Why DeFi Lending Is Becoming Financial-Grade Infrastructure

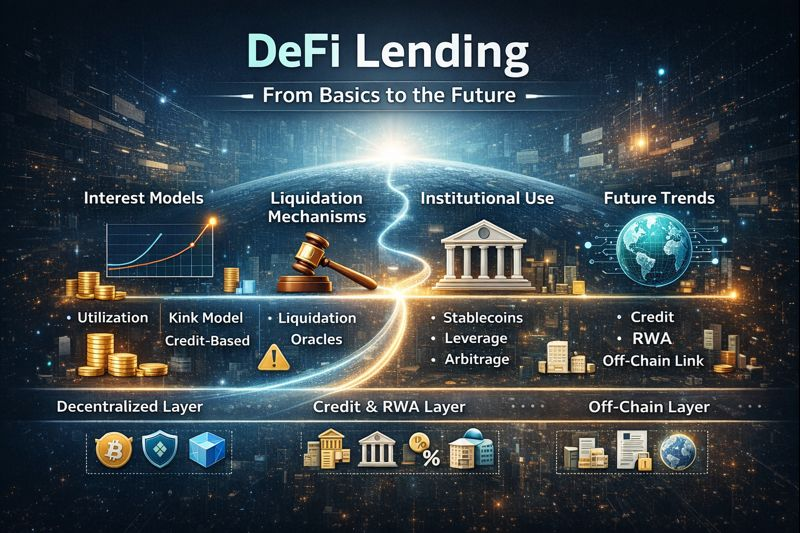

This lesson breaks down why DeFi lending is emerging as the new growth engine in the era of institutionalization. By examining stablecoin expansion, risk pricing, and financial structures, we'll explore how lending protocols are evolving into core on-chain financial infrastructure.

I. An Overlooked Shift: DeFi’s Growth Focus Is Changing

For a long time, DeFi was synonymous with one thing: high yields. Whether through early liquidity mining or later incentive-driven protocol designs, users were drawn to DeFi mainly by short-term APY. Yield rates almost single-handedly determined where capital flowed.

But in 2024–2025, this logic is undergoing a structural transformation. New capital is no longer prioritizing high-risk, high-volatility strategies. The proportion of stablecoins and low-volatility assets on-chain continues to rise, and protocol competition is shifting from “who offers more” to “whose risk is better managed.” Against this backdrop, lending protocols—rather than DEXs—are returning as the core growth module for DeFi.

This isn’t just a cyclical shift driven by sentiment—it’s a fundamental return to financial functionality.

II. Why Lending—Not Trading or Derivatives?

At its core, lending is the most foundational and scalable building block of any financial system.

Whether in traditional finance or on-chain finance, lending always serves three key roles:

- Capital allocation hub: connecting liquidity providers with borrowers

- Risk pricing tool: using interest rates to reflect market consensus on risk

- Source of leverage and liquidity: powering trading, market making, arbitrage, and hedging

By contrast, trading and derivatives sit closer to the application layer, while lending operates as infrastructure.

In DeFi’s early days, this advantage wasn’t fully realized—not because the models were flawed, but because the external environment wasn’t ready:

- Stablecoin supply was limited

- On-chain liquidation and risk controls were unstable

- Large capital lacked compliant, replicable ways to participate on-chain

These constraints are now gradually being lifted.

III. Stablecoins: The True “Fuel” of DeFi Lending

If DeFi lending is the engine, stablecoins are the fuel.

By 2025, stablecoins have undergone three major role shifts:

- From trading pair denomination

- To on-chain settlement medium

- To core asset in on-chain money markets

A crucial change is underway: more stablecoins are remaining on-chain long-term rather than constantly moving in and out of exchanges.

When stablecoins “stay put,” two critical questions naturally arise:

- Where are they safest?

- How can they generate returns under controlled risk?

This is exactly where lending protocols shine. For institutional capital, the appeal of on-chain lending isn’t extreme yields—it’s about:

- Transparent sources of yield

- Quantifiable risk

- Liquidity that can be exited at any time

At this stage, lending protocols are the closest fit for these requirements in DeFi.

IV. The “Institutionalization” of DeFi Lending

“Institutionalization” doesn’t mean DeFi is copying traditional banks; rather, its operational logic is evolving toward lower uncertainty and higher predictability.

This shift is evident in three key areas:

1. From “Highest Yield” to “Stable Returns”

Institutional capital rarely chases extreme APY; instead, it focuses on:

- Interest rate volatility range

- Liquidation performance during market stress

- Long-term compounding stability

This makes stablecoin-centric lending markets with clear risk parameters a natural entry point.

2. From Anonymous Play to Risk Segmentation

DeFi lending markets are becoming clearly segmented:

- Open-market, permissionless liquidity pools

- Targeted lending structures with credit screening for specific borrowers

This isn’t a retreat from decentralization—it’s an inevitable outcome of more precise risk pricing.

3. From “Code Is Law” to “Mechanism as Product”

For institutions, full decentralization isn’t the only metric; what matters more is:

- Stable and reliable liquidations

- Dynamically adjustable risk parameters

- Systemic resilience under extreme conditions

Competition among lending protocols is shifting from “feature-rich” to “mechanism maturity.”

V. Why Is DeFi Lending Becoming “Financial-Grade Infrastructure”?

To understand this, it’s important to distinguish between product-level applications and infrastructure-level protocols.

True financial infrastructure typically exhibits four traits:

- Reusability: continually integrated by different strategies and protocols

- Risk transparency: core parameters can be externally evaluated and modeled

- Greater scale brings greater system stability—not fragility

- Doesn’t depend on a single narrative for survival

DeFi lending today is steadily meeting these criteria:

- Lending positions are widely used for trading, market making, arbitrage, and hedging

- Interest rates have become one of the most important on-chain risk signals

- Leading protocols have proven their liquidation mechanisms through multiple market crises

- Yield sources are increasingly based on real demand for capital rather than incentive subsidies

That’s why more research institutions and long-term investors are clearly anchoring DeFi’s next growth phase to the lending ecosystem.