2025 SUKU Price Prediction: Expert Analysis, Market Trends, and Potential Growth Opportunities for the Year Ahead

Introduction: Market Position and Investment Value of SUKU

SUKU (SUKU) is a decentralized finance protocol designed to enhance supply chain transparency and provide financial tools to underserved suppliers, particularly smallholder farmers. Since its inception in 2020, SUKU has established itself as a unique bridge between Web3 communities and real-world supply chain solutions. As of December 2025, SUKU maintains a market capitalization of approximately $14.55 million, with a circulating supply of approximately 542.59 million tokens and a current price of around $0.009698. Known as a "supply chain DeFi solution," SUKU is playing an increasingly critical role in enabling blockchain-based product traceability, verification, and financial inclusion across global supply networks.

This article will comprehensively analyze SUKU's price trajectories from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

SUKU Price History Review and Market Status

I. SUKU Price History Review and Market Status

SUKU Historical Price Evolution Trajectory

- 2021: SUKU reached its all-time high of $1.51 on November 4, 2021, during the bull market cycle of that year.

- 2024-2025: SUKU experienced a significant long-term decline, with the token losing 87.64% of its value over a one-year period.

- December 2025: SUKU hit a new all-time low of $0.00955134 on December 19, 2025, representing an extreme depreciation from its historical peak.

SUKU Current Market Position

As of December 23, 2025, SUKU is trading at $0.009698, reflecting a marginal recovery of 0.31% from its recent low. The token exhibits the following market characteristics:

- 24-hour price movement: Down 2.95%, trading within a range of $0.009659 to $0.010002

- 7-day performance: Negative momentum with a 11.21% decline over the past week

- 30-day trend: Continued weakness with a 31.89% decline over the past month

- Market capitalization: $14.55 million in fully diluted valuation, ranking 1497th across the cryptocurrency market

- Trading volume: $12,645.36 in 24-hour volume, indicating relatively thin liquidity

- Circulating supply: 542.59 million SUKU tokens out of a maximum supply of 1.5 billion tokens, representing 36.17% circulation

- Holder distribution: 13,997 token holders currently hold SUKU

The market sentiment surrounding SUKU is currently characterized by "Extreme Fear" (VIX: 24), reflecting broader market pessimism and risk aversion in the cryptocurrency sector.

Click to view current SUKU market price

Crypto Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as traders react to negative sentiment and uncertainty. However, extreme fear often presents contrarian opportunities for long-term investors, as assets may be undervalued. Consider conducting thorough research and managing risk carefully before making investment decisions. Monitor market movements closely on Gate.com for real-time data and analysis to make informed trading choices.

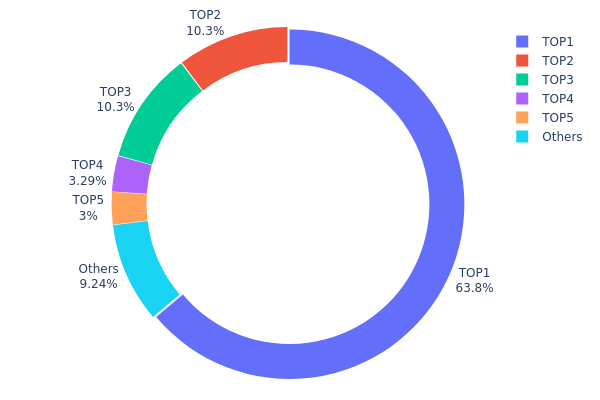

SUKU Holdings Distribution

Address holdings distribution refers to the concentration analysis of token ownership across different wallet addresses on the blockchain. This metric provides critical insights into the tokenomics structure, decentralization level, and potential market manipulation risks by tracking how SUKU tokens are distributed among top holders and the broader community.

The current SUKU holdings distribution reveals a highly concentrated ownership structure. The top address commands 63.82% of total token supply, representing an extreme concentration that significantly exceeds healthy decentralization benchmarks. The second and third largest holders each control approximately 10.3%, collectively accounting for over 20% of circulating supply. These three entities combined represent nearly 85% of all SUKU tokens, indicating substantial centralization risk. The remaining top five addresses hold an additional 6.3%, leaving only 9.27% distributed among all other addresses in the network.

This pronounced concentration poses notable structural vulnerabilities. The dominance of a single address holding nearly 64% of the token supply creates substantial price volatility potential and governance concentration concerns. Should the largest holder initiate significant token movements—whether through sales, transfers, or exchanges—the market could experience considerable price pressure and liquidity disruptions. The thin distribution among retail participants, with over 90% of supply held by just five addresses, limits true market decentralization and raises questions about long-term sustainability. While such concentrated structures are occasionally observed in early-stage projects or during token vesting periods, SUKU's extreme imbalance warrants careful monitoring as a potential catalyst for future market movements and price discovery mechanisms.

Click to view current SUKU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc05e...3c366f | 957412.59K | 63.82% |

| 2 | 0x178c...4dfd0a | 154834.01K | 10.32% |

| 3 | 0x3c4c...5204fb | 154747.22K | 10.31% |

| 4 | 0xa9d1...1d3e43 | 49407.73K | 3.29% |

| 5 | 0xbe91...3865be | 44977.70K | 2.99% |

| - | Others | 138620.76K | 9.27% |

II. Core Factors Affecting SUKU's Future Price

Market Sentiment and Adoption

-

Investor Confidence: Investor sentiment and confidence directly impact SUKU price movements. Positive market sentiment driven by widespread adoption announcements or major technological breakthroughs can significantly influence price direction.

-

Technology Progress: Market response to technical advancements and innovations within the SUKU ecosystem plays a crucial role in shaping investor outlook and price trajectory.

Price Forecast and Technical Indicators

-

2025 Price Outlook: According to technical analysis, SUKU is projected to trade between $0.008298 and $0.010533 during 2025, representing potential growth of approximately 52.57% from current levels.

-

Short-term Technical Trends: The 50-day Simple Moving Average (SMA) is expected to reach $0.01069 by January 21, 2026. Technical indicators including Stoch RSI (14) at 19.55 suggest a BUY signal, while momentum indicators remain neutral.

-

Long-term Growth Potential: Long-term projections through 2032 indicate SUKU could reach a maximum potential price of $0.05456, representing significant upside potential over the multi-year outlook.

Market Volatility Considerations

It is crucial to remember that cryptocurrency markets are highly volatile. Price predictions cannot account for sudden and extreme price fluctuations that may occur due to market shocks, regulatory changes, or macroeconomic developments.

- Investment Strategy Adjustment: Given the volatile nature of cryptocurrency markets, investment strategies should be continuously adjusted based on real-time market dynamics and changing conditions.

III. 2025-2030 SUKU Price Forecast

2025 Outlook

- Conservative Forecast: $0.00524 - $0.0097

- Base Case Forecast: $0.0097

- Optimistic Forecast: $0.01125 (requires sustained market recovery and increased institutional adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual consolidation and recovery phase with incremental adoption growth. The token is expected to experience moderate volatility while establishing stronger market fundamentals.

- Price Range Predictions:

- 2026: $0.00964 - $0.01487 (8% upside potential)

- 2027: $0.0076 - $0.01305 (30% cumulative growth)

- 2028: $0.00733 - $0.01454 (32% cumulative growth)

- Key Catalysts: Expansion of platform utility, strengthened tokenomics framework, increased enterprise partnerships, and broader market sentiment improvement within the digital asset ecosystem.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01137 - $0.01863 by 2029; $0.01018 - $0.0215 by 2030 (assumes steady ecosystem development and moderate market expansion)

- Optimistic Scenario: $0.01863 - $0.02150 range (assumes accelerated adoption, successful platform scaling, and favorable macroeconomic conditions)

- Transformation Scenario: $0.0215+ potential (requires breakthrough institutional investment, significant technological advancement, and mainstream integration of the SUKU protocol)

- 2025-12-23: SUKU consolidating near mid-range support levels (stable market position maintained)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01125 | 0.0097 | 0.00524 | 0 |

| 2026 | 0.01487 | 0.01047 | 0.00964 | 8 |

| 2027 | 0.01305 | 0.01267 | 0.0076 | 30 |

| 2028 | 0.01454 | 0.01286 | 0.00733 | 32 |

| 2029 | 0.01863 | 0.0137 | 0.01137 | 41 |

| 2030 | 0.0215 | 0.01617 | 0.01018 | 66 |

SUKU Investment Strategy and Risk Management Report

IV. SUKU Professional Investment Strategy and Risk Management

SUKU Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with medium to long-term investment horizons who believe in SUKU's supply chain and Web3 ecosystem vision

- Operational Recommendations:

- Accumulate SUKU tokens during market downturns, particularly when prices approach support levels

- Hold positions for 2-3 years or longer to capture potential ecosystem growth as adoption increases

- Reinvest any rewards or returns to compound your SUKU position over time

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action Analysis: SUKU has declined -87.64% over the past year (from historical highs of $1.51 to current levels around $0.0097), indicating strong downtrend momentum

- Volume Monitoring: Track the 24-hour trading volume of $12,645.36 to identify potential breakout opportunities and validate trend reversals

- Trading Operation Key Points:

- Identify support levels near the recent all-time low of $0.00955134 (established December 19, 2025)

- Monitor resistance at $0.010002 (24-hour high) for potential short-term bounce plays

- Exercise caution given the sustained downtrend and relatively thin trading volume

SUKU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Active Investors: 2-5% of total crypto portfolio

- Professional Investors: 5-10% of total crypto portfolio with structured risk controls

(2) Risk Hedging Solutions

- Position Sizing: Implement strict position sizing limits to ensure no single trade exceeds 2% of total capital

- Stop-Loss Orders: Set stop-loss orders at 10-15% below entry price to protect against rapid downside moves

(3) Secure Storage Solutions

- Exchange Storage: Use Gate.com for active trading positions, leveraging its institutional-grade security infrastructure

- Self-Custody Option: For long-term holdings, consider transferring SUKU tokens to Gate Web3 wallet for enhanced security and full asset control

- Security Considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange and wallet accounts; verify contract addresses before transactions

V. SUKU Potential Risks and Challenges

SUKU Market Risks

- Severe Price Decline: SUKU has experienced a -87.64% decline over one year and -31.89% over 30 days, reflecting significant market sell-off and loss of investor confidence

- Low Trading Volume: Daily volume of only $12,645.36 indicates limited liquidity, making it difficult to execute large positions without significant price slippage

- Concentrated Market Capitalization: With only $14.547 million in fully diluted valuation and circulating market cap of $5.262 million, SUKU remains a micro-cap token vulnerable to manipulation and rapid devaluation

SUKU Regulatory Risks

- Supply Chain Regulation Uncertainty: Regulatory frameworks governing blockchain-based supply chain solutions remain underdeveloped globally, potentially impacting SUKU's business model

- Token Classification Ambiguity: Depending on jurisdiction, SUKU tokens may face classification as securities, resulting in increased compliance burdens or trading restrictions

- International Compliance: Different countries have varying approaches to DeFi and token-based incentive systems, creating potential legal obstacles for cross-border operations

SUKU Technology Risks

- Smart Contract Vulnerabilities: Any exploits or bugs in SUKU's DeFi protocols could result in loss of funds or loss of confidence in the platform

- Scalability Challenges: Current Ethereum-based architecture may face congestion and high transaction costs, limiting adoption among the underbanked populations SUKU targets

- Integration Complexity: Successfully integrating SUKU tokens into existing supply chain infrastructure and enterprise systems remains technically challenging with uncertain timelines

VI. Conclusion and Action Recommendations

SUKU Investment Value Assessment

SUKU presents a high-risk, speculative investment opportunity focused on intersection of DeFi, supply chain digitalization, and financial inclusion. The project's team background from Deloitte's blockchain lab and enterprise partnerships demonstrate credibility, yet the severe 87.64% annual price decline reflects market skepticism regarding execution and adoption. The extremely low trading volume and micro-cap status make SUKU suitable only for risk-tolerant investors willing to accept potential total loss.

SUKU Investment Recommendations

✅ Beginners: Allocate no more than 0.5-1% of your crypto portfolio as a speculative position; consider starting with small, regular purchases during pronounced price declines rather than lump-sum investments

✅ Experienced Investors: Implement a disciplined accumulation strategy with predetermined entry points at technical support levels; use 2-3% portfolio allocation with strict stop-loss discipline at 15% below entry

✅ Institutional Investors: Conduct thorough due diligence on SUKU's enterprise partnerships and protocol adoption metrics; consider small pilot allocations with quarterly review of project milestones and market performance

SUKU Trading Participation Methods

- Via Gate.com Exchange: Trade SUKU directly on Gate.com's spot market, which supports this token across multiple trading pairs for liquidity management

- Gate.com Wallet Integration: Use Gate.com's wallet functionality to hold SUKU securely while maintaining accessibility for active trading

- Dollar-Cost Averaging: Execute periodic purchases over months or quarters rather than concentrated positions to mitigate timing risk in volatile markets

Cryptocurrency investment carries extreme risk. This report is not investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Is suku a good buy?

Based on current technical indicators, SUKU shows bearish signals in 2025. The price forecast remains negative, making it not an optimal buy opportunity at present. Consider waiting for stronger market conditions.

What is the future of suku?

SUKU is projected to reach ₹6.3051 by 2027 with a 10.25% growth rate. Strong fundamentals and increasing market adoption suggest promising long-term potential for the token.

What crypto will 1000x prediction?

DeepSnitch AI is predicted to deliver 1000x returns by 2026 through its AI agents scanning for high-potential cryptocurrencies. Pi Network and PUMP.fun also show strong 100x potential in the upcoming bull market.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

Timeframe Alignment Strategies for Beginner Traders | Essential Trading Guide

Top Bitcoin Mining Apps for Android & iOS in 2024

Guide to Selecting a Secure Cryptocurrency Wallet

How to buy DXN and store it securely

What is SIS: A Comprehensive Guide to Student Information Systems in Modern Education