2025 ALEO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: ALEO's Market Position and Investment Value

Aleo (ALEO) is a developer platform for building fully private, scalable, and cost-effective applications. As of December 17, 2025, Aleo's market capitalization has reached approximately $184.54 million, with a circulating supply of around 735.86 million tokens trading at approximately $0.11621. This innovative platform, which leverages zero-knowledge cryptography to move smart contract execution off-chain, is playing an increasingly critical role in enabling decentralized applications that maintain complete privacy while scaling to thousands of transactions per second.

This article will provide a comprehensive analysis of Aleo's price trajectory and market dynamics, combining historical patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors.

I. ALEO Price History Review and Current Market Status

ALEO Historical Price Evolution

- September 2024: ALEO reached its all-time high of $8.0002 on September 18, 2024, marking the peak of its market performance during the initial trading period.

- December 2025: ALEO declined to its all-time low of $0.1106 on December 9, 2025, representing a significant correction from previous highs.

ALEO Current Market Situation

As of December 17, 2025, ALEO is trading at $0.11621, with a 24-hour trading volume of $557,151.90. The token exhibits modest short-term momentum, gaining 1.82% over the past hour and 0.67% in the last 24 hours. However, the broader trend remains bearish, with ALEO down 8.6% over the past seven days and 38.07% over the past month. Over the one-year period, the token has experienced a dramatic decline of 91.32%, reflecting significant market pressure.

The total market capitalization stands at $184.54 million, with a circulating supply of 735.86 million ALEO tokens out of a total supply of 1.59 billion tokens. This represents a circulating supply ratio of approximately 49.06%. ALEO ranks 381st by market capitalization, with a market dominance of 0.0057%. The token is currently traded on 13 exchanges, including Gate.com.

Click to view current ALEO market price

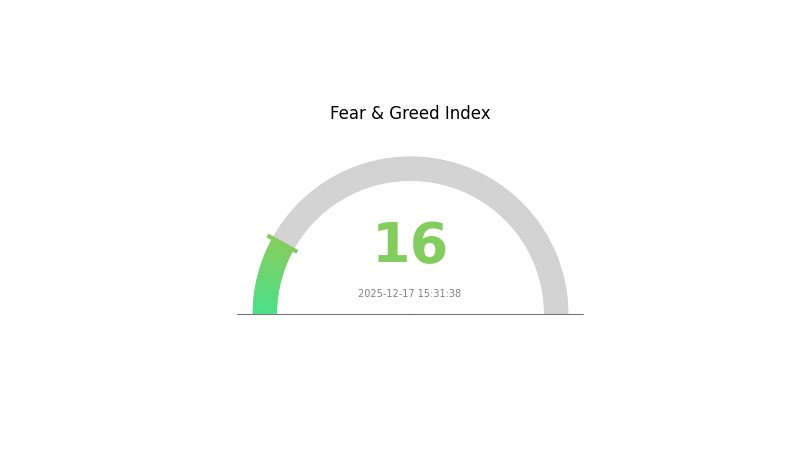

Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the fear and greed index dropping to 16. This indicates significant market pessimism and heightened risk aversion among investors. When fear reaches such extreme levels, it often presents contrarian buying opportunities for experienced traders, as panic-driven sell-offs may create undervalued entry points. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitoring market sentiment through Gate.com's fear and greed index can help you better understand market dynamics and make more informed trading strategies.

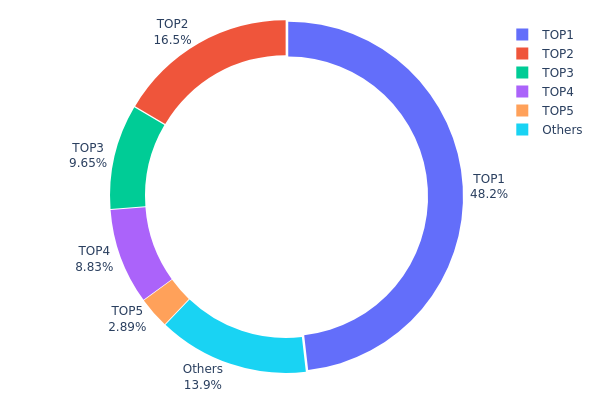

ALEO Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across different wallet addresses, serving as a critical metric for assessing the decentralization level and potential market fragility of a blockchain asset. By analyzing the top holders and their respective percentages of total supply, this data reveals whether wealth distribution is relatively balanced or concentrated among a small number of participants, which directly impacts market dynamics and governance structures.

The ALEO token distribution exhibits pronounced concentration characteristics, with the top four addresses collectively holding 83.17% of the total supply. The largest holder (0x73d8...4946db) commands an outsized position with 48.18% of all ALEO tokens, while the second-largest address controls an additional 16.51%. This level of concentration presents notable implications for market structure and stability. A single entity controlling nearly half of the circulating supply possesses significant capacity to influence price movements through large transactions, potentially triggering substantial volatility. Furthermore, the cumulative holdings of the top four addresses suggest that decisions made by a limited number of stakeholders could materially affect the token's trajectory, raising concerns about governance centralization and the vulnerability of the market to coordinated actions or sudden liquidation events.

The distribution pattern indicates that ALEO currently operates with a relatively centralized on-chain structure, where wealth concentration exceeds levels typically associated with mature, decentralized networks. While the remaining 13.94% distributed across other addresses provides some degree of diversification, the dominance of the top holders underscores a market structure still in early consolidation phases. This concentration warrants close monitoring, as any redistribution of holdings among the major addresses could trigger significant market repricing, and the potential for these large holders to become active participants in governance or liquidity provisioning creates both opportunity and risk for the broader ALEO ecosystem.

Click to view the current ALEO holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 13697.96K | 48.18% |

| 2 | 0x0c47...2ed07d | 4695.58K | 16.51% |

| 3 | 0xa325...9cc875 | 2744.45K | 9.65% |

| 4 | 0x4982...6e89cb | 2511.73K | 8.83% |

| 5 | 0xf9d4...095705 | 821.82K | 2.89% |

| - | Others | 3958.21K | 13.94% |

II. Core Factors Affecting ALEO's Future Price

Supply Mechanism

-

Initial Supply and Mining Distribution: ALEO has an initial supply of 1.5 billion tokens, which is projected to increase to 2.6 billion tokens over a ten-year mining period. Early supporters' rewards account for 34% of token distribution, with a one-year lock-up period for both US and non-US users.

-

Historical Impact: When ALEO's tokenomics were officially announced on September 16, 2024, the market reacted negatively. Initially priced near $9 USD in over-the-counter markets, the token experienced a sharp decline to $3.4 USD following the tokenomics disclosure, as the initial market valuation of approximately $13.5 billion was perceived as excessive for a project with only tens of thousands of active ecosystem users.

-

Current Impact: The excessive initial supply relative to ecosystem maturity continues to exert downward pressure on price. Validator rewards distribution—with top validators receiving over 1.1 million ALEO tokens and minimum validators receiving over 270,000 tokens—creates potential selling pressure as these early recipients may liquidate holdings.

Institutional and Major Holder Dynamics

-

Institutional Holdings: Major institutional investors backing ALEO include a16z, Softbank, Kora, and Coinbase. Validators and related institutional entities such as Coinbase, unit410, and the ALEO Foundation hold significant token allocations. B-round financing in 2022 reached $200 million at a $1.45 billion valuation.

-

Early Miner Concerns: The project faced significant backlash from early miners and the community. Miners expressed frustration over the delayed mainnet launch, token lock-up periods, and perceived developer advantage through pre-mining. Community sentiment shifted from positive to highly critical following mainnet launch on September 18, 2024.

Technological Development and Ecosystem Building

-

Algorithmic Challenge and ARC-0043 Proposal: The core technical issue centers on a fundamental algorithmic flaw. The current consensus mechanism cannot simultaneously support high transaction throughput (TPS) and reasonable block times. Specifically, increasing validator numbers from current levels to 50 validators would extend block times from 10 seconds to one minute, creating a paradox where more validators actually slow network performance. This architectural problem threatens the viability of the economic model. Founder Howard Wu submitted technical proposal "ARC-0043: Extending the Puzzle Algorithm to a Complete SNARK" on October 15, 2024, to address this critical issue.

-

Ecosystem Applications: Puzzle Wallet emerged as the most-called program on ALEO, with over 10,000 daily calls recorded on September 19, 2024, following the announcement of airdrop token claims through the wallet. Puzzle Wallet currently serves over 30,000 users, representing the most significant ecosystem activity metric, though overall ecosystem adoption remains limited.

III. 2025-2030 ALEO Price Forecast

2025 Outlook

- Conservative Forecast: $0.09378 - $0.11723

- Neutral Forecast: $0.11723

- Optimistic Forecast: $0.17233 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Early growth phase with recovery momentum, transitioning from consolidation to gradual appreciation driven by protocol maturity and ecosystem expansion.

- Price Range Forecast:

- 2026: $0.12596 - $0.20848 (projected 23% upside potential)

- 2027: $0.1572 - $0.1837 (projected 50% upside potential)

- Key Catalysts: Enhanced privacy technology adoption, strategic partnerships with decentralized applications, increased user base engagement, and improved market liquidity on trading platforms such as Gate.com.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.1099 - $0.18737 (assumes steady ecosystem growth with moderate institutional interest by 2028)

- Optimistic Scenario: $0.18016 - $0.24257 (assumes accelerated protocol adoption and mainstream blockchain integration by 2029)

- Transformative Scenario: $0.13856 - $0.30057 (assumes breakthrough in privacy technology adoption, enterprise-level integration, and significant market expansion by 2030, reflecting 81% cumulative growth potential)

Long-term Trajectory Note: ALEO demonstrates potential for sustained appreciation through 2030, with cumulative upside reaching 81% under favorable market conditions, supported by technological advancement and increasing integration within the decentralized finance ecosystem.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17233 | 0.11723 | 0.09378 | 0 |

| 2026 | 0.20848 | 0.14478 | 0.12596 | 23 |

| 2027 | 0.1837 | 0.17663 | 0.1572 | 50 |

| 2028 | 0.18737 | 0.18016 | 0.1099 | 53 |

| 2029 | 0.24257 | 0.18377 | 0.16355 | 56 |

| 2030 | 0.30057 | 0.21317 | 0.13856 | 81 |

ALEO Professional Investment Strategy and Risk Management Report

IV. ALEO Professional Investment Strategy and Risk Management

ALEO Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Privacy-focused technology adopters, developers interested in zero-knowledge cryptography, long-term believers in scalable private blockchain infrastructure

- Operational Recommendations:

- Accumulate during market downturns when ALEO trades significantly below historical highs (current price $0.11621 vs. ATH $8.0002)

- Dollar-cost averaging (DCA) approach to reduce timing risk across multiple purchase intervals

- Hold through market cycles to benefit from potential adoption growth in privacy-preserving applications

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Volatility Monitoring: Track 24-hour price ranges ($0.1118-$0.12031) and 7-day price movements (-8.6% change)

- Volume Analysis: Monitor daily trading volume ($557,151.90) to identify liquidity patterns and trend confirmation

-

Swing Trading Key Points:

- Identify support levels near the 52-week low ($0.1106) for potential entry opportunities

- Utilize resistance levels near recent 24-hour highs to set profit-taking targets

- Monitor long-term trend reversal signals given the significant -91.32% 1-year decline

ALEO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% portfolio allocation - ALEO represents a speculative, emerging technology play requiring measured exposure

- Active Investors: 1-3% portfolio allocation - suitable for those with higher risk tolerance comfortable with volatile emerging blockchain projects

- Professional Investors: 2-5% allocation - appropriate for diversified crypto portfolios with risk management infrastructure

(2) Risk Hedging Strategies

- Position Sizing: Implement strict position limits to ensure no single trade exceeds your risk tolerance threshold

- Diversification Approach: Balance ALEO holdings with other blockchain infrastructure projects and established cryptocurrencies to reduce concentration risk

(3) Secure Storage Solutions

- Hardware Wallet Options: Consider cold storage solutions for long-term holdings to minimize exchange counterparty risk

- Exchange Storage: For active trading on Gate.com, utilize platform security features including two-factor authentication and account protection

- Security Precautions:

- Enable withdrawal whitelisting to prevent unauthorized fund transfers

- Never share private keys or seed phrases with any third parties

- Regularly update security credentials and monitor account activity

- Use unique, strong passwords for all blockchain-related accounts

- Keep sensitive information offline in physically secure locations

V. ALEO Potential Risks and Challenges

ALEO Market Risks

-

Extreme Price Volatility: ALEO has experienced a -91.32% decline over the past year, demonstrating severe price volatility that can result in substantial losses. The project has also shown market cap concentration with only $85.5 million circulating market cap against $184.5 million fully diluted valuation.

-

Liquidity Risk: With only $557,151.90 in 24-hour volume and presence on 13 exchanges, liquidity may be insufficient for large position entries or exits, potentially resulting in significant slippage.

-

Market Adoption Uncertainty: As an early-stage privacy-focused platform, ALEO faces execution risk in achieving meaningful developer adoption and network growth necessary to justify current valuations.

ALEO Regulatory Risks

-

Privacy Feature Regulatory Scrutiny: Regulators worldwide are increasingly examining privacy-preserving cryptocurrencies and protocols. Enhanced regulation could impact ALEO's utility and adoption trajectory.

-

Compliance Uncertainty: Regulatory frameworks for zero-knowledge cryptography applications remain unclear in most jurisdictions, creating potential compliance challenges for the platform and its users.

-

Jurisdiction-Specific Restrictions: Some countries may restrict or ban ALEO usage or development due to its privacy-centric design, limiting geographic market opportunities.

ALEO Technical Risks

-

Zero-Knowledge Proof Complexity: The platform's reliance on advanced zero-knowledge cryptography introduces implementation complexity risk. Any cryptographic vulnerabilities could compromise the entire protocol.

-

Scalability Execution Risk: While ALEO claims capability to handle thousands of transactions per second, achieving and maintaining this performance at scale requires flawless protocol execution and sustained development.

-

Off-Chain Execution Model Risk: The off-chain execution architecture introduces additional complexity and potential security vectors that differ from traditional on-chain execution models.

VI. Conclusion and Action Recommendations

ALEO Investment Value Assessment

ALEO represents a speculative investment in emerging privacy-preserving blockchain technology. While the project addresses genuine market demand for scalable, private decentralized applications through innovative zero-knowledge cryptography, it remains in early development stages with unproven commercial viability. The 91.32% year-to-date decline reflects broader market skepticism and execution challenges. The project's long-term value proposition depends heavily on successful developer adoption, regulatory acceptance of privacy-preserving technologies, and the ability to deliver on scalability claims. Current valuation metrics suggest significant downside risk remains possible, though potential long-term upside exists for patient investors believing in privacy-focused blockchain infrastructure.

ALEO Investment Recommendations

✅ Beginners: Limit exposure to 0.5-1% of your crypto portfolio only after thoroughly understanding zero-knowledge cryptography fundamentals. Start with small allocations on Gate.com and consider dollar-cost averaging rather than lump-sum purchases.

✅ Experienced Investors: Allocate 1-3% of your crypto holdings while implementing strict stop-loss orders at meaningful support levels. Use technical analysis to identify entry points during market weakness and maintain disciplined position management.

✅ Institutional Investors: Consider 2-5% allocation within diversified blockchain infrastructure strategies. Conduct thorough technical due diligence on the zero-knowledge proof implementations and developer team capabilities before committing capital.

ALEO Trading Participation Methods

-

Spot Trading: Purchase ALEO directly on Gate.com using fiat or other cryptocurrencies. Best for long-term holders seeking direct ownership of the token.

-

Market Orders vs. Limit Orders: Use limit orders to maintain price discipline and avoid slippage during volatile market conditions. Market orders should only be used for small positions requiring immediate execution.

-

Portfolio Rebalancing: Periodically review your ALEO allocation against your overall investment objectives and rebalance positions to maintain target portfolio weightings and risk management parameters.

Cryptocurrency investments carry extreme risk of total loss. This report does not constitute investment advice. All investors must evaluate their personal risk tolerance, financial situation, and investment objectives before making any decisions. Consult with qualified financial advisors before committing capital. Never invest funds you cannot afford to lose completely. Past performance does not guarantee future results, and cryptocurrency markets remain highly speculative and subject to rapid change.

FAQ

What is the price prediction for Aleo in 2040?

Based on current market analysis, Aleo is predicted to reach approximately S$0.30 by 2040, with potential to climb higher to S$0.49 depending on market conditions and adoption rates.

What is the prediction for Aleo mining?

Aleo is predicted to reach S$0.24 by 2035, S$0.30 by 2040, and potentially S$0.49 in the future based on current market analysis and growth projections.

Why is Aleo's price dropping?

Aleo's price is dropping due to excessive speculation, poor market depth, and lack of real progress. High valuation combined with speculative trading has made the price extremely fragile, and continuous decline has shattered investor confidence.

How much is the Aleo coin worth?

Aleo coin is currently worth $0.117, with a 24-hour price increase of 1.46%. The 24-hour trading volume is $3,247,532.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is GIGGLE: A Comprehensive Guide to Understanding This Emerging Technology Platform

What is RECALL: A Comprehensive Guide to Understanding Information Retrieval and Memory Performance Metrics

What is ESPORTS: A Comprehensive Guide to Professional Gaming and Competitive Video Gaming Industry

What is LRC: A Complete Guide to Lyric Synchronization Format

2025 PIEVERSE Price Prediction: Expert Analysis and Market Forecast for the Next Year