How Institutions Use DeFi Lending: Stablecoins, Leverage, and On-Chain Arbitrage

This lesson focuses on how institutions and professional capital actually utilize DeFi lending protocols. It explores stablecoin lending, leverage strategies, and arbitrage techniques, while providing insight into institutional risk management and capital allocation in an on-chain environment.

I. Stablecoin Lending: On-Chain Cash Management Tools

For institutions, stablecoins are not just trading instruments—they represent true on-chain cash. They are neither risk assets nor speculative tools, but serve as the most essential liquidity unit on the balance sheet.

1. Stablecoins as Foundational Liability Instruments

In DeFi lending protocols, the most common and fundamental operation for institutions is not borrowing volatile assets, but rather:

- Collateralizing ETH / BTC / LST

- Borrowing USDC / USDT / DAI

The typical objectives include:

- Unlocking liquidity without selling core assets

- Deferring tax or accounting recognition events

- Preparing “deployable capital” for subsequent strategies

Financially, this behavior closely mirrors secured lending in traditional finance.

The key difference: In DeFi, rules are coded in advance, liquidations are executed by the market, and risk is borne by collateral—not by banks or intermediaries.

2. Macro Implications of Stablecoin Interest Rates

As stablecoin adoption grows, their lending rates are evolving into the on-chain equivalent of money market rates. For institutions, stablecoin lending rates now carry clear macro significance:

- Rising rates → increased demand for leverage, tightening liquidity

- Falling rates → deleveraging, reduced risk appetite

Some quantitative and hedge funds have incorporated DeFi stablecoin rates into their macro monitoring frameworks to assess:

- On-chain liquidity stress

- Whether the market is entering a risk accumulation phase

- If leverage is concentrating in one direction

At this level, DeFi stablecoin rates are approaching the role of SOFR or repo rates in traditional finance.

II. Building Leverage: Controlled and Transparent Risk Amplification

Unlike retail investors, institutions use leverage not to “bet on direction,” but to precisely manage risk exposure and capital efficiency.

1. Typical On-Chain Leverage Paths

The most common DeFi leverage structure is: deposit ETH → borrow stablecoins → buy more ETH → use it as collateral again—a classic recursive collateralization model.

Unlike traditional high-leverage trading, its key features are:

- All parameters visible in real time

- Liquidation prices clearly coded into contracts

- Leverage ratios strictly limited by collateralization rates

Leverage isn’t infinitely magnified; it’s rigorously contained within protocol risk frameworks.

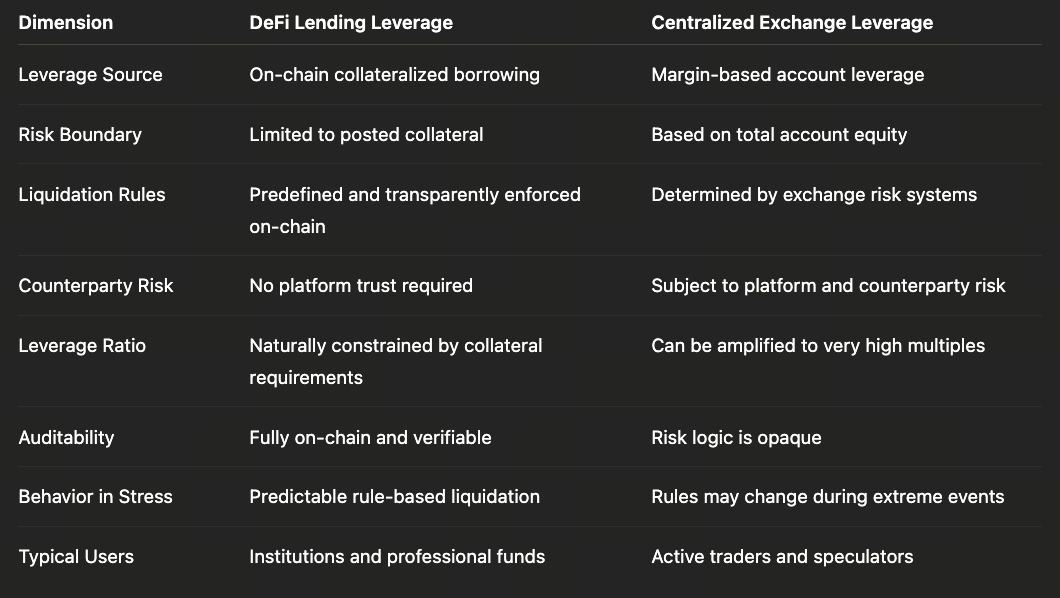

2. DeFi Leverage vs. Centralized Leverage

For this reason, some institutions actually prefer DeFi leverage over the higher multiples offered by centralized exchanges, especially in highly uncertain environments.

Here, the core consideration isn’t the size of the leverage, but whether the rules are trustworthy and risks are controllable.

III. Arbitrage and Structured Yield Strategies

Another central use case for DeFi lending is serving as the backbone of structured yield strategies.

1. Carry Trade (Interest Rate Arbitrage)

Typical strategy formats include:

- Borrowing stablecoins from low-rate protocols

- Deploying capital in high-yield, low-volatility scenarios

Examples:

- Borrow USDC → provide stablecoin liquidity

- Borrow USDC → allocate to RWA yield assets

These strategies focus not on extreme returns but on:

- Stability of rate differentials

- Sustainability of yield

- Ability to exit smoothly under stress

For institutions, this is a form of asset-liability duration and interest rate mismatch management—not speculation.

2. Cross-Protocol Arbitrage and Parameter Differentiation

Different lending protocols naturally differ in:

- Collateralization ratios

- Liquidation thresholds

- Rate responsiveness

Professional capital leverages these differences for structured allocations across protocols rather than betting on a single model. This arbitrage isn’t about “exploiting loopholes”—it’s about diversifying risk through institutional variations.

3. Lending as a “Yield Amplifier”

In many strategies, lending itself isn’t the source of returns—it serves to:

- Amplify existing low-risk yields

- Enhance overall capital efficiency

For example, in an ETH staking yield plus stablecoin lending combination:

- Staking yield is the foundational return

- Lending is merely an amplifier, not the primary risk driver

That’s why institutions focus intensely on liquidation thresholds and rate stability—not nominal APY.

IV. Risk Management: How Institutions Avoid Liquidations

For institutions, the primary goal in using DeFi lending is never maximizing returns—it’s avoiding any unexpected liquidation events.

1. Conservative Collateralization Management

Even when protocols allow high LTVs, institutions typically:

- Operate at significantly lower actual LTVs

- Reserve ample margin for price volatility

2. Dynamic Rebalancing Instead of Passive Liquidation

During heightened market volatility, institutions tend to:

- Proactively add collateral

- Reduce leverage ahead of time

- Narrow risk exposures

Rather than waiting for liquidation mechanisms to trigger.

3. Automated Risk Control Systems

Professional users usually deploy:

- Real-time monitoring scripts

- Automated repayment or top-up mechanisms

- Multi-layered alert systems

These minimize human response time and systematize risk management rather than relying on manual intervention.

V. Why Is DeFi Lending Suitable for Institutions?

Ultimately, the appeal of DeFi lending for institutions is straightforward:

- Rules are fully transparent

- Risks can be modeled and verified

- No counterparty credit risk exposure

It doesn’t promise higher yields—it delivers a financial system that’s auditable, quantifiable, and resilient even under extreme conditions.

When institutions start treating DeFi lending as a tool for cash management and risk control instead of speculation, DeFi enters the realm of true financial infrastructure.