2026 ECHO Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: ECHO's Market Position and Investment Value

Echo (ECHO), as a Bitcoin staking and liquidity infrastructure protocol built on the Move framework, has been establishing its presence in the crypto ecosystem since its launch in 2025. As of February 3, 2026, ECHO maintains a market capitalization of approximately $1.36 million, with a circulating supply of 208 million tokens, and trades at around $0.006529. This innovative protocol, serving both institutional partners and individual BTC holders, is playing an increasingly important role in enhancing Bitcoin asset liquidity through its restaking solutions.

Currently ranked #2320 in the cryptocurrency market with a market dominance of 0.00023%, ECHO operates on the Aptos blockchain and has attracted over 35,000 holders. Despite experiencing a 51.76% decline over the past 30 days and trading significantly below its all-time high of $0.07526 recorded in July 2025, the token has shown recent signs of recovery with an 11.73% increase in the past 24 hours. With a fully diluted valuation of $6.53 million and only 20.8% of its maximum supply currently in circulation, ECHO presents a unique investment opportunity within the Bitcoin DeFi ecosystem.

This article will comprehensively analyze ECHO's price trajectory from 2026 through 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ECHO Price History Review and Market Status

ECHO Historical Price Evolution Trajectory

- 2025: Echo Protocol launched on Gate.com in July 2025, reaching an all-time high of $0.07526 on July 9, 2025, demonstrating initial market enthusiasm for the Bitcoin staking and liquidity infrastructure project.

- 2025-2026: The token experienced significant price volatility, declining by 78.59% from its historical peak over the following months.

- 2026: On February 2, 2026, ECHO recorded its all-time low of $0.005544, reflecting broader market pressures and declining sentiment in the crypto asset space.

ECHO Current Market Situation

As of February 3, 2026, ECHO is trading at $0.006529, showing a 24-hour increase of 11.73%. The token's recent price movement indicates some recovery momentum, with a 1-hour gain of 2.37%, though it remains down 6.97% over the past week.

The current market capitalization stands at approximately $1.36 million, with a circulating supply of 208 million ECHO tokens representing 20.8% of the maximum supply of 1 billion tokens. The fully diluted market cap is calculated at $6.53 million. Daily trading volume reaches $54,903.63, suggesting moderate market liquidity.

ECHO maintains a market dominance of 0.00023% and is currently listed on 4 exchanges, with Gate.com being the primary trading venue. The token holder base has grown to 35,364 addresses, indicating expanding community participation in the Echo Protocol ecosystem.

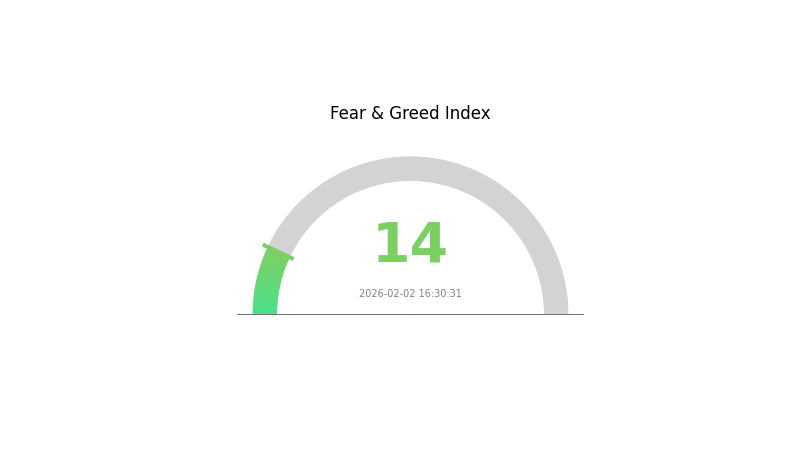

The broader cryptocurrency market sentiment, as measured by the fear and greed index, shows extreme fear at a reading of 14, which may be influencing ECHO's price performance alongside other digital assets in the current market environment.

Click to view current ECHO market price

ECHO Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index standing at just 14. This exceptionally low reading indicates widespread investor panic and pessimism across the digital asset space. Market participants are showing heightened risk aversion, with potential sell-offs and defensive positioning dominating trading activity. Such extreme fear conditions historically present contrarian opportunities for long-term investors, as markets tend to overreact during panic episodes. However, caution remains warranted as further downside risk cannot be ruled out. Traders should monitor key support levels and market fundamentals closely before making investment decisions in these volatile conditions.

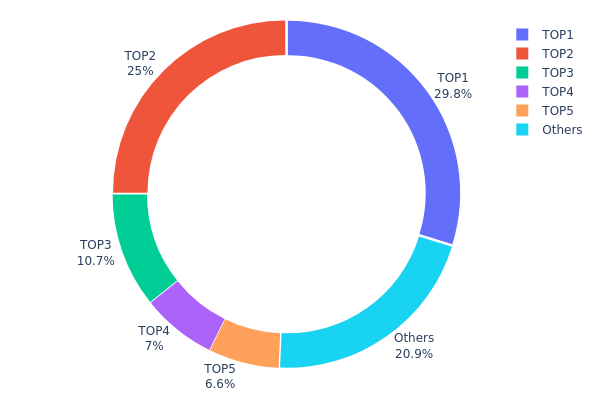

ECHO Holdings Distribution

The holdings distribution chart illustrates the concentration of ECHO tokens across different wallet addresses, revealing how token ownership is distributed among various holders. This metric serves as a critical indicator of decentralization and potential market manipulation risks, as highly concentrated holdings can lead to increased price volatility and centralized control.

Based on the current data, ECHO demonstrates a notably concentrated distribution pattern. The top holder controls 298,139.42K tokens (29.81%), while the second-largest address holds 250,024.71K tokens (25.00%). Combined, the top two addresses account for 54.81% of the total supply, representing a significant concentration of ownership. The top five addresses collectively control 79.12% of all ECHO tokens, with the remaining 20.88% distributed among other holders. This distribution structure suggests a centralization risk that could impact market dynamics.

Such concentrated holdings create potential vulnerabilities in market structure. Large holders possess substantial influence over price movements, as significant sell-offs could trigger cascading liquidations or panic selling. Additionally, coordinated actions among top holders could potentially manipulate market sentiment and price discovery mechanisms. The relatively small portion held by dispersed addresses (20.88%) indicates limited retail participation and weak decentralization, which may affect long-term project sustainability and community governance effectiveness. Investors should remain vigilant regarding potential whale movements and their impact on ECHO's price stability.

Click to view current ECHO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x12b7...c13cdf | 298139.42K | 29.81% |

| 2 | 0x2bd1...cb19e9 | 250024.71K | 25.00% |

| 3 | 0x4d59...f57fd5 | 107133.69K | 10.71% |

| 4 | 0xc9db...d3246b | 70000.00K | 7.00% |

| 5 | 0x57de...ed04c1 | 66000.00K | 6.60% |

| - | Others | 208702.18K | 20.88% |

II. Core Factors Influencing ECHO's Future Price

Supply Mechanism

-

Market Demand and Adoption Trends: ECHO's price trajectory is fundamentally shaped by evolving market demand and adoption patterns. As institutional participation expands and broader economic factors come into play, the token's value proposition becomes increasingly tied to real-world utility and ecosystem development.

-

Historical Patterns: Historical analysis reveals that ECHO's price movements correlate strongly with supply-demand dynamics and ecosystem maturation cycles. Past performance has demonstrated sensitivity to macroeconomic shifts and market sentiment cycles.

-

Current Impact: The token's supply structure continues to influence price discovery mechanisms, with market forces responding to changes in circulating supply and liquidity conditions across trading venues.

Institutional and Major Holder Dynamics

-

Strategic Acquisitions: Recent industry developments highlight ECHO's positioning within institutional frameworks. The platform has attracted attention as a tool for on-chain compliant fundraising, facilitating capital allocation within blockchain ecosystems. This institutional interest reflects growing recognition of ECHO's infrastructure capabilities.

-

Ecosystem Integration: ECHO's technology supports end-to-end solutions for token issuance and management, positioning it within broader capital market digitization trends. The platform's modular components enable infrastructure development that extends beyond crypto-native applications.

-

Market Positioning: The protocol's role in structured investment frameworks represents a shift from speculative trading toward more formalized capital formation mechanisms. This evolution reflects maturation in how digital assets are deployed within investment strategies.

Macroeconomic Environment

-

Economic Variables: ECHO's valuation remains influenced by macroeconomic factors including monetary policy trajectories, inflation dynamics, and global liquidity conditions. These broader financial market forces create backdrop conditions affecting crypto asset pricing.

-

Market Cycles: Price forecasts incorporate considerations of business cycle positioning and risk appetite trends across financial markets. Economic expansion or contraction phases influence capital flows into digital asset categories.

-

Regulatory Landscape: Evolving regulatory frameworks continue shaping market structure and institutional participation parameters. Compliance infrastructure development affects how traditional finance interfaces with crypto markets.

Technology Development and Ecosystem Building

-

On-Chain Infrastructure: The transition from off-chain to on-chain operations represents a fundamental development theme. Enhanced blockchain infrastructure enables more flexible asset portability and simplified market creation processes.

-

Platform Evolution: Technology enhancements focus on improving capital market functionality through blockchain-native solutions. These developments support tokenization initiatives and digital asset lifecycle management.

-

Ecosystem Applications: ECHO's integration within various DeFi protocols and investment platforms demonstrates practical utility beyond speculative trading. Real-world applications in structured products and compliant fundraising mechanisms contribute to value proposition expansion.

III. 2026-2031 ECHO Price Prediction

2026 Outlook

- Conservative Forecast: $0.00503 - $0.00653

- Neutral Forecast: $0.00653 average price level

- Optimistic Forecast: $0.00849 (contingent on favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Phase Expectation: The token is projected to enter a gradual growth phase, with price appreciation driven by ecosystem development and broader market sentiment

- Price Range Projections:

- 2027: $0.0039 - $0.01119, representing a potential 14% increase

- 2028: $0.00533 - $0.00963, with a projected 43% growth

- 2029: $0.00674 - $0.01214, potentially achieving a 45% increase

- Key Catalysts: Market maturation, technological enhancements, and expanding user base could serve as primary drivers for price appreciation during this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.01027 - $0.01081 (assuming steady market conditions and consistent project development)

- Optimistic Scenario: $0.01557 (contingent on strong market momentum and successful ecosystem expansion, representing a potential 65% increase by 2030)

- Extended Growth Scenario: $0.01319 - $0.01359 by 2031 (under conditions of sustained adoption and favorable regulatory environment, potentially achieving a 102% increase)

- February 3, 2026: ECHO trading within $0.00503 - $0.00849 range (initial phase of the forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00849 | 0.00653 | 0.00503 | 0 |

| 2027 | 0.01119 | 0.00751 | 0.0039 | 14 |

| 2028 | 0.00963 | 0.00935 | 0.00533 | 43 |

| 2029 | 0.01214 | 0.00949 | 0.00674 | 45 |

| 2030 | 0.01557 | 0.01081 | 0.01027 | 65 |

| 2031 | 0.01359 | 0.01319 | 0.00831 | 102 |

IV. ECHO Professional Investment Strategies and Risk Management

ECHO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Bitcoin Layer 2 infrastructure and liquidity solutions with a focus on the Move ecosystem

- Operational Recommendations:

- Consider accumulating positions during market corrections, particularly when 24-hour volatility exceeds typical ranges

- Monitor project development milestones and partnerships within the Bitcoin restaking space

- Utilize Gate Web3 Wallet for secure storage of ECHO tokens on the Aptos network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor daily trading volumes (currently around 54,903 USDT) for liquidity assessment and entry/exit timing

- Support and Resistance Levels: Track the recent low at 0.005544 USDT and resistance near 0.006525 USDT for short-term trading opportunities

- Swing Trading Considerations:

- Be aware of significant price volatility, with 30-day changes showing substantial fluctuations

- Set stop-loss orders to manage downside risk given the token's historical price movements

ECHO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-10% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance ECHO holdings with established Bitcoin-related assets and stablecoins

- Position Sizing: Avoid over-concentration given the token's relatively low market cap and limited exchange listings

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation on Aptos network

- Cold Storage Option: Consider hardware wallet solutions compatible with Aptos-based tokens for long-term holdings

- Security Precautions: Always verify contract address (0xb2c7780f0a255a6137e5b39733f5a4c85fe093c549de5c359c1232deef57d1b7) before transactions, enable two-factor authentication, and never share private keys

V. ECHO Potential Risks and Challenges

ECHO Market Risks

- Liquidity Constraints: With a circulating market cap of approximately 1.36 million USDT and limited exchange availability, ECHO may experience significant price slippage during large trades

- High Volatility: Historical data shows substantial price fluctuations, including a 51.76% decline over 30 days, indicating elevated market risk

- Competitive Landscape: The Bitcoin restaking and liquidity infrastructure space faces competition from multiple projects, which may impact ECHO's market position

ECHO Regulatory Risks

- Restaking Classification: Evolving regulatory frameworks around staking and restaking mechanisms may impact ECHO's operational model

- Cross-chain Compliance: As a Bitcoin-related infrastructure project, regulatory developments affecting Bitcoin Layer 2 solutions could influence ECHO's adoption

- Jurisdictional Uncertainties: Global regulatory approaches to DeFi liquidity protocols remain in flux, potentially affecting project operations

ECHO Technical Risks

- Smart Contract Vulnerabilities: As with any blockchain protocol, smart contract bugs or exploits could pose security risks to user funds

- Network Dependencies: ECHO's reliance on the Aptos blockchain means any issues with the underlying network could impact protocol functionality

- Integration Complexity: The protocol's focus on Bitcoin asset integration introduces technical challenges related to cross-chain operations and security

VI. Conclusion and Action Recommendations

ECHO Investment Value Assessment

ECHO Protocol presents an opportunity within the emerging Bitcoin restaking and liquidity infrastructure sector, leveraging the Move programming language on Aptos. The project addresses growing demand for Bitcoin asset utilization and yield generation. However, investors should carefully weigh the early-stage nature of the project, reflected in its limited market cap, recent price volatility, and relatively small holder base of 35,364. The token's circulation of only 20.8% of total supply suggests potential future supply expansion considerations.

ECHO Investment Recommendations

✅ Beginners: Approach with caution due to high volatility and limited liquidity; consider starting with minimal allocation and thoroughly research the Bitcoin restaking concept before investing

✅ Experienced Investors: May consider speculative positions sized appropriately within a diversified crypto portfolio, focusing on project development milestones and market adoption metrics

✅ Institutional Investors: Conduct comprehensive due diligence on protocol mechanics, team background, and competitive positioning before considering strategic allocations

ECHO Trading Participation Methods

- Spot Trading: Access ECHO through Gate.com and other supporting exchanges with proper risk management protocols

- Staking Participation: Explore protocol staking opportunities for Bitcoin-related assets through official Echo Protocol channels

- Liquidity Provision: Monitor opportunities for providing liquidity within the Echo ecosystem as the protocol develops

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of ECHO token? What are its all-time high and all-time low prices?

ECHO token's all-time high price reached 0.08. The current price and all-time low price details are not fully disclosed. ECHO has declined significantly from its historical peak, presenting potential opportunity for recovery in the market.

What are the main factors affecting ECHO price predictions?

ECHO price predictions are primarily influenced by supply-demand dynamics, market sentiment driven by news and social media, regulatory developments including policy changes, and overall investor confidence in the ecosystem.

How to analyze ECHO token's future price trends? What are the prediction methods?

Analyze ECHO's price through technical analysis of historical trends and fundamental analysis of market supply-demand dynamics. Combine on-chain metrics, trading volume, ecosystem development, and macroeconomic factors. Use chart patterns and price forecasting models for trend prediction.

What is the circulating supply and total supply of ECHO tokens? How does this affect the price?

ECHO has a total supply of 1,000,000,000 tokens. Limited circulating supply creates scarcity, driving upward price pressure. As adoption grows and circulating supply increases gradually, price appreciation potential strengthens through supply constraints and rising demand dynamics.

What are the main risks of investing in ECHO tokens? Is price volatility high?

ECHO tokens carry market volatility and price manipulation risks. The token experiences significant price fluctuations due to market uncertainty and regulatory factors. Investors should monitor market conditions closely for potential price swings.

What are the advantages of ECHO token compared to similar tokens?

ECHO token stands out with its streamlined approach: no complex whitepaper, no formal announcements, just a simple platform for early-stage projects to raise funds from investors. This direct, efficient model reduces complexity while enabling rapid project financing and investor participation in emerging opportunities.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What Moves Intel Stock and Why It Matters

PUSH vs HBAR: Which Blockchain Platform Offers Better Performance and Scalability in 2024?

HTM vs GRT: A Comprehensive Comparison of Hierarchical Temporal Memory and Graph Representation Techniques for Machine Learning Applications

The Most Promising Cryptocurrencies: Where to Invest in the Current Cycle

How to Get Free NFTs: 5 Easy Ways