2025 ALU Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: ALU's Market Position and Investment Value

Altura (ALU) is a cross-chain NFT platform token designed to integrate blockchain and cryptocurrency into the gaming world, enabling communities to obtain NFTs that flow seamlessly between different games. Since its launch in 2021, Altura has established itself as a utility token within its ecosystem. As of December 2025, ALU maintains a market capitalization of approximately $8.14 million, with a circulating supply of 990 million tokens trading at around $0.008219 per coin. This BEP20 token, recognized for its role in NFT marketplace transactions, continues to play an important part in the gaming and digital asset sectors.

This article will provide a comprehensive analysis of ALU's price trajectory from 2025 to 2030, incorporating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. ALU Price History Review and Current Market Status

ALU Historical Price Evolution Trajectory

-

2021: Altura NFT platform launched as a cross-chain application. ALU reached its all-time high of $0.462652 on November 3, 2021, marking the peak of early market enthusiasm for NFT gaming tokens.

-

2021 - Present: Significant market downturn. ALU declined from its historical high of $0.462652 to a low of $0.00255407 on July 19, 2021, demonstrating substantial volatility in the early NFT gaming sector.

ALU Current Market Situation

As of December 22, 2025, Altura (ALU) is trading at $0.008219, reflecting the token's current valuation in the broader cryptocurrency market. The token has experienced pronounced long-term depreciation, with a 1-year decline of -91.4%, indicating sustained downward pressure on its market value.

Short-term performance metrics:

- 1-hour change: -0.11%

- 24-hour change: -0.33%

- 7-day change: -7.6%

- 30-day change: -4.95%

Market capitalization and liquidity:

- Total market capitalization: $8,136,810

- 24-hour trading volume: $85,727.36

- Circulating supply: 990,000,000 ALU (100% of total supply)

- Token holders: 73,149

- Market dominance: 0.00025%

ALU maintains its presence across 9 cryptocurrency exchanges, with Gate.com providing trading access to the token. The 24-hour price range stood between $0.007963 and $0.008348, indicating relatively tight intraday volatility.

Access current ALU market price on Gate.com

ALU Market Sentiment Index

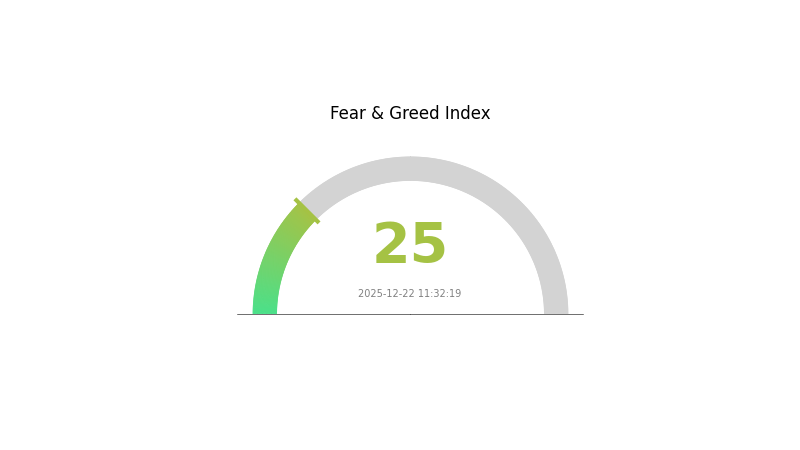

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index reading at 25. This sentiment reflects heightened market anxiety and significant investor pessimism. During such periods, risk aversion dominates trading behavior, and market volatility tends to increase. However, historically, extreme fear has often preceded market recoveries, presenting potential opportunities for strategic investors. Monitor market developments closely and consider your risk tolerance before making investment decisions on Gate.com.

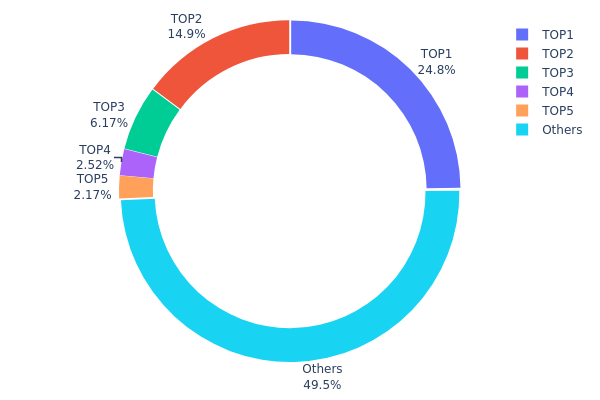

ALU Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across different blockchain addresses, providing critical insights into the decentralization level and potential market structure risks of ALU. By analyzing the top addresses and their respective holdings percentages, we can assess whether wealth is overly concentrated among a small number of holders, which could impact price stability and market dynamics.

Current data reveals a moderately concentrated distribution pattern for ALU. The top two addresses control 39.66% of total holdings, with the leading address alone commanding 24.81% of the circulating supply. The top five addresses collectively represent 50.5% of all tokens, indicating that half of ALU's supply is distributed among just five entities. While this concentration level is notable, the remaining 49.5% dispersed among other addresses suggests a degree of decentralization that provides some resilience against potential manipulation by individual large holders.

This distribution structure presents mixed implications for market stability. The significant holdings by top addresses creates potential risk for sudden large liquidations or coordinated selling that could trigger price volatility. However, the substantial portion held by smaller address clusters reduces the likelihood of unilateral market control. The current distribution reflects a typical pattern for established tokens, where early investors and major stakeholders maintain considerable positions while the broader community gradually accumulates holdings. This structure suggests ALU maintains reasonable on-chain decentralization characteristics, though investors should monitor whether the top holders' behavior aligns with long-term project sustainability.

Check current ALU holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2255...da51e2 | 330000.00K | 24.81% |

| 2 | 0xc882...84f071 | 197583.41K | 14.85% |

| 3 | 0xaa18...d45965 | 82090.59K | 6.17% |

| 4 | 0x2e8f...725e64 | 33487.90K | 2.51% |

| 5 | 0x69be...6ee5e0 | 28816.03K | 2.16% |

| - | Others | 658022.07K | 49.5% |

II. Core Factors Influencing ALU's Future Price

Supply Mechanism

-

Global Aluminum Production: Global aluminum output serves as the core pillar for any aluminum price forecast. Since 2023, aluminum production growth has slowed significantly due to rising energy costs and tightening environmental restrictions. Aluminum producers face ongoing pressure from electricity prices, carbon emission regulations, and production constraints.

-

Cost Structure Evolution: As of October 2024, the cost composition of electrolytic aluminum has undergone significant changes. Alumina prices have risen substantially, increasing their share in the cost structure to 45%, while electricity costs have declined to 30% and anode costs have fallen to 11%. This structural shift impacts overall production economics and supply dynamics.

-

Supply-Demand Balance: The market supply and demand equilibrium is the key factor shaping aluminum price movements. Inventory levels of electrolytic aluminum are significantly influenced by seasonal factors, making the supply-demand relationship critical to price trends.

Macroeconomic Environment

-

Trade Policy Impact: Trade policy adjustments have become a dominant force in price volatility. For instance, U.S. tariff expansions on aluminum products have created negative market sentiment and demand concerns, pressuring prices downward.

-

Energy Cost Fluctuations: Energy costs remain a critical factor. High energy prices, particularly volatile natural gas prices in Europe, provide price support during market downturns, while energy efficiency initiatives such as China's green electricity aluminum projects offer structural support to production.

-

Supply Shortage Expectations: Medium-term outlook shows supply deficit expectations. JPMorgan predicts a global aluminum market shortage of 600,000 tons in 2025, and emerging demand growth for new energy applications (such as the "aluminum replacing copper" trend) is expected to push aluminum price levels upward.

-

Currency and Monetary Policy: If the Federal Reserve implements interest rate cuts and China strengthens growth-stabilizing policies, aluminum prices could potentially break through previous highs, with LME targets reaching $2,850-3,000 per ton and SHFE targets reaching 21,000-23,000 yuan per ton.

Three、2025-2030 ALU Price Forecast

2025 Outlook

- Conservative Prediction: $0.00437 - $0.00824

- Neutral Prediction: $0.00824

- Optimistic Prediction: $0.01145 (requires sustained market interest and positive sentiment)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Recovery and gradual accumulation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.00827 - $0.01034 (19% potential upside)

- 2027: $0.00585 - $0.01161 (22% potential upside)

- 2028: $0.00716 - $0.01378 (32% potential upside)

- Key Catalysts: Increased adoption in decentralized finance protocols, ecosystem expansion, and growing institutional interest in emerging digital assets

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01022 - $0.01540 (49% growth potential by 2029)

- Optimistic Scenario: $0.01232 - $0.01995 (68% growth potential by 2030 assuming accelerated ecosystem development and mainstream adoption)

- Transformative Scenario: $0.01995+ (contingent on breakthrough technological developments, significant partnership announcements, and broader market capitalization expansion)

- 2030-12-31: ALU trading in the $0.01108 - $0.01995 range (potential medium-to-long-term consolidation or breakthrough phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01145 | 0.00824 | 0.00437 | 0 |

| 2026 | 0.01034 | 0.00985 | 0.00827 | 19 |

| 2027 | 0.01161 | 0.01009 | 0.00585 | 22 |

| 2028 | 0.01378 | 0.01085 | 0.00716 | 32 |

| 2029 | 0.0154 | 0.01232 | 0.01022 | 49 |

| 2030 | 0.01995 | 0.01386 | 0.01108 | 68 |

Altura (ALU) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Altura (ALU) is a cross-chain NFT application token built on the Binance Smart Chain (BSC) designed to integrate blockchain technology into the gaming ecosystem. As of December 22, 2025, ALU is trading at $0.008219 with a market capitalization of $8.14 million and a 24-hour trading volume of $85,727. The token has experienced significant depreciation, declining 91.4% over the past year from its all-time high of $0.462652 reached on November 3, 2021.

II. ALU Market Overview and Current Status

Token Fundamentals

| Metric | Value |

|---|---|

| Current Price | $0.008219 |

| Market Cap | $8,136,810 |

| 24H Trading Volume | $85,727 |

| Circulating Supply | 990,000,000 ALU |

| Total Supply | 990,000,000 ALU |

| All-Time High | $0.462652 (Nov 3, 2021) |

| All-Time Low | $0.00255407 (Jul 19, 2021) |

| Market Dominance | 0.00025% |

| Token Holders | 73,149 |

| Primary Network | Binance Smart Chain (BSC) |

Price Performance Analysis

Short-term Performance:

- 1-Hour Change: -0.11%

- 24-Hour Change: -0.33%

- 7-Day Change: -7.6%

- 30-Day Change: -4.95%

Long-term Performance:

- 1-Year Change: -91.4%

- Recovery from ATL: 221.8%

- Decline from ATH: 98.2%

III. ALU Project Overview

Project Description

Altura NFT operates as a cross-chain application dedicated to bridging blockchain technology and cryptocurrency with the gaming industry. The platform enables communities to access and trade NFTs that maintain liquidity across multiple gaming environments.

Core Utility

ALU token serves as:

- Primary Exchange Medium: The sole currency for purchasing and selling NFTs on the Altura marketplace

- Platform Center: Core utility token enabling ecosystem transactions

- Transaction Currency: Medium for all in-game NFT commerce

Technical Specifications

- Token Standard: BEP-20 (Binance Smart Chain)

- Contract Address: 0x8263CD1601FE73C066bf49cc09841f35348e3be0

- Network: Binance Smart Chain (BSC)

- Token Supply: Fixed at 990,000,000 ALU (100% circulating)

Project Resources

- Official Website: https://www.alturanft.com/

- Application Platform: https://app.alturanft.com/

- Twitter: https://twitter.com/AlturaNFT

- GitHub: https://github.com/alturanft

- Community: https://www.reddit.com/r/AlturaNFT/

IV. ALU Professional Investment Strategy and Risk Management

ALU Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Risk-tolerant investors with 12+ month investment horizons and belief in NFT gaming industry development

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Implement systematic purchases at regular intervals to mitigate timing risk given ALU's historical volatility

- Fundamental Accumulation: Consider accumulating during extended downturns if project fundamentals remain intact

- Asset Storage: Maintain holdings on secure platforms with direct BSC integration for receiving gaming rewards or ecosystem airdrops

(2) Active Trading Strategy

Technical Analysis Tools:

- On-Chain Analytics: Monitor ALU transaction volume and holder distribution patterns to identify genuine demand

- Volume Profile Analysis: Track trading volume concentrations to identify key support and resistance levels

Wave Trading Key Points:

- Volatility Monitoring: Execute trades during periods of elevated volume when ALU exhibits 3-5% daily swings

- Liquidity Management: Only execute trades during peak trading hours when 24-hour volume exceeds $80,000

ALU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of portfolio allocation (ALU carries substantial risk as a lower-cap token)

- Aggressive Investors: 1-3% of portfolio allocation (only after thorough research and due diligence)

- Professional Investors: 2-5% of portfolio allocation (with dedicated risk hedging mechanisms)

(2) Risk Hedging Solutions

- Position Sizing Limits: Maintain individual position sizes at less than 1% of total portfolio to minimize concentrated risk exposure

- Rebalancing Schedule: Implement quarterly portfolio rebalancing to manage exposure as market conditions evolve

(3) Secure Storage Solutions

- Recommended Approach: Store ALU tokens on Gate.com or directly in BSC-compatible wallets where you maintain full private key control

- Custody Options: For larger holdings, consider professional custody solutions that support BSC tokens

- Security Precautions: Never share private keys; enable two-factor authentication on all exchange accounts; store recovery phrases in secure offline locations; regularly verify wallet addresses before transactions

V. ALU Potential Risks and Challenges

ALU Market Risks

- Extreme Price Volatility: ALU has experienced a 98.2% decline from its all-time high, demonstrating extreme market vulnerability to sentiment shifts and profit-taking

- Minimal Trading Liquidity: Daily trading volume of $85,727 creates significant price impact risk for large trades and potential execution challenges

- Low Market Capitalization: At $8.14 million, ALU is susceptible to rapid capital inflows or outflows that can trigger dramatic price movements

ALU Regulatory Risks

- Gaming and NFT Regulation Uncertainty: Evolving global regulations on gaming tokens and NFT platforms create compliance uncertainty that could impact project viability

- Securities Classification Risk: Potential regulatory classification of ALU as a security could impose restrictive trading and distribution requirements

- Jurisdictional Restrictions: Certain geographic regions may restrict or prohibit ALU trading and ownership

ALU Technology Risks

- Smart Contract Vulnerabilities: Any discovered flaws in the BEP-20 implementation or platform smart contracts could result in fund loss

- Cross-Chain Integration Risks: Technical failures in cross-chain NFT transfer mechanisms could compromise core platform functionality

- Blockchain Dependency: Platform reliance on BSC creates vulnerability to network congestion, security incidents, or protocol changes

VI. Conclusion and Action Recommendations

ALU Investment Value Assessment

Altura presents a speculative investment opportunity in the gaming NFT sector with significant downside risk. The token has depreciated 91.4% over the past year, indicating either fundamental challenges or severe market pessimism. With only 73,149 token holders and minimal daily trading volume, ALU exhibits characteristics typical of abandoned or stalled projects. However, for sophisticated investors who believe in the gaming NFT thesis and the project's technical roadmap, the extreme depreciation may present contrarian opportunities. Any investment decision must be grounded in thorough due diligence regarding project development status, ecosystem adoption metrics, and team execution capabilities.

ALU Investment Recommendations

✅ Beginners: Avoid direct ALU investment until you develop sophisticated portfolio risk management skills and understand gaming NFT sector dynamics. If interested, limit exposure to less than 0.5% of total portfolio through speculative allocation only.

✅ Experienced Investors: Conduct detailed on-chain analysis of transaction patterns and holder concentration before committing capital. Consider small speculative positions (1-2% allocation) only if you identify positive catalysts and improved ecosystem metrics. Implement strict stop-loss orders at 15-25% decline levels.

✅ Institutional Investors: Perform comprehensive due diligence on project team credentials, development roadmap, competitive positioning, and regulatory exposure. Evaluate ALU as a small speculative allocation only if integrated into diversified cryptocurrency strategies. Require institutional-grade custody and compliance frameworks.

ALU Trading Participation Methods

- Exchange Trading: Trade ALU directly on Gate.com, which provides 24/7 market access, real-time price discovery, and competitive trading fees for BSC-based tokens

- Direct Wallet Management: Purchase ALU through Gate.com and transfer to personal BSC-compatible wallets for long-term holders prioritizing asset security

- Liquidity Pools: Advanced users can provide liquidity in BSC DEX pools containing ALU pairs, earning trading fees but accepting impermanent loss risk

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must assess their personal risk tolerance and financial situation before investing. Consult with qualified financial advisors prior to making investment decisions. Never invest more than you can afford to lose completely.

FAQ

Can altura reach 1 dollar?

Altura reaching $1 is highly unlikely. It would require a gain of over 12,999%, which current market fundamentals and price predictions do not support.

What is the share price forecast for Alu?

Based on analyst predictions, the share price forecast for Alu is 426.00 GBX, with estimates ranging from 410.00 to 442.00 GBX for 2026. This projection reflects current market analysis and expert consensus.

What is the all time high for Alu coin?

The all-time high for Alu coin is $0.4627. This peak was achieved in the past, and the current price remains significantly below this historical level.

2025 LION Price Prediction: Analyzing Market Trends and Future Prospects for the Digital Asset

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

2025 WAXPPrice Prediction: Market Trends and Future Outlook for the WAX Ecosystem

ALU vs FLOW: Evaluating Different Computational Architectures for Modern Machine Learning Applications

2025 ALUPrice Prediction: Market Analysis and Future Outlook for Aluminum Commodity Trends

ZCX vs ENJ: A Comprehensive Analysis of Two Leading Cryptocurrency Tokens in the Gaming Ecosystem

How to Buy Pepe (PEPE) Coin: A Comprehensive Guide

Understanding Pudgy Penguins (PENGU): A Guide to This NFT Collection

2025 CTA Price Prediction: Expert Analysis and Future Market Outlook

2025 FAIR3 Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Manta Network's Innovative Layer 2 Scaling Solution for Privacy