2025 PYRPrice Prediction: Analyzing Market Trends and Key Factors Influencing Vulcan Forged's Native Token

Introduction: PYR's Market Position and Investment Value

Vulcan Forged (PYR), as a native token for the Vulcan Forged gaming ecosystem, has made significant strides since its inception in 2021. As of 2025, PYR's market capitalization has reached $23,663,502.54, with a circulating supply of approximately 23,897,700 tokens, and a price hovering around $0.9902. This asset, often referred to as the "gaming and NFT powerhouse," is playing an increasingly crucial role in the blockchain gaming and NFT sectors.

This article will provide a comprehensive analysis of PYR's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. PYR Price History Review and Current Market Status

PYR Historical Price Evolution

- 2021: Project launch, price reached all-time high of $49.24 on December 1

- 2022-2024: Prolonged bear market, price declined significantly

- 2025: Price hit all-time low of $0.784486 on June 23, followed by slight recovery

PYR Current Market Situation

As of October 4, 2025, PYR is trading at $0.9902, down 1.67% in the past 24 hours. The token has shown some signs of recovery, with a 3.63% increase over the past 7 days. However, it remains down 2.97% over the past 30 days and has experienced a substantial 61.73% decline over the past year.

PYR's current market cap stands at $23,663,502.54, ranking it 1017th among all cryptocurrencies. The circulating supply is 23,897,700 PYR, which represents 47.8% of the total supply of 50,000,000 tokens. The fully diluted market cap is $49,510,000.

Trading volume in the last 24 hours reached $25,385.25, indicating moderate market activity. The token is currently trading significantly below its all-time high, suggesting potential for growth if market conditions improve and the Vulcan Forged ecosystem continues to develop.

Click to view the current PYR market price

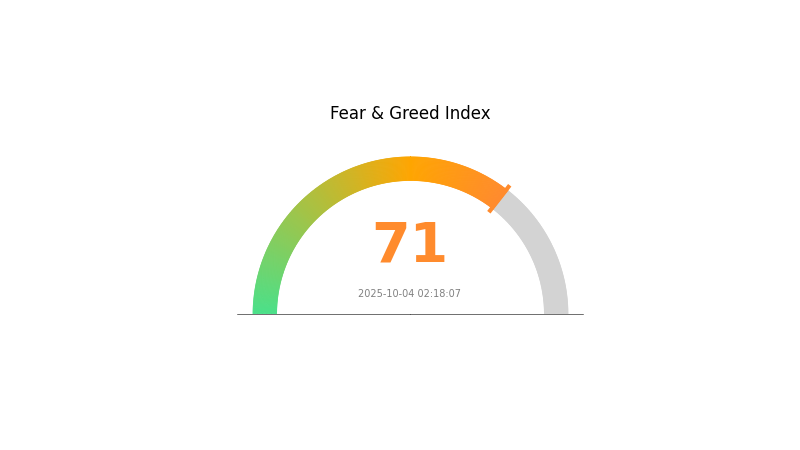

PYR Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a wave of greed, with the sentiment index reaching 71. This suggests investors are becoming increasingly optimistic, possibly driven by recent price gains or positive news. However, such high levels of greed often precede market corrections. Traders should exercise caution and consider taking profits or hedging positions. Remember, market sentiment can shift rapidly, and it's crucial to maintain a balanced approach to risk management in these volatile conditions.

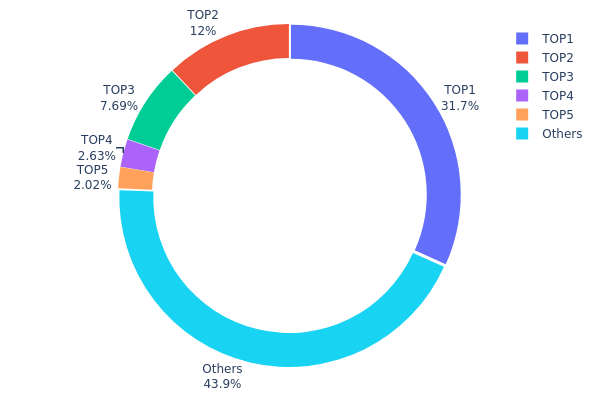

PYR Holdings Distribution

The address holdings distribution for PYR reveals a highly concentrated ownership structure. The top address holds a significant 31.73% of the total supply, while the top 5 addresses collectively control 56.07% of all PYR tokens. This level of concentration raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution can have profound implications for PYR's market dynamics. The large holdings by a few addresses may lead to increased price volatility if any of these major holders decide to liquidate their positions. Furthermore, this concentration of power could potentially undermine the decentralization ethos that many cryptocurrency projects strive for.

From a market structure perspective, the current distribution suggests a relatively low level of on-chain stability and a higher risk of price manipulation. The significant influence wielded by a small number of addresses could potentially allow for coordinated actions that impact the broader market. Investors and traders should be aware of these structural characteristics when considering PYR in their portfolios or trading strategies.

Click to view the current PYR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 15866.77K | 31.73% |

| 2 | 0xf977...41acec | 6000.00K | 12.00% |

| 3 | 0xb04e...ad8ee3 | 3845.24K | 7.69% |

| 4 | 0xb0a3...7e4411 | 1315.30K | 2.63% |

| 5 | 0xd621...d19a2c | 1010.88K | 2.02% |

| - | Others | 21961.81K | 43.93% |

II. Key Factors Influencing PYR's Future Price

Supply Mechanism

- User Growth: The rate of active user growth on the Vulcan Forged platform directly affects the frequency of PYR usage and token demand.

- Current Impact: Increasing platform adoption is expected to drive demand for PYR tokens.

Institutional and Whale Dynamics

- Market Sentiment: Investor sentiment and confidence have a direct impact on PYR/USD trends.

Technical Development and Ecosystem Building

- DApp and Game Releases: The pace of new DApp and game launches on the Vulcan Forged platform influences PYR's utility and value.

- Ecosystem Applications: Vulcan Forged's ecosystem includes various DApps and games that utilize PYR, contributing to its overall ecosystem growth.

III. PYR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.77 - $0.85

- Neutral prediction: $0.85 - $0.98

- Optimistic prediction: $0.98 - $1.04 (requires favorable market conditions)

2026-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.86 - $1.31

- 2027: $0.76 - $1.63

- 2028: $1.18 - $1.70

- Key catalysts: Increased adoption, technological advancements, market expansion

2029-2030 Long-term Outlook

- Base scenario: $1.50 - $1.70 (assuming steady market growth)

- Optimistic scenario: $1.70 - $2.00 (assuming strong market performance)

- Transformative scenario: $2.00 - $2.30 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: PYR $1.58 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.04495 | 0.9858 | 0.77878 | 0 |

| 2026 | 1.30983 | 1.01537 | 0.86307 | 2 |

| 2027 | 1.62764 | 1.1626 | 0.76732 | 17 |

| 2028 | 1.70205 | 1.39512 | 1.18586 | 40 |

| 2029 | 1.62602 | 1.54859 | 0.89818 | 56 |

| 2030 | 2.30159 | 1.5873 | 0.93651 | 60 |

IV. Professional PYR Investment Strategies and Risk Management

PYR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in blockchain gaming

- Operation suggestions:

- Accumulate PYR tokens during market dips

- Participate in Vulcan Forged ecosystem to earn additional rewards

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage risk

- Take profits at predetermined levels

PYR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Use of stablecoins: Convert portion of PYR to stablecoins during volatility

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, be cautious of phishing

V. Potential Risks and Challenges for PYR

PYR Market Risks

- High volatility: Gaming tokens can experience rapid price swings

- Competition: Increasing number of blockchain gaming projects

- Market sentiment: Dependent on overall crypto market trends

PYR Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of gaming tokens

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of gaming rewards and NFT transactions

PYR Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased user adoption

- Interoperability issues: Seamless integration with multiple blockchain networks

VI. Conclusion and Action Recommendations

PYR Investment Value Assessment

PYR offers exposure to the growing blockchain gaming sector but comes with high volatility and regulatory uncertainties. Long-term potential exists if Vulcan Forged continues to innovate and attract users.

PYR Investment Recommendations

✅ Beginners: Consider small, experimental positions to learn about gaming tokens ✅ Experienced investors: Allocate a portion of gaming sector exposure to PYR ✅ Institutional investors: Monitor project development and user growth metrics

PYR Trading Participation Methods

- Spot trading: Buy and hold PYR tokens on Gate.com

- Staking: Participate in PYR staking programs for additional rewards

- In-game engagement: Utilize PYR within Vulcan Forged ecosystem

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for pols crypto in 2030?

Based on current market analysis, the price prediction for POLS crypto in 2030 is $0.290893. This projection suggests moderate growth potential for Polkastarter over the next few years.

Is Pyr a gaming coin?

Yes, PYR is a gaming coin. It's a utility token used in Vulcan Forged games on Ethereum and Polygon networks, serving as a cross-platform currency for gamers.

What is Pepe's price prediction for 2025?

Based on technical analysis, Pepe's price is predicted to range between $0.00000882 and $0.000011 in 2025. However, cryptocurrency predictions are inherently uncertain.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $140,652. Chainlink follows with a prediction of $62.60.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Is TEN Protocol (TEN) a good investment?: A Comprehensive Analysis of Token Potential, Market Positioning, and Risk Factors for 2024

Is Echo (ECHO) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Market Risks

TEN vs ENJ: A Comprehensive Comparison of Two Leading Blockchain Gaming Tokens

GAI vs IMX: Which Layer 2 Scaling Solution Offers Better Returns for Crypto Investors in 2024?

ECHO vs HBAR: A Comprehensive Comparison of Two Emerging Blockchain Ecosystems