Comparing Mainstream DeFi Lending Protocol Mechanisms: Aave, Morpho, and Maple

This lesson uses three representative protocols—Aave, Morpho, and Maple—as core samples to systematically break down how DeFi lending evolves from a "unified market" to a "layered financial system," focusing on three dimensions: liquidity pool structure, interest rate formation mechanism, and risk management logic.

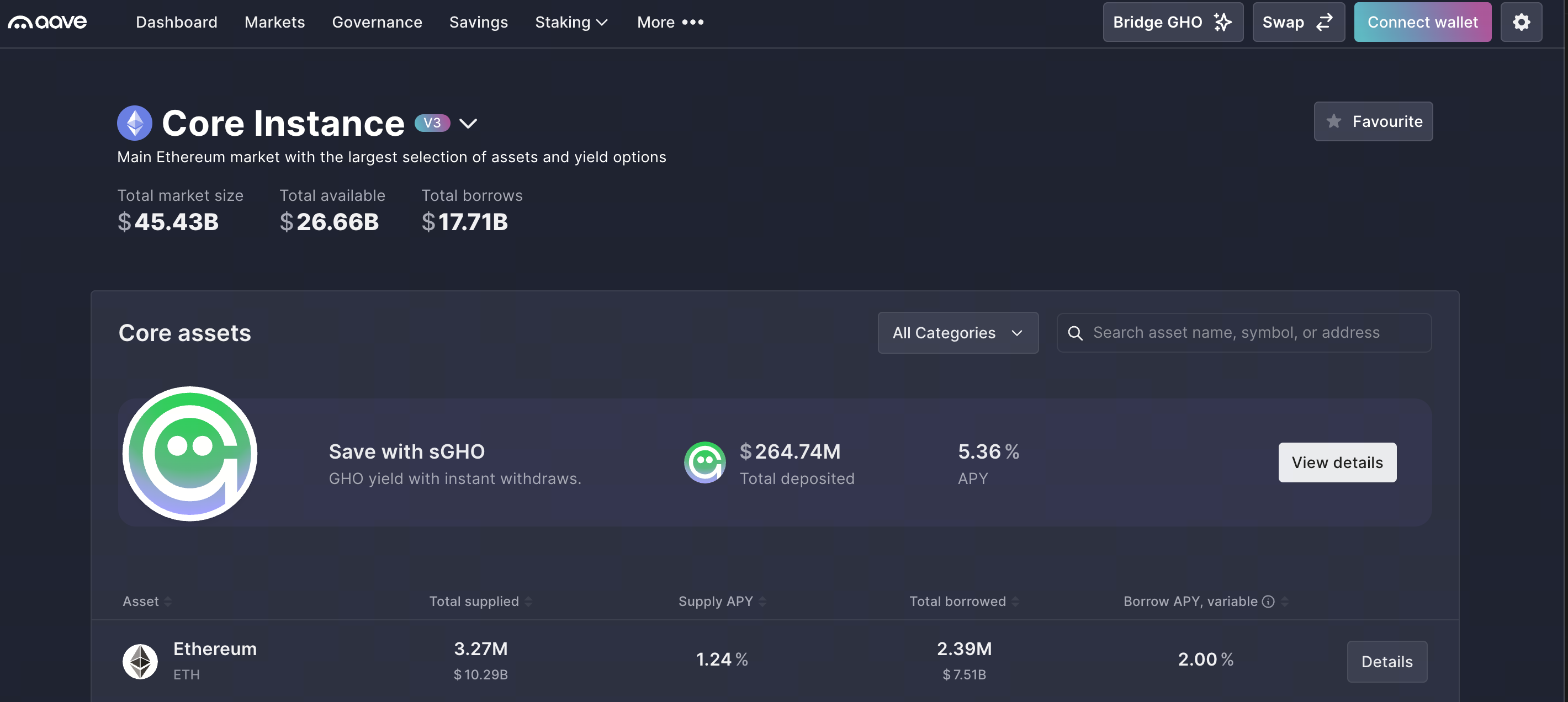

1. Aave: Infrastructure Model of Unified Liquidity Pools

Source: https://app.aave.com/

Among all DeFi lending protocols, Aave is the most typical and closest to a financial infrastructure. Rather than pursuing maximum efficiency or customization, Aave prioritizes solving three key issues: accessibility, predictability, and system stability.

1. Unified Liquidity Pool: Market Design by the Greatest Common Denominator

Aave’s core design centers on a unified liquidity pool:

- All depositors inject like assets into the same pool

- All borrowers draw assets from this pool

- Interest rates adjust automatically based on overall supply and demand

This structure fundamentally embodies a “shared risk, shared liquidity” approach with clear advantages:

- Highly concentrated liquidity with minimal fragmentation

- Permissionless participation for users of any scale

- High predictability of user actions and protocol outcomes

For both early and current stages of DeFi, this “greatest common denominator” design dramatically lowers the barriers to understanding and usage, making Aave the default underlying lending module for numerous protocols, strategies, and institutions.

2. Interest Rate Model: Single Curve Driven by Utilization

Aave’s interest rate mechanism is based on a core metric:

Utilization Rate = Borrowed Funds / Total Deposited Funds

- When utilization rises, capital tightens and borrowing rates increase;

- When utilization falls, capital is abundant and rates drop.

The advantages of this single-curve model are:

- Clear logic for rate changes

- Intuitive market signals

- No reliance on complex parameters or subjective judgment

However, its drawbacks are equally clear: all borrowers face “average risk pricing.” High-quality collateral and marginal-risk loans aren’t effectively differentiated in rates—an upside for security but a downside for capital efficiency.

3. Risk Management Logic: Parameterized, Not Personalized

Aave’s risk control relies heavily on standardized parameters:

- Loan-to-Value (LTV) ratio

- Liquidation threshold

- Liquidation penalty

These parameters are set at the asset level, not by user or strategy. This means:

- The protocol as a whole is extremely secure

- High scalability and replicability

- But risk and capital efficiency can’t be finely distinguished

From a financial perspective, Aave resembles an on-chain money market in the DeFi world: Robust, transparent, and resilient—but not optimized for maximum efficiency.

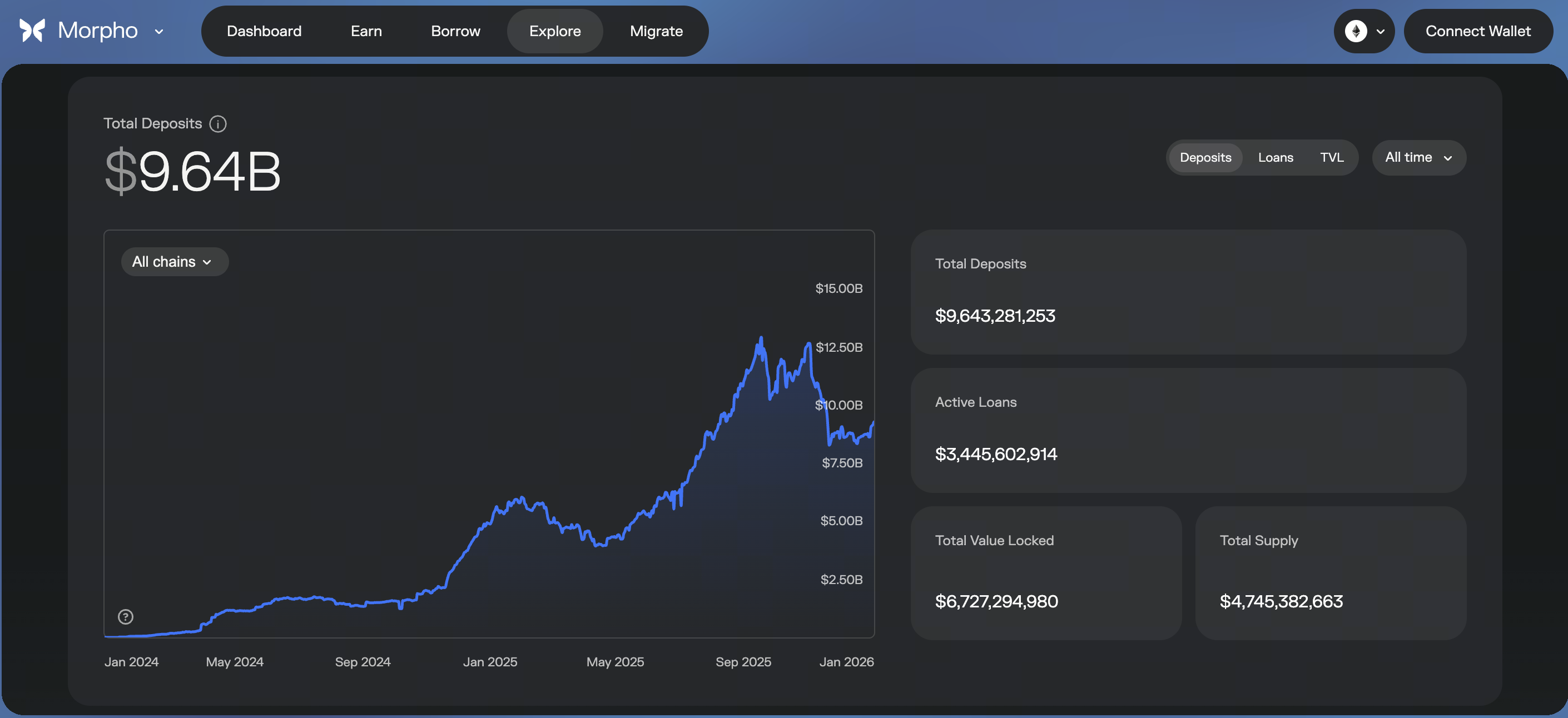

2. Morpho: Reconstructing the “Efficiency Layer” Above Unified Pools

Source: https://app.morpho.org/ethereum/explore

If Aave solves the question of “does the market exist,” Morpho addresses “is the market efficient enough.”

1. Overlay Model of Peer-to-Peer Matching

Morpho doesn’t replace Aave’s infrastructure; instead, it overlays on top:

- Depositors and borrowers are matched peer-to-peer by default

- Unmatched portions automatically revert to the Aave pool

This design introduces three key changes:

- Lenders earn higher yields

- Borrowers pay lower interest rates

- Overall liquidation and risk remain handled by Aave

Morpho isn’t an independent lending market—it’s an efficiency enhancement layer above Aave.

2. Interest Rates Move Beyond the “Single Curve”

With Morpho, interest rate formation changes:

- Peer-to-peer loan rates sit between Aave’s deposit and borrow rates

- Actual rates are determined by matching efficiency and supply-demand structure

This brings about:

- Stronger competition

- Finer price discovery

- Pricing that closely reflects real supply and demand

In essence, Morpho transforms Aave’s “passive algorithmic pricing” into “active matching-based pricing.”

3. Restrained Redistribution of Risk

Morpho doesn’t introduce new liquidation or credit models; instead:

- Credit and systemic risk remain anchored to Aave

- Users benefit from improved rate efficiency and returns

This is a restrained yet ingenious design: no new risks are created—efficiency is simply redistributed. As a result, Morpho is highly attractive to conservative capital, institutional strategies, and long-term investors.

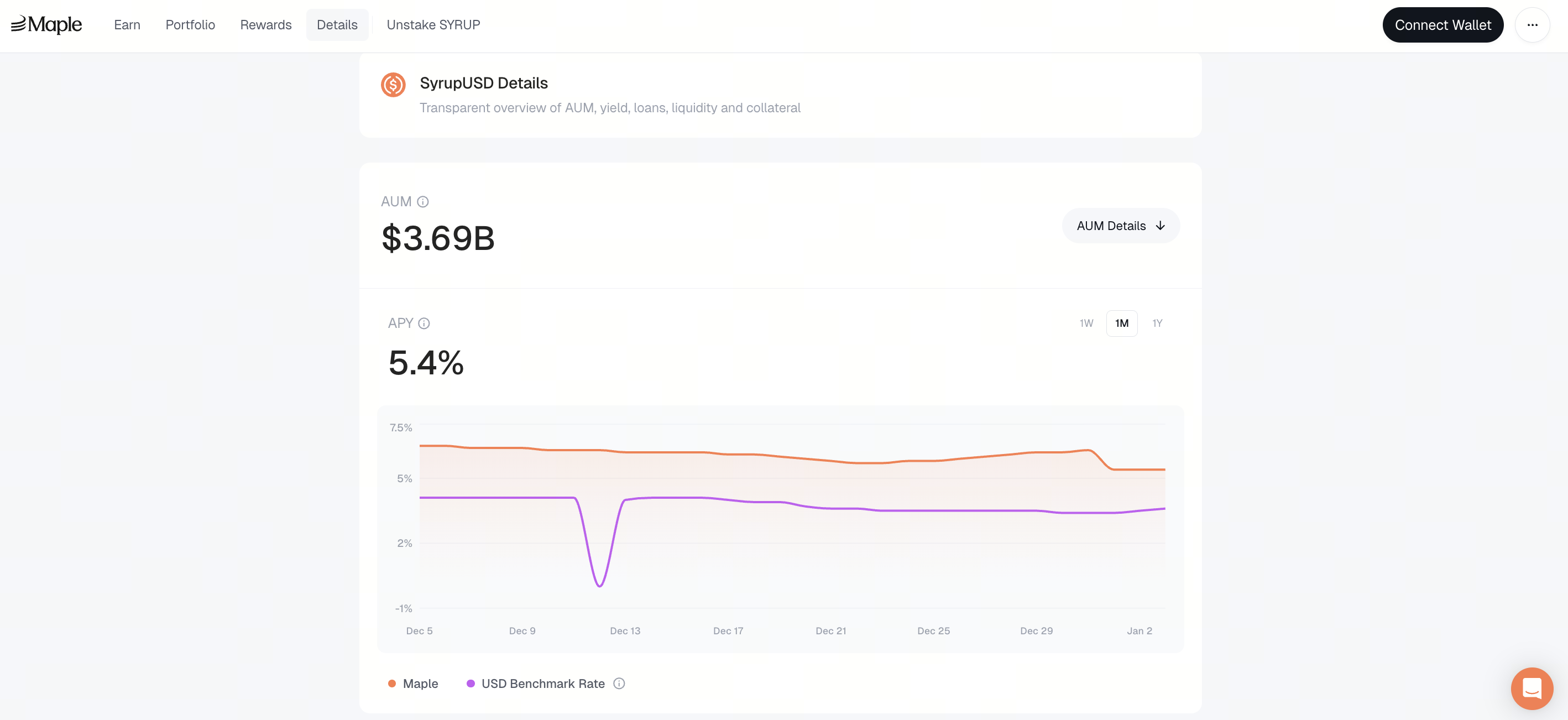

3. Maple: Institutional Credit Lending Model

Source: https://app.maple.finance/earn/details

While Aave and Morpho operate under “over-collateralization logic,” Maple represents DeFi’s move toward credit-based lending.

1. Pools as Strategies, Not Public Markets

Maple’s core isn’t a unified market—it’s “pool-as-strategy”:

- Each lending pool has independent rules

- Clear borrowers and specified fund uses

- Defined interest rates, terms, and risk expectations

This makes Maple more akin to:

- Private credit markets

- Structured financing

- On-chain debt markets

It doesn’t aim to serve every user—only those whose creditworthiness can be assessed.

2. Interest Rates Set by Risk Assessment, Not Algorithms

In Maple:

- Rates aren’t auto-generated by utilization curves

- Instead, they’re determined by borrower credit, term structure, and market conditions

As a result:

- Rates are more stable

- Returns are more predictable

- Transparency and decentralization are noticeably reduced

This is Maple’s deliberate trade-off to enhance institutional usability.

3. Fundamental Shift in Risk Bearing

Maple’s risk control relies not on instant liquidation but on:

- Pool Delegate risk management and oversight

- Legal agreement enforcement

- Governance and accountability mechanisms

This marks a new stage for DeFi lending: risk is no longer resolved solely by code but jointly managed by systems and contracts.

4. Fundamental Differences Among the Three Models

At a higher level, these three protocols aren’t direct competitors—they each have distinct functional roles:

- Aave: Unified, open, resilient to risk

- Morpho: Enhanced efficiency, optimized rates

- Maple: Credit stratification, institutional customization

It’s not about “which is more advanced,” but rather:

- Different risk appetites

- Different capital attributes

- Different financial use cases

5. DeFi Lending Is Moving Toward “Structured Layering”

A clear trend is emerging: DeFi lending is evolving from a “single market” into a “multi-layered market system.”

- Base layer: Unified liquidity pools with high security but lower efficiency

- Middle layer: Enhanced efficiency and matching mechanisms

- Upper layer: Institutional markets differentiated by credit, terms, and use cases

This isn’t accidental—it’s an on-chain replay of decades of traditional financial evolution.