# RiskManagement

10.34K

zubairr90

Your “Moon Bag” means nothing without risk management. 🛡️

With $500M+ liquidations shaking the market, survival matters more than hype.

• Never exceed 5x leverage in extreme volatility.

• Take profits gradually.

• Keep core holdings secured.

Don’t let one bad trade end your journey.

#RiskManagement #TradingTips #GateioSecurity

$BTC / $ETH #GateSquare$50KRedPacketGiveaway

With $500M+ liquidations shaking the market, survival matters more than hype.

• Never exceed 5x leverage in extreme volatility.

• Take profits gradually.

• Keep core holdings secured.

Don’t let one bad trade end your journey.

#RiskManagement #TradingTips #GateioSecurity

$BTC / $ETH #GateSquare$50KRedPacketGiveaway

- Reward

- like

- Comment

- Repost

- Share

📉⚡ #BuyTheDipOrWaitNow

BTC: 66,501.8 (-0.60%)

Mark Price: 66,503.1

Index: 66,531.2

24H High: 68,385.9

24H Low: 65,068.0

24H Turnover: 6.98B USDT

Open Interest: 64.08K BTC

Funding Rate: +0.0016%

Bitcoin is sitting near mid-range support after tapping 65K lows.

Volatility is active. Liquidity is rotating. The big question:

🧠 Is This a Dip to Buy — or a Trap Before Lower?

🔎 Bullish Signals:

• Funding slightly positive → no extreme long overcrowding

• Strong 24H volume (6.98B USDT) → active participation

• Holding above 65K key support zone

⚠️ Bearish Risks:

• Failed to hold 68K momentum

• Lowe

BTC: 66,501.8 (-0.60%)

Mark Price: 66,503.1

Index: 66,531.2

24H High: 68,385.9

24H Low: 65,068.0

24H Turnover: 6.98B USDT

Open Interest: 64.08K BTC

Funding Rate: +0.0016%

Bitcoin is sitting near mid-range support after tapping 65K lows.

Volatility is active. Liquidity is rotating. The big question:

🧠 Is This a Dip to Buy — or a Trap Before Lower?

🔎 Bullish Signals:

• Funding slightly positive → no extreme long overcrowding

• Strong 24H volume (6.98B USDT) → active participation

• Holding above 65K key support zone

⚠️ Bearish Risks:

• Failed to hold 68K momentum

• Lowe

BTC4.13%

- Reward

- 4

- 8

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

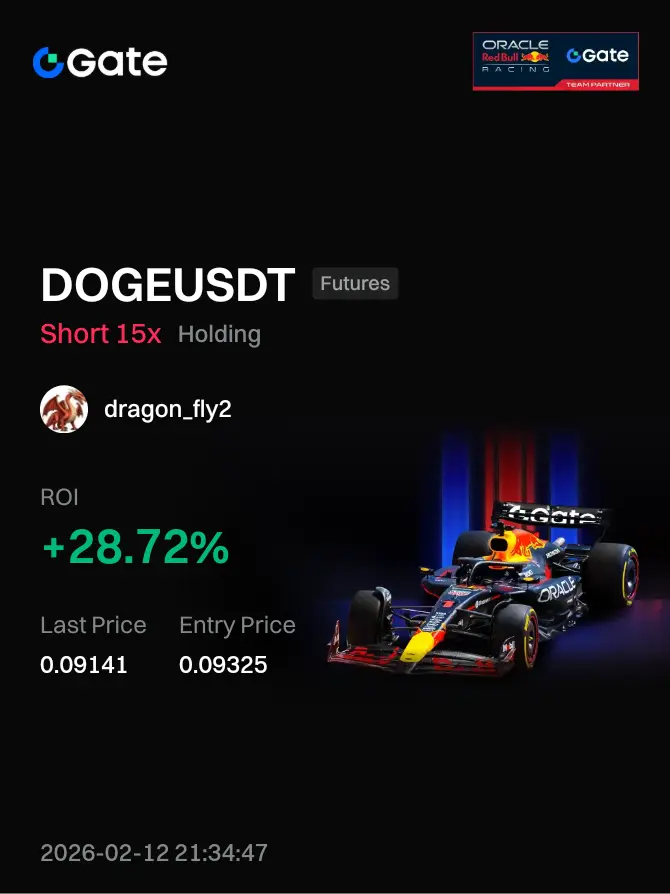

🔥 +28.2% WIN — Calm Down.

Most traders see +28.2% and start acting like they cracked the market code. That’s exactly how accounts get destroyed. One good trade doesn’t make you elite. It tests your discipline.

Let’s be honest. If this trade followed a structured plan — defined entry, calculated risk, logical stop-loss, proper position sizing — then this 28.2% is skill.

If it was impulse, random leverage, emotional revenge from a previous loss, or blind momentum chasing… then it’s trash disguised as success.

The market rewards discipline, not excitement.

I don’t celebrate profit. I analyze exe

Most traders see +28.2% and start acting like they cracked the market code. That’s exactly how accounts get destroyed. One good trade doesn’t make you elite. It tests your discipline.

Let’s be honest. If this trade followed a structured plan — defined entry, calculated risk, logical stop-loss, proper position sizing — then this 28.2% is skill.

If it was impulse, random leverage, emotional revenge from a previous loss, or blind momentum chasing… then it’s trash disguised as success.

The market rewards discipline, not excitement.

I don’t celebrate profit. I analyze exe

- Reward

- 5

- 3

- Repost

- Share

LittleQueen :

:

To The Moon 🌕View More

Walsh Says To Cautiously Shrink

Walsh suggests cautious shrinking amid economic uncertainty ⚠️

Risk management remains key in volatile markets.

Playing safe or staying aggressive?

#RiskManagement #MarketTalk #Crypto

Walsh suggests cautious shrinking amid economic uncertainty ⚠️

Risk management remains key in volatile markets.

Playing safe or staying aggressive?

#RiskManagement #MarketTalk #Crypto

SAFE6.47%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕Risk Management: The 1% Rule

Want to survive in crypto?

Start with this simple rule 👇

1% Rule = Never risk more than 1% of your total capital on a single trade.

Example:

Capital = $1,000

Max risk per trade = $10

That means if your stop loss gets hit,

you only lose $10 — not your account.

Why it matters:

• Protects you from emotional trading

• Prevents account blow-ups

• Keeps you in the game long term

• Helps you think in probabilities, not hope

Remember:

You don’t need one big win.

You need consistent survival.

In crypto,

capital preservation > fast profit.

#RiskManagement #TradingPsycho

Want to survive in crypto?

Start with this simple rule 👇

1% Rule = Never risk more than 1% of your total capital on a single trade.

Example:

Capital = $1,000

Max risk per trade = $10

That means if your stop loss gets hit,

you only lose $10 — not your account.

Why it matters:

• Protects you from emotional trading

• Prevents account blow-ups

• Keeps you in the game long term

• Helps you think in probabilities, not hope

Remember:

You don’t need one big win.

You need consistent survival.

In crypto,

capital preservation > fast profit.

#RiskManagement #TradingPsycho

- Reward

- 2

- 2

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵View More

#CryptoSurvivalGuide 🧭📊

Crypto market me survive karna sirf profits ka game nahi — yeh mindset, risk control, aur discipline ka test hota hai. Bull runs sab enjoy karte hain… lekin real traders bear markets me build hote hain.

Agar aap long-term survive karna chahte ho, to yeh Crypto Survival Guide aapke liye essential hai. 👇

🛡️ 1️⃣ Risk Management First Kabhi bhi apna pura capital ek trade me mat dalo.

Golden rule:

• 1–5% risk per trade

• Stop loss mandatory

• Emotional revenge trading avoid karo

📉 2️⃣ Not Every Dip Is a Buying Opportunity Market me “cheap” aur “falling knife” ka differe

Crypto market me survive karna sirf profits ka game nahi — yeh mindset, risk control, aur discipline ka test hota hai. Bull runs sab enjoy karte hain… lekin real traders bear markets me build hote hain.

Agar aap long-term survive karna chahte ho, to yeh Crypto Survival Guide aapke liye essential hai. 👇

🛡️ 1️⃣ Risk Management First Kabhi bhi apna pura capital ek trade me mat dalo.

Golden rule:

• 1–5% risk per trade

• Stop loss mandatory

• Emotional revenge trading avoid karo

📉 2️⃣ Not Every Dip Is a Buying Opportunity Market me “cheap” aur “falling knife” ka differe

- Reward

- 4

- 7

- Repost

- Share

MoonGirl :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

- Reward

- 5

- 7

- Repost

- Share

CryptoEye :

:

Buy To Earn 💎View More

#BuyTheDipOrWaitNow?

The market is testing patience again.

Prices drop… fear rises… and everyone starts asking — “Is this the bottom?”

But here’s the truth:

Not every dip is a discount. Some dips are warnings.

A real opportunity shows signs: ✔️ Price reacts at a key support zone

✔️ Sellers lose momentum

✔️ Volume increases on bullish candles

✔️ Structure starts shifting

If the chart is still making lower lows with strong selling pressure, buying blindly is not confidence — it’s hope. And hope is not a trading strategy.

Professional traders don’t chase bottoms.

They wait for confirmation or bui

The market is testing patience again.

Prices drop… fear rises… and everyone starts asking — “Is this the bottom?”

But here’s the truth:

Not every dip is a discount. Some dips are warnings.

A real opportunity shows signs: ✔️ Price reacts at a key support zone

✔️ Sellers lose momentum

✔️ Volume increases on bullish candles

✔️ Structure starts shifting

If the chart is still making lower lows with strong selling pressure, buying blindly is not confidence — it’s hope. And hope is not a trading strategy.

Professional traders don’t chase bottoms.

They wait for confirmation or bui

- Reward

- 8

- 13

- Repost

- Share

YingYue :

:

Diamond Hands 💎View More

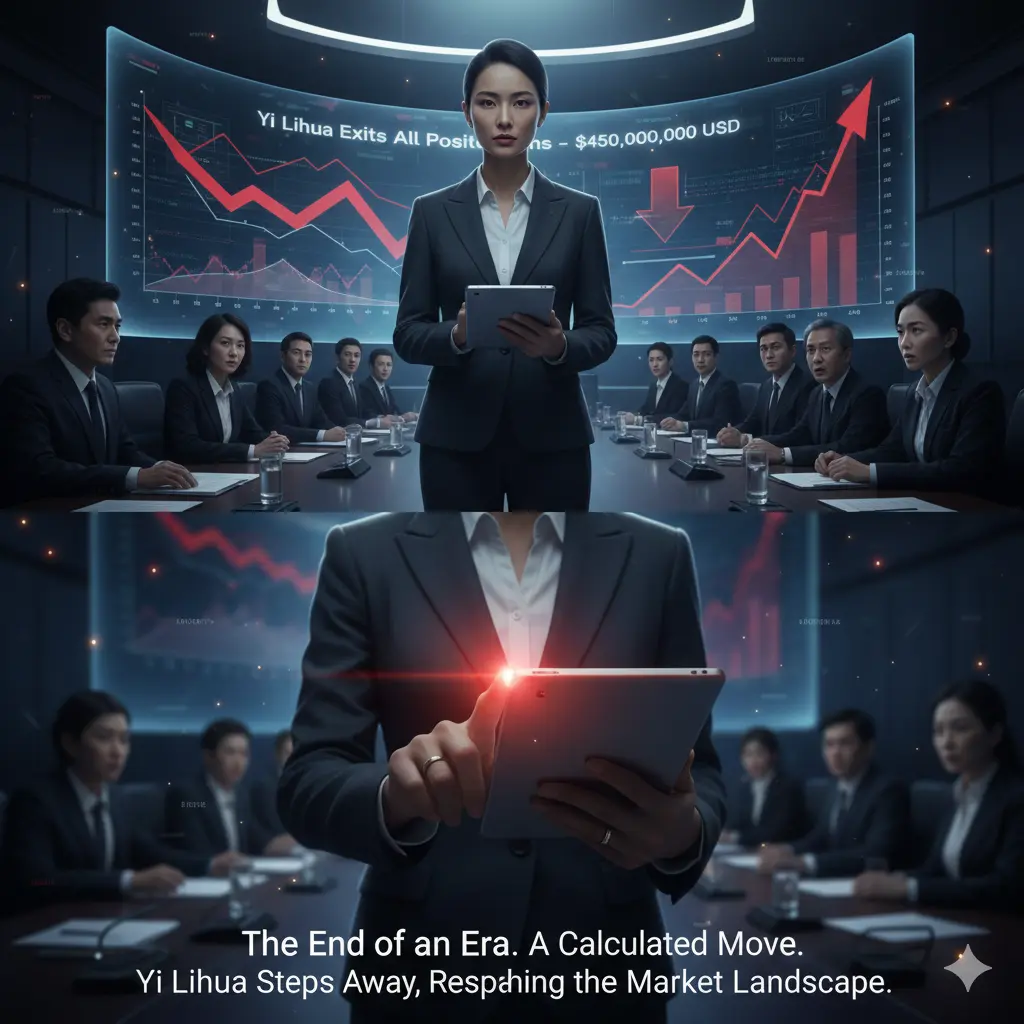

#YiLihuaExitsPositions

As of today, Yi Lihua’s decision to exit positions signals a cautious shift among certain market participants, highlighting how sentiment can pivot quickly even after periods of stability. Large-scale exits often reflect risk reassessment, and in this case, it seems to indicate that some investors are prioritizing capital preservation over chasing short-term gains.

What stands out is the timing. Position exits often happen during periods of uncertainty whether triggered by macroeconomic signals, technical resistance levels, or broader market volatility. Yi Lihua’s move

As of today, Yi Lihua’s decision to exit positions signals a cautious shift among certain market participants, highlighting how sentiment can pivot quickly even after periods of stability. Large-scale exits often reflect risk reassessment, and in this case, it seems to indicate that some investors are prioritizing capital preservation over chasing short-term gains.

What stands out is the timing. Position exits often happen during periods of uncertainty whether triggered by macroeconomic signals, technical resistance levels, or broader market volatility. Yi Lihua’s move

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

70.76K Popularity

2.93K Popularity

2.98K Popularity

50.03K Popularity

1.8K Popularity

258.45K Popularity

234.66K Popularity

14.08K Popularity

1.22K Popularity

718 Popularity

866 Popularity

1.17K Popularity

1.54K Popularity

30.56K Popularity

News

View MoreData: If ETH drops below $1,971, the total long liquidation strength on major CEXs will reach $839 million.

6 m

Psy Protocol achieves 521,000 TPS, offering a $100,000 bounty for verification

16 m

The American Film Association condemns ByteDance's Seedance 2.0 for lack of effective copyright protection measures

22 m

X Product Manager: Truly hopes that cryptocurrencies can become popular on the X platform, with plans to launch multiple features within a few weeks.

29 m

Today's Cryptocurrency News (February 14) | X Timeline or Built-in Crypto Trading; Russian Central Bank Plans to Study Ruble Stablecoin

52 m