2025 MATH Price Prediction: Analyzing Market Trends and Future Opportunities for the Decentralized Mathematics Protocol

Introduction: Market Position and Investment Value of MATH

MATH (MATH) serves as a one-stop solution platform for digital open finance, offering comprehensive products and services including Math Wallet, VPOS Mining Pool, MathDEX, Math ID, MATH dApp Store, and Math Chain. Since its launch in 2020, MATH has established itself as a foundational token within its ecosystem. As of December 2025, MATH maintains a market capitalization of approximately $6.37 million, with a circulating supply of around 185.96 million tokens, currently trading at $0.03185 per token. This utility token plays an increasingly critical role in powering the decentralized finance ecosystem and supporting cross-chain interoperability solutions.

This article provides a comprehensive analysis of MATH's price trajectory, examining historical price movements, market dynamics, ecosystem development, and broader crypto market conditions. By synthesizing on-chain data, trading patterns, and fundamental project metrics, this report delivers professional price forecasts and actionable investment strategies for market participants seeking to understand MATH's potential through 2030.

MATH Token Market Analysis Report

I. MATH Price History Review and Market Status

MATH Historical Price Evolution

-

2021: MATH reached its all-time high of $3.15 on March 21, 2021, marking the peak of the token's market performance during the early bull market phase.

-

2025: MATH declined significantly throughout the year, hitting its all-time low of $0.03014445 on December 19, 2025, representing a severe market downturn.

MATH Current Market Dynamics

As of December 23, 2025, MATH is trading at $0.03185, with a market capitalization of $5,922,681.86 and a fully diluted valuation of $6,370,000. The token maintains a circulating supply of 185,955,474.51 MATH out of a total supply of 200,000,000, representing a circulation ratio of approximately 92.98%.

24-Hour Price Movement: MATH experienced a -3.61% decline in the past 24 hours, with trading volume reaching $27,621.33. The token's price ranged between $0.03185 (low) and $0.03482 (high) during this period.

Broader Price Trends: The token exhibits weakness across multiple timeframes:

- 1-Hour: -0.77%

- 7-Day: -8.23%

- 30-Day: -34.58%

- 1-Year: -87.83%

This represents a substantial depreciation from the issuance price of $0.1433, indicating a challenging market environment for MATH token holders.

Market Position: MATH ranks #1446 by market capitalization with a market dominance of 0.00019%, suggesting a relatively small market presence within the broader cryptocurrency ecosystem. The token has 14,748 token holders and is listed on 5 exchanges, with Gate.com providing active trading support.

Click to view current MATH market price

MATH Market Sentiment Index

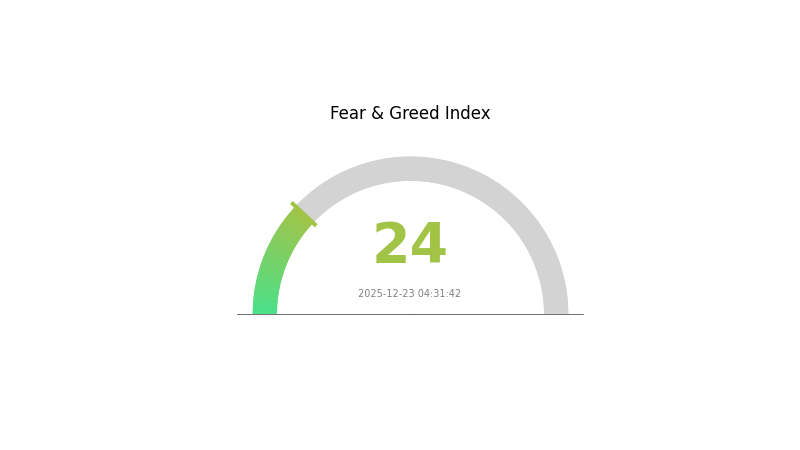

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 24. This indicates heightened market anxiety and pessimistic sentiment among investors. When fear reaches such extreme levels, it often presents potential opportunities for contrarian investors, as asset prices may become undervalued. However, caution remains essential as downward pressure may persist. Monitor key support levels and consider dollar-cost averaging strategies. Stay informed through Gate.com's market data tools to navigate this volatile period effectively.

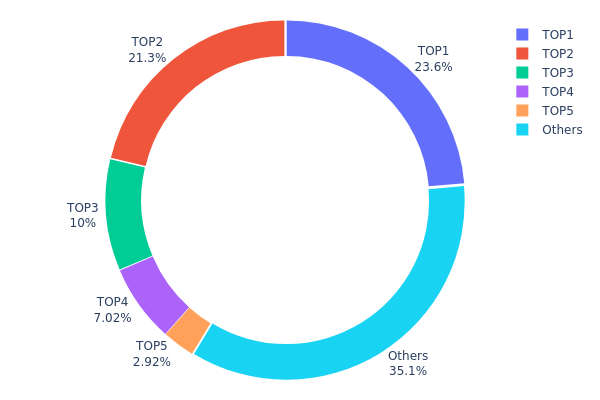

MATH Holdings Distribution

The holdings distribution chart illustrates the concentration of MATH tokens across on-chain addresses, revealing the degree of decentralization and potential market concentration risk. By analyzing the top addresses and their proportional holdings, we can assess the token's vulnerability to large holder actions and the overall health of its decentralized structure.

MATH demonstrates moderate concentration characteristics, with the top five addresses collectively holding 64.92% of the total token supply. The largest holder controls 23.62% of tokens, while the second-largest holds 21.32%, indicating a duopoly-like structure among the top two addresses that account for 44.94% of the circulating supply. The third-largest address holds 10.04%, and concentration decreases incrementally thereafter. The remaining 35.08% distributed among other addresses suggests a relatively fragmented secondary tier of holders, which provides some counterbalance to top-holder dominance.

While the distribution does not constitute extreme concentration, it presents notable structural considerations. The substantial holdings concentrated in the top tier creates potential liquidity and price volatility risks, as coordinated movements by leading addresses could significantly impact market dynamics. However, the presence of a substantial "Others" category representing over one-third of supply indicates meaningful decentralization beyond the primary holders. This bifurcated structure reflects a market where institutional or early-stage holdings remain prominent, though retail and smaller stakeholder participation has established a meaningful base.

View current MATH holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x817b...b4835c | 47245.64K | 23.62% |

| 2 | 0x16de...3b8d7b | 42649.05K | 21.32% |

| 3 | 0xc8a0...cdbdea | 20096.60K | 10.04% |

| 4 | 0x4e74...a52917 | 14044.53K | 7.02% |

| 5 | 0xa9d1...1d3e43 | 5849.04K | 2.92% |

| - | Others | 70115.14K | 35.08% |

II. Core Factors Influencing MATH's Future Price

Supply Mechanism

- Total Supply Architecture: MATH has a total supply of 200,000,000 tokens with a circulating supply of approximately 185,955,474.51 MATH tokens as of 2025.

- Historical Patterns: Previous supply changes have influenced price volatility, though specific details remain limited in available sources.

- Current Impact: The current supply dynamics continue to affect MATH pricing, with the token currently trading at approximately $0.0472 USD against a market capitalization of $8,777,098.

Institutional and Whale Dynamics

- Enterprise Adoption: MATH is positioned as a "one-stop solution platform for digital open finance," attracting interest from institutions and enterprises seeking decentralized finance solutions.

- Regulatory Environment: Real-world events such as regulatory changes, enterprise adoption initiatives, and government policies continue to influence MATH's price trajectory.

Macroeconomic Environment

- Market Expansion and Demand Growth: The broader cryptocurrency market expansion and growing demand for digital assets directly impact MATH's market performance, particularly through Bitcoin and mainstream cryptocurrency price movements.

- Institutional Investment Trends: Active institutional investor participation and enterprise positioning in the cryptocurrency market provide support for MATH's long-term valuation potential.

- Inflation Hedge Properties: MATH benefits from increased adoption within decentralized finance ecosystems as investors seek inflation hedging and alternative asset allocation strategies.

Technology Development and Ecosystem Building

- Protocol Updates: MATH's price is influenced by protocol upgrades, hard forks, and technical improvements to its underlying infrastructure.

- Ecosystem Expansion: Development of DeFi applications and ecosystem projects built on MATH's platform continues to strengthen its utility and market positioning.

Three、2025-2030 MATH Price Forecast

2025 Outlook

- Conservative Forecast: $0.0201 - $0.02500

- Neutral Forecast: $0.02500 - $0.03191

- Optimistic Forecast: $0.03191 - $0.03797 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with potential for growth acceleration driven by adoption metrics and protocol upgrades

- Price Range Predictions:

- 2026: $0.02236 - $0.04298

- 2027: $0.03039 - $0.05299

- 2028: $0.04275 - $0.04873

- Key Catalysts: Ecosystem expansion, increased utility adoption, market sentiment stabilization, and potential institutional interest in the asset class

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02652 - $0.05067 (assuming steady adoption curve and moderate market conditions)

- Optimistic Scenario: $0.04735 - $0.05783 (contingent on significant protocol achievements and broader market expansion)

- Transformative Scenario: $0.05783+ (under conditions of breakthrough technological innovations, mainstream adoption acceleration, and favorable macroeconomic environment)

- 2025-12-23: MATH currently at transition point (baseline reference for projection models)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03797 | 0.03191 | 0.0201 | 0 |

| 2026 | 0.04298 | 0.03494 | 0.02236 | 9 |

| 2027 | 0.05299 | 0.03896 | 0.03039 | 22 |

| 2028 | 0.04873 | 0.04597 | 0.04275 | 44 |

| 2029 | 0.05067 | 0.04735 | 0.02652 | 48 |

| 2030 | 0.05783 | 0.04901 | 0.02794 | 53 |

MATH Investment Strategy and Risk Management Report

IV. MATH Professional Investment Strategy and Risk Management

MATH Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors seeking exposure to decentralized finance infrastructure platforms with established ecosystems

- Operational Recommendations:

- Accumulate MATH tokens during market downturns to reduce average entry price, leveraging the token's 92.98% circulating-to-fully-diluted supply ratio

- Participate in MATH ecosystem incentive programs through staking mechanisms to generate additional yield from your holdings

- Dollar-cost averaging (DCA) approach by investing fixed amounts at regular intervals to mitigate volatility impact

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the recent trading range between $0.03185 and $0.03482 (24-hour high/low) to identify entry and exit points for swing trades

- Volume Analysis: Track the 24-hour volume of 27,621.33 MATH to assess liquidity and confirm trend reversals

- Wave Operation Key Points:

- Exercise caution given the severe 1-year decline of -87.83%, indicating potential weakness in market sentiment despite ecosystem development

- Consider the token's recent low of $0.03014445 (December 19, 2025) as potential support level for short-term trading positions

MATH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 2-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation (with appropriate hedging strategies)

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance MATH holdings with established cryptocurrencies and stablecoins to reduce concentration risk from ecosystem-specific token exposure

- Partial Profit Taking: Implement systematic profit-taking strategies at predetermined price levels to lock in gains during market rallies

(3) Safe Storage Solutions

- hardware wallet Approach: Store MATH tokens offline using industry-standard hardware security devices to eliminate exchange counterparty risk

- Exchange Custody: Maintain a portion of holdings on Gate.com for active trading liquidity while keeping the majority in self-custody for long-term security

- Security Considerations: Enable two-factor authentication on all exchange accounts, utilize non-custodial solutions where possible, and never share private keys or recovery phrases with any third parties

V. MATH Potential Risks and Challenges

MATH Market Risk

- Severe Historical Decline: The token has declined 87.83% over the past year, reflecting sustained loss of investor confidence and potential weakness in competitive positioning relative to other DeFi platforms

- Liquidity Constraints: With only 5 exchanges listing MATH and a relatively modest 24-hour trading volume of 27,621.33 tokens, the market exhibits limited liquidity that could amplify price volatility during significant buy or sell pressures

- Market Sentiment Deterioration: Current negative price momentum across all timeframes (1H: -0.77%, 24H: -3.61%, 7D: -8.23%, 30D: -34.58%) indicates weak market sentiment toward the project

MATH Regulatory Risk

- Regulatory Classification Uncertainty: Evolving global regulations regarding digital assets and DeFi platforms could materially impact MATH's utility and market valuation

- Jurisdiction-Specific Restrictions: Different regulatory frameworks across countries may limit platform accessibility for MATH ecosystem users and services

MATH Technology Risk

- Ecosystem Adoption Challenges: Despite offering multiple products (Math Wallet, VPOS mining pool, MathDEX, Math ID, MATH dApp Store, MATH Chain), the project faces ongoing challenges in driving substantial user adoption relative to competing platforms

- Smart Contract Vulnerabilities: Ongoing technical risks associated with decentralized finance infrastructure, including potential security vulnerabilities in deployed smart contracts across the MATH ecosystem

VI. Conclusion and Action Recommendations

MATH Investment Value Assessment

MATH operates as a decentralized finance infrastructure platform with a diversified product ecosystem. However, the token exhibits significant headwinds, including an 87.83% one-year decline and weak market momentum across all timeframes. The ecosystem's utility as a value medium for MATH's various services (wallet, mining pool, DEX, dApp store, and blockchain) provides fundamental value proposition, yet limited exchange presence and relatively modest trading volumes present liquidity constraints. The project's long-term viability depends on successful ecosystem adoption and user growth within an increasingly competitive DeFi landscape.

MATH Investment Recommendations

✅ Beginners: Exercise extreme caution; this token is not recommended as an entry point for novice cryptocurrency investors due to its extreme volatility and poor performance trajectory. Consider establishing positions only after gaining substantial experience with more established cryptocurrency assets.

✅ Experienced Investors: May evaluate small positions (1-3% of portfolio) aligned with a high-risk tolerance strategy, focusing on potential turnaround scenarios if ecosystem adoption metrics improve materially. Implement strict position sizing and profit-taking protocols.

✅ Institutional Investors: Conduct comprehensive due diligence on MATH ecosystem adoption metrics, user growth trends, and competitive positioning before considering any allocation. Any position should be limited and accompanied by rigorous hedging strategies.

MATH Trading Participation Methods

- Exchange Trading: Purchase MATH directly on Gate.com through spot trading markets using fiat or cryptocurrency pairs, providing immediate exposure to price movements

- Accumulation Strategy: Implement systematic buying during significant price declines to build positions at favorable valuations for long-term holding

- Staking and Incentives: Explore available ecosystem incentive programs within MATH's network to generate yield on held tokens beyond simple price appreciation

Cryptocurrency investment carries extreme risk and is suitable only for investors who can afford to lose their entire investment. This report does not constitute investment advice. Investors should conduct their own research and consult professional financial advisors before making any investment decisions. Never invest more than you can afford to lose.

FAQ

Is MATH coin a good investment?

MATH coin shows strong potential with growing community adoption and continuous development. Its utility in the web3 ecosystem makes it an attractive long-term investment opportunity for crypto enthusiasts.

Is MATH a good investment?

MATH demonstrates strong fundamentals with growing adoption and utility in the DeFi ecosystem. Its innovative technology and increasing transaction volume make it an attractive investment opportunity for long-term holders seeking exposure to blockchain innovation.

What is MATH coin and what is its use case?

MATH coin is an ERC-20 utility token designed for staking and user rewards. It enables ecosystem participants to stake their tokens and earn rewards, serving as the primary utility asset within its platform.

What factors influence MATH coin price?

MATH coin price is influenced by market sentiment, trading volume and value, technological developments, user adoption rates, and overall cryptocurrency market trends.

What is the price prediction for MATH coin in 2024/2025?

MATH coin is predicted to reach an average price of $0.032109492 by 2025 and $0.038913531 by 2026, based on market trend analysis and technical forecasting models.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

What is WEN: A Comprehensive Guide to Understanding the Decentralized Social Platform

What is MLC: A Comprehensive Guide to Machine Learning Compilation and Its Applications

What is MAVIA: A Comprehensive Guide to the Mobile Autonomous Vehicle Intelligence Architecture

What is REN: A Comprehensive Guide to Understanding the Renewable Energy Network and Its Impact on Global Energy Markets

Cryptocurrency ETF Investment Guide: How Beginners Can Select and Invest in Bitcoin ETFs