Interest Rate Models, Liquidation Mechanisms, and Systemic Risks in DeFi Lending

This lesson provides a comprehensive analysis of interest rate models and liquidation mechanisms in DeFi lending, exploring how they regulate risk and maintain system stability. It also examines the systemic risks faced by lending protocols during extreme market conditions and the strategies for mitigating them.

I. Interest Rates: Not a Yield Tool, but a Risk Regulator

In the DeFi lending ecosystem, the primary function of interest rates isn’t to “provide returns on capital,” but rather to regulate the speed, direction, and scale of systemic risk exposure.

Put simply, interest rates are fundamentally risk regulators—not marketing tools.

A healthy lending protocol’s interest rate mechanism must accomplish at least three objectives:

- Suppress excessive borrowing to prevent the system from accumulating risk in a single direction

- Attract or release liquidity, guiding capital reallocation when supply and demand become imbalanced

- Signal impending stress before it hits, allowing the market to respond ahead of liquidations

This is why nearly all mainstream DeFi lending protocols use dynamic interest rate models instead of fixed rates. On-chain, interest rates are not “prices”; they’re real-time indicators of system health.

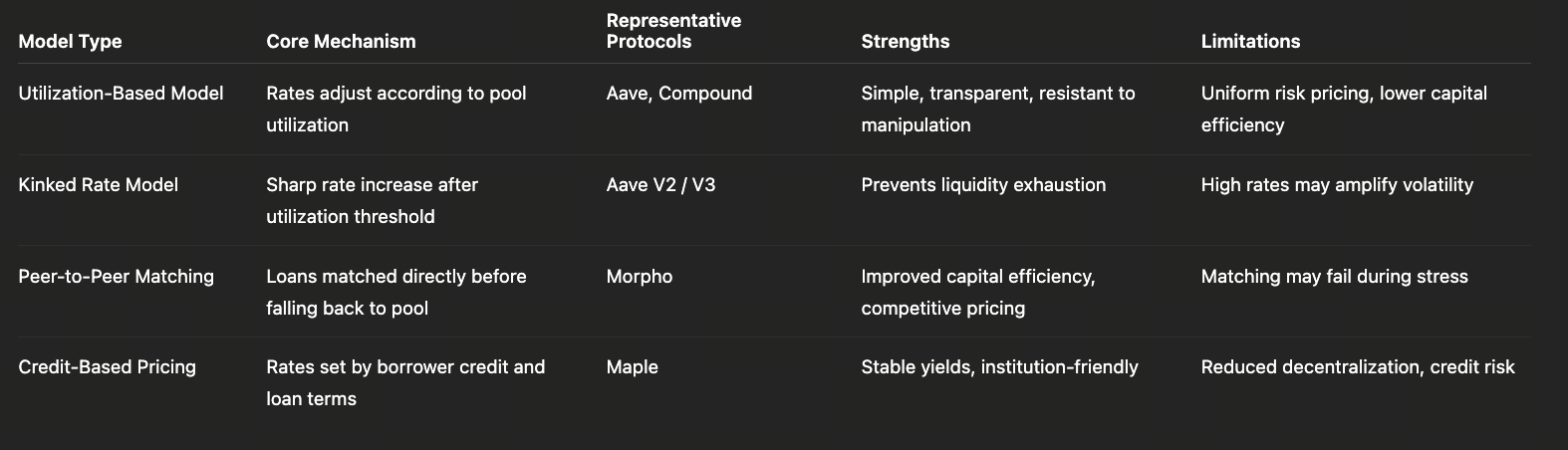

II. Three Main Interest Rate Model Paradigms

1. Utilization-Based Model (Aave / Compound)

This is the most classic and widely adopted interest rate model in DeFi, with a single core variable: Utilization Rate = Funds Lent Out ÷ Total Deposited Funds.

The basic logic is straightforward:

- Low utilization → ample liquidity → lower borrowing rates

- High utilization → tight liquidity → rates rise rapidly

To prevent runaway risk at high utilization, protocols typically set a Kink (inflection point):

- Before the kink: rates rise gradually, encouraging normal borrowing activity

- After the kink: rates spike sharply, forcibly curbing new borrowing demand

Advantages

- Simple and transparent model

- Clear market signals

- Strong resistance to manipulation

- Easily scalable and replicable

Disadvantages

- All borrowers bear the same risk premium

- Cannot distinguish between “healthy leverage” and “high-risk leverage”

- Lower capital efficiency in complex strategies

As such, this model is best suited for infrastructure-level rate mechanisms rather than precise risk pricing tools.

2. Peer-to-Peer / Semi-Market Rate Model (Morpho)

Morpho introduces a key change: interest rates are no longer determined solely by “pool status,” but by the efficiency of supply-demand matching.

In Morpho, when peer-to-peer matching succeeds:

- Borrowers pay less than the pool borrowing rate

- Lenders earn more than the pool deposit rate

This adds a micro-level competitive pricing layer atop a unified pool.

Advantages

- Significantly higher capital efficiency

- More nuanced rate signals

- Multiple rate tiers for the same asset

Potential Risks

- Matching may break down quickly in extreme markets

- The system remains highly dependent on the underlying pool for liquidity and liquidation buffering

Morpho’s success thus hinges on a robust, predictable, shock-resistant base pool. It’s not a replacement for infrastructure—it’s an efficiency enhancement layer built on top of it.

3. Credit & Manual Pricing Model (Maple)

Maple fundamentally changes the rate logic: Interest rates are not algorithmically generated; they’re determined by:

- Borrower credit quality

- Loan term structure

- Market conditions and risk appetite

This closely resembles credit spread pricing models in traditional finance.

Advantages

- Minimal rate volatility

- Highly predictable returns

- Better suited for institutional liability management and asset allocation

Trade-offs

- Noticeably reduced decentralization

- Systemic risk shifts from “market risk” to “credit + legal risk”

This is a deliberate trade-off Maple makes to improve institutional usability and control.

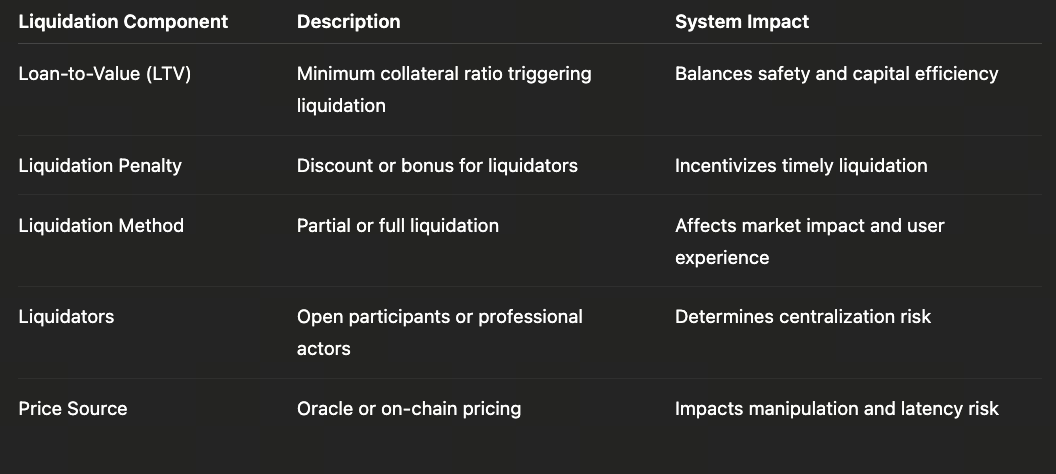

III. Liquidation Mechanism: DeFi Lending’s True “Insurance System”

If interest rates regulate risk in advance, liquidation mechanisms are designed for real-time loss mitigation. In DeFi lending, liquidation isn’t an anomaly—it’s an integral part of system design.

1. The Logic of Automated Liquidation

In overcollateralized lending, the liquidation process usually unfolds as follows:

- Collateral price drops

- Collateralization ratio falls below the liquidation threshold

- The system allows third parties to forcibly close positions

Liquidators are rewarded by:

- Buying collateral assets at a discount

- Incentivizing them to take on price volatility and execution risks

This mechanism relies on a core assumption: that there’s always market liquidity willing to step in.

2. Three Key Design Variables in Liquidation Mechanisms

(1) Liquidation Threshold

- Higher threshold → safer system but lower capital efficiency

- Lower threshold → higher efficiency but greater tail risk

(2) Liquidation Penalty

- Penalty too low → insufficient incentive for liquidators

- Penalty too high → higher costs for borrowers, dampening demand

(3) Liquidation Method

- Partial vs. full liquidation

- Dutch auction vs. instant execution

These parameters are interdependent and together determine system resilience during extreme volatility.

IV. What Happens When Markets Fail?

In theory, liquidation mechanisms should work—but extreme market conditions often prove otherwise.

DeFi history has repeatedly shown:

- Falling prices ≠ available liquidity

- On-chain congestion exacerbates liquidation delays

- Collateral asset correlations spike under stress

When these factors converge, the risk faced is no longer individual—it’s systemic.

V. Three Typical Sources of Systemic Risk

1. Highly Correlated Collateral Assets

When most lending concentrates in similar collateral types:

- ETH, LSTs, and LRTs drop simultaneously

- Liquidations trigger en masse

- Liquidity evaporates instantly

2. Oracle & Price Lag Risks

- Delayed price updates

- Thinly traded markets are easily manipulated

- Off-chain prices diverge from on-chain settlement prices

All directly undermine the effectiveness of liquidation mechanisms.

3. Concentrated Liquidators

In reality:

- Liquidation relies heavily on a handful of specialized teams

- There’s significant dependence on MEV and infrastructure advantages

This means liquidation itself carries “centralization risk.”

VI. How Protocols Address Systemic Risk

Mature lending protocols have started deploying multi-layered defenses:

- Dynamic adjustment of risk parameters

- Lending caps (Supply / Borrow Cap)

- Insurance funds and bad debt buffers

- Governance intervention during extreme scenarios

These mechanisms mark a crucial shift: DeFi lending is evolving from “fully automated systems” to “governable financial systems.”

VII. Summary

The true competitiveness of DeFi lending isn’t about:

- Offering higher rates,

- Or bigger leverage,

But rather:

- Whether it can keep running under stress,

- If risks can be exposed promptly and transparently,

- And if the system can self-heal.

When these questions become central to market discussions, DeFi moves beyond experimentation—it becomes genuine financial infrastructure.