SisterSaiEr

No content yet

SisterSaiEr

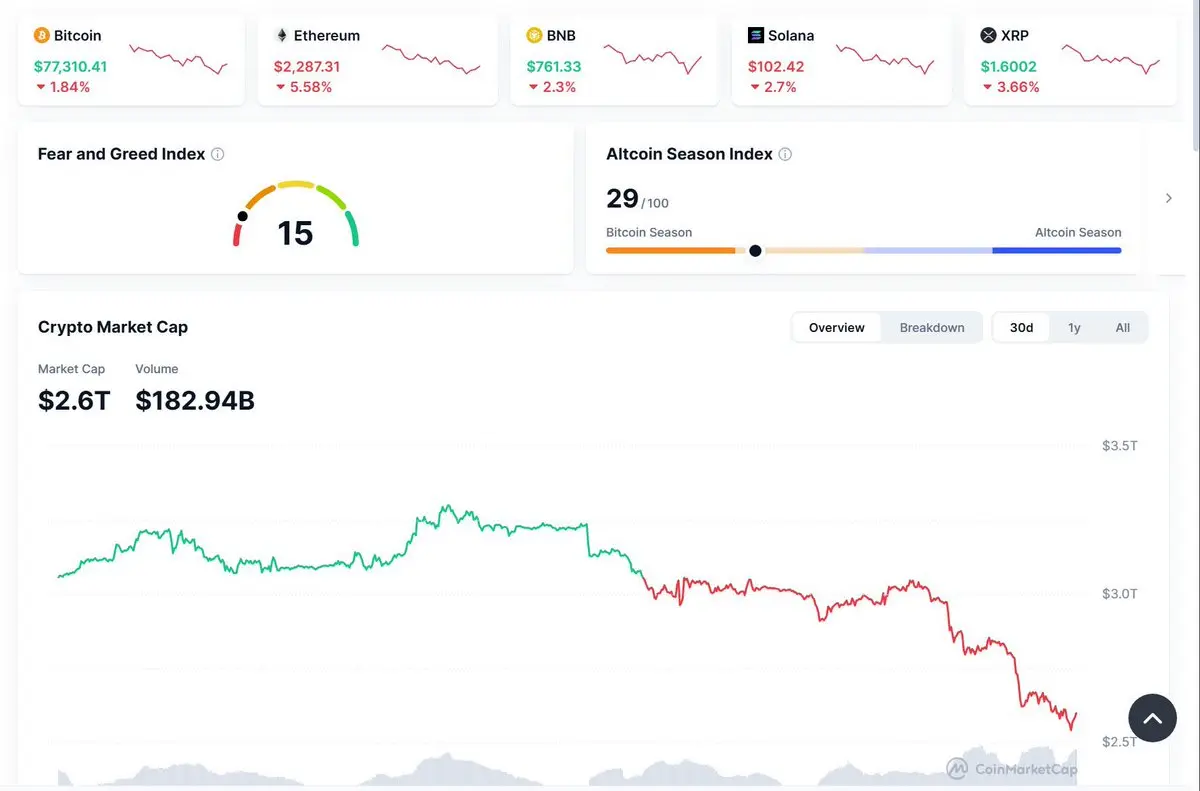

The market is yet again a day of bloodshed, fully understanding everyone's despair. Having been in the circle for 9 years, I have experienced many such moments. Every time, it feels like the end of the world, with paper losses making you doubt life. You think about cutting losses and exiting, but the crypto market has never disappointed anyone in the long run. It is during times like these that you can see who the true traders are. At the peak of the bull market, everyone thought they were Buffett, but now is the real test. The fundamentals of Web3 have never been so strong. Although there are

BTC-0.72%

- Reward

- like

- Comment

- Repost

- Share

The most underestimated way to make money in the prediction market: follow top traders such as selecting a niche track, whether it's US politics or sports. Use any tools to find traders who consistently make profits. When they enter a deep market, follow early, but keep your position conservative. Focus on traders in a single field—politics, sports, macroeconomics—as their returns grow faster. Because they understand the niche rules, timing, and group psychology better than anyone else. Stick to one niche, follow the best traders, trade in markets with high liquidity, and continuously adjust a

View Original- Reward

- like

- Comment

- Repost

- Share

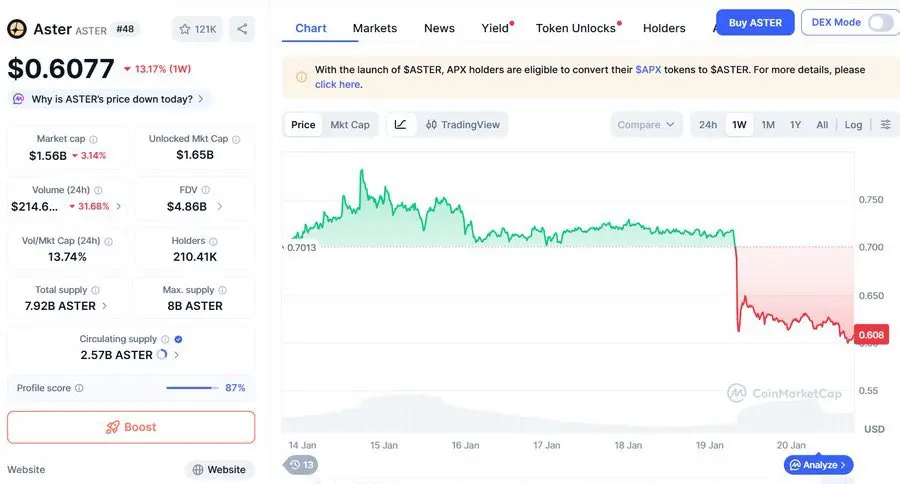

$ASTER Even CZ needs to lose 30%

How many people's positions got wiped out in this wave

Where did the problem lie? The investment logic has completely gone off track

CZ's involvement is just blindly going all-in, seeing $BNB 's increase makes him think ASTER can also be replicated, the buyback concept is more important than the actual price trend

Bought it and brainwashed himself, every dip is seen as a bottom-fishing opportunity

These decisions share a common point: they are driven by emotions, not technical analysis

Just like many people used to chase the rise of LUNA, the story was beautif

View OriginalHow many people's positions got wiped out in this wave

Where did the problem lie? The investment logic has completely gone off track

CZ's involvement is just blindly going all-in, seeing $BNB 's increase makes him think ASTER can also be replicated, the buyback concept is more important than the actual price trend

Bought it and brainwashed himself, every dip is seen as a bottom-fishing opportunity

These decisions share a common point: they are driven by emotions, not technical analysis

Just like many people used to chase the rise of LUNA, the story was beautif

- Reward

- like

- Comment

- Repost

- Share

During the overall price decline phase, continuing to trade Perp DEX might be one of the few remaining opportunities to participate.

Projects like Extended, Variational, Ethereal, and Nado are likely to still emerge, provided you don't spend too much on transaction fees and keep your costs under control.

But the real potential for a new wave of big profits still depends on new public blockchains, such as MegaETH (or Monad). If they can succeed, more opportunities will arise.

Just like last year, there were big profit opportunities on Solana, Sui, Bera, and HyperEVM back then, but now many of t

View OriginalProjects like Extended, Variational, Ethereal, and Nado are likely to still emerge, provided you don't spend too much on transaction fees and keep your costs under control.

But the real potential for a new wave of big profits still depends on new public blockchains, such as MegaETH (or Monad). If they can succeed, more opportunities will arise.

Just like last year, there were big profit opportunities on Solana, Sui, Bera, and HyperEVM back then, but now many of t

- Reward

- like

- Comment

- Repost

- Share

2026 is the year you must go all out:

• AI stocks will surge to a bubble peak, possibly the last wave of dividends

• Scale of monetary expansion, historically unprecedented liquidity

• AI agents and coding capabilities will completely reshape the job market

• Quantum computing acceleration will further drive AI breakthroughs

Like every technological revolution, early participants eat the meat, later ones drink the soup

A few things you must do:

• Cultivate high autonomy and execution ability

• Stay curious, immerse yourself in AI every day

• Maintain good health, go to the gym more often

• Foc

View Original• AI stocks will surge to a bubble peak, possibly the last wave of dividends

• Scale of monetary expansion, historically unprecedented liquidity

• AI agents and coding capabilities will completely reshape the job market

• Quantum computing acceleration will further drive AI breakthroughs

Like every technological revolution, early participants eat the meat, later ones drink the soup

A few things you must do:

• Cultivate high autonomy and execution ability

• Stay curious, immerse yourself in AI every day

• Maintain good health, go to the gym more often

• Foc

- Reward

- like

- Comment

- Repost

- Share

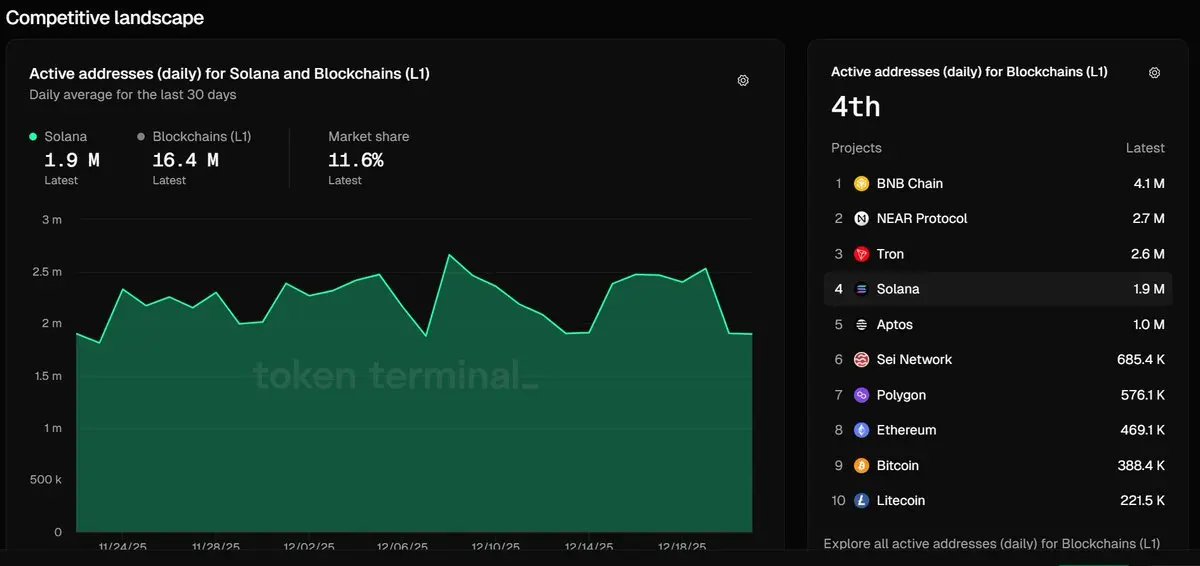

It's only been half a month into 2026, but the momentum is already very clear.

The White Whale on SOL has directly surged to a $200 million market cap.

A new round of Chinese meme projects on BSC has also emerged.

A bunch of Perpdex projects continue to be hot, with some already breaking even.

Those old coins that survived the hellish market are now revalued much higher than before.

The traders who exited earlier have come back.

Stay at the table, and you'll win in 2026!!

The White Whale on SOL has directly surged to a $200 million market cap.

A new round of Chinese meme projects on BSC has also emerged.

A bunch of Perpdex projects continue to be hot, with some already breaking even.

Those old coins that survived the hellish market are now revalued much higher than before.

The traders who exited earlier have come back.

Stay at the table, and you'll win in 2026!!

SOL-2.18%

- Reward

- like

- Comment

- Repost

- Share

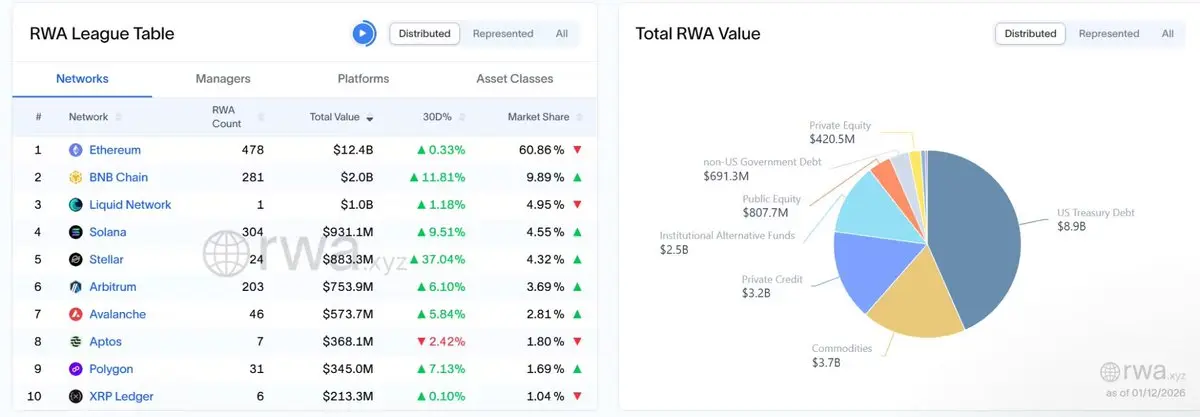

Looking at the latest RWA data, several signals are very clear

Ethereum is now the absolute leader, valued at $12.4 billion, accounting for over 60% of the share

BNB Chain ranks second, with a market cap of $2 billion, close to 10% market share, clearly riding the wave of “compliance-friendly + low issuance costs,” a pragmatic approach

Chains like Solana and Stellar are growing very fast, with 30-day increases of over 30%, but their market caps are still below $1 billion, more like pilot zones rather than main battlefields

The most tokenized assets remain U.S. Treasuries, leading by a wide mar

View OriginalEthereum is now the absolute leader, valued at $12.4 billion, accounting for over 60% of the share

BNB Chain ranks second, with a market cap of $2 billion, close to 10% market share, clearly riding the wave of “compliance-friendly + low issuance costs,” a pragmatic approach

Chains like Solana and Stellar are growing very fast, with 30-day increases of over 30%, but their market caps are still below $1 billion, more like pilot zones rather than main battlefields

The most tokenized assets remain U.S. Treasuries, leading by a wide mar

- Reward

- like

- Comment

- Repost

- Share

If you are in your early 20s now and don't know what to do

First, stop chasing short-term pleasures and start building your own leverage

Learn programming, master AI tools, not to write prompts, but to build systems and automate processes

Those who master AI will not be replaced; instead, they will replace entire companies

Invest regularly every week, even if it's only 10U or 20U

Invest in Bitcoin, S&P 500, gold, and others

Learn to accept work that makes you uncomfortable, ask stupid questions, dare to take the risk of appearing "behind," because comfort is more frightening than failure

Drink

First, stop chasing short-term pleasures and start building your own leverage

Learn programming, master AI tools, not to write prompts, but to build systems and automate processes

Those who master AI will not be replaced; instead, they will replace entire companies

Invest regularly every week, even if it's only 10U or 20U

Invest in Bitcoin, S&P 500, gold, and others

Learn to accept work that makes you uncomfortable, ask stupid questions, dare to take the risk of appearing "behind," because comfort is more frightening than failure

Drink

BTC-0.72%

- Reward

- like

- Comment

- Repost

- Share

Did the privacy coin Zcash $ZEC , which recently surged against the trend, get "RUG"ed by its employees?

Supporting $ZEC 's Electric Coin Company (ECC), the entire team, including the CEO, collectively resigned.

The reason given was a fallout with the Bootstrap board, and the CEO called it a "constructive dismissal."

It is said that the board changed the rules of the game, and the development team felt they couldn't continue.

After resigning, these people plan to start anew and continue working on their "privacy coin."

The same people, the same mission, just a different company name.

Although

Supporting $ZEC 's Electric Coin Company (ECC), the entire team, including the CEO, collectively resigned.

The reason given was a fallout with the Bootstrap board, and the CEO called it a "constructive dismissal."

It is said that the board changed the rules of the game, and the development team felt they couldn't continue.

After resigning, these people plan to start anew and continue working on their "privacy coin."

The same people, the same mission, just a different company name.

Although

ZEC0.14%

- Reward

- like

- Comment

- Repost

- Share

There are reports that Venezuela has hidden over 600,000 Bitcoins, worth over $60 billion USD.

Since 2018, the Venezuelan government has been accumulating this large amount through gold swaps and settling oil transactions in USDT to evade sanctions. They bought at an average price of $5,000 at the time, and now it's worth $90,000. Calculate the return on investment.

U.S. authorities are interrogating those involved and are now trying to seize the mnemonic phrases for these coins.

600,000 coins is 12 times the amount the German government sold last year. Selling just 50,000 coins caused the mar

Since 2018, the Venezuelan government has been accumulating this large amount through gold swaps and settling oil transactions in USDT to evade sanctions. They bought at an average price of $5,000 at the time, and now it's worth $90,000. Calculate the return on investment.

U.S. authorities are interrogating those involved and are now trying to seize the mnemonic phrases for these coins.

600,000 coins is 12 times the amount the German government sold last year. Selling just 50,000 coins caused the mar

BTC-0.72%

- Reward

- like

- Comment

- Repost

- Share

Looking back at the main narrative of 2025, it basically revolves around prediction markets,

memecoin, Perp DEX, prediction markets, and real crypto casinos—all within this scope.

I think there will be changes in 2026.

The reason this set of gameplay was effective before was solely because everyone thought it was positive EV due to airdrop expectations.

But now, the value of most airdrops has dropped tenfold, while competition has increased tenfold.

For those who burn money to farm airdrops, most protocols are no longer worth doing, and funds will definitely flow elsewhere.

What kind of revolu

View Originalmemecoin, Perp DEX, prediction markets, and real crypto casinos—all within this scope.

I think there will be changes in 2026.

The reason this set of gameplay was effective before was solely because everyone thought it was positive EV due to airdrop expectations.

But now, the value of most airdrops has dropped tenfold, while competition has increased tenfold.

For those who burn money to farm airdrops, most protocols are no longer worth doing, and funds will definitely flow elsewhere.

What kind of revolu

- Reward

- like

- Comment

- Repost

- Share

Lighter $LIT Chinese CT has quite a lot of disagreements

Here are some core issues:

First, $LIT launched very chaotically, secretly going live at 2 AM Eastern Time, and as a result, withdrawals immediately crashed, leaving a very bad first impression.

At launch, there was no $LIT perpetual contract, which means that the actual trading volume and price discovery are likely to be determined by platforms like Hyperliquid, rather than within Lighter's own ecosystem.

The official mention of "market-based buybacks" is a dangerous signal, essentially telling the market that the project team will in

View OriginalHere are some core issues:

First, $LIT launched very chaotically, secretly going live at 2 AM Eastern Time, and as a result, withdrawals immediately crashed, leaving a very bad first impression.

At launch, there was no $LIT perpetual contract, which means that the actual trading volume and price discovery are likely to be determined by platforms like Hyperliquid, rather than within Lighter's own ecosystem.

The official mention of "market-based buybacks" is a dangerous signal, essentially telling the market that the project team will in

- Reward

- like

- Comment

- Repost

- Share

I just came across a rumor: a certain bank was forcibly liquidated during this wave of short-selling.

Here's what happened roughly—

This bank is a heavyweight player in the silver futures market, holding long positions worth hundreds of millions of ounces for a long time.

Last Friday, after silver prices broke above $70, the bank received a margin call notice, demanding more than its available liquid funds.

They were asked to supplement $2.3 billion in cash collateral before Sunday morning.

In the following 36 hours, the bank scrambled to raise funds:

Contacted trading partners, sold assets, s

View OriginalHere's what happened roughly—

This bank is a heavyweight player in the silver futures market, holding long positions worth hundreds of millions of ounces for a long time.

Last Friday, after silver prices broke above $70, the bank received a margin call notice, demanding more than its available liquid funds.

They were asked to supplement $2.3 billion in cash collateral before Sunday morning.

In the following 36 hours, the bank scrambled to raise funds:

Contacted trading partners, sold assets, s

- Reward

- like

- Comment

- Repost

- Share

The 5 simplest signals to determine whether a coin is in a strong trend:

First, the trading volume must be high, which is easy to understand. Just like the PEPE wave, the daily trading volume jumped from tens of millions of dollars to billions, indicating genuine capital entering the market.

Second, the volume should continue to expand. It's not about occasional spikes in volume, but an overall trend where trading volume gradually increases.

Third, the price moves in a long-term single direction. For example, SOL's rally last year was basically a one-sided upward trend with a clear direction.

View OriginalFirst, the trading volume must be high, which is easy to understand. Just like the PEPE wave, the daily trading volume jumped from tens of millions of dollars to billions, indicating genuine capital entering the market.

Second, the volume should continue to expand. It's not about occasional spikes in volume, but an overall trend where trading volume gradually increases.

Third, the price moves in a long-term single direction. For example, SOL's rally last year was basically a one-sided upward trend with a clear direction.

- Reward

- like

- Comment

- Repost

- Share

🎄Merry Christmas🎄

- Reward

- like

- Comment

- Repost

- Share

Many changes have occurred in the market

The S&P 500 breaks new highs, a typical risk-on signal

Gold also breaks new highs, a standard risk-off signal

Risk assets are rising, safe-haven assets are also rising

So the question is, this year Bitcoin, which has been treated as a risk-on asset, has been stuck at 87,000 without moving

Theoretically, which side should it follow?

If BTC is digital gold, then it should follow gold

If it is a high Beta risk asset, then it should follow US stocks

But now, neither side is following

This is probably another example of how the market structure was completel

The S&P 500 breaks new highs, a typical risk-on signal

Gold also breaks new highs, a standard risk-off signal

Risk assets are rising, safe-haven assets are also rising

So the question is, this year Bitcoin, which has been treated as a risk-on asset, has been stuck at 87,000 without moving

Theoretically, which side should it follow?

If BTC is digital gold, then it should follow gold

If it is a high Beta risk asset, then it should follow US stocks

But now, neither side is following

This is probably another example of how the market structure was completel

BTC-0.72%

- Reward

- like

- Comment

- Repost

- Share

"Encryption is over", this sentence has to be heard a few times every year.

It has indeed been quiet recently, the VCs have all gone on vacation, and the project teams have been inactive, with no new narratives emerging.

After months of intensive information bombardment, the market really needs a hard reset.

This is necessary for the follow-up rhythm of new projects and new narratives.

Now everyone is waiting for the next wave of new meta, waiting for new VC investments.

These are likely to appear one after another in January and February.

Before this, it was actually the best window period, w

View OriginalIt has indeed been quiet recently, the VCs have all gone on vacation, and the project teams have been inactive, with no new narratives emerging.

After months of intensive information bombardment, the market really needs a hard reset.

This is necessary for the follow-up rhythm of new projects and new narratives.

Now everyone is waiting for the next wave of new meta, waiting for new VC investments.

These are likely to appear one after another in January and February.

Before this, it was actually the best window period, w

- Reward

- like

- Comment

- Repost

- Share

The number of players still trading in the crypto market is decreasing.

Various on-chain data and trading activity are clearly declining, and group chats are also becoming less active.

Even @_FORAB hasn't updated for two days.

What is everyone doing when the market is not good?

View OriginalVarious on-chain data and trading activity are clearly declining, and group chats are also becoming less active.

Even @_FORAB hasn't updated for two days.

What is everyone doing when the market is not good?

- Reward

- like

- Comment

- Repost

- Share

Don't casually try to buy the dip

Since the 10.11 incident, the market has been clearly off

The daily repeated pump and dump pattern is essentially to liquidate leveraged positions

The recent trend follows the same script

Large funds have already gradually exited the market, while retail investors have been repeatedly washed out over the past few months

Now, be cautious, and don't just go long based on someone's opinion

A few months ago, you were already lured by FOMO into buying high, and now your account is stuck with unrealized losses

Currently, the only truly meaningful buying volume in th

View OriginalSince the 10.11 incident, the market has been clearly off

The daily repeated pump and dump pattern is essentially to liquidate leveraged positions

The recent trend follows the same script

Large funds have already gradually exited the market, while retail investors have been repeatedly washed out over the past few months

Now, be cautious, and don't just go long based on someone's opinion

A few months ago, you were already lured by FOMO into buying high, and now your account is stuck with unrealized losses

Currently, the only truly meaningful buying volume in th

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More378.68K Popularity

7.28K Popularity

7.17K Popularity

4.24K Popularity

2.83K Popularity

Pin