This week's US economic data (January 2026 CPI and NFP) showed that inflation has cooled but employment remains strong.

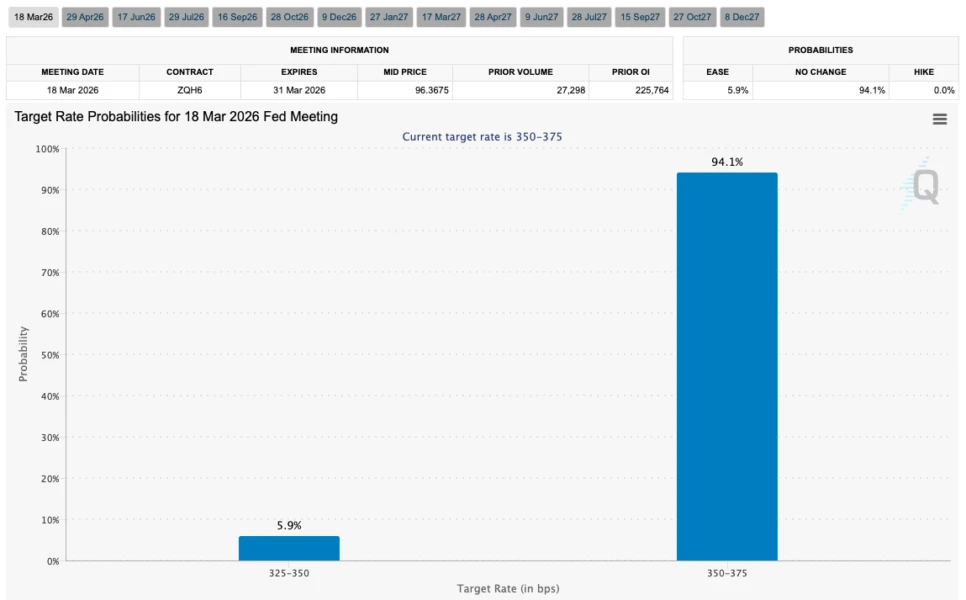

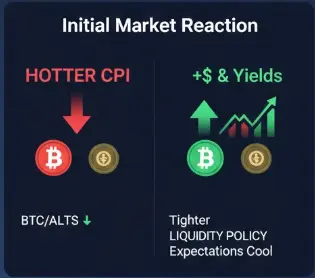

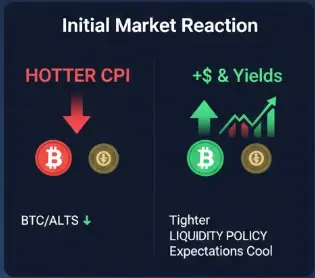

🔹CPI (Consumer Price Index): 2.4% annual increase (below the expected 2.5%), 0.2% monthly. Core CPI 2.5% annually. Inflation is approaching the Fed's 2% target, driven by a slowdown in energy and rent costs. This has increased expectations of a rate cut.

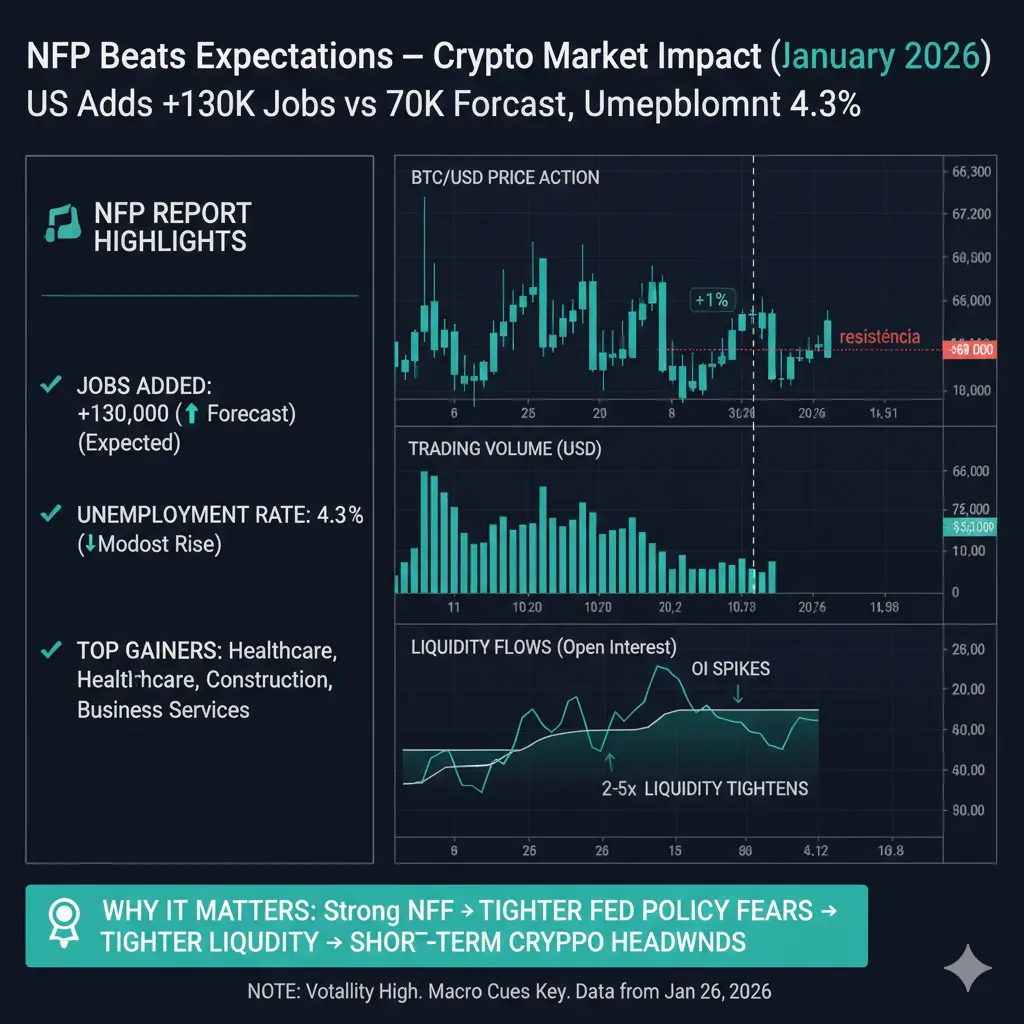

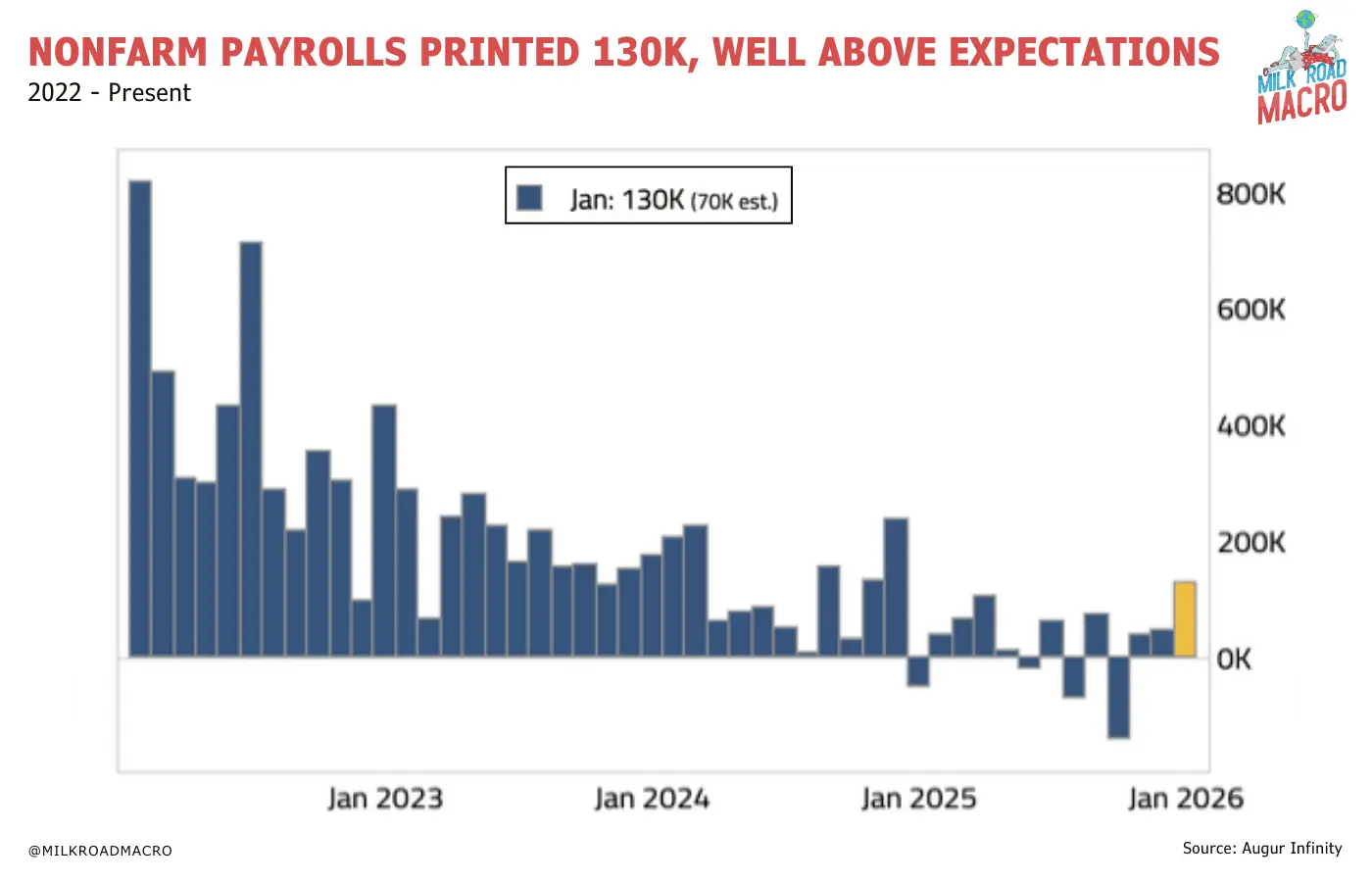

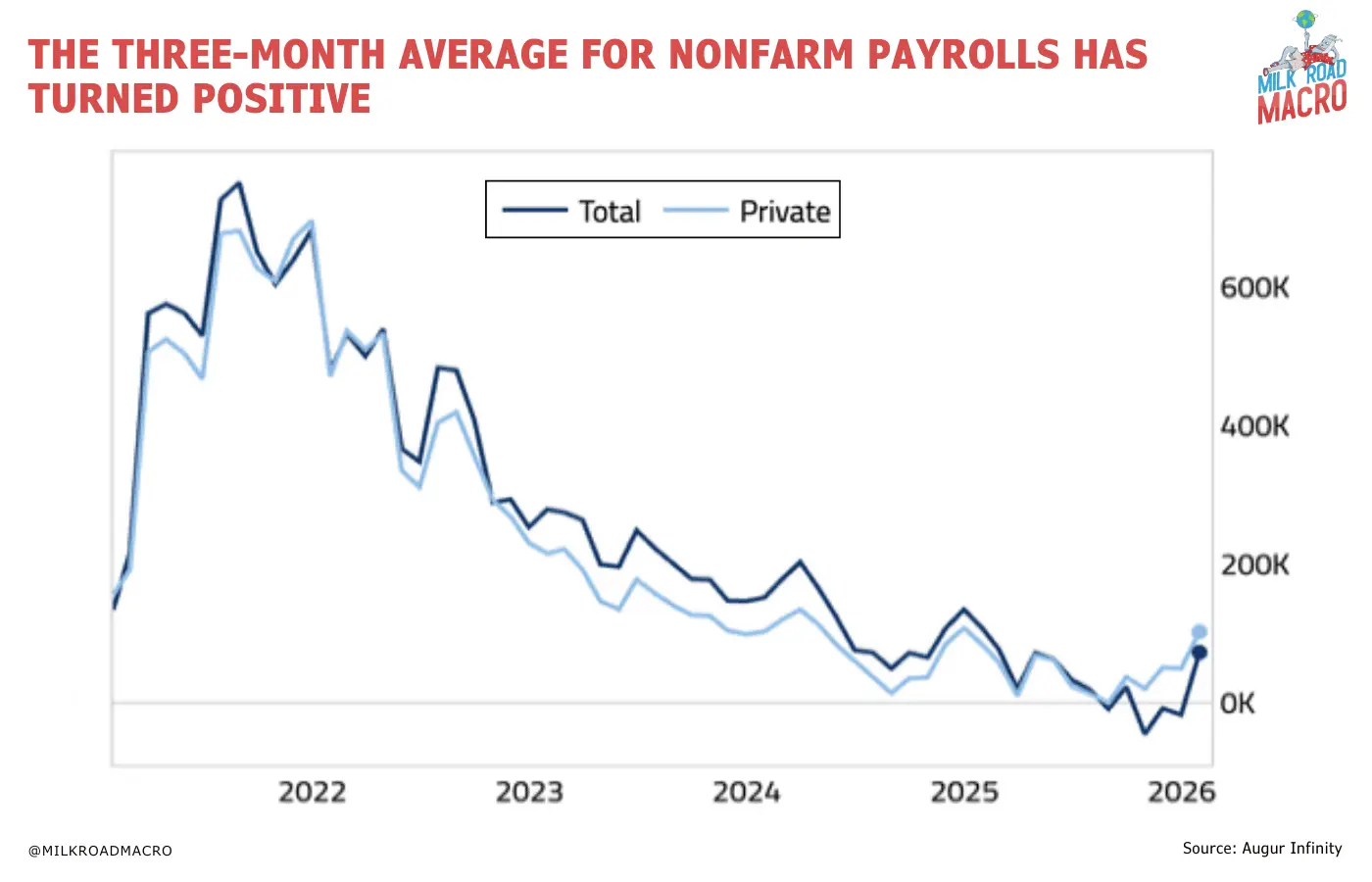

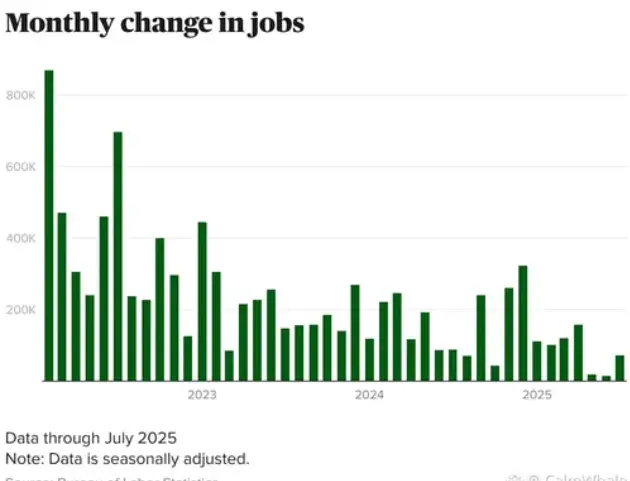

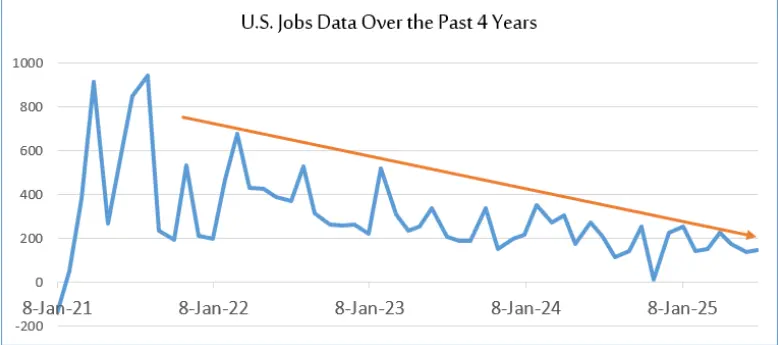

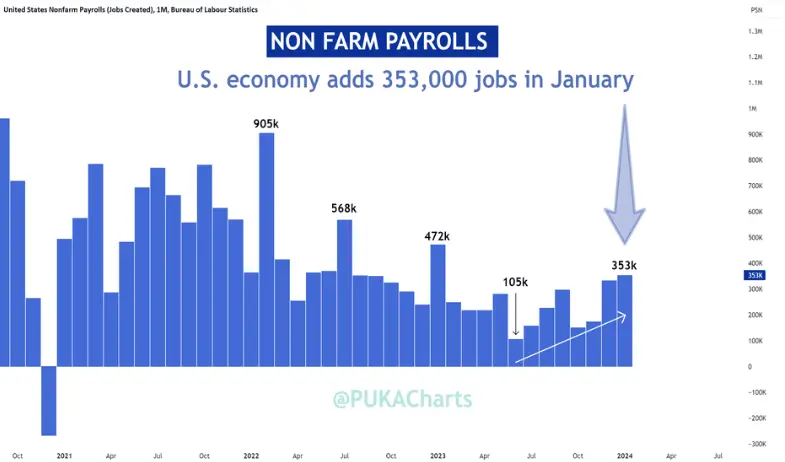

🔹NFP (Non-Farm Payrolls): 130,000 new jobs (expected around 70,000, some estimates 55,000). Unemployment fell to 4.3%. Healthcare and social services sectors led the way; strong data increased the likelihood of the Fed delaying rate cuts.

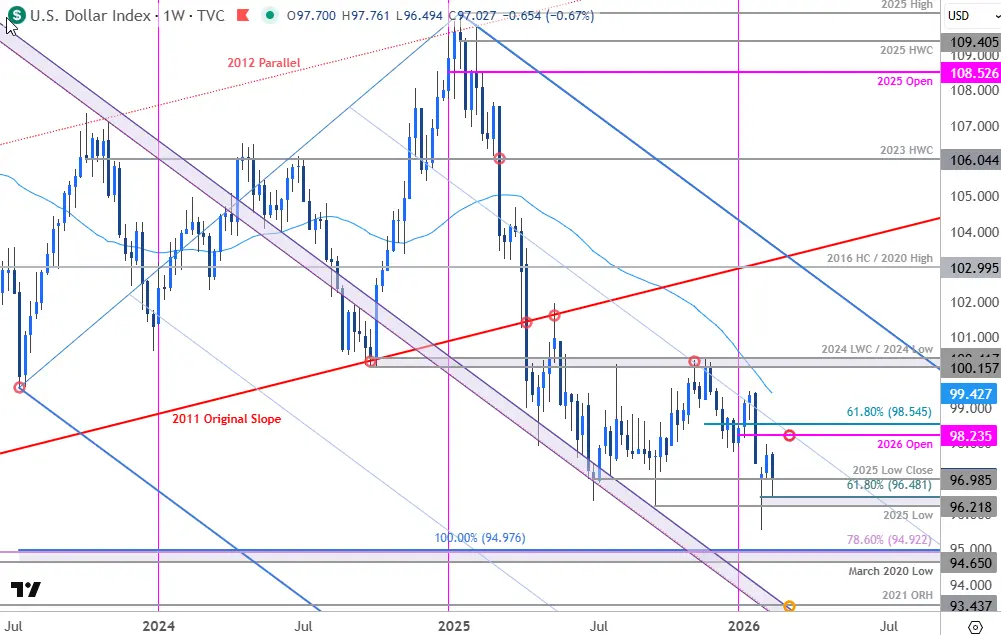

🔹Mixed signals support a "soft landing" scenario. Falling inflation increases risk appetite, while strong employment could support the dollar and keep interest rates high.

✨Impact on Crypto Markets: Low CPI supported Bitcoin in the short term (expectation of increased liquidity due to hopes of interest rate cuts). However, strong NFP created pressure with fears of "higher for longer"; BTC fluctuated in the $67-69 thousand range, while altcoins saw mixed performance. The market is focusing on the Fed's data-driven approach; upcoming reports will be decisive.

#CPIDataAhead

#NFPBeatsExpectations

🔹CPI (Consumer Price Index): 2.4% annual increase (below the expected 2.5%), 0.2% monthly. Core CPI 2.5% annually. Inflation is approaching the Fed's 2% target, driven by a slowdown in energy and rent costs. This has increased expectations of a rate cut.

🔹NFP (Non-Farm Payrolls): 130,000 new jobs (expected around 70,000, some estimates 55,000). Unemployment fell to 4.3%. Healthcare and social services sectors led the way; strong data increased the likelihood of the Fed delaying rate cuts.

🔹Mixed signals support a "soft landing" scenario. Falling inflation increases risk appetite, while strong employment could support the dollar and keep interest rates high.

✨Impact on Crypto Markets: Low CPI supported Bitcoin in the short term (expectation of increased liquidity due to hopes of interest rate cuts). However, strong NFP created pressure with fears of "higher for longer"; BTC fluctuated in the $67-69 thousand range, while altcoins saw mixed performance. The market is focusing on the Fed's data-driven approach; upcoming reports will be decisive.

#CPIDataAhead

#NFPBeatsExpectations