03K Popularity

33.65K Popularity

News

View MoreRoundhill plans to launch six event contract ETFs related to the 2028 U.S. presidential election results

6 m

Punch surged 111.40% after launching Alpha, current price 0.0048092112031334 USDT

10 m

The USDC circulation increased by approximately 2.6 billion tokens in the past 7 days.

10 m

DeFi derivatives protocol Polynomial will cease operations

15 m

US Media: Pentagon Threatens to Sever AI Collaboration with Anthropic

29 m

Pin