2026 PAI Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: PAI's Market Position and Investment Value

ParallelAI (PAI), as a decentralized AI computing platform dedicated to solving GPU bottleneck issues through innovative parallel processing solutions, has been actively developing since its launch in 2024. As of 2026, PAI maintains a market capitalization of approximately $1.28 million, with a circulating supply of 100 million tokens, and the price hovers around $0.01283. This asset, characterized as a "democratized AI innovation enabler," is playing an increasingly significant role in optimizing GPU utilization for developers worldwide and making AI development more accessible and cost-effective.

This article will comprehensively analyze PAI's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PAI Price History Review and Market Status

PAI Historical Price Evolution Trajectory

- 2024: Token launched on September 29, 2024 at an initial price of $0.193, subsequently reaching an all-time high of $1.518 on December 12, 2024, representing a significant appreciation from its launch price

- 2025: Price experienced substantial volatility throughout the year as the project continued its development phase

- 2026: Market correction intensified, with price declining to an all-time low of $0.01189 on February 2, 2026, reflecting broader market sentiment shifts

PAI Current Market Status

As of February 3, 2026, PAI is trading at $0.01283, representing a 0.94% increase over the past hour. However, the token faces downward pressure across longer timeframes, declining 5.17% over 24 hours and 34.98% over the past week. The 30-day performance shows a 59.76% decrease, while the one-year performance indicates a 94.61% decline from previous levels.

The token maintains a market capitalization of $1,283,000, with a fully diluted valuation matching this figure at $1,283,000, indicating that 100% of the maximum supply of 100,000,000 PAI tokens is currently in circulation. The 24-hour trading volume stands at $36,052.19. PAI holds a market dominance of 0.000045%, with 10,724 token holders across the network. The token operates on the Ethereum blockchain using the ERC-20 standard.

The 24-hour price range has fluctuated between a low of $0.01189 and a high of $0.01389. The current price represents a 99.15% decrease from the all-time high of $1.518 recorded in December 2024, while sitting approximately 7.91% above the all-time low. The market-cap-to-FDV ratio of 100% suggests complete token distribution with no additional supply scheduled for release.

Parallel AI is currently listed on 3 cryptocurrency exchanges, with Gate.com serving as one of the trading platforms. The project continues to develop its decentralized GPU infrastructure aimed at addressing computational bottlenecks in AI development through innovative parallel processing solutions.

Click to view current PAI market price

PAI Market Sentiment Index

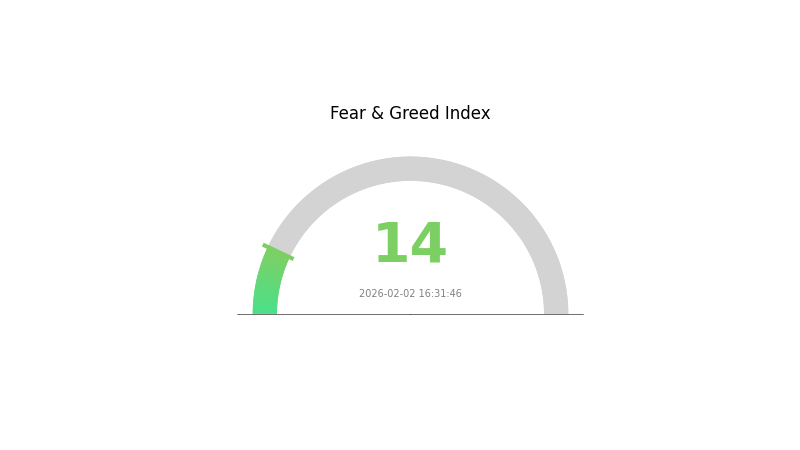

2026-02-02 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The PAI market is currently experiencing extreme fear, with the Fear & Greed Index registering at 14. This exceptionally low reading suggests that market participants are highly pessimistic and risk-averse. During such periods, selling pressure typically intensifies as investors seek to exit positions. However, extreme fear historically presents contrarian opportunities for those with conviction and capital to accumulate assets at depressed valuations. Traders should exercise caution while monitoring for potential reversal signals.

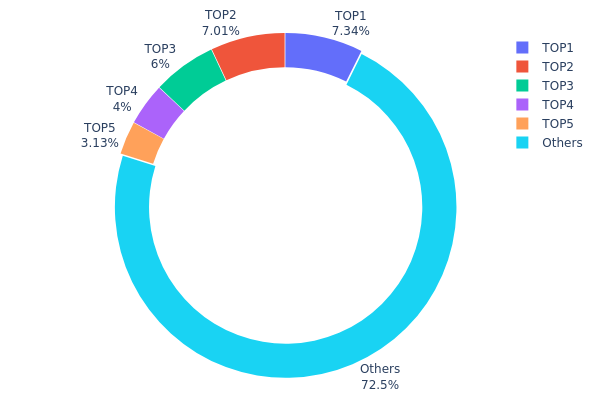

PAI Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different wallet addresses in the market. By analyzing the proportion of tokens held by top addresses versus the broader holder base, this metric provides insights into the degree of centralization and potential market manipulation risks associated with a cryptocurrency asset.

According to the current data, PAI exhibits a relatively moderate concentration pattern. The top five addresses collectively hold approximately 27.45% of the total supply, with the largest single address controlling 7.33% (7.337M tokens), followed by the second-largest at 7.00% (7.008M tokens). The remaining 72.55% of tokens are distributed among other addresses, indicating a fairly dispersed ownership structure beyond the major holders. This distribution suggests that while significant positions exist among top addresses, PAI maintains a reasonably decentralized network where no single entity exercises overwhelming control over the circulating supply.

From a market structure perspective, this distribution pattern presents both stability factors and potential risks. The moderate concentration among top holders provides a degree of price stability, as these major stakeholders typically have vested interests in maintaining long-term value. However, the combined 27.45% holdings of top five addresses still represents considerable influence, which could contribute to short-term volatility if coordinated selling occurs. The substantial 72.55% held by other addresses demonstrates healthy retail participation and reduces the likelihood of extreme price manipulation by any single actor, contributing to a more resilient on-chain ecosystem with balanced power dynamics between whale holders and the broader community.

Click to view current PAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x24b8...320817 | 7337.36K | 7.33% |

| 2 | 0x3cc9...aecf18 | 7008.23K | 7.00% |

| 3 | 0xe94e...11e717 | 6000.00K | 6.00% |

| 4 | 0x39f6...a86a47 | 4000.00K | 4.00% |

| 5 | 0x9642...2f5d4e | 3128.71K | 3.12% |

| - | Others | 72525.70K | 72.55% |

II. Core Factors Influencing PAI's Future Price

Supply Mechanism

Based on available information, specific supply mechanism details for PAI are not clearly documented in the provided materials. The token's supply dynamics remain a factor that requires further project disclosure.

Institutional and Major Holder Dynamics

Current data regarding institutional holdings, corporate adoption, and national-level policies specific to PAI is limited in the reference materials. Market participants should monitor official project announcements for updates on institutional involvement.

Macroeconomic Environment

- Monetary Policy Impact: The strength of the U.S. dollar and global interest rate expectations can have direct effects on cryptocurrency markets. Market analysis suggests that employment data and central bank policy shifts may influence overall crypto market sentiment.

- Geopolitical Factors: Geopolitical uncertainties continue to play a role in shaping risk appetite across digital asset markets, though their specific impact on PAI requires ongoing assessment.

Technical Development and Ecosystem Building

- Project Commitment Fulfillment: The future trajectory of PAI will depend significantly on whether the project can deliver on its core promises and consistently advance ecosystem development.

- Community Activity: The level of community engagement and participation represents a key indicator for project momentum and user retention.

- User Adoption Rate: The pace at which users adopt PAI within its intended use cases will be instrumental in determining its market position.

- Market Competition: PAI's performance will be influenced by competitive dynamics within its sector and its ability to differentiate from alternative projects.

- Overall Crypto Market Cycle: Broader cryptocurrency market trends and cycles will continue to affect PAI's price movements alongside project-specific fundamentals.

III. 2026-2031 PAI Price Prediction

2026 Outlook

- Conservative Prediction: $0.01168 - $0.01284

- Neutral Prediction: Around $0.01284

- Optimistic Prediction: Up to $0.01412 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectations: The token is anticipated to enter a gradual growth phase, with price fluctuations reflecting broader market sentiment and project development milestones.

- Price Range Predictions:

- 2027: $0.00728 - $0.01861 (potential 5% growth)

- 2028: $0.01139 - $0.02214 (potential 25% growth)

- 2029: $0.01680 - $0.02043 (potential 48% growth)

- Key Catalysts: Project ecosystem expansion, increased adoption rates, and positive cryptocurrency market trends could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.01462 - $0.02648 (assuming steady project development and market stability)

- Optimistic Scenario: $0.01976 - $0.02659 (contingent upon significant ecosystem growth and favorable regulatory environment)

- Transformative Scenario: Up to $0.02312 average price by 2031 (requires exceptional market conditions and widespread adoption)

- 2026-02-03: PAI trading within the $0.01168 - $0.01412 range (early-stage consolidation phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01412 | 0.01284 | 0.01168 | 0 |

| 2027 | 0.01861 | 0.01348 | 0.00728 | 5 |

| 2028 | 0.02214 | 0.01604 | 0.01139 | 25 |

| 2029 | 0.02043 | 0.01909 | 0.0168 | 48 |

| 2030 | 0.02648 | 0.01976 | 0.01462 | 54 |

| 2031 | 0.02659 | 0.02312 | 0.01433 | 80 |

IV. PAI Professional Investment Strategies and Risk Management

PAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term vision of decentralized AI computing and are willing to tolerate high volatility

- Operational Recommendations:

- Consider accumulating positions during market downturns, as PAI has experienced significant price corrections from its historical high

- Monitor the development progress of Parallel AI's parallel processing solutions and GPU optimization platform

- Utilize Gate Web3 Wallet for secure storage with enhanced security features

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the $0.01189 (recent low) and $0.01389 (24-hour high) levels for potential entry and exit points

- Volume Analysis: Track the 24-hour trading volume of approximately $36,052 to gauge market interest and liquidity

- Swing Trading Key Points:

- Pay attention to short-term volatility patterns, as PAI has shown -5.17% change in 24 hours

- Set stop-loss orders to manage downside risk given the token's high volatility characteristics

PAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: 5-10% of crypto portfolio based on risk tolerance and market analysis

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine PAI with more established cryptocurrencies to balance risk exposure

- Dollar-Cost Averaging: Implement regular, smaller purchases to mitigate timing risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking access

- Cold Storage Option: Hardware wallets for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, never share private keys, verify contract address (0x13e4b8cffe704d3de6f19e52b201d92c21ec18bd) before transactions

V. PAI Potential Risks and Challenges

PAI Market Risks

- High Volatility: PAI has experienced a -94.61% decline over one year and -59.76% in the past 30 days, indicating substantial price instability

- Limited Liquidity: With a market cap of approximately $1.28 million and ranking at #2348, the token faces liquidity constraints that could amplify price swings

- Early Stage Development: As a relatively new project (launched September 2024), PAI carries inherent risks associated with unproven market adoption

PAI Regulatory Risks

- AI and Blockchain Intersection: The convergence of AI and blockchain technologies may attract increased regulatory scrutiny across multiple jurisdictions

- Token Classification Uncertainty: Evolving regulations regarding utility tokens and their classification could impact PAI's operational framework

- Compliance Requirements: Changes in cryptocurrency regulations could affect the project's ability to operate in certain markets

PAI Technical Risks

- Platform Development Risk: The success of Parallel AI depends on successfully delivering its GPU optimization and parallel processing solutions

- Competition Risk: The decentralized AI computing space is becoming increasingly competitive, with multiple projects vying for market share

- Smart Contract Vulnerabilities: As an ERC-20 token, PAI is subject to potential smart contract exploits or technical failures

VI. Conclusion and Action Recommendations

PAI Investment Value Assessment

Parallel AI presents an innovative approach to addressing GPU bottlenecks through decentralized parallel processing solutions. The project's focus on making AI development more accessible and cost-effective aligns with growing demand for computational resources. However, the token has experienced significant price depreciation from its all-time high of $1.518 to the current price of $0.01283, reflecting market challenges and high volatility. The fully diluted market cap of $1.28 million with 100% of tokens in circulation (100 million PAI) suggests a relatively small market presence. Investors should weigh the project's technological vision against substantial short-term risks and market uncertainty.

PAI Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio) and focus on understanding the project fundamentals before increasing exposure; use Gate Web3 Wallet for secure storage ✅ Experienced Investors: Consider small to moderate positions (2-5% of crypto portfolio) with strict stop-loss protocols; monitor development milestones and market sentiment closely ✅ Institutional Investors: Conduct thorough due diligence on the technical roadmap and team execution capabilities; consider positions only within diversified AI-crypto investment strategies

PAI Trading Participation Methods

- Spot Trading: Purchase PAI directly on Gate.com with BTC, USDT, or other supported trading pairs

- Dollar-Cost Averaging: Set up regular purchase intervals to smooth out price volatility and build positions gradually

- Trading Tools: Utilize Gate.com's advanced trading features including limit orders, stop-loss orders, and portfolio tracking for better risk management

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PAI, and what are its uses and value?

PAI is a blockchain-based utility token designed for decentralized AI services and personal data monetization. Its value derives from enabling secure data exchange, powering smart contracts, and facilitating ecosystem transactions. PAI holders gain access to exclusive AI features and governance rights within the network.

How to conduct PAI price prediction and what analysis methods are available?

Analyze PAI price trends using technical analysis(支撑阻力、趋势线),fundamental analysis(团队、应用场景、交易额),and on-chain metrics(持币地址、转账频率). Machine learning models and regression analysis can identify patterns for price forecasting.

What are the main factors affecting PAI price fluctuations?

PAI price is primarily influenced by supply and demand dynamics, trading volume, market sentiment, ecosystem development, regulatory environment, and macroeconomic factors. Supply-demand imbalance is the fundamental driver of price trends.

What are the risks and limitations of PAI price prediction?

PAI price prediction relies on historical data and market analysis, which may not accurately reflect future price movements. Market volatility, liquidity changes, and unexpected events can significantly impact predictions. Prediction models have inherent limitations and may contain pricing errors. Users should conduct independent research before making decisions.

What are the advantages and disadvantages of PAI compared to other cryptocurrencies?

PAI offers greater stability and lower risk compared to other cryptocurrencies, but faces challenges with market adoption and liquidity. Its regulatory framework and long-term development prospects remain uncertain.

What are the future prospects and price trends for PAI?

PAI shows strong long-term growth potential driven by increasing adoption and ecosystem development. Price momentum suggests continued upward trajectory through 2026-2027, with potential for significant appreciation as utility expands and market demand grows.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is NEURO: A Comprehensive Guide to Blockchain's Next-Generation Neural Computing Protocol

What is TEN: A Comprehensive Guide to Understanding Tokenized Economic Networks and Their Impact on Digital Finance

What is ARCH: A Comprehensive Guide to Autoregressive Conditional Heteroskedasticity in Financial Modeling

How to Identify Entry and Exit Points with Multi-Timeframe Analysis

2026 NEURO Price Prediction: Expert Analysis and Market Forecast for Neurocoin's Future Value