2025 PUFF Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: PUFF's Market Position and Investment Value

PUFF (Puff The Dragon) is an innovative ERC-20 memecoin token based around the mETH community, representing a unique blockchain interactive story experiment where holders can experience a multi-chapter journey. Since its launch in March 2024, PUFF has established itself as a distinctive digital asset within the memecoin ecosystem. As of December 18, 2025, PUFF commands a market capitalization of approximately $72.48 million with a circulating supply of 888,888,888 tokens, trading at around $0.08154 per coin.

This community-led project, known for its innovative approach combining gamified storytelling with blockchain technology through Puff's Penthouse (accessible via methlab.xyz), is carving out a distinctive niche in the digital asset landscape. Currently, users can engage with PUFF to earn $COOK tokens, creating an interactive ecosystem that extends beyond traditional token mechanics.

This report will comprehensively analyze PUFF's price trajectory and market dynamics, examining historical price movements, market supply-demand dynamics, and ecosystem development to provide investors with professional price forecasting and actionable investment strategies for informed decision-making.

PUFF The Dragon (PUFF) Market Report

I. PUFF Price History Review and Current Market Status

PUFF Historical Price Evolution

-

March 2024: PUFF launched with a genesis supply of 888,888,888 tokens at an initial price of $0.12982.

-

October 2024: Price declined to its all-time low of $0.03 on October 18, 2024, marking a significant correction from the launch price.

-

December 2024: Price surged to its all-time high of $0.14998 on December 24, 2024, representing a recovery and peak performance since launch.

PUFF Current Market Status

As of December 18, 2025, PUFF is trading at $0.08154, representing a -37.45% decline from its all-time high recorded on December 24, 2024. The token has experienced modest short-term weakness, with a -0.24% decline over the past 24 hours and a -0.22% decline in the last hour. However, the token shows positive momentum on a weekly basis with a +1.78% increase over the past 7 days.

The total market capitalization of PUFF stands at approximately $72.48 million, with a fully diluted valuation matching this figure since 100% of the supply is currently in circulation. The 24-hour trading volume is $12,142.11, indicating moderate liquidity. PUFF maintains a market dominance of 0.0023% and ranks 408th among cryptocurrencies.

The token has attracted a holder base of 28,840 addresses, demonstrating community engagement. All 888,888,888 PUFF tokens have been released, with 48.5% unlocked at genesis and the remainder distributed across Chapters 2 through 6 of the project's narrative structure.

Click to view current PUFF market price

PUFF Market Sentiment Index

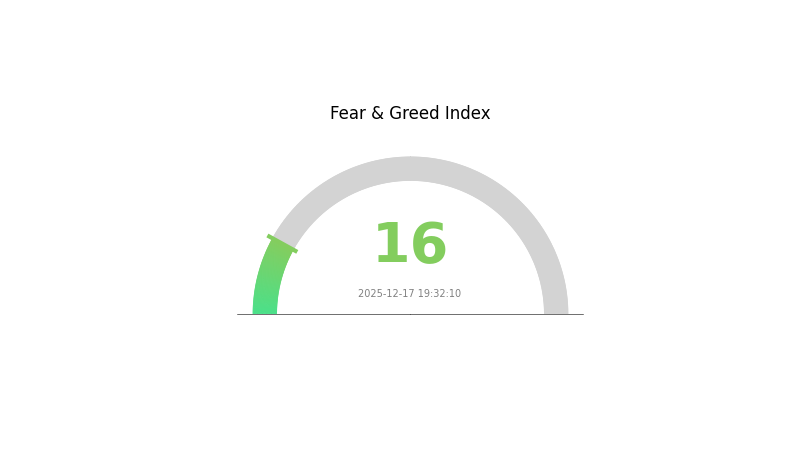

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 16. This reading signals heightened market anxiety and pessimism among investors. During such periods, panic selling often intensifies, creating significant price volatility across digital assets. However, contrarian investors frequently view extreme fear as a potential buying opportunity, as historically these conditions have preceded market reversals. Monitor market fundamentals carefully and consider your risk tolerance before making trading decisions on Gate.com.

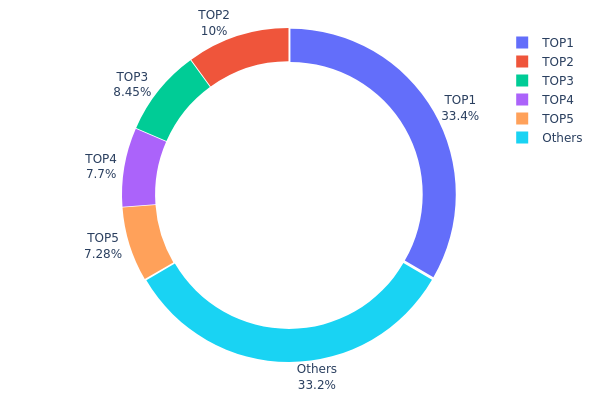

PUFF Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the top wallet addresses within the PUFF ecosystem. This metric serves as a critical indicator of token decentralization and market structure, revealing the degree to which supply is concentrated among major holders relative to the broader holder base. By analyzing the distribution patterns, investors and analysts can assess potential risks related to market manipulation, liquidity fragmentation, and the token's resilience to large-scale liquidations.

PUFF currently exhibits moderate to elevated concentration characteristics. The top five addresses collectively control 64.22% of the total token supply, with the largest holder commanding 32.08% alone. This concentration level warrants attention, as the dominant position of the leading address represents a significant single point of control. However, the fact that the remaining 35.78% is distributed among numerous other addresses suggests that the token maintains a diversified holder base beyond the top tier, preventing extreme centralization scenarios. The relatively balanced distribution among addresses two through five—ranging from 7.00% to 9.62%—indicates that power is not concentrated in a single entity but rather distributed among several major stakeholders.

The current address distribution structure presents both opportunities and risks for market dynamics. While concentrated holdings among top addresses can facilitate coordinated movements and potential price volatility, the substantial "Others" category suggests sufficient liquidity distribution to accommodate normal trading activities. The presence of multiple significant holders reduces the likelihood of unilateral market manipulation, though investors should monitor whether top address behavior shows coordinated patterns. Overall, PUFF demonstrates a decentralization profile typical of established tokens with institutional participation, maintaining relative stability through its distributed top-five structure while preserving sufficient concentration among key stakeholders to enable governance efficiency.

View current PUFF holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6C64...2197b3 | 285167.23K | 32.08% |

| 2 | 0x0d4D...B5CA48 | 85506.85K | 9.62% |

| 3 | 0xc876...b381C2 | 72200.00K | 8.12% |

| 4 | 0x74D9...CC7fF5 | 65800.00K | 7.40% |

| 5 | 0xaCC4...aE6417 | 62200.00K | 7.00% |

| - | Others | 283528.45K | 35.78% |

II. Core Factors Influencing PUFF's Future Price

Supply Mechanism

- Tokenomics Structure: PUFF's supply mechanism plays a critical role in determining its long-term price trajectory. As a meme coin, the token's distribution and availability directly impact market dynamics and holder incentives.

- Historical Patterns: Past supply changes have demonstrated significant influence on PUFF's price movements, reflecting market sensitivity to tokenomic adjustments and token release schedules.

- Current Impact: Present supply dynamics continue to shape price expectations, with market participants closely monitoring distribution patterns and their implications for future valuation.

Macroeconomic Environment

- Market Acceptance: PUFF's price is substantially influenced by overall market acceptance and sentiment within the cryptocurrency ecosystem. Adoption rates and community support directly correlate with price performance.

- Economic Cycles: Total economic factors and market cycles significantly impact PUFF's valuation, as broader cryptocurrency market conditions affect investor behavior and capital allocation decisions.

Technology Development and Ecosystem Building

- Ecosystem Development: The expansion of PUFF's ecosystem and integration with various applications contribute to its long-term growth prospects and utility value within the broader blockchain space.

- Community Participation: As a meme coin project, PUFF's success remains highly dependent on active community engagement and sustained support. Community-driven initiatives and participation levels directly influence project momentum and price stability.

Market Dynamics and Competitive Landscape

- Price Volatility: As a meme coin, PUFF exhibits significant price volatility and is susceptible to dramatic market fluctuations, which creates both opportunities and risks for investors.

- Competitive Pressure: The cryptocurrency sector continues to experience intensifying competition from emerging meme coins and similar projects, which may impact PUFF's market position and investor attention allocation.

III. 2025-2030 PUFF Price Forecast

2025 Outlook

- Conservative Forecast: $0.06686 - $0.08154

- Neutral Forecast: $0.08154

- Bullish Forecast: $0.09866 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Perspective

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecasts:

- 2026: $0.08199 - $0.11083

- 2027: $0.06229 - $0.14467

- 2028: $0.07967 - $0.16669

- Key Catalysts: Expanded adoption of PUFF within its ecosystem, improved market liquidity on platforms like Gate.com, positive regulatory developments, and strengthening institutional interest in emerging digital assets

2029-2030 Long-term Outlook

- Base Case Scenario: $0.09505 - $0.22597 (assuming continued steady adoption and market maturation)

- Bullish Scenario: $0.12727 - $0.21405 (contingent on accelerated ecosystem growth and mainstream integration)

- Transformational Scenario: $0.17934 - $0.22597 (under conditions of breakthrough technological advancements and significant market capitalization expansion)

- 2030-12-18: PUFF at $0.17934 (midpoint projection reflecting cumulative 119% gains from current valuation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09866 | 0.08154 | 0.06686 | 0 |

| 2026 | 0.11083 | 0.0901 | 0.08199 | 10 |

| 2027 | 0.14467 | 0.10046 | 0.06229 | 23 |

| 2028 | 0.16669 | 0.12257 | 0.07967 | 50 |

| 2029 | 0.21405 | 0.14463 | 0.12727 | 77 |

| 2030 | 0.22597 | 0.17934 | 0.09505 | 119 |

PUFF The Dragon Investment Analysis Report

IV. PUFF Professional Investment Strategy and Risk Management

PUFF Investment Methodology

(1) Long-term Holding Strategy

-

Target Investor Profile: Community-oriented investors interested in innovative blockchain narratives and memecoin ecosystems; investors seeking exposure to the mETH community ecosystem.

-

Operational Recommendations:

- Accumulate PUFF during market dips to build a diversified portfolio position

- Participate in Puff's Penthouse interactive story experience on methlab.xyz to gain deeper engagement with the project

- Monitor token unlock schedules across Chapters 2 to 6 for supply dynamics

-

Storage Solution:

- Store PUFF securely using Gate.com Web3 Wallet for convenient access to trading pairs and ecosystem participation

- Maintain private key security and enable multi-layer authentication protocols

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: Monitor support and resistance levels around historical price ranges ($0.03 to $0.14998)

- Volume Trends: Track 24-hour trading volume fluctuations on Gate.com to identify momentum shifts

-

Trading Insights:

- Current price of $0.08154 represents approximately 45.6% decline from all-time high of $0.14998 (reached December 24, 2024)

- 24-hour volatility of -0.24% suggests relatively stable short-term price action

- 7-day positive momentum of 1.78% indicates potential recovery phases

PUFF Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 0.5-1.5% portfolio allocation

- Limit PUFF exposure to speculative allocation portion

- Dollar-cost average entries over extended periods

-

Active Investors: 1.5-5% portfolio allocation

- Balance between community participation and trading opportunities

- Engage with Penthouse features on methlab.xyz for ecosystem utility

-

Professional Investors: 5-10% allocation

- Structured position sizing based on risk-adjusted returns

- Systematic rebalancing tied to chapter releases and supply unlocks

(2) Risk Hedging Strategies

- Diversification Approach: Maintain PUFF as portion of broader meme token and community-driven asset portfolio

- Stop-Loss Implementation: Establish predetermined exit points based on individual risk tolerance thresholds

(3) Secure Storage Solutions

- Custodial Wallets: Gate.com Web3 Wallet recommended for active traders requiring frequent transaction capabilities and ecosystem integration

- Non-Custodial Solutions: Maintain backup storage options for long-term security

- Critical Security Considerations: Never share private keys or seed phrases; verify contract addresses before transactions; enable account security features on Gate.com

V. PUFF Potential Risks and Challenges

PUFF Market Risks

- Memecoin Volatility: PUFF demonstrates significant price swings, with 1-year performance of -37.45%, reflecting speculative market dynamics inherent to community-driven tokens

- Liquidity Concentration: Limited exchange presence (currently listed on 2 exchanges) may restrict trading accessibility and increase slippage during large transactions

- Regulatory Uncertainty: Memecoin and community token regulatory status remains evolving, with potential future compliance requirements

PUFF Regulatory Risks

- Evolving Framework: Cryptocurrency regulations continue to develop globally, potentially affecting PUFF's operational status and community activities

- Compliance Requirements: Increased regulatory scrutiny may impose restrictions on token utilities or community participation mechanisms

- Jurisdictional Variations: Different regulatory approaches across regions may impact accessibility for international community members

PUFF Technical Risks

- Network Dependency: PUFF operates on the Mantle blockchain; network congestion or technical issues could impact transaction processing

- Smart Contract Risk: While built on established infrastructure, any underlying smart contract vulnerabilities could pose technical challenges

- Supply Release Execution: Successful implementation of Chapter-based token unlocks (Chapters 2-6) is critical to roadmap credibility

VI. Conclusion and Action Recommendations

PUFF Investment Value Assessment

Puff The Dragon represents a unique intersection of community-driven storytelling and blockchain technology, differentiated by its innovative interactive narrative framework. With 888,888,888 fixed supply and 100% circulating ratio, the token demonstrates transparent tokenomics. However, the project remains highly speculative, carrying substantial volatility and concentration risks typical of emerging memecoin ecosystems. Success hinges on sustained community engagement, effective execution of the six-chapter story progression, and the viability of the Penthouse utility ecosystem on methlab.xyz.

PUFF Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of speculative portfolio) to understand community dynamics; engage with Puff's Penthouse to evaluate project development before increasing exposure.

✅ Experienced Investors: Consider 2-5% allocation leveraging technical analysis of price levels ($0.03-$0.14998 range); actively monitor token unlock schedules and chapter releases for trading signals.

✅ Institutional Investors: Evaluate 5-10% positions within community-token research allocations; establish systematic monitoring of regulatory developments and ecosystem expansion metrics.

PUFF Trading Participation Methods

- Gate.com Direct Trading: Access PUFF trading pairs directly on Gate.com platform for transparent pricing and real-time execution

- Penthouse Ecosystem Engagement: Participate in methlab.xyz Penthouse for $COOK token earning opportunities and story interaction, offering alternative value capture mechanisms

- Community Participation: Join community channels via Twitter (@puff_drgn) to stay informed on chapter releases, utility updates, and ecosystem developments

Cryptocurrency investing carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What crypto will 1000x prediction?

PUFF token shows strong potential for exponential growth. With its innovative protocol, growing trading volume, and strategic partnerships, PUFF is positioned to achieve significant gains in the upcoming market cycle. Early investors have strong upside potential.

Can pump coin reach $1?

While reaching $1 is theoretically possible with significant market growth, current analyst predictions suggest PUMP is unlikely to reach $1 in the foreseeable future. Most forecasts place potential highs well below this threshold, making it a highly challenging target.

Can phala coin reach $1?

Yes, Phala Network has strong potential to reach $1. With growing adoption and market expansion, this target is achievable within the next few years based on current market trends and development momentum.

How much will 1 pi be worth in 2025?

Based on current market analysis and growth predictions, 1 PI is expected to be worth approximately $0.20061 in 2025, with an estimated 5% annual growth rate.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Recall (RECALL) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects in the Digital Asset Space

Is Pieverse (PIEVERSE) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Is Loopring (LRC) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Risk Factors for 2024

FRAX vs MANA: A Comprehensive Comparison of Two Leading Crypto Tokens in the DeFi and Metaverse Ecosystems

Is Waves (WAVES) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Risk Factors