2025 CFG Price Prediction: Expert Analysis and Market Outlook for Centrifuge Token

Introduction: CFG's Market Position and Investment Value

Centrifuge (CFG) serves as a decentralized asset financing protocol that bridges real-world assets with DeFi, designed to reduce capital costs for small and medium-sized enterprises while providing stable income sources for DeFi investors. Since its inception in 2021, Centrifuge has established itself as a bridge between traditional finance and decentralized finance ecosystems. As of December 2025, CFG's market capitalization has reached approximately $73.63 million, with a circulating supply of around 573.42 million tokens, currently trading at $0.12841. This innovative protocol, recognized for its ability to tokenize real-world assets and facilitate asset-backed lending through its Tinlake platform, is playing an increasingly critical role in enabling institutional-grade DeFi participation.

This article will provide a comprehensive analysis of Centrifuge's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for discerning investors.

Centrifuge (CFG) Market Analysis Report

I. CFG Price History Review and Current Market Status

CFG Historical Price Evolution

- October 15, 2021: CFG reached its all-time high (ATH) of $2.19, marking the peak of the project's valuation during the 2021 bull market cycle.

- April 7, 2025: CFG touched its all-time low (ATL) of $0.09996, reflecting significant depreciation from historical peaks.

- December 18, 2025: CFG is currently trading at $0.12841, recovering modestly from recent lows but remaining far below historical highs.

CFG Current Market Positioning

As of December 18, 2025, Centrifuge (CFG) exhibits the following market characteristics:

Price Performance:

- Current Price: $0.12841

- 24-Hour Range: $0.12384 - $0.14562

- 24-Hour Change: +3.57%

- 1-Hour Change: -3.33%

- 7-Day Change: -15.83%

- 30-Day Change: -14.13%

- 1-Year Change: -68.01%

Market Capitalization & Supply:

- Market Capitalization: $73,632,616.29

- Fully Diluted Valuation (FDV): $73,812,793.37

- Circulating Supply: 573,418,085 CFG

- Total Supply: 574,821,224 CFG

- Market Dominance: 0.0023%

- Market Cap Ratio to FDV: 100%

Trading Activity:

- 24-Hour Trading Volume: $211,214.29

- Token Holders: 7,336

- Listed on 18 Exchanges

Technical Specifications:

- Blockchain: Ethereum (ERC-20 standard)

- Contract Address: 0xcccccccccc33d538dbc2ee4feab0a7a1ff4e8a94

- Launch Price: $0.55 (May 26, 2021)

Market Sentiment:

- Current Market Emotion Index: 0

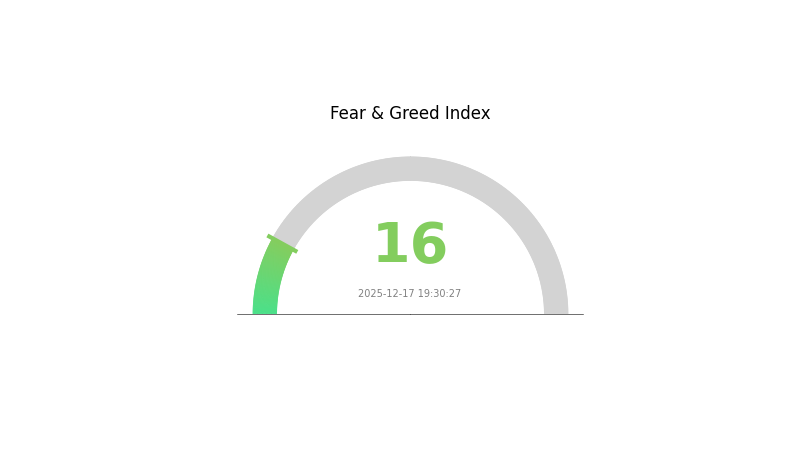

- Prevailing Fear/Greed Index: Extreme Fear (VIX: 16)

The token demonstrates moderate short-term volatility with a positive 24-hour momentum (+3.57%), though it faces significant downward pressure over longer timeframes, particularly the one-year performance decline of -68.01% from launch prices.

Click to view current CFG market price

CFG Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with a CFG index of 16. This historically low reading suggests widespread market pessimism and significant selling pressure. During such extreme fear periods, risk-averse investors typically exit positions, while contrarian traders may identify potential buying opportunities at depressed price levels. Market participants should exercise caution and conduct thorough research before making investment decisions. Monitor Gate.com's real-time market data for the latest sentiment shifts and trading opportunities in this volatile environment.

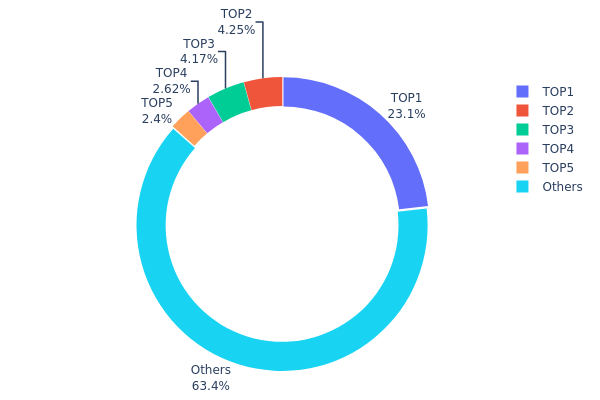

CFG Holdings Distribution

The address holdings distribution map illustrates the concentration of CFG tokens across the blockchain network by tracking the top individual addresses and their proportional share of total token supply. This metric serves as a critical indicator for assessing token decentralization, identifying potential concentration risks, and evaluating the overall market structure integrity.

Current data reveals a moderate concentration pattern within the CFG ecosystem. The top address commands 23.13% of total holdings, followed by the second and third addresses holding 4.25% and 4.17% respectively. The top five addresses collectively control approximately 36.56% of the circulating supply, while the remaining 63.44% is distributed across other addresses. This distribution suggests that while significant token concentration exists in the top tier, a majority of tokens remain dispersed throughout the network.

The existing concentration structure presents a balanced risk profile for market dynamics. The dominant position of the leading address could theoretically facilitate coordinated price movements or liquidity operations; however, the substantial portion held by distributed addresses (over 63%) provides meaningful resistance against unilateral market manipulation. The secondary addresses maintaining relatively modest individual positions further indicates that token ownership is not excessively concentrated within a narrow elite group. Overall, CFG's current holdings distribution reflects an intermediate decentralization state, with sufficient token dispersion to support market resilience while maintaining clear stakeholder positions that may influence protocol governance and development initiatives.

Click to view current CFG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd052...f293cb | 145259.27K | 23.13% |

| 2 | 0x073f...113ad7 | 26705.11K | 4.25% |

| 3 | 0x495d...2e0d01 | 26194.19K | 4.17% |

| 4 | 0x30e6...b56682 | 16467.64K | 2.62% |

| 5 | 0x4cd9...0ffeca | 15043.47K | 2.39% |

| - | Others | 398129.44K | 63.44% |

II. Core Factors Influencing CFG's Future Price

Market Supply and Demand Dynamics

-

Supply and Demand Relationship: CFG token prices in the cryptocurrency market are primarily influenced by market supply and demand dynamics, which reflect the complex interactions within the blockchain ecosystem's price determination mechanisms.

-

Historical Price Patterns: CFG has experienced significant pullback from its historical peak, with the current price showing a -94.65% retracement from its all-time high. This substantial correction demonstrates the volatility inherent in the token's market history.

-

Current Market Sentiment: Over the past 7 days, CFG has appreciated by 8.18%, with most CFG investors capturing positive returns during this period. Current market sentiment toward CFG's price trajectory remains optimistic overall.

Blockchain Ecosystem Development

- Ecosystem Growth Impact: CFG's price movements are significantly influenced by the development and expansion of the blockchain ecosystem. The evolution of decentralized finance applications and real-world asset (RWA) tokenization trends within the broader market create indirect impacts on utility tokens' valuations.

Note: The provided materials do not contain sufficient specific information regarding CFG's token supply mechanisms, institutional holdings, enterprise adoption, national policies, monetary policy impacts, inflation-hedge attributes, geopolitical factors, or specific technical upgrades related to Centrifuge. Therefore, these sections have been omitted in accordance with the provided guidelines.

III. 2025-2030 CFG Price Forecast

2025 Outlook

- Conservative Forecast: $0.0973 - $0.1281

- Base Case Forecast: $0.1281

- Optimistic Forecast: $0.1767 (contingent on increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady accumulation momentum

- Price Range Predictions:

- 2026: $0.1006 - $0.1981 (18% upside potential)

- 2027: $0.0946 - $0.2419 (36% upside potential)

- 2028: $0.2002 - $0.2795 (62% upside potential)

- Key Catalysts: Protocol upgrades, ecosystem expansion, DeFi integration improvements, and growing market liquidity

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1830 - $0.2855 (90% appreciation by 2029, assuming steady network growth and stable macroeconomic conditions)

- Optimistic Scenario: $0.2440 - $0.2855 (further consolidation of market position with strong institutional backing and ecosystem maturation)

- Bull Case Scenario: $0.2686 - $0.2886 (106% appreciation by 2030 under favorable regulatory environment, mainstream adoption acceleration, and successful platform scaling)

Note: These forecasts are based on historical market data and technical analysis. Actual price movements may differ significantly based on regulatory changes, macroeconomic conditions, and market sentiment shifts. Investors are advised to conduct thorough due diligence and consider risk management strategies when trading on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17674 | 0.12807 | 0.09733 | 0 |

| 2026 | 0.19812 | 0.1524 | 0.10059 | 18 |

| 2027 | 0.24186 | 0.17526 | 0.09464 | 36 |

| 2028 | 0.27948 | 0.20856 | 0.20022 | 62 |

| 2029 | 0.2855 | 0.24402 | 0.18301 | 90 |

| 2030 | 0.28859 | 0.26476 | 0.19592 | 106 |

Centrifuge (CFG) Professional Investment Strategy and Risk Management Report

IV. CFG Professional Investment Strategy and Risk Management

CFG Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: DeFi yield-seeking investors and risk-averse portfolio builders seeking stable returns uncorrelated with crypto volatility

- Operational Recommendations:

- Accumulate CFG during market downturns, particularly when prices fall below $0.12, as the current price of $0.12841 represents a recovery opportunity from historical lows

- Hold positions through market cycles to benefit from Centrifuge's real-world asset (RWA) financing ecosystem maturation

- Reinvest any protocol rewards or staking returns to compound gains over time

- Dollar-cost averaging (DCA) strategy: invest fixed amounts monthly to mitigate timing risk

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor the 24-hour volatility range ($0.12384 to $0.14562) for scalping opportunities

- Track the 7-day downtrend (-15.83%) to identify potential reversal zones

- Wave Trading Key Points:

- Watch for support levels near the historical low of $0.09996 and resistance at previous local highs

- Observe trading volume patterns around the 24-hour volume of 211,214.29 CFG to confirm breakout signals

CFG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing: Never allocate more than 5% of total portfolio to CFG to limit downside exposure

- Stop-Loss Implementation: Set stops at 15-20% below entry prices to cap potential losses

- Diversification Strategy: Combine CFG holdings with stablecoins and other RWA tokens to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage Method: Hardware wallet storage for long-term holdings exceeding 6 months

- Security Precautions: Enable two-factor authentication, use hardware wallets for amounts exceeding $10,000, never share private keys or seed phrases, and verify contract addresses before any token transactions

V. CFG Potential Risks and Challenges

CFG Market Risk

- Extreme Price Volatility: CFG has declined 68.01% over the past year and trades significantly below its all-time high of $2.19 (reached October 15, 2021), indicating substantial downside risk potential

- Low Trading Liquidity: With 24-hour volume of only 211,214.29 CFG, large trades could face slippage and difficulty exiting positions

- Market Capitalization Sensitivity: At $73.6 million market cap, CFG is vulnerable to rapid price movements from moderate institutional flows

CFG Regulatory Risk

- Evolving RWA Regulatory Framework: Real-world asset tokenization remains subject to increasing regulatory scrutiny across jurisdictions

- Classification Uncertainty: Regulatory bodies may reclassify CFG token utility, affecting its legal status and trading availability

- Compliance Burden: Enhanced KYC and AML requirements for RWA platforms could restrict user access and adoption

CFG Technology Risk

- Smart Contract Vulnerability: As an ERC-20 token, CFG depends on Ethereum network security; bugs in Tinlake protocol could cause fund loss

- Protocol Adoption Risk: If enterprises fail to adopt Centrifuge's asset tokenization framework, demand for CFG utility diminishes significantly

- Scalability Challenges: Ethereum congestion and high gas fees may limit the cost-effectiveness of RWA financing through Centrifuge

VI. Conclusion and Action Recommendations

CFG Investment Value Assessment

Centrifuge presents a compelling thesis for investors seeking exposure to the real-world asset (RWA) tokenization sector, a rapidly emerging area bridging traditional finance and decentralized protocols. The project's focus on reducing capital costs for small and medium-sized enterprises while providing stable yield sources for DeFi participants addresses a genuine market gap. However, the token's 68% annual decline and trading well below historical highs suggest significant market skepticism regarding adoption velocity and tokenomics sustainability. The current price of $0.12841 represents a potential entry point for conviction-based investors, though it also reflects elevated risk premia reflecting execution uncertainties.

CFG Investment Recommendations

✅ Newcomers: Begin with micro-positions (0.5-1% portfolio allocation) through Gate.com's trading platform using dollar-cost averaging strategy over 3-6 months to build familiarity with RWA sector dynamics

✅ Experienced Investors: Construct a 3-5% core position supplemented by tactical trading around identified support/resistance levels; actively monitor protocol metrics and enterprise adoption announcements

✅ Institutional Investors: Conduct deep protocol analysis and enterprise partnership assessment; consider 5-10% allocation as alternative asset class diversification within risk budgets designated for early-stage blockchain infrastructure

CFG Trading Participation Methods

- Spot Trading: Purchase CFG directly on Gate.com platform using fiat-to-crypto conversion, ideal for long-term accumulation

- Margin Trading: Utilize Gate.com's leveraged trading for experienced traders seeking enhanced returns during identified bullish patterns (use caution and strict risk controls)

- Staking/Yield Programs: Participate in Centrifuge protocol staking opportunities to earn additional rewards beyond price appreciation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Will Coti reach $10?

COTI is projected to potentially reach $10 by 2030 based on current forecasts. This projection considers its utility and growing market recognition in the crypto community. Success depends on continued adoption and development.

Can CorgiAI hit 1 dollar?

CorgiAI is unlikely to reach $1. Current price prediction models estimate the highest potential price at approximately $0.001686 by 2050, based on historical performance and market analysis.

What does CFG crypto do?

CFG is the native token of Centrifuge Chain, used to pay transaction fees for operations like creating asset pools, minting NFTs, and transferring assets on the platform.

How high can Filecoin go in 2025?

Filecoin is expected to reach a high of $1.62 by 2025, with an average price forecast of $1.58. This prediction is based on current market analysis and trends in the cryptocurrency sector.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Recall (RECALL) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects in the Digital Asset Space

Is Pieverse (PIEVERSE) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Is Loopring (LRC) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Risk Factors for 2024

FRAX vs MANA: A Comprehensive Comparison of Two Leading Crypto Tokens in the DeFi and Metaverse Ecosystems

Is Waves (WAVES) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Risk Factors