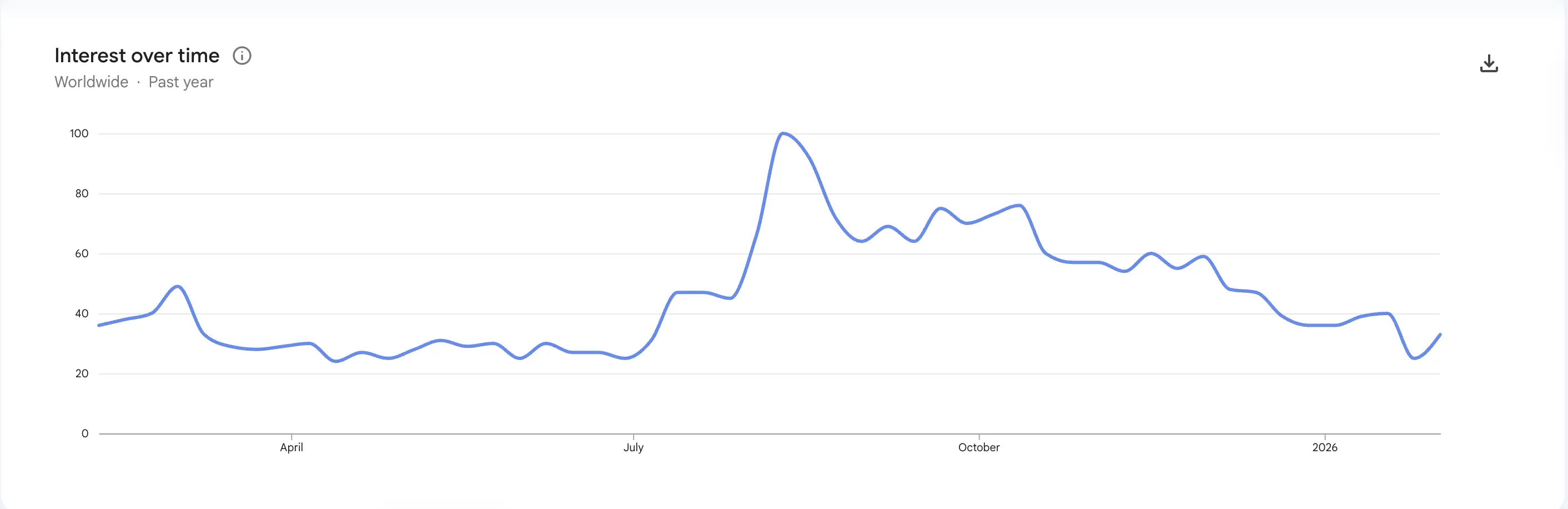

Google Trends reveals market despair! "Cryptocurrency" search volume replays Terra crash panic

Google Trends data shows that global searches for “cryptocurrency” have plummeted to 30 (out of 100), approaching the annual low of 24. The total market capitalization of cryptocurrencies has crashed from a record high of over $4.2 trillion to about $2.4 trillion, evaporating $1.8 trillion. The Fear and Greed Index has fallen to a historic low of 5, currently matching investor sentiment during the Terra-LUNA collapse in 2022.

Google Trends Plummets to 30, Global Search Volume Hits New Annual Low

(Source: Google Trends)

As of writing, Google Trends data indicates that the global search volume for “cryptocurrency” is 30 (with 100 being the highest). The last time such low search interest was recorded was in August 2025, when cryptocurrency market cap was also near a peak, but market sentiment was already turning cautious. According to Google Trends, the lowest search volume in the past 12 months was 24, which occurred during a deep bear market as the market continued to decline.

Google Trends search volume data is often used as a leading indicator of investor sentiment. When search interest is high, it typically signals increased market attention and participation, often accompanied by rising prices and new capital inflows. Conversely, when search interest crashes, it indicates that the public has lost interest in cryptocurrencies, usually coinciding with market panic, falling prices, and capital outflows.

Historically, Google Trends search volume correlates strongly with cryptocurrency market cap movements. During the 2021 bull market peak, “cryptocurrency” searches remained above 80 for extended periods, even reaching 100 at times. During the 2022 bear market, search interest declined to between 30 and 40. In the recovery period of 2023 to 2024, search volume gradually increased. The current drop to 30 signals that market sentiment has again fallen into extreme pessimism.

This collapse in search volume not only reflects disinterest among existing investors but also highlights the absence of new entrants. During bull markets, many novice investors turn to Google to learn about cryptocurrencies, driving search volumes higher. When search interest plummets, it suggests that new capital inflows have nearly halted, leaving only existing funds in play—often the most painful phase of a bear market.

The sharp decline in trading volume in the crypto market further confirms this sentiment. According to CoinMarketCap data, total trading volume dropped from over $153 billion on January 14 to about $87.5 billion on Sunday, a decline of over 40%. Reduced trading volume indicates lower market liquidity, wider bid-ask spreads, and can further exacerbate price volatility and investor panic.

U.S. Market Search Volume Briefly Rebounds but Remains Far Below Peak

U.S. Google Trends data shows a slightly different pattern from the global trend. The data indicates that U.S. search interest peaked at 100 in July, then fell below 37 in January. However, the U.S. search volume rebounded to 56 in the first week of February, indicating some degree of recovery.

This brief rebound may be related to several factors. First, the market volatility triggered by President Trump’s tariff policies drew investor attention back to cryptocurrencies as a hedge against traditional market risks. Second, some U.S. investors may see current prices as a buying opportunity and are researching market conditions. Third, ongoing operations of U.S. crypto ETFs and institutional participation help maintain a certain level of market attention.

However, even considering this rebound, U.S. search interest remains well below bull market highs. The annual low for the U.S. was 32, recorded during the market crash of April 2025, when Trump’s tariff policies first sparked panic selling across global financial markets. The current 56, while higher than the bottom, is just over half of the peak levels, indicating that market sentiment remains subdued.

The U.S. market’s uniqueness lies in its more mature crypto infrastructure and higher institutional involvement. Many institutional investors do not rely on Google searches for information but instead use professional data services and research reports. Therefore, the decline in search volume in the U.S. may partly reflect retail investor exit, while institutional behavior is not fully captured by Google Trends data.

It’s also worth noting that U.S. search volume tends to be more volatile than the global average. This may be because U.S. investors are more sensitive to macroeconomic policies and market events. Major news (such as SEC regulatory decisions, major exchange incidents, or presidential policy statements) often cause short-term spikes in search interest, but these tend to be fleeting.

Fear and Greed Index Drops to 5 Repeating Terra Crash Panic

Google Trends data aligns closely with other sentiment indicators, especially the Crypto Fear and Greed Index. According to CoinMarketCap, the Fear and Greed Index fell to a historic low of 5 on Thursday but rebounded slightly to 8 on Sunday. Nonetheless, both levels indicate the market is in “extreme fear” territory.

The Fear and Greed Index measures overall market sentiment, combining multiple factors such as volatility, market momentum, social media sentiment, surveys, and Bitcoin dominance. The index ranges from 0 (extreme fear) to 100 (extreme greed), with 50 being neutral. Historically, when the index drops below 20, it signals excessive fear, often near market bottoms.

Currently, crypto investors’ sentiment is comparable to the levels seen after the 2022 Terra ecosystem and its UST stablecoin collapse. Terra’s crash shocked the crypto community, wiping out over $40 billion in market cap within days and triggering a chain of liquidations, accelerating the 2022 bear market. At that time, the Fear and Greed Index also fell into single digits, and the market was in extreme panic.

Comparison of 2022 Terra Collapse and Current Market

Market Cap Erosion: Terra’s collapse wiped out about $40 billion; current market loss is $1.8 trillion

Fear Index Level: Terra period saw 8-10; now it’s 5-8

Google Trends Search Volume: Terra period around 35-40; now about 30

Chain Reaction: Terra caused multiple institutional failures; no similar scale institutional collapses currently

Duration: Terra was a sudden event; current decline has been ongoing for months

This comparison shows that, although current market panic levels are similar to those during Terra’s collapse, the nature differs. Terra was a sudden project-specific collapse causing systemic risk, while the current situation results from macroeconomic deterioration, regulatory uncertainty, and cyclical market adjustments. Nonetheless, from an investor sentiment perspective, both scenarios reflect comparable despair.

Historical experience suggests that extreme panic often presents contrarian investment opportunities. When the Fear and Greed Index drops below 10, markets may have overreacted, increasing the likelihood of a rebound. However, this does not guarantee a bottom; markets can oscillate at low levels for weeks or months.

Social Media Negative Sentiment Peaks, Investors Seek Bottom Signals

According to the sentiment analysis platform Santiment, investors are currently looking for social signals indicating a market bottom to time their entries. “Market sentiment is extremely pessimistic. The ratio of positive to negative comments has dropped sharply, reaching the highest point of negativity since December 1,” Santiment said in a report on Friday.

Social media sentiment analysis has become an important tool in modern market sentiment research. Using natural language processing, platforms scan millions of comments on Twitter, Reddit, Telegram, and other social media to calculate the ratio of positive to negative sentiment. When negative comments surge, it often coincides with market bottoms, as extreme pessimism suggests most willing sellers have already sold.

However, market bottoms are complex and difficult to predict with a single indicator. Historically, true bottoms are characterized by: sustained low Google Trends search interest for weeks, the Fear and Greed Index lingering at very low levels, trading volume collapsing, social media discussions nearly disappearing, and prices repeatedly testing support levels.

Currently, most of these conditions are met, but the duration is still insufficient. The 2022 bear market bottom took about six months to form—from the Terra crash in May to the actual bottom in November. If this pattern holds, the current market may still need several weeks or months to complete its bottoming process.

For investors, indicators like Google Trends provide valuable reference points but should not be the sole basis for decisions. Combining technical analysis, fundamental research, and risk management is essential to make rational choices in this highly panicked environment. History shows that the best investment opportunities often arise during the darkest times, but only well-prepared investors can seize these moments.

Related Articles

When the US dollar drops by 10%... will Bitcoin once again usher in a "bull market"?

Deleveraging Phase: Bitcoin Stabilizes at $70K After February’s Volatility Flush

Data: In the past 24 hours, the entire network has liquidated $227 million, with long positions liquidated at $156 million and short positions at $71.47 million.