2025 WHITE Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: WHITE's Market Position and Investment Value

WhiteRock (WHITE) is a real-world assets protocol designed to tokenize economic rights to traditional financial assets like stocks, bonds, property, options, and derivatives. As of December 2025, WHITE has achieved a market capitalization of $73,515,000 USD, with a circulating supply of approximately 650 billion tokens and a fully diluted valuation of $113,100,000 USD. The token is currently trading at approximately $0.0001131, representing a bridge between traditional finance and blockchain technology.

This innovative protocol, which empowers users to trade tokenized assets seamlessly while complying with global regulations, is playing an increasingly significant role in reshaping the landscape of decentralized finance and institutional asset tokenization.

This article will provide a comprehensive analysis of WHITE's price trajectory and market outlook, combining historical price movements, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to real-world assets tokenization opportunities.

WHITE Token Market Analysis Report

I. WHITE Price History Review and Current Market Status

WHITE Historical Price Evolution

-

May 29, 2025: WhiteRock protocol launched on Ethereum, reaching its all-time high of $0.0027701, reflecting strong initial market enthusiasm for the real-world assets tokenization platform.

-

December 3, 2025: Price declined to its all-time low of $0.0001002, representing a significant correction of approximately 96.4% from the peak, indicating substantial market pressure and investor sentiment shift.

-

December 18, 2025: Current price stabilized at $0.0001131, showing a marginal recovery of 12.9% from the recent low, though remaining 95.9% below the historical peak.

WHITE Current Market Position

As of December 18, 2025, WHITE token is trading at $0.0001131, with a 24-hour trading volume of $13,599.48. The token demonstrates a market capitalization of $73.515 million based on circulating supply of 650 billion tokens (65% of total supply), while the fully diluted valuation stands at $113.1 million.

Over the past 24 hours, WHITE has experienced a decline of 1.82%, reflecting broader market weakness. The one-hour performance shows a slight positive momentum of +0.09%, while the 7-day period reveals a 2.08% decrease. More significant pressure is evident over the 30-day window with a 16.72% depreciation, and the one-year performance indicates a severe 72.24% decline from launch.

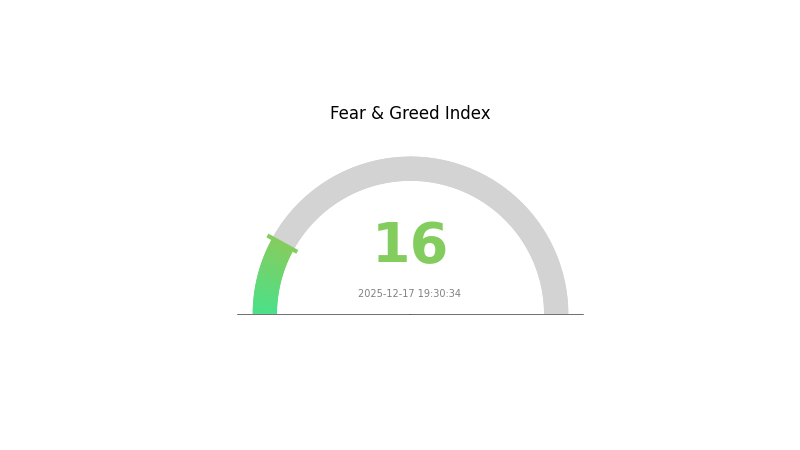

WhiteRock maintains a market ranking of 405 among cryptocurrencies with a market dominance of 0.0036%. The token is listed on 3 exchanges and has accumulated 24,559 token holders. Current market sentiment reflects extreme fear with a VIX reading of 16, indicating heightened risk aversion across the broader cryptocurrency market.

Visit WHITE Token Price on Gate.com for real-time market data.

WHITE Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 16, signaling significant investor pessimism and risk aversion. This exceptionally low level typically indicates capitulation in market sentiment, where fear overwhelms rational investment decision-making. During such periods, assets often reach attractive entry points for contrarian investors. However, extreme fear can persist longer than expected, so careful market analysis and risk management remain essential. Traders should monitor for potential market stabilization signals while maintaining disciplined portfolio strategies.

WHITE Holdings Distribution

The address holdings distribution represents a snapshot of how WHITE tokens are allocated across different wallet addresses on-chain, providing critical insights into token concentration, market structure, and potential risks associated with centralized ownership. This metric serves as a fundamental indicator for assessing the decentralization level and underlying stability of the token ecosystem.

WHITE demonstrates moderate concentration characteristics, with the top holder controlling 35.00% of total supply, which represents a significant concentration point. The top five addresses collectively hold 47.25% of all WHITE tokens, while the remaining 52.75% is dispersed among other addresses. This distribution pattern indicates a dual-layer structure: a concentrated upper tier dominated by a single major holder, followed by a relatively distributed secondary market. While single-holder dominance at 35% warrants attention, the fact that more than half the supply remains in dispersed hands suggests the token has not reached extreme centralization levels observed in certain emerging projects.

The current holdings configuration presents mixed implications for market dynamics. The substantial stake held by the top address creates potential liquidity risks and concentration-dependent price movement scenarios, particularly during large-scale redemptions or transfers. However, the meaningful dispersion among the remaining addresses—where the top five collectively represent less than half the supply—provides a structural safeguard against complete market manipulation. This balance suggests WHITE maintains a relatively resilient on-chain structure, though ongoing monitoring of major holder activities remains essential for understanding price volatility and medium-term market direction.

Click to view current WHITE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7c6c...37d4e0 | 350000000.00K | 35.00% |

| 2 | 0x8bcc...3f585a | 34100318.29K | 3.41% |

| 3 | 0xe9c3...8decdd | 33730150.06K | 3.37% |

| 4 | 0x5fb7...aab294 | 30534826.30K | 3.05% |

| 5 | 0xc4d2...152f43 | 24219845.65K | 2.42% |

| - | Others | 527414859.70K | 52.75% |

II. Core Factors Influencing WHITE's Future Price

Supply Mechanism

- Fixed Supply: WHITE has a constant total supply. As demand increases, a scarcity effect may emerge, which could help push prices higher.

- Historical Pattern: Cryptocurrencies with fixed supply mechanisms have historically experienced appreciation driven by scarcity dynamics.

- Current Impact: With a fixed supply, any increase in market demand is expected to create upward pressure on WHITE's price.

Macroeconomic Environment

- Monetary Policy Impact: Major central banks are expected to maintain accommodative policies, which is conducive to global economic recovery and typically benefits risk assets like cryptocurrencies.

- Anti-Inflation Characteristics: WHITE demonstrates inflation-hedging potential during periods of rising global inflationary pressures, similar to other scarce digital assets.

III. 2025-2030 WHITE Price Forecast

2025 Outlook

- Conservative Forecast: $0.00011

- Neutral Forecast: $0.00011

- Optimistic Forecast: $0.00017 (requires increased institutional adoption and market sentiment improvement)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with steady token utility expansion

- Price Range Forecast:

- 2026: $0.00008 - $0.00019 (24% potential upside)

- 2027: $0.0001 - $0.00023 (46% potential upside)

- 2028: $0.00015 - $0.00028 (76% potential upside)

- Key Catalysts: Ecosystem development maturation, strategic partnerships, increased trading volume on platforms like Gate.com, and broader market recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00015 - $0.00028 (sustained moderate growth through 2029 with 114% cumulative gains)

- Optimistic Scenario: $0.00021 - $0.00032 (strong ecosystem adoption and positive macroeconomic conditions drive 131% appreciation by 2030)

- Transformative Scenario: $0.00032+ (contingent on major protocol upgrades, significant institutional inflows, and breakthrough network effects)

Note: These forecasts are based on historical data analysis and current market conditions as of December 18, 2025. Actual price movements may vary significantly based on regulatory changes, market volatility, and unforeseen macroeconomic factors.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00017 | 0.00011 | 0.00011 | 0 |

| 2026 | 0.00019 | 0.00014 | 0.00008 | 24 |

| 2027 | 0.00023 | 0.00017 | 0.0001 | 46 |

| 2028 | 0.00028 | 0.0002 | 0.00015 | 76 |

| 2029 | 0.00028 | 0.00024 | 0.00015 | 114 |

| 2030 | 0.00032 | 0.00026 | 0.00021 | 131 |

WhiteRock (WHITE) Professional Investment Strategy and Risk Management Report

IV. WHITE Professional Investment Strategy and Risk Management

WHITE Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors and individuals seeking exposure to tokenized real-world assets, particularly those believing in the long-term adoption of blockchain-based financial infrastructure.

- Operational Recommendations:

- Establish a dollar-cost averaging (DCA) approach to accumulate WHITE tokens over extended periods, mitigating short-term volatility concerns.

- Hold positions through multiple market cycles to capture the potential appreciation as the real-world assets protocol ecosystem matures.

- Regularly review project milestones and protocol developments to ensure alignment with investment thesis.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor momentum shifts and potential trend reversals around key support and resistance levels.

- Relative Strength Index (RSI): Identify overbought conditions above 70 and oversold conditions below 30 for optimal entry and exit points.

- Wave Trading Key Points:

- Capitalize on the 24-hour volatility range of $0.0001092 to $0.0001188, setting limit orders at technical support levels.

- Monitor volume patterns during price movements to confirm trend strength before initiating positions.

WHITE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Active Investors: 2-5% of total crypto portfolio allocation

- Professional Investors: 5-10% of total crypto portfolio allocation, with hedging strategies implemented

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance WHITE holdings with established cryptocurrencies and stablecoins to reduce concentration risk.

- Profit-Taking Strategy: Lock in gains at predetermined price targets (e.g., 20-30% gains) to secure returns amid market uncertainty.

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for convenient trading and active portfolio management with built-in security features.

- Cold Storage Option: Transfer significant WHITE holdings to offline storage solutions for long-term security and protection against exchange counterparty risk.

- Security Precautions: Enable two-factor authentication on all exchange accounts, use hardware-backed key management, never share private keys, and regularly verify contract addresses before token transactions.

V. WHITE Potential Risks and Challenges

WHITE Market Risk

- High Volatility: WHITE has experienced a 72.24% decline over the past year and a 16.72% decline in the last 30 days, indicating significant price instability unsuitable for risk-averse investors.

- Liquidity Constraints: With 24-hour trading volume of only $13,599.48, WHITE exhibits low liquidity, potentially resulting in slippage on larger trades and difficulty exiting positions.

- Market Capitalization Concentration: At a $73.5 million market cap ranking 405th, WHITE maintains a marginal 0.0036% market dominance, vulnerable to sudden capital outflows.

WHITE Regulatory Risk

- RWA Protocol Regulatory Uncertainty: Real-world assets protocols face evolving regulatory frameworks globally, with potential restrictions on tokenized securities and derivatives trading.

- Jurisdictional Compliance: Operating across multiple regulatory environments creates complexity in maintaining compliance with securities laws, particularly regarding tokenized stocks and bonds.

- Potential Enforcement Actions: Regulators may target RWA platforms if deemed to offer unregistered securities, posing existential risks to the protocol.

WHITE Technical Risk

- Smart Contract Vulnerabilities: ERC-20 token deployment on Ethereum exposes the protocol to potential smart contract exploits and security breaches.

- Cross-Chain Integration Risk: Expansion to multiple blockchain networks increases technical complexity and introduces new attack vectors.

- Scalability Challenges: As transaction volumes increase, network congestion may impact the protocol's ability to efficiently process tokenized asset transfers.

VI. Conclusion and Action Recommendations

WHITE Investment Value Assessment

WhiteRock addresses a substantial market opportunity in tokenizing real-world assets by bridging traditional finance with blockchain infrastructure. The protocol's focus on regulatory compliance and transparency positions it competitively within the emerging RWA sector. However, current market dynamics reveal significant challenges: the 72.24% annual decline reflects either market skepticism regarding the RWA thesis or broader sector headwinds. The low trading volume and marginal market position suggest limited institutional adoption to date. Investors should carefully evaluate whether they possess conviction in the long-term viability of tokenized traditional assets before committing capital. The protocol remains in early adoption phases, making it a speculative investment vehicle rather than an established infrastructure play.

WHITE Investment Recommendations

✅ Beginners: Start with micro-allocations (0.1-0.5% of crypto portfolio) through Gate.com's spot trading platform. Focus on understanding the RWA thesis before deploying significant capital. Use limit orders to control entry prices and minimize slippage given low liquidity.

✅ Experienced Investors: Implement a layered accumulation strategy using technical analysis to identify support levels. Allocate 1-3% of crypto holdings, employing stop-loss orders at 15-20% below entry points. Monitor protocol governance updates and competitive developments in the RWA space.

✅ Institutional Investors: Conduct comprehensive due diligence on WhiteRock's regulatory compliance framework and tokenization mechanisms. Consider position sizing of 3-5% maximum with dedicated risk management protocols. Engage directly with the protocol team to understand roadmap and institutional partnerships.

WHITE Trading Participation Methods

- Gate.com Spot Trading: Execute buy and sell orders directly through Gate.com's trading interface with real-time price discovery and order book depth visibility.

- Limit Order Strategy: Place conditional orders at predetermined price levels to accumulate positions during downturns or take profits during rallies, minimizing emotional decision-making.

- Diversified Entry Points: Spread purchases across multiple price levels and timeframes rather than executing single large transactions, reducing market impact and average acquisition cost.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Professional financial consultation is strongly recommended. Never invest more capital than you can afford to lose completely.

FAQ

What is the price of white Bitcoin in 2030?

Based on current market analysis and trends, WHITE token price in 2030 is projected to range between $58.32 and $112.79, depending on market conditions and adoption rates.

What is the price prediction for Whitecap stock?

Whitecap stock is predicted to reach up to 8.321 USD in the short term, with gradual increases expected through 2029. Forecasts suggest the stock will close at approximately 9.388 USD by May 2029.

Does White Rock have a future?

Yes. WhiteRock offers licensed tokenized assets trading from major exchanges with 24/7 capability, positioning it as a future-oriented financial platform with strong growth potential in decentralized finance.

What is the prediction for WhiteRock token?

WhiteRock token is predicted to reach a maximum price of $0.0003324 by 2030, representing a potential 172.70% increase from current levels based on market analysis and trend forecasts.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Recall (RECALL) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects in the Digital Asset Space

Is Pieverse (PIEVERSE) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Is Loopring (LRC) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Risk Factors for 2024

FRAX vs MANA: A Comprehensive Comparison of Two Leading Crypto Tokens in the DeFi and Metaverse Ecosystems

Is Waves (WAVES) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Risk Factors