2025 BLUR Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: BLUR's Market Position and Investment Value

Blur (BLUR) is a decentralized NFT marketplace and aggregator managed by BLUR token holders. Since its launch in February 2023, it has established itself as a significant player in the NFT infrastructure space. As of December 2025, BLUR has a market capitalization of approximately $83.07 million, with a circulating supply of around 2.65 billion tokens, currently trading at $0.02769 per token. This innovative platform, characterized as an "advanced NFT marketplace aggregator," is playing an increasingly critical role in the decentralized NFT trading ecosystem through its real-time data feeds, charts, bulk listing and purchasing tools, and portfolio management features.

This article will provide a comprehensive analysis of BLUR's price movements and market trends, combining historical patterns, market dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the period from 2025 to 2030.

BLUR (Blur) Market Analysis Report

I. BLUR Price History Review and Market Status

BLUR Historical Price Evolution

-

February 2023: BLUR reached its all-time high of $5.02 on February 15, 2023, marking the peak of the token's market performance since its launch.

-

December 2025: BLUR has experienced significant decline, dropping to an all-time low of $0.02772666 on December 18, 2025, reflecting a 92.44% decrease over the past year.

BLUR Current Market Conditions

As of December 18, 2025, BLUR is trading at $0.02769, demonstrating continued weakness in recent trading sessions:

-

24-hour performance: The token declined by 6.33%, with a trading range between $0.02753 (24h low) and $0.03027 (24h high).

-

Short-term trends: Over the past hour, BLUR fell 1.43%. The 7-day period shows a steeper decline of 22.33%, while the 30-day performance reflects a 30.66% decrease.

-

Trading volume: 24-hour trading volume stands at approximately $85,903.88, indicating relatively modest market activity.

-

Market capitalization: With a current market cap of $73.35 million and a fully diluted valuation (FDV) of $83.07 million, BLUR maintains a market cap to FDV ratio of 88.3%, suggesting 88.29% of total token supply is in circulation.

-

Token supply dynamics: Out of the total supply of 3 billion BLUR tokens, 2.65 billion tokens are currently circulating, held across 53,299 unique addresses.

-

Market sentiment: Current market emotion indicator shows a reading of 1 (Extreme Fear), reflecting negative sentiment in the broader crypto market environment.

Click to view current BLUR market price

BLUR Market Sentiment Indicator

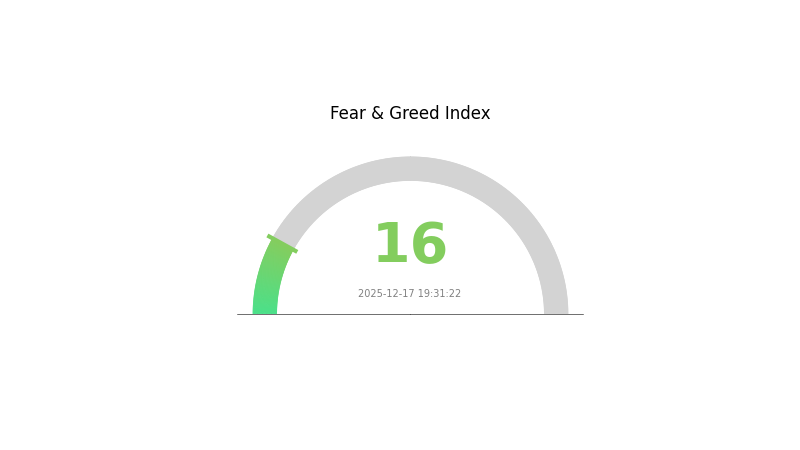

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The BLUR market is currently experiencing extreme fear, with the Fear and Greed Index reaching just 16 points. This exceptionally low reading indicates severe pessimism and panic selling pressure among investors. Market participants are highly risk-averse, creating potential opportunities for contrarian investors. Such extreme fear levels historically precede market reversals. Traders should exercise caution and consider their risk management strategies carefully during this volatile period. Monitor Gate.com's market data for real-time updates and trading insights.

BLUR Holdings Distribution

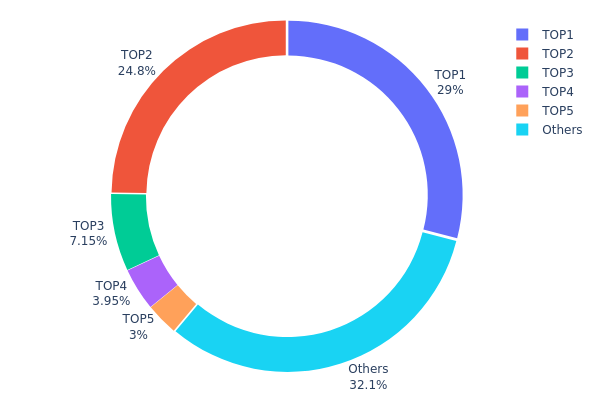

The address holdings distribution chart illustrates the concentration of BLUR tokens across blockchain addresses, revealing the ownership structure and decentralization characteristics of the token. This metric is crucial for assessing potential market risks, including concentration vulnerability and the possibility of coordinated price movements by major stakeholders.

BLUR demonstrates a pronounced concentration pattern, with the top five addresses controlling approximately 67.87% of the total token supply. The largest holder maintains a dominant 29.00% stake, while the second-largest address holds 24.79%, collectively representing over half of all circulating tokens. This binary concentration at the top tier presents a significant structural imbalance. The third through fifth addresses contribute an additional 14.08% to the aggregate, indicating that decision-making power remains heavily centralized among a limited number of entities. The remaining 32.13% distributed across "Others" provides only modest decentralization, as this fragmented segment lacks sufficient coordination to counterbalance the influence of top holders.

This concentration profile introduces material considerations for market stability and governance dynamics. With just two addresses commanding over 53% of the supply, the potential for price manipulation or sudden liquidity shifts remains elevated. Major token movements from these addresses could trigger significant price volatility, while the limited distribution among smaller holders reduces the resilience of the network against coordinated actions. The current holdings distribution suggests that BLUR's on-chain structure remains in an early maturation phase, where centralized decision-making prevails over truly decentralized ownership models.

Click to view current BLUR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x581e...f3fb26 | 870000.00K | 29.00% |

| 2 | 0x04b5...aeed1c | 743747.77K | 24.79% |

| 3 | 0x3f1b...7db647 | 214386.07K | 7.14% |

| 4 | 0x11d0...fd7c44 | 118476.32K | 3.94% |

| 5 | 0xf977...41acec | 90000.00K | 3.00% |

| - | Others | 963389.84K | 32.13% |

II. Core Factors Impacting BLUR's Future Price

Supply Mechanism

-

Token Distribution and Protocol Updates: BLUR's price trajectory is driven by supply and demand dynamics, with protocol updates playing a significant role in market behavior. As the platform evolves, adjustments to tokenomics and distribution mechanisms can substantially influence token availability and pricing pressure.

-

Historical Patterns: Market conditions have previously necessitated adjustments to platform parameters. For instance, Blur officially reduced creator royalties to a minimum of 0.5% in response to market environment pressures, demonstrating how protocol modifications directly impact the ecosystem and subsequently affect token valuation.

-

Current Impact: Ongoing protocol refinements and supply-side adjustments are expected to continue shaping BLUR's price dynamics as the platform matures and adapts to market conditions.

Regulatory Environment and Market Sentiment

-

Regulatory Landscape: Government policies and regulatory frameworks for cryptocurrencies directly influence BLUR's market acceptance and adoption rates. Regulatory clarity or uncertainty can produce significant price volatility as market participants adjust their exposure based on compliance expectations.

-

Market Sentiment: Investor confidence and market sentiment play a direct role in BLUR price movements. Market psychology, influenced by broader cryptocurrency market trends and platform-specific developments, substantially affects trading behavior and valuation.

-

Global Economic Conditions: The broader macroeconomic environment and cryptocurrency market volatility create important price pressure points. Global economic conditions and crypto market fluctuations directly impact BLUR's price performance and market dynamics.

Technology Development and Ecosystem Innovation

-

Protocol Enhancements: Hard forks and protocol updates represent key technological developments that influence BLUR's future trajectory. These upgrades can expand functionality, improve efficiency, or introduce new features that enhance the platform's competitive positioning within the NFT marketplace ecosystem.

-

Platform Positioning: Blur's focus on innovation within the NFT market distinguishes its value proposition. The platform's technical development and continuous refinement of its marketplace infrastructure contribute to long-term price sustainability through ecosystem maturation and user adoption expansion.

III. 2025-2030 BLUR Price Forecast

2025 Outlook

- Conservative Estimate: $0.02571

- Base Case: $0.02764

- Optimistic Estimate: $0.03731

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and growth phase with increasing adoption and ecosystem development

- Price Range Forecast:

- 2026: $0.03118 - $0.04157 (17% upside potential)

- 2027: $0.01962 - $0.03925 (33% upside potential)

- 2028: $0.02364 - $0.04462 (38% upside potential)

- Key Catalysts: Platform expansion, increased NFT market activity, strategic partnerships, and improved liquidity conditions on major exchanges like Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.02152 - $0.05586 (49% upside potential by 2029)

- Optimistic Scenario: $0.04473 - $0.05396 (75% upside potential by 2030)

- Transformative Scenario: $0.05396+ (Assumes sustained mainstream NFT adoption, major institutional participation, and significant expansion of BLUR's utility across digital asset ecosystems)

- 2030-12-18: BLUR projected at $0.04862 (stabilization phase with consolidated market position)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03731 | 0.02764 | 0.02571 | 0 |

| 2026 | 0.04157 | 0.03248 | 0.03118 | 17 |

| 2027 | 0.03925 | 0.03702 | 0.01962 | 33 |

| 2028 | 0.04462 | 0.03813 | 0.02364 | 38 |

| 2029 | 0.05586 | 0.04138 | 0.02152 | 49 |

| 2030 | 0.05396 | 0.04862 | 0.04473 | 75 |

Blur (BLUR) Professional Investment Strategy and Risk Management Report

Four. BLUR Professional Investment Strategy and Risk Management

BLUR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: NFT market enthusiasts and crypto portfolio diversifiers with medium to long-term investment horizons

- Operation Recommendations:

- Accumulate BLUR during market downturns when price volatility creates buying opportunities below historical averages

- Hold tokens for 12+ months to benefit from potential ecosystem expansion and increased platform adoption

- Set price targets based on historical resistance levels, with current all-time high of $5.02 serving as a reference benchmark

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the historical high of $5.02 and recent low of $0.02773 to identify breakout opportunities

- Volume Analysis: Track 24-hour trading volume trends on Gate.com to confirm price movements and identify liquidity conditions

- Wave Trading Key Points:

- Enter positions during negative momentum phases (current 24-hour decline of -6.33%) when sentiment reaches oversold conditions

- Exit or take profits when price approaches historical resistance or when positive volume indicators emerge

BLUR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Combine BLUR holdings with stablecoin positions to reduce downside exposure during market corrections

- Dollar-Cost Averaging (DCA): Implement systematic purchases over time to mitigate timing risk and reduce average acquisition cost

(3) Secure Storage Solutions

- Cold Storage Option: Transfer BLUR tokens to hardware wallets for long-term security and protection against exchange risks

- Hot wallet Option: Maintain a portion on Gate.com for active trading convenience while securing the majority of holdings offline

- Security Precautions: Enable two-factor authentication on all exchange accounts, use strong unique passwords, never share private keys or seed phrases, and regularly audit wallet addresses on Etherscan

Five. BLUR Potential Risks and Challenges

BLUR Market Risk

- Extreme Price Volatility: BLUR has experienced a -92.44% decline over the past year, demonstrating significant price instability that can result in substantial losses for investors

- Low Trading Volume: Daily trading volume of approximately $85,903.88 is relatively low, potentially limiting liquidity and increasing slippage for large transactions

- Market Concentration: With only 53,299 token holders and a market cap ranking of 406, BLUR remains vulnerable to whale accumulation and potential manipulation

BLUR Regulatory Risk

- NFT Market Uncertainty: Regulatory frameworks governing NFT markets and platforms remain evolving and unclear in most jurisdictions, creating potential compliance challenges

- Token Classification: Regulatory bodies may classify BLUR tokens differently across regions, leading to potential trading restrictions or delisting risks

- Jurisdictional Compliance: Changes in cryptocurrency regulations across major markets could impact the platform's operational capabilities and token utility

BLUR Technical Risk

- Smart Contract Vulnerabilities: As an Ethereum-based token, BLUR is subject to potential smart contract bugs or vulnerabilities that could compromise security

- Platform Scalability: The NFT aggregator must continuously upgrade infrastructure to handle increased network load and maintain competitive performance

- Cross-chain Integration: Expanding to multiple blockchains introduces additional technical complexity and potential compatibility issues

Six. Conclusion and Action Recommendations

BLUR Investment Value Assessment

Blur represents a decentralized NFT marketplace and aggregator with genuine utility in the Web3 ecosystem. The project offers advanced functionality including real-time data feeds, portfolio management, and bulk transaction tools. However, current market conditions present significant challenges: the token has declined 92.44% from its all-time high of $5.02, trading near historical lows with limited liquidity. The project's long-term value depends on sustained NFT market interest and successful platform adoption. Investors should carefully evaluate whether current pricing reflects genuine opportunity or declining market demand for NFT trading services.

BLUR Investment Recommendations

✅ Beginners: Start with small position sizes (0.5-1% of portfolio) using Dollar-Cost Averaging on Gate.com to reduce timing risk and learn market dynamics without significant capital exposure

✅ Experienced Traders: Implement tactical trading strategies based on technical analysis of support/resistance levels, monitor volume patterns for entry signals, and maintain strict stop-loss discipline given current market volatility

✅ Institutional Investors: Conduct thorough due diligence on the Blur protocol, assess NFT market fundamentals, and consider BLUR as a small allocation within a diversified digital asset strategy

BLUR Trading Participation Methods

- Gate.com Spot Trading: Execute direct buy/sell orders for BLUR tokens with competitive pricing and reliable liquidity during market hours

- Limit Orders: Set predetermined price levels on Gate.com to automate entry and exit strategies without requiring continuous market monitoring

- Portfolio Rebalancing: Periodically adjust BLUR position sizes relative to overall portfolio allocation to maintain target risk exposure

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should conduct independent research, evaluate their risk tolerance carefully, and consult professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Does Blur crypto have a future?

Yes, Blur crypto has a promising future. Market analysis suggests potential growth, with price forecasts predicting BLUR could exceed $0.03293 by December 2026. Strong community engagement and development initiatives support long-term viability.

Is Blur a good investment?

Blur is a leading decentralized NFT marketplace with zero trading fees, deep liquidity, and strong trader incentives. Its innovative Blend lending platform and governance token create compelling utility. However, investment returns depend on market conditions and adoption growth. Consider your risk tolerance and market research before investing.

How high can blur go?

Blur's price can potentially reach up to $0.04342 based on current market analysis and trends. However, actual price movements depend on market conditions, adoption, and trading volume.

What crypto will 1000x prediction?

Emerging altcoins with strong fundamentals and early-stage pricing show potential for significant gains. Bitcoin Hyper and similar projects with innovative use cases and community support are positioned as promising candidates for substantial returns in the current market cycle.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Recall (RECALL) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects in the Digital Asset Space

Is Pieverse (PIEVERSE) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Is Loopring (LRC) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Risk Factors for 2024

FRAX vs MANA: A Comprehensive Comparison of Two Leading Crypto Tokens in the DeFi and Metaverse Ecosystems

Is Waves (WAVES) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Risk Factors