2026 NESS Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: NESS Market Position and Investment Value

Ness LAB (NESS), as an innovative platform advancing the information economy through meaningful connections, collaboration, and knowledge sharing, has been building its ecosystem with the blockchain-based NESS Token at its core. As of February 3, 2026, NESS holds a market capitalization of approximately $1.18 million, with a circulating supply of around 204.24 million tokens, and the price maintaining at approximately $0.0058. This community-driven digital asset, operating on the Polygon network, is playing an increasingly important role in incentivizing content creation, expert networks, and collaborative knowledge exchange.

This article will comprehensively analyze NESS's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. NESS Price History Review and Current Market Status

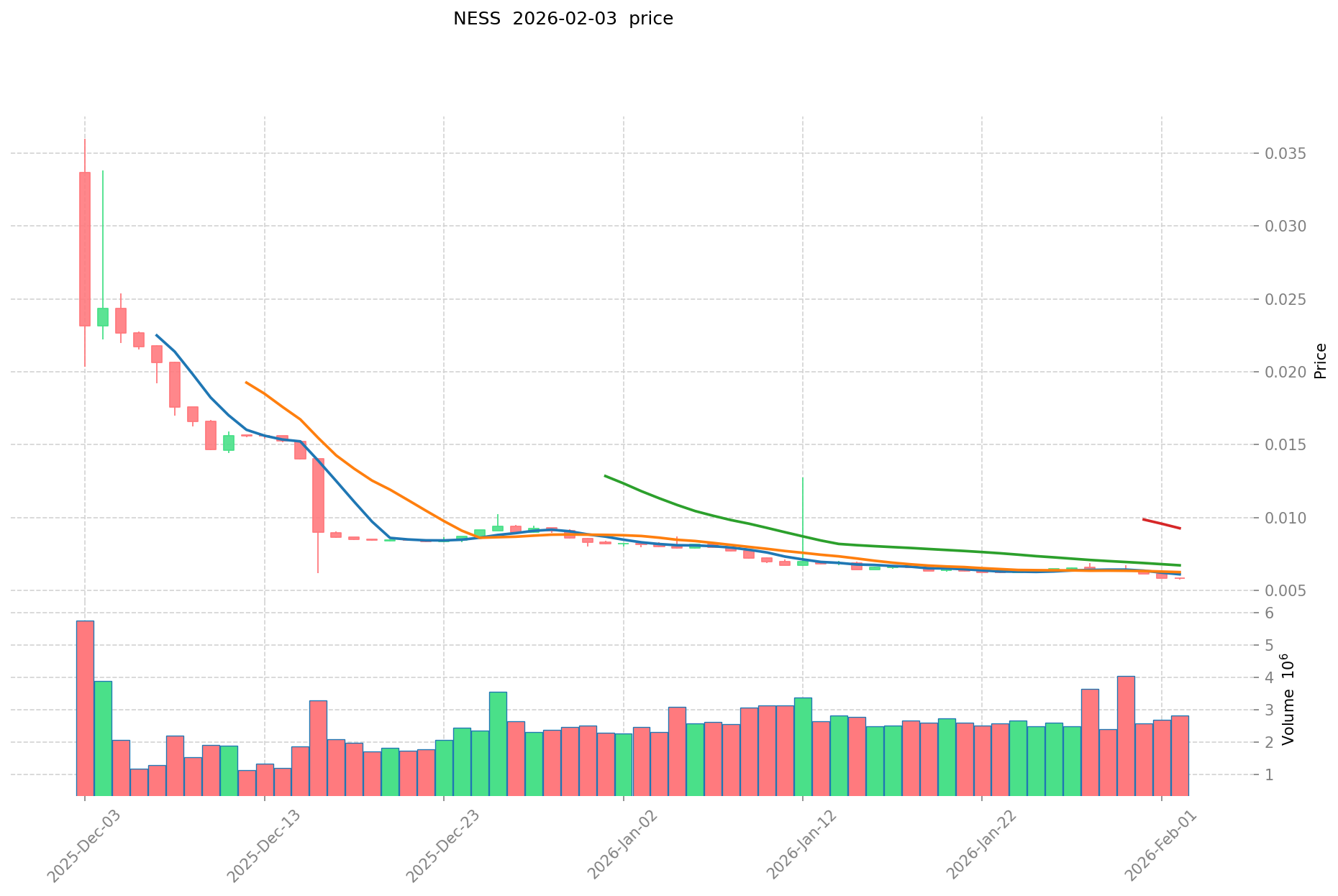

NESS Historical Price Evolution Trajectory

- 2025: NESS reached its highest price level at $0.036 in December, demonstrating notable market interest during this period

- 2026: In early February, the token experienced a decline to $0.005726, representing a significant correction from previous levels

NESS Current Market Situation

As of February 03, 2026, NESS is trading at $0.005799, showing mixed short-term momentum with a 0.44% increase over the past hour, while facing downward pressure of 0.75% in the 24-hour period. The 24-hour trading volume stands at $16,337.81, indicating moderate market activity.

The token's market capitalization is approximately $1.18 million, with a circulating supply of 204.24 million NESS tokens, representing 40.85% of the maximum supply of 500 million tokens. The fully diluted market cap is estimated at $2.90 million. NESS currently holds a market share of 0.00010% within the broader cryptocurrency ecosystem.

Looking at broader timeframes, NESS has experienced a 10.23% decline over the past week and a 28.68% decrease over the past month. The one-year performance shows an 82.12% decline from previous levels. The market sentiment indicator currently reflects a value of 17, suggesting heightened caution among market participants.

With 4,957 token holders and availability on 3 exchanges including Gate.com, NESS maintains a presence in the cryptocurrency trading landscape. The token operates with a contract address on the Polygon network, providing users with access to blockchain-based verification and transactions.

Click to view the current NESS market price

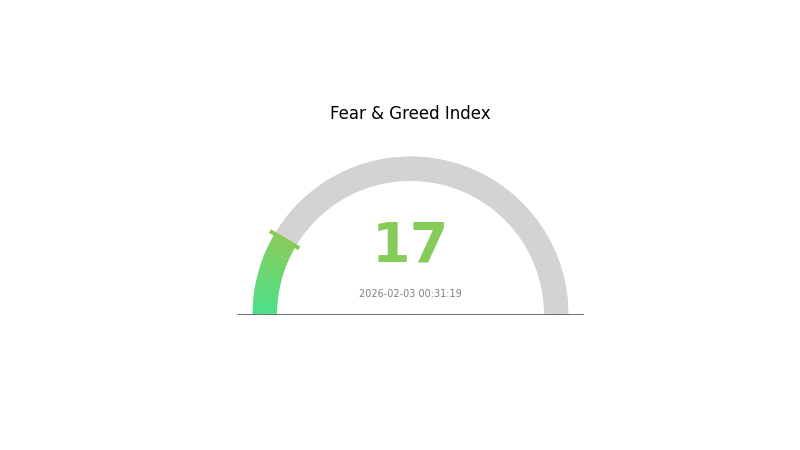

NESS Market Sentiment Index

2026-02-03 Fear & Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear & Greed Index plummeting to 17. This reading reflects significant market pessimism and heightened investor anxiety. During such periods of extreme fear, opportunities may emerge for long-term investors, as assets often become oversold. However, caution is warranted, as volatility typically remains elevated. Traders should carefully assess their risk tolerance and avoid making emotionally-driven decisions. Monitor market developments closely and consider dollar-cost averaging strategies to mitigate short-term price fluctuations.

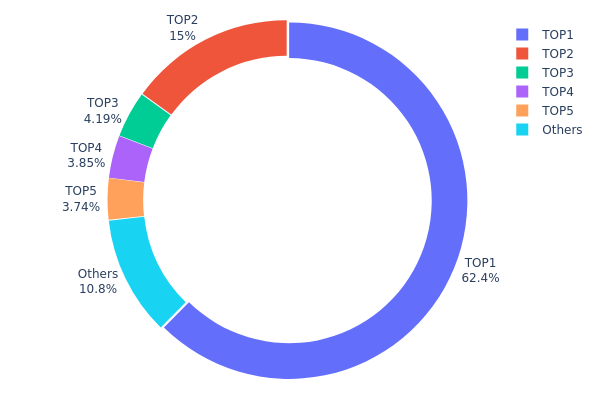

NESS Holding Distribution

The holding distribution chart illustrates the allocation of NESS tokens across different wallet addresses, providing crucial insights into the token's decentralization level and market structure. This metric is essential for assessing concentration risk and understanding the potential influence of major holders on price dynamics.

Based on the current data, NESS exhibits a highly concentrated holding pattern. The top address controls 27,513.77K tokens, representing 62.39% of the total supply, while the second-largest holder possesses 6,614.65K tokens (15.00%). The top five addresses collectively account for approximately 89.15% of the total circulation, leaving only 10.85% distributed among other addresses. This extreme concentration indicates that the majority of NESS tokens are held by a small group of entities, which significantly deviates from the decentralized ideal typically sought in cryptocurrency projects.

Such a concentrated distribution structure poses several implications for market behavior. First, the dominant position of the top holder creates substantial price manipulation risk, as large-scale selling or buying actions could trigger significant market volatility. Second, the limited token distribution among smaller holders may result in reduced liquidity and trading depth, making the market more susceptible to dramatic price swings. Third, this concentration pattern suggests that NESS is currently in a stage where token distribution has not yet fully matured, potentially reflecting early-stage project characteristics or strategic token allocation by the development team.

Click to view current NESS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1ab4...8f8f23 | 27513.77K | 62.39% |

| 2 | 0x0d07...b492fe | 6614.65K | 15.00% |

| 3 | 0x2691...4956c6 | 1846.29K | 4.18% |

| 4 | 0xa995...1468b9 | 1696.94K | 3.84% |

| 5 | 0x9676...bc66db | 1649.85K | 3.74% |

| - | Others | 4772.65K | 10.85% |

II. Core Factors Influencing NESS Future Price

Platform Adoption Rate

- Ecosystem Development: The fundamental value of NESS token is determined by whether Ness LAB can attract a substantial user base and establish an active knowledge-sharing and collaboration ecosystem.

- User Growth Pattern: Platform adoption directly correlates with token demand, as increased participation in the knowledge-sharing network enhances the token's utility value.

- Current Impact: The success of building a robust user community will be a primary driver of NESS price trajectory.

Market Sentiment and Investor Confidence

- Investor Perception: Market participants' confidence and sentiment toward NESS play a significant role in price fluctuations.

- Volatility Characteristics: Like many digital assets, NESS may experience considerable price movements in relatively short timeframes.

- Psychological Factors: Overall market mood and investor expectations can amplify or dampen price trends beyond fundamental value considerations.

Regulatory Environment

- Policy Impact: Regulatory frameworks and policy changes across different jurisdictions can substantially affect NESS token valuation.

- Compliance Considerations: The project's ability to navigate evolving regulatory landscapes may influence institutional and retail participation levels.

- Regional Variations: Different regulatory approaches in various markets could create divergent price dynamics across regions.

Technological Innovation

- Platform Development: Ongoing technological improvements and feature enhancements within the Ness LAB ecosystem may positively impact token value.

- Innovation Capacity: The project's ability to maintain technological relevance and introduce novel solutions could strengthen long-term price prospects.

- Technical Complexity: Understanding the underlying technology and economic model requires careful analysis by potential participants.

III. 2026-2031 NESS Price Prediction

2026 Outlook

- Conservative Forecast: $0.0032 - $0.00582

- Neutral Forecast: $0.00582

- Optimistic Forecast: $0.00657 (contingent on favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: NESS may experience gradual growth as the project matures and potentially expands its ecosystem during this period.

- Price Range Forecast:

- 2027: $0.00341 - $0.00749

- 2028: $0.00479 - $0.00862

- 2029: $0.00588 - $0.00928

- Key Catalysts: Potential drivers could include increased adoption, ecosystem development, partnerships, and broader crypto market sentiment.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00434 - $0.00885 (assuming steady project development and stable market conditions)

- Optimistic Scenario: $0.00851 - $0.0105 (assuming enhanced utility, expanded user base, and favorable regulatory environment)

- Transformative Scenario: potentially exceeding $0.0105 (under exceptionally favorable conditions such as major technological breakthroughs or significant institutional adoption)

- February 3, 2026: NESS trading within the $0.0032 - $0.00657 range (early-stage development phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00657 | 0.00582 | 0.0032 | 0 |

| 2027 | 0.00749 | 0.00619 | 0.00341 | 6 |

| 2028 | 0.00862 | 0.00684 | 0.00479 | 18 |

| 2029 | 0.00928 | 0.00773 | 0.00588 | 33 |

| 2030 | 0.00885 | 0.00851 | 0.00434 | 46 |

| 2031 | 0.0105 | 0.00868 | 0.00451 | 49 |

IV. NESS Professional Investment Strategy and Risk Management

NESS Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Investors who believe in the information economy model and community-driven platform development, with a medium to long-term investment horizon

- Operational Recommendations:

- Consider accumulating positions during market corrections when NESS trades below $0.006

- Monitor platform user growth metrics and community governance participation rates as key indicators

- Implement a dollar-cost averaging approach to mitigate entry timing risks

- Storage Solution: Utilize Gate Web3 Wallet for secure custody with multi-signature options, ensuring private key management best practices

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor crossovers on the 4-hour and daily charts to identify potential momentum shifts

- Relative Strength Index (RSI): Look for oversold conditions below 30 and overbought signals above 70 to time entries and exits

- Swing Trading Key Points:

- Establish position sizing rules limiting single trade exposure to 2-5% of portfolio value

- Set stop-loss orders at 8-12% below entry points to manage downside risk

NESS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance NESS holdings with established digital assets to reduce concentration risk

- Position Sizing: Adjust exposure based on market volatility and liquidity conditions

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and daily transactions with enhanced security features

- Cold Storage Solution: Hardware wallet backup for long-term holdings exceeding 30-day holding periods

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x6eaea1ed457e06f8cf6ee7adf34e621844c3b0fc on Polygon), and avoid sharing private keys or seed phrases

V. NESS Potential Risks and Challenges

NESS Market Risks

- Liquidity Risk: With a 24-hour trading volume of approximately $16,337, liquidity may be limited during periods of market stress, potentially resulting in wider bid-ask spreads

- Volatility Risk: NESS has experienced significant price fluctuations, with a 30-day decline of approximately 28.68% and annual decline of approximately 82.12%, indicating substantial volatility

- Concentration Risk: With only 40.85% of tokens in circulation and approximately 4,957 holders, distribution is relatively concentrated, which may impact price stability

NESS Regulatory Risks

- Platform Governance Uncertainty: Community-driven governance models may face regulatory scrutiny regarding decision-making processes and token holder rights

- Digital Asset Classification: Evolving regulatory frameworks may impact the classification and treatment of NESS tokens in different jurisdictions

- Compliance Requirements: Future regulatory developments may impose additional compliance obligations on the platform and token holders

NESS Technical Risks

- Smart Contract Risk: As a Polygon-based token, NESS is subject to potential vulnerabilities in smart contract code or underlying blockchain infrastructure

- Platform Dependency: Token value is closely tied to the adoption and success of the Ness Lab platform ecosystem

- Scalability Challenges: As the platform grows, technical infrastructure may need continuous upgrades to support increasing user activity and transactions

VI. Conclusion and Action Recommendations

NESS Investment Value Assessment

NESS represents an early-stage opportunity in the information economy and knowledge-sharing space, with a community-driven governance model and reward mechanisms designed to incentivize participation. However, the token faces significant challenges including limited liquidity, high volatility, and substantial price declines over recent periods. The platform's success depends on sustained user growth, effective community governance, and successful execution of its ecosystem development roadmap. Short-term risks include continued price pressure and market uncertainty, while long-term value potential hinges on platform adoption and ecosystem maturity.

NESS Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of crypto portfolio) to understand platform dynamics and community governance mechanisms before increasing allocation ✅ Experienced Investors: Consider a staged entry approach with position limits of 3-5%, focusing on risk management and diversification across multiple information economy projects ✅ Institutional Investors: Conduct thorough due diligence on platform metrics, community engagement levels, and tokenomics before committing capital, with appropriate hedging strategies

NESS Trading Participation Methods

- Spot Trading: Execute buy and sell orders on Gate.com with appropriate position sizing and risk management protocols

- Dollar-Cost Averaging: Implement systematic purchase plans to reduce timing risk and build positions gradually

- Portfolio Integration: Incorporate NESS as a thematic allocation within broader information economy or Web3 social platform strategies

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is NESS token? What are its uses and application scenarios?

NESS is a utility token designed to incentivize user participation and community engagement within its ecosystem. It rewards contributions, facilitates governance participation, and enables access to platform features and services.

How to conduct NESS price prediction? What are the analysis methods and tools?

NESS price prediction uses fundamental analysis(examining economic factors and project developments)and technical analysis(studying historical price charts and patterns). Key tools include candlestick charts, moving averages, RSI indicators, and trading volume analysis to identify trends and support/resistance levels.

What are the main factors affecting NESS price fluctuations?

NESS price is primarily influenced by market demand, regulatory news, competitive landscape, and development activity. Trading volume, investor sentiment, and macroeconomic conditions also play significant roles in price movements.

What is the historical price performance of NESS token? What are its future prospects?

NESS token has experienced significant price volatility with fluctuating market performance. Looking ahead, strong community support and ecosystem development position NESS for potential growth, with increasing adoption driving positive momentum in the coming years.

What are the risks to be aware of when investing in NESS tokens?

NESS token investment carries high risks. Conduct thorough research on the project whitepaper, team background, and roadmap. Market volatility and regulatory changes may significantly impact token value. Assess your risk tolerance carefully before investing.

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

XRP Price Analysis 2025: Market Trends and Investment Outlook

Toncoin Price Prediction for 2025: Will TON Reach New Heights?

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

EMYC vs ADA: A Comprehensive Comparison of Two Leading Blockchain Platforms in the Crypto Market

P00LS vs VET: A Comprehensive Comparison of Two Leading Blockchain Utility Tokens

UNIBOT vs APT: A Comprehensive Comparison of Two Leading Automated Trading Bots in the Cryptocurrency Market

PRISM vs KAVA: A Comprehensive Comparison of Two Leading Privacy-Focused Blockchain Platforms

Comprehensive Guide to Cryptocurrency Mining: Methods, Profitability, and Coin Selection