阿名的思维日记A-Ming's

No content yet

阿名的思维日记A-Ming's

2.2 Evening Gold Trading Strategy

Intraday gold experiences wide fluctuations, with bulls and bears repeatedly battling, resulting in a rollercoaster market. After a significant rise and fall during the day, the evening volatility is likely to narrow. Focus on light positions within the 4628-4878 range, selling high and buying low. Be sure to strictly set stop-losses and control risks.

Short-term Trading Strategy

▫️Short position setup: Enter a short position lightly on rebounds to the 4878-4888 range, with a stop-loss at 4898. First target is 4700; if it dips further, watch for 4628.

▫️Long p

View OriginalIntraday gold experiences wide fluctuations, with bulls and bears repeatedly battling, resulting in a rollercoaster market. After a significant rise and fall during the day, the evening volatility is likely to narrow. Focus on light positions within the 4628-4878 range, selling high and buying low. Be sure to strictly set stop-losses and control risks.

Short-term Trading Strategy

▫️Short position setup: Enter a short position lightly on rebounds to the 4878-4888 range, with a stop-loss at 4898. First target is 4700; if it dips further, watch for 4628.

▫️Long p

- Reward

- like

- Comment

- Repost

- Share

Black Monday! Global financial markets are experiencing a collective bloodbath, with gold plunging over 6% in a single day and silver crashing 36%. This crash, triggered by the Fed's hawkish leadership change and tightening liquidity, has taught all traders the most hardcore lesson! The fact that this wave of decline didn't lead to liquidation is not luck but risk management. This is the most tangible gain! In the current macro environment of the Fed's policy shift and global liquidity contraction, caution is always the top priority. Position management and strict stop-losses have never been e

View Original

- Reward

- like

- Comment

- Repost

- Share

Today, I guess we can only do high🈳 now, can't do any more brothers. The market is highly volatile, it is recommended to observe and wait for the fluctuations to stabilize before considering trading, to avoid being shaken out.

View Original

- Reward

- like

- Comment

- Repost

- Share

The situation has changed! Bearish factors release in full force, gold opens 90 points lower

Latest news: Russia, the US, Ukraine, and Abu Dhabi talks have been finalized, easing geopolitical tensions; both Iran and the US send clear signals of de-escalation, and Middle East risk premiums are rapidly fading. Powell's hawkish stance maintains that inflation has not yet met targets, making a March rate cut unlikely; Trump plans to nominate a hawkish figure to lead the Federal Reserve. The US dollar surges strongly, bearish news dominates, and gold is facing a serious and severe test.

View OriginalLatest news: Russia, the US, Ukraine, and Abu Dhabi talks have been finalized, easing geopolitical tensions; both Iran and the US send clear signals of de-escalation, and Middle East risk premiums are rapidly fading. Powell's hawkish stance maintains that inflation has not yet met targets, making a March rate cut unlikely; Trump plans to nominate a hawkish figure to lead the Federal Reserve. The US dollar surges strongly, bearish news dominates, and gold is facing a serious and severe test.

- Reward

- like

- Comment

- Repost

- Share

This dive, those chasing after it won't be able to figure it out for at least ten years.

View Original

- Reward

- like

- Comment

- Repost

- Share

The morning opening rose, gaining 80 points. It is always emphasized that the core principle of trading is to prioritize preserving the principal. Based on this, seek profits. In practice, it is necessary to strictly set profit and loss limits, implement risk control measures, and maintain the bottom line of trading.

View Original

- Reward

- like

- Comment

- Repost

- Share

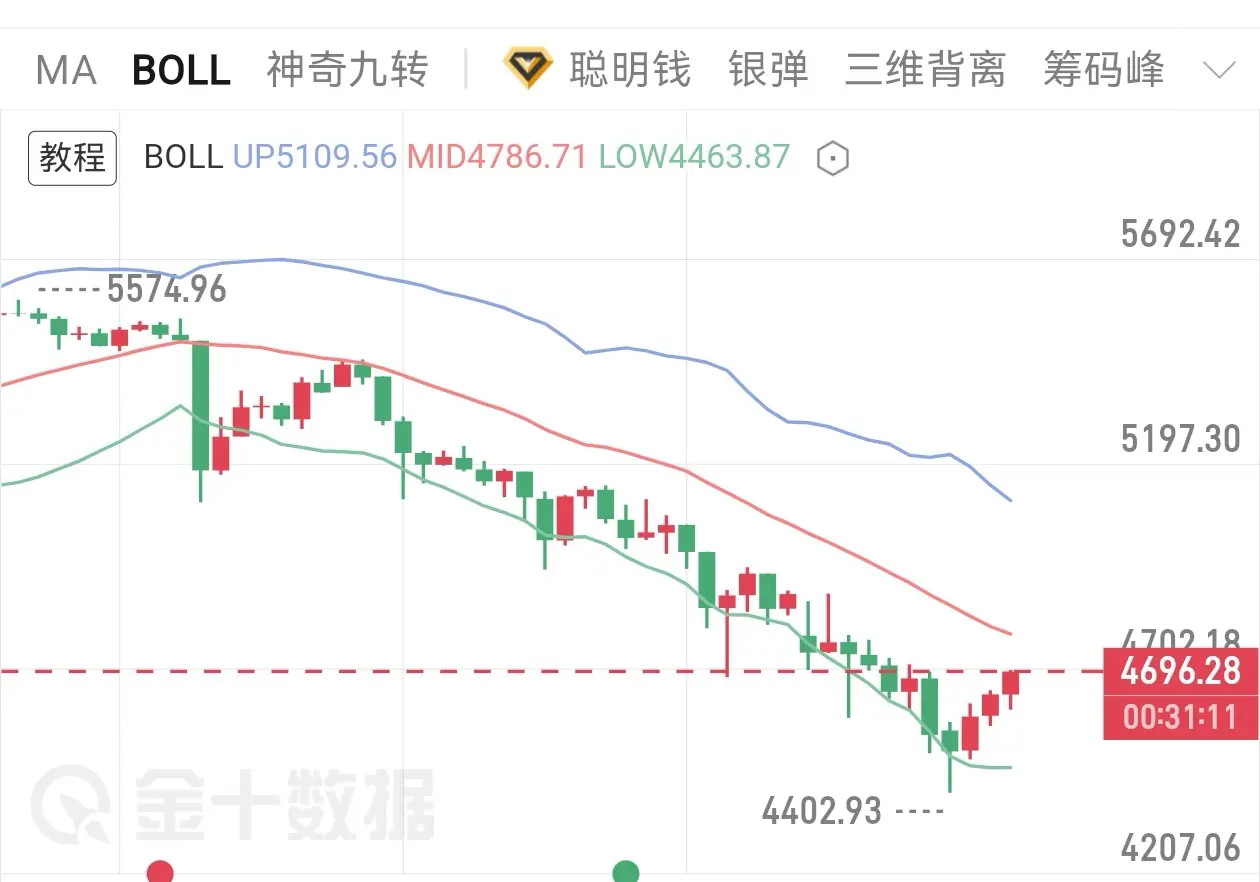

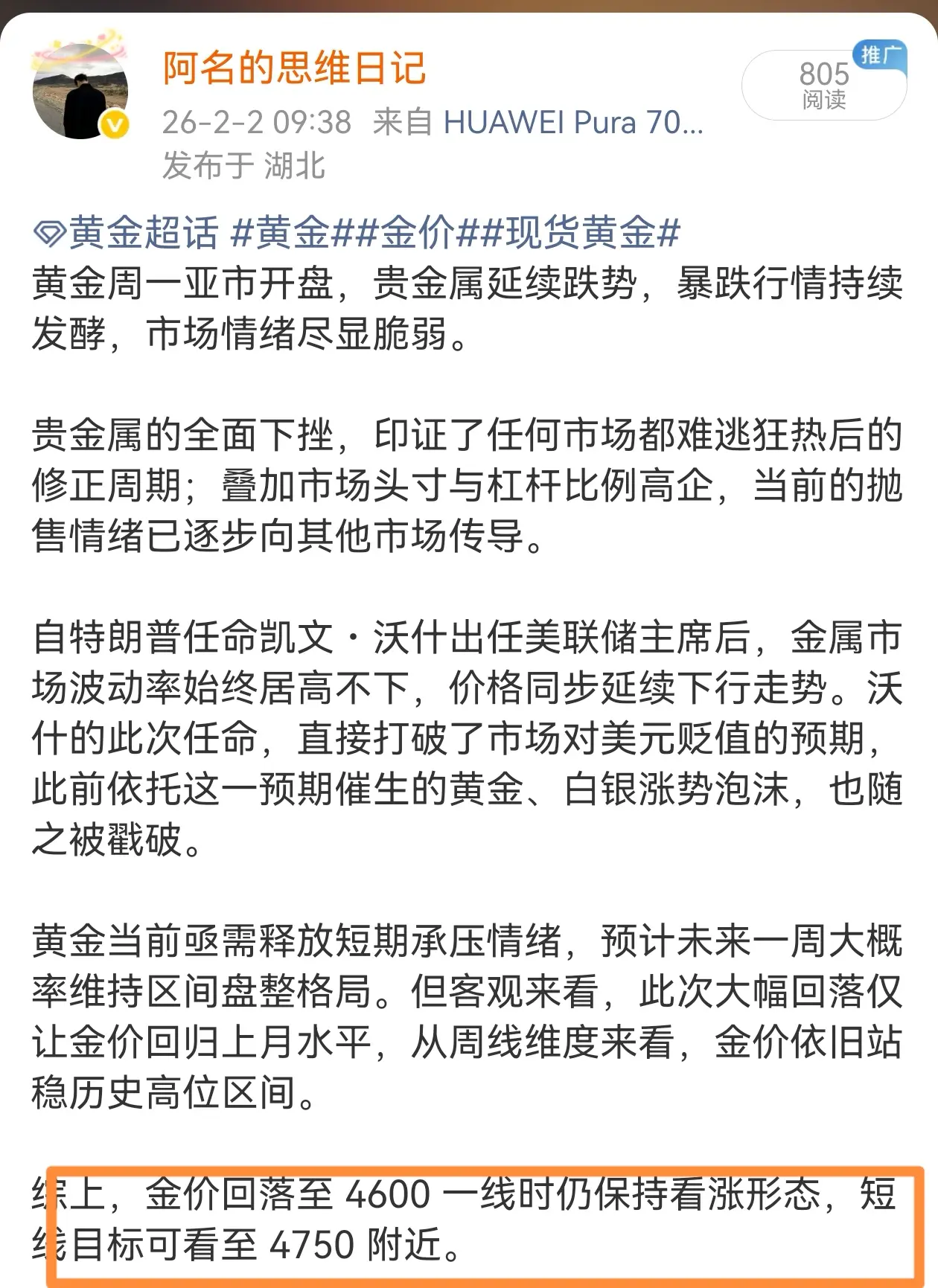

Golden Week opening in the Asian market, precious metals continue to decline, with the plunge intensifying and market sentiment showing fragility.

The overall decline in precious metals confirms that no market can escape a correction cycle after mania; combined with high market positions and leverage ratios, the current selling pressure is gradually spreading to other markets.

Since Trump appointed Kevin W. Waugh as Federal Reserve Chairman, volatility in the metals market has remained high, with prices continuing to decline. Waugh's appointment directly disrupted market expectations of dollar

View OriginalThe overall decline in precious metals confirms that no market can escape a correction cycle after mania; combined with high market positions and leverage ratios, the current selling pressure is gradually spreading to other markets.

Since Trump appointed Kevin W. Waugh as Federal Reserve Chairman, volatility in the metals market has remained high, with prices continuing to decline. Waugh's appointment directly disrupted market expectations of dollar

- Reward

- like

- Comment

- Repost

- Share

New Year Market Exclusive Recruitment

✅ Real-time market insights and precise analysis, identifying bullish and bearish turning points at the beginning of the month, ensuring no profit opportunities before the Spring Festival are missed.

✅ Hands-on practical training, from strategy formulation to order execution, with a full process breakdown to master core trading skills.

✅ Customized capital and position management, scientific allocation, strict risk control, making profits more stable and confident.

✅ Exclusive guidance for full position management, with techniques for position recovery + m

View Original✅ Real-time market insights and precise analysis, identifying bullish and bearish turning points at the beginning of the month, ensuring no profit opportunities before the Spring Festival are missed.

✅ Hands-on practical training, from strategy formulation to order execution, with a full process breakdown to master core trading skills.

✅ Customized capital and position management, scientific allocation, strict risk control, making profits more stable and confident.

✅ Exclusive guidance for full position management, with techniques for position recovery + m

- Reward

- like

- Comment

- Repost

- Share

1.28 Strategy Review

View Original

- Reward

- like

- Comment

- Repost

- Share

Next Week's Global Financial Events Overview: Central Bank Decisions and Non-Farm Payroll Data Lead Market Trends!

🔴 Monday

- Key Events: Global Manufacturing PMI Final, US ISM Manufacturing PMI, Atlanta Fed President Bostic Speech

- Trading Highlights: Weakening manufacturing PMI will suppress crude oil demand expectations; Bostic's speech focuses on the pace of rate cuts, influencing USD fluctuations

🟠 Tuesday

- Key Events: RBA Rate Decision, US JOLTs Job Openings, Domestic Fuel Price Adjustment

- Trading Highlights: RBA hawkish signals boost AUD, dovish signals put pressure; Decline in JO

View Original🔴 Monday

- Key Events: Global Manufacturing PMI Final, US ISM Manufacturing PMI, Atlanta Fed President Bostic Speech

- Trading Highlights: Weakening manufacturing PMI will suppress crude oil demand expectations; Bostic's speech focuses on the pace of rate cuts, influencing USD fluctuations

🟠 Tuesday

- Key Events: RBA Rate Decision, US JOLTs Job Openings, Domestic Fuel Price Adjustment

- Trading Highlights: RBA hawkish signals boost AUD, dovish signals put pressure; Decline in JO

- Reward

- 1

- Comment

- Repost

- Share

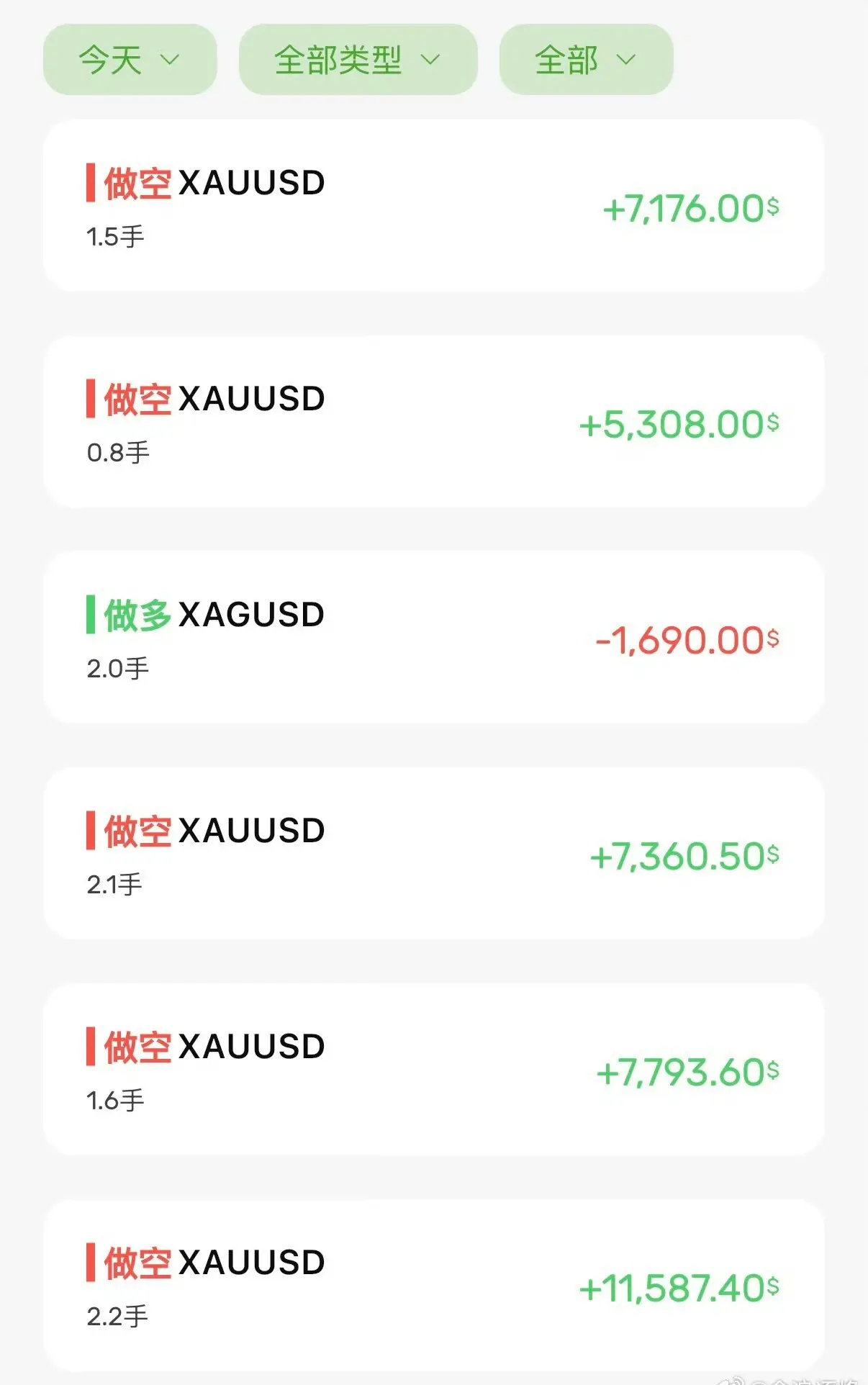

1.30 Performance Review

Accurate Trend Judgment and Precise Entry Points: Today’s correction trend for gold was particularly well-timed. Several orders were precisely placed at key resistance levels like 5225 and 5234. Especially two orders of 3 lots each, entered right before the price moved downward, resulting in peaks of 18,000 and 21,000 USD respectively.

Avoiding Overthinking and Maximizing Flexibility: No rigid approach to trading; when opportunities appeared at lower levels, I acted decisively. This prevented missing rebounds after corrections and demonstrated good rhythm control. There

View OriginalAccurate Trend Judgment and Precise Entry Points: Today’s correction trend for gold was particularly well-timed. Several orders were precisely placed at key resistance levels like 5225 and 5234. Especially two orders of 3 lots each, entered right before the price moved downward, resulting in peaks of 18,000 and 21,000 USD respectively.

Avoiding Overthinking and Maximizing Flexibility: No rigid approach to trading; when opportunities appeared at lower levels, I acted decisively. This prevented missing rebounds after corrections and demonstrated good rhythm control. There

- Reward

- like

- Comment

- Repost

- Share

1.29 Performance Review

Today, the strategy was to focus on gold trading, and both sides of the market yielded profits. The overall rhythm was quite good.

Flexible switching between long and short positions: Today, I took both long and short trades. Whether riding the upward trend with large long positions or precisely shorting during pullbacks, I was able to catch the market rhythm accurately.

Steady large positions: The entry points for large long positions were well-chosen, allowing me to capture a full upward move, which significantly boosted today's profits.

There were also some small pit

View OriginalToday, the strategy was to focus on gold trading, and both sides of the market yielded profits. The overall rhythm was quite good.

Flexible switching between long and short positions: Today, I took both long and short trades. Whether riding the upward trend with large long positions or precisely shorting during pullbacks, I was able to catch the market rhythm accurately.

Steady large positions: The entry points for large long positions were well-chosen, allowing me to capture a full upward move, which significantly boosted today's profits.

There were also some small pit

- Reward

- like

- Comment

- Repost

- Share

1.26 Review of Performance

Overall, I followed the trend of . Most of the entries were made at low levels, capturing profits from the upward movement, and I managed the rhythm fairly well.

However, I hit a small pitfall: one of the trades was a entered at a relatively high level, and right after entering, there was a short-term pullback, leading to a stop loss. This incident reminded me that even in markets, blindly chasing highs is risky, especially after a price has already surged, as it’s easy to get caught out.

Going forward, I need to pay more attention to entry points, try to find opp

View OriginalOverall, I followed the trend of . Most of the entries were made at low levels, capturing profits from the upward movement, and I managed the rhythm fairly well.

However, I hit a small pitfall: one of the trades was a entered at a relatively high level, and right after entering, there was a short-term pullback, leading to a stop loss. This incident reminded me that even in markets, blindly chasing highs is risky, especially after a price has already surged, as it’s easy to get caught out.

Going forward, I need to pay more attention to entry points, try to find opp

- Reward

- like

- Comment

- Repost

- Share

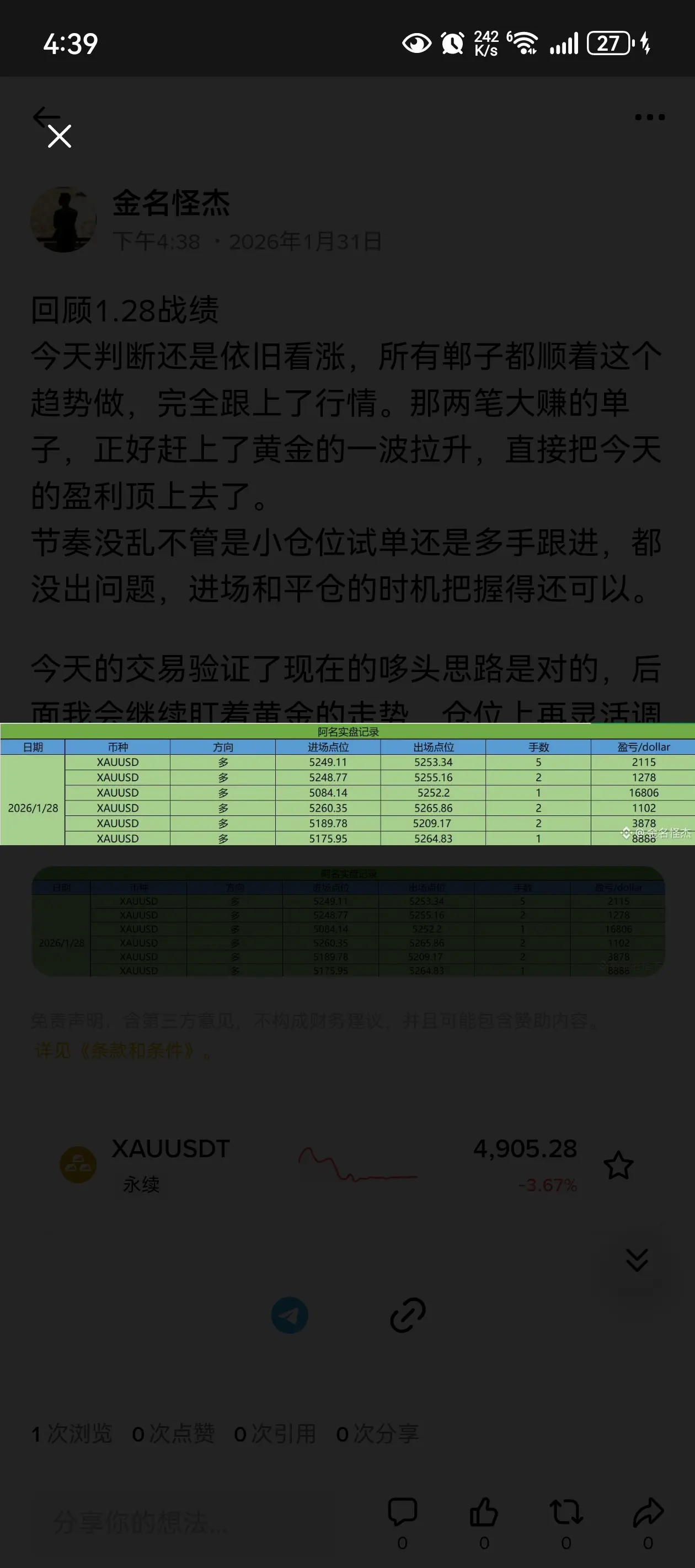

Review of 1.28 Performance

Today’s judgment remains bullish, and all trades followed this trend, perfectly aligning with the market. The two big profitable trades coincided with a surge in gold, directly boosting today’s profit to the highest point.

The rhythm was steady, whether trying small positions or multiple entries, no issues occurred. The timing for entry and exit was well managed.

Today’s trading confirmed that the current Dodo strategy is correct. Moving forward, I will continue to monitor gold’s trend and adjust my positions more flexibly — taking more profits when the market

View OriginalToday’s judgment remains bullish, and all trades followed this trend, perfectly aligning with the market. The two big profitable trades coincided with a surge in gold, directly boosting today’s profit to the highest point.

The rhythm was steady, whether trying small positions or multiple entries, no issues occurred. The timing for entry and exit was well managed.

Today’s trading confirmed that the current Dodo strategy is correct. Moving forward, I will continue to monitor gold’s trend and adjust my positions more flexibly — taking more profits when the market

- Reward

- 1

- 1

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊Review of 1.27 Operations

Slight setbacks, with two stop-losses at current prices. Fortunately, subsequent timely adjustments and regaining momentum allowed us to smoothly recover the lost ground. On the trading journey, reflection is always an essential lesson for progress. Every opening position is a carefully considered execution; every profit is a cumulative reward from daily effort. Stay true to the trading original intention, deeply cultivate the market essence, and believe that amidst market fluctuations, we will eventually find our own answers.

View OriginalSlight setbacks, with two stop-losses at current prices. Fortunately, subsequent timely adjustments and regaining momentum allowed us to smoothly recover the lost ground. On the trading journey, reflection is always an essential lesson for progress. Every opening position is a carefully considered execution; every profit is a cumulative reward from daily effort. Stay true to the trading original intention, deeply cultivate the market essence, and believe that amidst market fluctuations, we will eventually find our own answers.

- Reward

- like

- 1

- Repost

- Share