2025 SFUND Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SFUND's Market Position and Investment Value

Seedify.fund (SFUND) is an incubator and seed fund that supports innovative development within the blockchain ecosystem through decentralized mechanisms while rewarding experts and communities. Since its launch in 2021, SFUND has established itself as a notable player in the blockchain funding landscape. As of December 2025, SFUND maintains a market capitalization of approximately $8.62 million with a circulating supply of 83 million tokens, currently trading at $0.10384. This innovative funding mechanism is playing an increasingly vital role in nurturing early-stage blockchain projects and fostering ecosystem growth.

This article will provide a comprehensive analysis of SFUND's price trends through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Seedify.fund (SFUND) Market Analysis Report

I. SFUND Price History Review and Current Market Status

SFUND Historical Price Evolution

- 2021: Project launch and initial growth phase, reaching all-time high of $16.79 on November 29, 2021

- 2022-2025: Extended downtrend period, with significant price depreciation from peak valuations

SFUND Current Market Performance

As of December 22, 2025, SFUND is trading at $0.10384, reflecting a market capitalization of approximately $8.62 million with a fully diluted valuation of $10.38 million. The token has experienced substantial long-term decline, down 92.97% over the past year, though showing modest recovery with 10.47% gains over the past 30 days.

24-hour trading metrics indicate:

- Price range: $0.10268 to $0.10449

- 24-hour change: +0.11%

- 24-hour trading volume: $29,015.24

- Market circulating supply: 83 million SFUND (83% of total 100 million max supply)

- Active token holders: 2,672

- Listed on 4 cryptocurrency exchanges

The token remains operational on the Binance Smart Chain (BSC) network with contract address 0xffda10b7fd9cf172e0502a6bc0e5e355516c5232. Current market sentiment reflects extreme fear conditions with a VIX indicator reading of 25.

Click to view current SFUND market price

SFUND Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 25. This significant drop reflects heightened investor anxiety and pessimism across digital asset markets. During such periods, risk-averse traders typically reduce positions while contrarian investors may identify potential buying opportunities at depressed valuations. Market participants should exercise caution, conduct thorough risk assessment, and avoid emotional decision-making. Monitor key support levels and market developments closely. Consider diversifying your portfolio and only invest capital you can afford to lose during high-fear environments.

SFUND Holdings Distribution

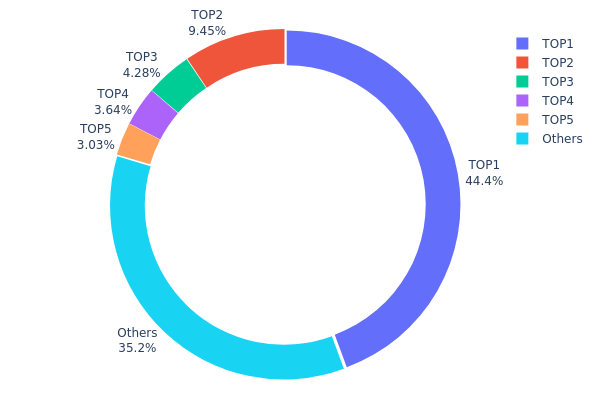

The address holdings distribution chart provides a comprehensive view of how SFUND tokens are concentrated across different wallet addresses on the blockchain. This metric is instrumental in assessing the decentralization status of the token, identifying potential concentration risks, and understanding the overall market structure and governance dynamics of the project.

The current distribution data reveals a notable concentration pattern in SFUND's holder landscape. The top address commands 44.38% of total holdings, while the top five addresses collectively control 64.78% of the circulating supply. This level of concentration indicates a significant centralization tendency, where a small number of entities maintain substantial influence over token availability and potential market movements. The remaining 35.22% distributed among other addresses demonstrates that while some decentralization exists, the majority of tokens remain in the hands of a limited number of stakeholders.

This concentration structure carries meaningful implications for market dynamics and price stability. High token concentration in few addresses amplifies the potential for sudden market movements, as large holders possess the capacity to execute substantial transactions that could trigger volatility. Additionally, such distribution raises considerations regarding governance participation and decision-making authority within the SFUND ecosystem. The current structure suggests that token holders should monitor large address activities closely, as coordinated movements or strategic dispositions by top holders could significantly impact market sentiment and price discovery mechanisms. The 35.22% allocation to dispersed addresses indicates an ongoing decentralization process, though the dominance of major holders remains the defining characteristic of SFUND's present on-chain structure.

Click to view current SFUND holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9b22...b10216 | 44380.96K | 44.38% |

| 2 | 0xe618...e2d6d0 | 9450.89K | 9.45% |

| 3 | 0x9b45...34e038 | 4283.62K | 4.28% |

| 4 | 0x69be...6ee5e0 | 3640.33K | 3.64% |

| 5 | 0x1c0d...5e9067 | 3033.48K | 3.03% |

| - | Others | 35210.72K | 35.22% |

II. Core Factors Influencing SFUND's Future Price

Supply Mechanism

- Token Supply Dynamics: Historical supply adjustments have demonstrated significant impact on SFUND pricing patterns.

- Historical Precedent: Past supply modifications have shown notable influence on price performance.

- Current Impact: Present-stage supply variations are anticipated to continue affecting price trajectory and market dynamics.

Institutional and Whale Activity

- Market Sentiment: Current cryptocurrency market sentiment leans toward greed, with the Fear and Greed Index scoring 74, indicating optimistic investor sentiment. This surge may be driven by recent price appreciation or positive news developments. However, extreme greed often signals potential market correction, warranting rational analysis.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate fluctuations and broader monetary policy adjustments influence investment attractiveness in cryptocurrency assets.

- Inflation Hedge Characteristics: Under inflationary pressures, SFUND benefits from increased hedging demand, supporting its positioning as a "digital asset" alternative.

- Geopolitical Factors: International uncertainties may potentially amplify demand for SFUND as investors seek alternative asset allocations amid geopolitical instability.

III. 2025-2030 SFUND Price Forecast

2025 Outlook

- Conservative Forecast: $0.0758–$0.10384

- Neutral Forecast: $0.10384 (average expected level)

- Optimistic Forecast: $0.15264 (requiring sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecasts:

- 2026: $0.11029–$0.18082 (23% upside potential)

- 2027: $0.1499–$0.16226 (48% cumulative gains)

- 2028: $0.13305–$0.16632 (52% cumulative gains)

- Key Catalysts: Expansion of platform utility, increased adoption within the Seedify ecosystem, strategic partnerships, and positive sentiment shifts in the broader crypto market

2029-2030 Long-term Outlook

- Base Case Scenario: $0.14287–$0.23866 (56% cumulative appreciation by 2029, driven by mainstream adoption and protocol maturation)

- Optimistic Scenario: $0.13835–$0.2346 (93% cumulative gains by 2030, assuming accelerated institutional participation and ecosystem scaling)

- Transformation Scenario: $0.20051+ (extreme bull case contingent upon transformative regulatory clarity, major exchange listings on platforms like Gate.com, and breakthrough utility applications)

- 2030-12-31: SFUND achieves $0.2346 average valuation (reflecting mature market positioning and sustained developmental progress)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15264 | 0.10384 | 0.0758 | 0 |

| 2026 | 0.18082 | 0.12824 | 0.11029 | 23 |

| 2027 | 0.16226 | 0.15453 | 0.1499 | 48 |

| 2028 | 0.16632 | 0.1584 | 0.13305 | 52 |

| 2029 | 0.23866 | 0.16236 | 0.14287 | 56 |

| 2030 | 0.2346 | 0.20051 | 0.13835 | 93 |

SFUND Professional Investment Strategy and Risk Management Report

IV. SFUND Professional Investment Strategy and Risk Management

SFUND Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a 2+ year investment horizon who believe in blockchain ecosystem development and project incubation models

- Operational Recommendations:

- Accumulate SFUND during market downturns when prices stabilize near support levels

- Maintain a consistent position while the project develops its incubator platform and community ecosystem

- Reinvest any rewards or earnings back into your position to compound gains over time

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action Monitoring: Track the 0.10268-0.10449 range as immediate support and resistance levels

- Volume Analysis: Monitor the 24-hour trading volume of approximately 29,015 SFUND to identify breakout opportunities

- Swing Trading Key Points:

- Execute trades during high volatility periods when volume exceeds daily averages

- Set stop-losses at 5-10% below entry points to manage downside risk in this volatile asset class

SFUND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total portfolio

- Active Investors: 1-3% of total portfolio

- Professional Investors: 3-5% of total portfolio

(2) Risk Hedging Strategies

- Position Sizing: Implement strict position limits relative to your total capital to limit exposure to this asset with high volatility

- Diversification: Balance SFUND holdings with other established blockchain and DeFi projects to reduce concentration risk

(3) Secure Storage Solutions

- Hardware Wallet Method: Store SFUND on secure hardware wallets with strong backup procedures; maintain private keys in offline, secure locations

- Exchange Storage: For active traders, maintain minimal SFUND on Gate.com for liquidity; withdraw the majority to personal security custody

- Security Best Practices: Enable two-factor authentication on all exchange accounts, use strong passwords, and regularly audit wallet transactions

V. SFUND Potential Risks and Challenges

SFUND Market Risk

- Extreme Price Volatility: SFUND has experienced a 92.97% decline over the past year, demonstrating significant downside risk for investors entering at unfavorable price points

- Liquidity Concerns: With only 4 exchange listings and relatively low 24-hour trading volume of 29,015 tokens, SFUND faces potential liquidity constraints during market stress periods

- Market Sentiment Fluctuations: The current neutral market emotion suggests price movements could shift rapidly based on project announcements or broader market conditions

SFUND Regulatory Risk

- Blockchain Regulation Evolution: Increasing government scrutiny of cryptocurrency and token projects globally may impact Seedify.fund's operations and token utility

- Securities Compliance: Depending on jurisdiction, SFUND's incubator/seed fund model may face regulatory challenges regarding classification as a security or investment product

- Geographic Restrictions: Different jurisdictions impose varying regulations on token sales and trading, potentially limiting the project's addressable market

SFUND Technical Risk

- Smart Contract Vulnerabilities: Any bugs or exploits in the SFUND token or platform smart contracts could result in permanent token loss or platform compromise

- Network Dependency: SFUND operates on the Binance Smart Chain (BSC); network congestion or vulnerabilities could affect token transfers and platform functionality

- Project Execution Risk: The incubator model's success depends on the team's ability to identify and support viable blockchain projects, which remains uncertain

VI. Conclusion and Action Recommendations

SFUND Investment Value Assessment

SFUND represents a niche investment opportunity within the blockchain incubator/seed funding space. While the project addresses a real need for decentralized project support and community rewards, the token has experienced severe price depreciation (down 92.97% year-over-year) indicating significant market challenges. The low trading volume, limited exchange listings, and small holder base suggest low liquidity and market adoption. Investors should carefully weigh the long-term vision of supporting blockchain ecosystem development against the current weak market performance and execution risks.

SFUND Investment Recommendations

✅ Beginners: Start with a very small position (0.5-1% of portfolio) only if you understand blockchain technology and can afford total loss; use only Gate.com for trading with strict position limits

✅ Experienced Investors: Consider SFUND as a speculative allocation if you have conviction in the decentralized incubator model; implement strict stop-losses and maintain disciplined profit-taking strategies

✅ Institutional Investors: Conduct thorough due diligence on the Seedify.fund team, platform progress, and incubated project performance before considering any allocation; if proceeding, maintain positions below 2% of crypto allocations

SFUND Trading Participation Methods

- Exchange Trading: Purchase SFUND directly on Gate.com using BNB or other supported trading pairs

- Limit Orders: Set buy orders at support levels (0.053711 historical low or current 0.10268 support) to accumulate at favorable prices

- Systematic Accumulation: Dollar-cost average purchases over months to reduce timing risk and volatility exposure

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the market cap of Sfund?

The market cap of Sfund is $8,638,721, ranking it at #1683 on CoinGecko. This reflects the current valuation of the Seedify.fund token in the market.

What is the current price of SFUND and how has it performed historically?

SFUND is currently trading at $12.50, demonstrating strong historical performance with approximately 20% growth over the past year, showcasing consistent upward momentum and solid market resilience.

What factors could influence SFUND price in the future?

SFUND price may be influenced by ecosystem growth, launchpad upgrades, Monad integration, trading volume, market sentiment, and broader crypto market trends. Security developments and trust factors could also impact its valuation.

Is SFUND a good investment and what are the risks?

SFUND offers growth potential as a launchpad token in the blockchain ecosystem. However, it carries significant risks including market volatility, regulatory uncertainty, and potential investment loss. Conduct thorough research before investing.

What is SFUND used for and what is its utility?

SFUND is the core token of Seedify.fund platform, empowering its entire ecosystem. It facilitates platform operations, governance participation, and ecosystem incentives for users and stakeholders.

How does SFUND compare to other similar tokens?

SFUND is deflationary, creating upward price pressure during bull markets, unlike inflationary tokens such as DOT. This deflationary model supports long-term value appreciation and differentiates SFUND's investment profile in the blockchain ecosystem.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

How to Buy Pepe (PEPE) Coin: A Comprehensive Guide

Understanding Pudgy Penguins (PENGU): A Guide to This NFT Collection

2025 CTA Price Prediction: Expert Analysis and Future Market Outlook

2025 FAIR3 Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Manta Network's Innovative Layer 2 Scaling Solution for Privacy