2025 LOFI Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: LOFI's Market Position and Investment Value

Lofi (LOFI) is a digital asset built on the Sui blockchain, representing a collective mission to establish a thriving, forward-thinking decentralized finance ecosystem. Since its launch in April 2023, Lofi has emerged as a unique player in the crypto space, embodying optimism and vision for a better financial future. As of December 23, 2025, LOFI's market capitalization stands at $5,927,000, with a circulating supply of 1,000,000,000 tokens and a current price of $0.005927.

This asset, characterized as a movement rather than merely a financial instrument, is playing an increasingly significant role in building a forward-thinking ecosystem on the Sui blockchain.

This article will comprehensively analyze LOFI's price trajectory through 2030, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

LOFI Price Analysis Report

I. LOFI Price History Review and Market Status

LOFI Historical Price Evolution Trajectory

Based on available data, LOFI's price history shows significant volatility:

- April 2023: LOFI was launched at an initial price of $0.008

- January 2025: LOFI reached its all-time high (ATH) of $0.1845, representing a peak valuation point

- December 2025: LOFI declined to its all-time low (ATL) of $0.00532 on December 18, 2025, marking a substantial correction from the ATH

The token has experienced a dramatic year-over-year decline of -95.52%, reflecting significant market pressure and correction from its peak valuation.

LOFI Current Market Posture

Current Price Performance:

- Current trading price: $0.005927 (as of December 23, 2025)

- 24-hour price change: -6.49%

- 7-day price change: -3.69%

- 30-day price change: -12.76%

- 52-week price change: -95.52%

Market Capitalization Metrics:

- Market capitalization: $5,927,000

- Fully diluted valuation (FDV): $5,927,000

- Market cap to FDV ratio: 100%

- Market dominance: 0.00018%

Trading Activity:

- 24-hour trading volume: $27,010.88

- Number of holders: 10,482

- Listed on 5 exchanges

Supply Structure:

- Circulating supply: 1,000,000,000 LOFI

- Total supply: 1,000,000,000 LOFI

- Maximum supply: 1,000,000,000 LOFI

- Circulation ratio: 100%

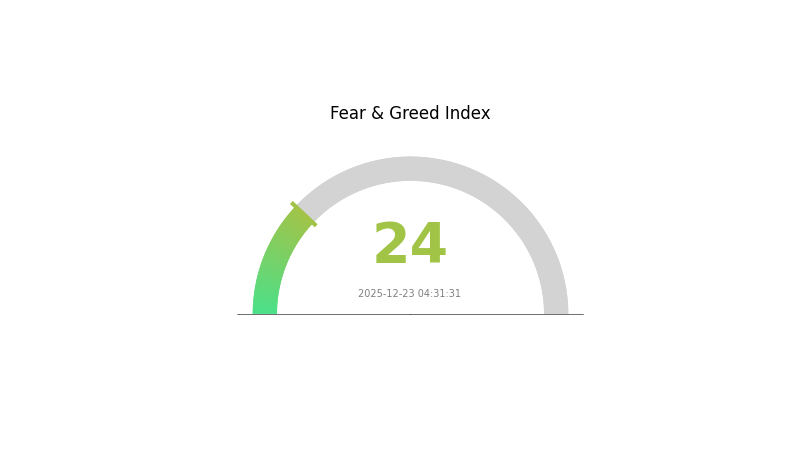

Market Sentiment: Current market sentiment indicates "Extreme Fear" (VIX: 24), suggesting heightened risk aversion in the broader cryptocurrency market.

Click to view current LOFI market price

LOFI Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 24. This level typically indicates significant market pessimism and risk aversion among investors. During such periods, volatility tends to increase, and market participants often reassess their positions. However, extreme fear can also present opportunities for contrarian investors and long-term believers in digital assets. It's crucial to stay informed and manage risk carefully. Visit Gate.com's market sentiment tools to monitor real-time market conditions and make informed investment decisions.

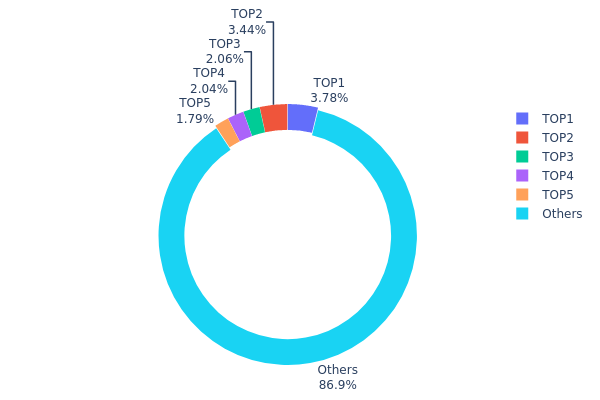

LOFI Address Holdings Distribution

The address holdings distribution chart reveals the concentration of token ownership across the network by tracking the top individual wallet addresses and their proportional stakes. This metric serves as a critical indicator for assessing the degree of decentralization, potential market manipulation risks, and the overall health of the token's distribution structure.

Current LOFI distribution data demonstrates a relatively healthy degree of decentralization, with the top five addresses collectively holding only 13.09% of total supply. The largest holder controls 3.77% with 37,792.15K tokens, followed by the second-largest at 3.43%. This gradual decline in holding percentages across top addresses suggests an absence of extreme concentration in single hands. The overwhelming majority of tokens—86.91%—remain distributed among other addresses, indicating a broad-based holder ecosystem that substantially mitigates centralization risks typically associated with early-stage or newly launched projects.

From a market structure perspective, LOFI's current distribution profile reduces vulnerability to large-scale price manipulation through coordinated whale activity. The fragmented ownership pattern enhances market resilience and distributes voting power across a wider participant base, supporting a more authentic price discovery mechanism. The absence of dominant stakeholders holding above 4% suggests that individual investors maintain proportionally balanced influence on network governance and market dynamics.

View the current LOFI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb0c4...f305a0 | 37792.15K | 3.77% |

| 2 | 0x62f3...fa53ad | 34378.13K | 3.43% |

| 3 | 0xf8b7...c2d43f | 20611.85K | 2.06% |

| 4 | 0xc38e...f15f32 | 20403.02K | 2.04% |

| 5 | 0x443c...dba79a | 17945.08K | 1.79% |

| - | Others | 868869.77K | 86.91% |

II. Core Factors Influencing LOFI's Future Price

Market Sentiment and Trading Dynamics

-

Market Sentiment: LOFI's token price is significantly influenced by overall cryptocurrency market sentiment and broader digital asset trends. Positive developments in the crypto market generally drive increased retail investment flows.

-

Trading Volume and Liquidity: Exchange trading volume and liquidity play crucial roles in determining LOFI's price movements. Enhanced liquidity across trading platforms increases market accessibility and trading opportunities.

-

Exchange Listings: LOFI's listing on major cryptocurrency exchanges significantly impacts its price trajectory. Notable exchange listings expand market reach and increase trading activity.

Macroeconomic Environment

-

Cryptocurrency Market Trends: As Bitcoin maintains stable upward momentum, altcoins including LOFI become focal points of market attention. The broader cryptocurrency market's performance directly correlates with LOFI's price movements.

-

Institutional Adoption and Regulatory Changes: Shifts in institutional adoption and regulatory frameworks in the cryptocurrency sector impact LOFI's price. Recent changes in government attitudes toward cryptocurrency, particularly in the United States, have driven significant retail investment inflows into the digital asset space.

Project Development Progress

- Development Milestones: LOFI's project development progress serves as a fundamental price driver. Advancements in project features and functionality enhance investor confidence in the token.

III. 2025-2030 LOFI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00342 - $0.00744

- Neutral Forecast: $0.006 (average level)

- Bullish Forecast: $0.00744 (requires sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-Term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, followed by recovery and growth momentum as adoption increases

- Price Range Forecasts:

- 2026: $0.0043 - $0.00719 (13% upside potential)

- 2027: $0.00459 - $0.00932 (17% upside potential)

- 2028: $0.00611 - $0.01107 (37% upside potential)

- Key Catalysts: Increased community engagement, protocol enhancements, partnership announcements, and broader market recovery cycles

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.00922 - $0.01124 (62% appreciation by 2029, driven by sustained ecosystem growth and mainstream adoption)

- Optimistic Scenario: $0.01001 - $0.01126 (75% total appreciation by 2030, assuming accelerated institutional interest and successful network expansion)

- Transformative Scenario: Price levels significantly exceeding $0.01126 (contingent upon breakthrough developments, major exchange listings including Gate.com, or fundamental shifts in market dynamics)

Note: All forecasts are subject to market volatility and macroeconomic conditions. Investors should conduct independent due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00744 | 0.006 | 0.00342 | 1 |

| 2026 | 0.00719 | 0.00672 | 0.0043 | 13 |

| 2027 | 0.00932 | 0.00696 | 0.00459 | 17 |

| 2028 | 0.01107 | 0.00814 | 0.00611 | 37 |

| 2029 | 0.01124 | 0.00961 | 0.00922 | 62 |

| 2030 | 0.01126 | 0.01042 | 0.01001 | 75 |

LOFI Investment Strategy and Risk Management Report

IV. LOFI Professional Investment Strategy and Risk Management

LOFI Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Patient capital allocators and believers in Sui ecosystem development

- Operational Recommendations:

- Accumulate LOFI during market downturns to dollar-cost average into positions, leveraging the current -95.52% one-year decline as a potential entry opportunity

- Hold through ecosystem development cycles, as LOFI's value proposition is tied to Sui blockchain maturation and DeFi ecosystem expansion

- Reinvest any trading gains back into core positions to compound returns over multi-year horizons

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range of 0.005769-0.006423 to identify breakout opportunities and consolidation patterns

- Volume Analysis: Track the 24-hour volume of 27,010.88 LOFI against historical averages to confirm momentum shifts and price direction validity

- Wave Trading Key Points:

- Enter positions after confirmed breakouts above recent resistance with volume confirmation

- Set stop losses below immediate support levels to manage downside risk in volatile market conditions

LOFI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, focusing on small speculative positions

- Active Investors: 3-5% portfolio allocation, allowing for more meaningful exposure while maintaining diversification

- Professional Investors: 5-10% allocation, with additional hedging strategies and derivative instruments

(2) Risk Hedging Solutions

- Position Sizing Strategy: Limit individual trade size to 1-3% of total portfolio to prevent catastrophic losses from adverse price movements

- Profit Taking Protocol: Establish predetermined exit points at 20%, 50%, and 100%+ gains to lock in profits systematically

(3) Secure Storage Solutions

- Custodial Exchange Option: Gate.com offers secure institutional-grade custody with insurance coverage for LOFI holdings

- Self-Custody Approach: For substantial holdings, consider cold storage solutions with multi-signature security protocols

- Security Precautions: Enable two-factor authentication, use hardware isolation for private keys, and maintain backup recovery phrases in secure offline locations

V. LOFI Potential Risks and Challenges

LOFI Market Risk

- Extreme Volatility Exposure: LOFI has experienced a -95.52% decline over the past year, indicating severe price instability that can trigger rapid liquidations and substantial losses

- Low Market Liquidity: With only 27,010.88 LOFI in 24-hour volume and a market cap of $5.927 million, thin liquidity creates wide bid-ask spreads and slippage risks

- Market Concentration Risk: Limited to 10,482 token holders, suggesting high concentration that increases vulnerability to large holder sell-offs

LOFI Regulatory Risk

- Blockchain Regulatory Uncertainty: Sui-based tokens face ongoing regulatory scrutiny as jurisdictions worldwide develop comprehensive digital asset frameworks

- Classification Ambiguity: The project's DeFi positioning may attract regulatory attention if classified as a security or financial instrument in certain jurisdictions

- Compliance Requirements: Future regulatory changes could impose restrictions on token trading, staking, or utility functions

LOFI Technical Risk

- Blockchain Dependency: LOFI's value is entirely dependent on Sui network stability and continued development; network failures or security breaches could impact token utility

- Smart Contract Vulnerability: Any exploits or bugs in LOFI's smart contracts could lead to fund losses or token supply manipulation

- Ecosystem Integration Risk: Limited integration across DeFi protocols reduces utility and creates adoption friction

VI. Conclusion and Action Recommendations

LOFI Investment Value Assessment

LOFI presents a high-risk, speculative investment opportunity centered on Sui blockchain ecosystem growth. The project's narrative-driven approach and community-focused mission offer long-term potential if the Sui ecosystem gains mainstream adoption. However, the severe -95.52% annual decline, low market capitalization, and limited liquidity present significant near-term challenges. Current valuations suggest the market has repriced expectations substantially downward, potentially creating opportunities for risk-tolerant investors, but the fundamentals remain unproven and dependent on broader Web3 adoption trends.

LOFI Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through Gate.com's easy-to-use trading interface, focusing on learning the Sui ecosystem before committing significant capital

✅ Experienced Investors: Implement tactical accumulation strategies during confirmed downtrends, combining technical analysis with fundamental monitoring of Sui ecosystem developments

✅ Institutional Investors: Utilize Gate.com's institutional custody and advanced trading tools for systematic position building with proper hedging, risk compartmentalization, and governance participation strategies

LOFI Trading Participation Methods

- Direct Spot Trading: Purchase LOFI directly on Gate.com against stablecoins or major cryptocurrencies, ideal for long-term position building

- Margin Trading: For experienced traders, Gate.com's margin functionality enables leverage strategies, though this significantly amplifies risk exposure

- Community Participation: Engage with the LOFI community through official channels at https://lofitheyeti.com/ and https://x.com/lofitheyeti to stay informed on ecosystem developments and governance initiatives

Cryptocurrency investment carries extreme risk, and this report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult with qualified financial advisors. Never invest capital you cannot afford to lose entirely.

FAQ

What is the price prediction for LOFI?

LOFI is predicted to reach $0.0063 within a week and $0.00552 within four weeks, based on current analytical trends and market momentum.

What is LOFI token and what is its use case?

LOFI token is a cryptocurrency that brings lo-fi music culture to blockchain. It enables users to engage with relaxed, nostalgic digital experiences while participating in decentralized communities centered around lo-fi aesthetics and culture.

Is LOFI a good investment opportunity?

Yes, LOFI presents a compelling investment opportunity. Technical analysis indicates strong growth potential, supported by increasing trading volume and positive market sentiment. The project demonstrates solid fundamentals with expanding ecosystem development and community engagement, making it attractive for investors seeking exposure to emerging digital assets.

What factors could affect LOFI's price in the future?

LOFI's price is primarily driven by supply and demand dynamics, protocol updates, and hard forks. Block reward halvings, trading volume, and real-world market events also significantly influence its price movements.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 COTI Price Prediction: Analyzing Market Trends and Future Potential in the Evolving Cryptocurrency Landscape

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 C98 Price Prediction: Analyzing Market Trends and Growth Potential for Coin98 in the Coming Bull Cycle

Crypto Gift Cards: The Perfect Gift for Everyone | A Guide to Using Them for Digital Purchases

Everything You Need to Know About Using Crypto Gift Cards

2025 SOIL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 CDL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SMTX Price Prediction: Expert Analysis and Market Forecast for the Coming Year