2025 XVS Price Prediction: Expert Analysis and Market Outlook for Venus Token in the Coming Year

Introduction: Market Position and Investment Value of XVS

Venus (XVS), a decentralized finance lending and stablecoin issuance platform built on the Binance Smart Chain (BSC), has established itself as a key infrastructure protocol since its launch in 2020. Over the past years, Venus has successfully built a comprehensive DeFi lending market on BSC while enabling the issuance of synthetic stablecoin assets through various BEP-20 collateral mechanisms. As of December 2025, XVS has achieved a market capitalization of approximately $73.41 million, with a circulating supply of around 16.75 million tokens, currently trading at $4.38. This governance token plays an increasingly vital role in shaping the platform's evolution through community participation in protocol upgrades, collateral additions, and parameter adjustments.

This article provides a comprehensive analysis of XVS price trends and market dynamics, examining historical performance patterns, supply-demand fundamentals, ecosystem development, and macroeconomic factors. By synthesizing these analytical dimensions, we deliver professional price forecasts and actionable investment strategies to guide your decision-making in the digital asset market.

Venus (XVS) Market Analysis Report

I. XVS Price History Review and Current Market Status

XVS Historical Price Evolution Trajectory

- October 2020: Venus protocol launch on BSC, initial price at $4.00

- May 2021: All-time high of $146.82 reached, representing a 3,570% gain from launch price

- October 2020 to Present: Price declined from peak to current levels, reflecting broader market cycles and protocol maturation phases

XVS Current Market Status

As of December 18, 2025, XVS is trading at $4.382, showing a -4.81% decline over the past 24 hours. The token demonstrates the following market characteristics:

Price Performance Metrics:

- 1-hour change: -1.53%

- 7-day change: -10.52%

- 30-day change: +5.50%

- 1-year change: -60.23%

- 24-hour trading range: $4.361 - $4.62

Market Capitalization Data:

- Current market cap: $73,412,099.82

- Fully diluted valuation: $130,343,063.19

- Market dominance: 0.0042%

- Current market ranking: #406

Supply Metrics:

- Circulating supply: 16,753,103.56 XVS (55.84% of total)

- Total supply: 29,745,107.99 XVS

- Maximum supply: 30,000,000 XVS

- Total holders: 78,212

Trading Activity:

- 24-hour trading volume: $141,671.34

- Listed on 21 exchanges

- Actively traded on Gate.com

The market sentiment indicator shows "Extreme Fear" (VIX level: 16) as of December 17, 2025, reflecting heightened market volatility and risk-off sentiment across the broader cryptocurrency landscape.

View current XVS market price

XVS 市场情绪指标

2025-12-17 恐惧与贪婪指数:16(Extreme Fear)

Click to view current Fear & Greed Index

The market is currently experiencing extreme fear, with the index at 16, indicating a significantly risk-averse sentiment among investors. This level of panic typically presents potential opportunities for contrarian investors, as assets may be oversold. During such periods, it's advisable to conduct thorough research and consider long-term investment strategies on Gate.com. Market volatility is elevated, so position sizing and risk management are essential. Monitor price action closely as extreme fear often precedes market reversals.

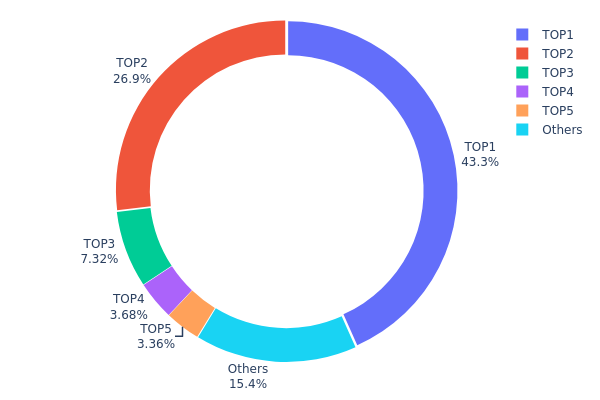

XVS Holdings Distribution

The address holdings distribution chart illustrates the concentration of XVS tokens across different wallet addresses on the blockchain. By analyzing the top holders and their respective proportions, we can assess the level of token centralization, identify potential risks associated with large holder positions, and evaluate the overall health and decentralization status of the network.

Current analysis of XVS token distribution reveals a pronounced concentration pattern. The top two addresses control 70.22% of the total supply, with the leading address alone holding 43.30%. This significant concentration in the hands of a limited number of entities raises concerns about potential market manipulation risks and the vulnerability of the token to sudden large-scale liquidations. The subsequent three addresses (ranked 3-5) collectively hold an additional 14.33%, meaning the top five addresses account for approximately 84.55% of all XVS tokens. Such distribution is notably imbalanced compared to more decentralized token structures, indicating a high degree of centralization.

The current address distribution pattern suggests potential vulnerabilities in XVS market structure. With such concentrated holdings among top addresses, the token faces elevated risks of price volatility should any major holder decide to rebalance or liquidate their position. Additionally, the remaining 15.45% distributed among other addresses demonstrates limited participation from smaller retail holders, which may constrain organic liquidity and market depth. From a decentralization perspective, XVS exhibits characteristics typical of tokens in early distribution phases or those with significant allocations to core development teams and strategic investors. This structure, while not uncommon for protocol tokens, warrants monitoring to track whether token distribution becomes more dispersed over time through ecosystem growth and community participation.

Click to view current XVS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfd36...158384 | 12992.09K | 43.30% |

| 2 | 0x0511...3f9204 | 8076.44K | 26.92% |

| 3 | 0x5a52...70efcb | 2194.92K | 7.31% |

| 4 | 0xf977...41acec | 1102.85K | 3.67% |

| 5 | 0x151b...fe3e1d | 1007.42K | 3.35% |

| - | Others | 4626.29K | 15.45% |

II. Core Factors Affecting XVS Future Price

Supply Mechanism

- Market Sentiment: Investor confidence and sentiment directly drive XVS price fluctuations. The amplitude of price movements is significantly influenced by the psychological state of market participants.

- Historical Patterns: XVS price is highly dependent on market sentiment and Venus Protocol developments. Price movements have historically correlated strongly with shifts in investor confidence and protocol-related announcements.

- Current Impact: Ongoing market sentiment regarding Venus Protocol adoption and technological progress continues to serve as a primary driver of XVS valuation.

III. XVS Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $4.16-$4.38

- Neutral Forecast: $4.38-$5.20

- Bullish Forecast: $6.43 (contingent on positive ecosystem developments)

Mid-term Outlook (2026-2028)

- Market Stage Expectations: Potential consolidation phase with gradual recovery and accumulation opportunities as the protocol strengthens its market position and utility expansion.

- Price Range Predictions:

- 2026: $5.13-$5.94

- 2027: $3.29-$6.30

- 2028: $3.89-$6.88

- Key Catalysts: Expansion of Venus Protocol adoption, DeFi ecosystem growth, strategic partnerships, enhancement of yield farming mechanisms, and integration with emerging blockchain infrastructure.

Long-term Outlook (2029-2030)

- Base Case Scenario: $4.89-$7.14 by 2029 (assuming steady protocol adoption and moderate market growth)

- Optimistic Scenario: $5.43-$7.94 by 2030 (contingent on successful ecosystem expansion and increased institutional interest in decentralized finance platforms)

- Transformational Scenario: $7.94+ (under conditions of widespread DeFi mainstream adoption, significant Venus Protocol market share gains, and favorable regulatory environment for crypto assets)

- 2025-12-18: XVS trading near mid-range levels with potential for directional movement based on broader market dynamics and protocol-specific developments on platforms such as Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 6.43272 | 4.376 | 4.1572 | 0 |

| 2026 | 5.9448 | 5.40436 | 5.13414 | 23 |

| 2027 | 6.29878 | 5.67458 | 3.29126 | 29 |

| 2028 | 6.88468 | 5.98668 | 3.89134 | 36 |

| 2029 | 7.14361 | 6.43568 | 4.89112 | 46 |

| 2030 | 7.94388 | 6.78964 | 5.43171 | 54 |

Venus (XVS) Professional Investment Strategy and Risk Management Report

IV. XVS Professional Investment Strategy and Risk Management

XVS Investment Methodology

(1) Long-term Holding Strategy

- Suitable For: DeFi protocol believers and passive income seekers who understand blockchain lending mechanisms

- Operational Recommendations:

- Accumulate XVS during market downturns when volatility exceeds historical averages, particularly given the -60.23% year-over-year decline

- Hold through governance cycles to participate in protocol decision-making and benefit from potential recovery phases

- Reinvest governance rewards to compound returns over extended periods

(2) Active Trading Strategy

- Technical Analysis Approach:

- Price volatility tracking: Monitor the 24-hour range ($4.361 - $4.62) against the historical peak of $146.82 (May 2021) to identify capitulation levels

- Volume analysis: Track the $141,671 daily volume against historical trading patterns to identify breakout opportunities

- Wave Trading Key Points:

- Entry opportunities: Consider positions when price rebounds from support levels established after recent -4.81% daily decline

- Exit signals: Take profits when price shows +5-8% gains in single sessions, consistent with recent 30-day performance of +5.5%

XVS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio maximum

- Active Investors: 5-8% of portfolio allocation

- Professional Investors: 10-15% with structured hedging strategies

(2) Risk Hedging Solutions

- Protocol dependency mitigation: Diversify across multiple DeFi lending platforms to reduce concentrated exposure to Venus smart contract vulnerabilities

- Market correlation hedging: Maintain positions in other BSC ecosystem tokens to balance sector-specific risk

(3) Secure Storage Solutions

- Hardware Wallet Recommendation: Use cold storage solutions for holdings exceeding 30-day trading volumes

- Exchange Storage: Gate.com offers professional custody solutions for active traders requiring regular access

- Security Best Practices: Enable two-factor authentication, use hardware wallets for holdings exceeding $10,000 equivalent, never share private keys or seed phrases, and verify contract addresses on official channels before transactions

V. XVS Potential Risks and Challenges

XVS Market Risk

- Price volatility exposure: XVS has declined 60.23% year-over-year with only 55.84% of maximum supply in circulation, indicating potential dilution risks from remaining 44.16% of tokens

- Low market liquidity relative to market cap: With only $141,671 in 24-hour volume against $130.3 million fully diluted valuation, large positions face significant slippage

- Market dominance concentration: At 0.0042% of total cryptocurrency market cap, XVS remains highly vulnerable to broader market sentiment shifts

XVS Regulatory Risk

- BSC ecosystem regulatory uncertainty: Regulatory actions targeting Binance Smart Chain or its primary sponsors could directly impact Venus protocol viability

- DeFi lending regulation: Increasing global scrutiny of decentralized lending protocols may impose compliance requirements affecting protocol operations

- Stablecoin governance risk: Venus's stablecoin issuance functionality faces evolving regulatory frameworks across multiple jurisdictions

XVS Technical Risk

- Smart contract vulnerability exposure: Lending protocols inherently carry code audit risks; any discovery of exploits could trigger significant value destruction

- Protocol scalability limitations: As BSC network congestion increases, Venus may face transaction cost pressures and performance degradation

- Collateral liquidation cascade risk: During extreme market volatility, borrower liquidations could create cascading failures affecting protocol solvency

VI. Conclusion and Action Recommendations

XVS Investment Value Assessment

Venus (XVS) represents a specialized DeFi protocol play on the BSC ecosystem. With governance token utility centered on protocol administration rather than direct revenue capture, XVS value depends critically on Venus's competitive positioning in the crowded lending market. The token's -60.23% year-over-year performance reflects broader DeFi protocol challenges, reduced leverage trading activity, and competitive pressures from alternative platforms. The current price of $4.382 represents a 97% decline from historical highs, suggesting either significant undervaluation or continued downward price discovery. Investment decisions should weigh genuine protocol advancement and adoption metrics against speculation on potential recoveries.

XVS Investment Recommendations

✅ Beginners: Start with minimal allocations (under 1% of portfolio) on Gate.com, focus on understanding governance mechanisms before accumulating, and never use leverage or borrowed capital for DeFi protocol tokens

✅ Experienced Investors: Implement systematic dollar-cost averaging strategies during confirmed support levels, actively participate in governance voting to understand protocol trajectory, and maintain strict position sizing limits

✅ Institutional Investors: Conduct comprehensive technical audits of Venus smart contracts through independent security firms, structure positions with formal risk management frameworks, and diversify across multiple BSC DeFi protocols to reduce concentration risk

XVS Trading Participation Methods

- Spot Trading: Execute XVS trading pairs against USDT or BUSD on Gate.com with real-time price discovery and professional order management tools

- Governance Participation: Stake XVS tokens to vote on protocol parameters, collateral additions, and platform upgrades to influence Venus development direction

- DeFi Protocol Interaction: Deposit XVS into Venus protocol itself to earn governance rewards while participating in lending market dynamics

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely. DeFi protocols carry additional smart contract risks beyond standard market volatility.

FAQ

What is XVS crypto?

XVS is the native token of the Venus protocol on Binance Smart Chain, enabling decentralized lending, borrowing, and financial services. XVS holders can stake tokens to earn rewards and participate in governance decisions that shape the protocol's future development.

How much is XVS to USD?

As of today, XVS is priced at $4.14 per unit in USD. The price fluctuates based on market conditions. Five XVS equals $20.72, and $50.00 converts to approximately 12.07 XVS.

Is XVG a good investment?

XVG shows promising potential for long-term growth. With its solid project fundamentals and strategic partnerships, it's viewed favorably by many investors. Current market momentum suggests continued upward trajectory for XVG.

Which coin will reach 1 rupee prediction?

Shiba Inu is predicted to reach 1 rupee by the end of 2030 based on current market trends and analysis. This projection reflects potential growth momentum in the cryptocurrency market during this period.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Recall (RECALL) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects in the Digital Asset Space

Is Pieverse (PIEVERSE) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Is Loopring (LRC) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Risk Factors for 2024

FRAX vs MANA: A Comprehensive Comparison of Two Leading Crypto Tokens in the DeFi and Metaverse Ecosystems

Is Waves (WAVES) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Risk Factors