2026 TEN Price Prediction: Expert Analysis and Market Forecast for Tensor Network Token

Introduction: TEN's Market Position and Investment Value

TEN Protocol (TEN), positioned as a privacy-focused Layer 2 solution for Ethereum, has been advancing smart contract transparency and encrypted application capabilities since its launch in 2026. As of February 3, 2026, TEN maintains a market capitalization of approximately $1.26 million, with a circulating supply of around 133.9 million tokens, and the price hovering near $0.009396. This asset, recognized as a "programmable privacy infrastructure," is playing an increasingly significant role in gaming, DeFi, AI, and institutional finance applications.

This article will comprehensively analyze TEN's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TEN Price History Review and Current Market Status

Historical Price Evolution Trajectory of TEN

TEN Protocol (TEN) was launched on January 27, 2025, representing a relatively recent entry into the crypto asset market. As a nascent project, its price history remains limited but exhibits notable volatility characteristic of emerging Layer 2 solutions.

Since its market debut, TEN has experienced significant price fluctuations. The token reached a notable price level of $0.11662 on November 27, 2025, reflecting initial market enthusiasm for privacy-focused Ethereum Layer 2 solutions. However, market sentiment shifted, and the token subsequently declined to $0.005094 on December 25, 2025, demonstrating the volatility inherent in new crypto projects.

Over the past 30 days, TEN has shown considerable recovery momentum with a price increase of 71.95%, suggesting renewed interest in privacy-preserving blockchain infrastructure. The weekly performance indicates a positive trend with a 4.6% increase, while the 24-hour movement shows a modest gain of 2.07%.

Current Market Position of TEN

As of February 3, 2026, TEN is trading at $0.009396, positioning itself within the broader market at rank #2358. The token demonstrates an active trading environment with a 24-hour trading volume of $22,387.26, though this represents a relatively modest liquidity profile compared to more established projects.

The circulating supply stands at 133.9 million TEN tokens, representing 13.39% of the total supply of 1 billion tokens. This relatively low circulation ratio suggests that a substantial portion of tokens remains to be released into the market, which may influence future price dynamics. The current market capitalization is approximately $1.26 million, with a fully diluted market cap of $9.4 million.

TEN's market dominance remains minimal at 0.00033%, reflecting its early-stage position within the competitive Layer 2 ecosystem. The token is currently listed on 3 exchanges, including Gate.com, with ERC-20 token standard compatibility. The project has attracted 7,118 holders, indicating a growing but still developing community base.

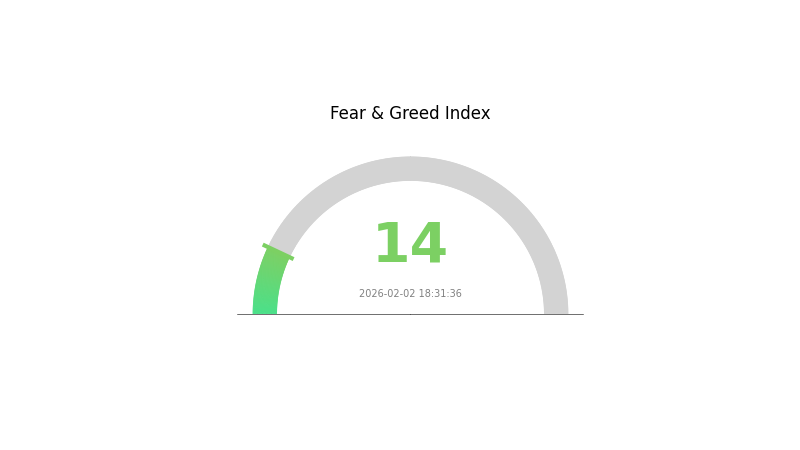

The Crypto Fear & Greed Index currently registers at 14, indicating an "Extreme Fear" sentiment in the broader market, which may be influencing TEN's price action alongside other crypto assets. Despite this challenging sentiment backdrop, TEN's recent 30-day performance suggests that privacy-focused infrastructure projects may be capturing investor attention.

Click to view the current TEN market price

TEN Market Sentiment Index

2026-02-02 Fear and Greed Index: 14(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 14. This exceptionally low level indicates heightened investor anxiety and significant market pessimism. When the index enters extreme fear territory, it often presents opportunities for contrarian investors to accumulate positions at reduced valuations. Market participants should exercise caution while remaining vigilant for potential entry points. Such extreme sentiment readings historically precede market reversals, though timing remains unpredictable. Risk management and portfolio diversification remain essential during periods of peak fear.

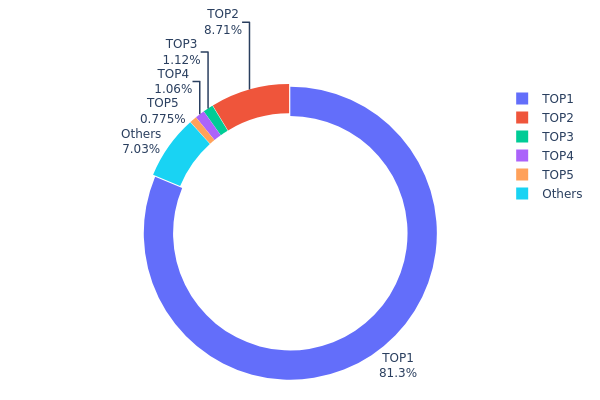

TEN Holdings Distribution

The holdings distribution chart represents the concentration of token ownership across different wallet addresses, serving as a crucial indicator of market structure and decentralization. By analyzing the distribution pattern, we can assess potential risks related to price manipulation, liquidity concentration, and the overall health of the token's ecosystem.

Current data reveals a highly concentrated holdings structure for TEN. The top address (0xe689...8af57b) controls 813,020.20K tokens, representing 81.30% of the total supply—an exceptionally high concentration ratio. The second-largest holder (0x7950...736869) possesses 87,144.64K tokens (8.71%), while the remaining top five addresses collectively account for less than 3% of the supply. The "Others" category, comprising all remaining addresses, holds only 70,293.19K tokens (7.05%), indicating that the vast majority of tokens are locked within a very small number of wallets.

This extreme concentration presents significant implications for market dynamics. With over 80% of tokens controlled by a single address—potentially a project treasury, foundation wallet, or major institutional holder—the market faces elevated risks of sudden price volatility should this entity decide to execute large-scale transactions. The limited distribution among smaller holders suggests weak retail participation and reduced liquidity depth, making the token vulnerable to sharp price movements on relatively modest trading volumes. From a decentralization perspective, this structure indicates a centralized control mechanism that may contradict the fundamental principles of distributed blockchain networks. However, if the dominant address represents locked team tokens or ecosystem reserves with transparent vesting schedules, this concentration might be temporary and decrease over time as tokens are gradually released into circulation.

Click to view current TEN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe689...8af57b | 813020.20K | 81.30% |

| 2 | 0x7950...736869 | 87144.64K | 8.71% |

| 3 | 0x58ed...a36a51 | 11183.82K | 1.11% |

| 4 | 0x464b...851106 | 10611.67K | 1.06% |

| 5 | 0x9642...2f5d4e | 7746.48K | 0.77% |

| - | Others | 70293.19K | 7.05% |

II. Core Factors Influencing TEN's Future Price Trends

Supply Mechanism

Based on the available materials, specific information regarding TEN's supply mechanism is not provided. Without concrete data on token issuance schedules, emission rates, or deflationary mechanisms, this section cannot be accurately developed.

Institutional and Major Holder Dynamics

The reference materials do not contain specific information about institutional holdings, corporate adoption, or national policy support related to TEN. Consequently, detailed analysis of institutional positioning and strategic adoption patterns cannot be provided at this time.

Macroeconomic Environment

-

Monetary Policy Impact: The global economic environment has entered a rate-cutting cycle, with major developed economies implementing monetary easing policies. This relaxation of financial conditions may help alleviate downward economic pressure and support external demand resilience. However, monetary policy adjustments create complex dynamics for crypto assets, as they are typically considered higher-risk investments that respond sensitively to macroeconomic shifts.

-

Inflation Hedge Characteristics: As a crypto asset, TEN may potentially serve as a hedge against fiat currency inflation risks. However, the actual effectiveness of this hedge function depends heavily on market recognition and the overall acceptance of crypto assets. The anti-inflation properties remain subject to market adoption rates and investor sentiment.

-

Geopolitical Factors: The intensification of great power competition and rising geopolitical risks continue to reshape global political and economic structures. These uncertainties create a complex external environment. While geopolitical tensions traditionally support safe-haven asset allocation, the impact on emerging digital assets like TEN requires careful evaluation within the broader context of regulatory policies and market sentiment.

Technology Development and Ecosystem Building

The provided materials do not contain specific information about TEN's technical upgrades, development roadmap, or ecosystem applications such as DApps or major projects. Without concrete details on technological advancements or ecosystem expansion, this section cannot be substantively addressed.

III. 2026-2031 TEN Price Forecast

2026 Outlook

- Conservative prediction: $0.00582 - $0.00939

- Neutral prediction: $0.00939

- Optimistic prediction: $0.01192 (subject to favorable market conditions)

2027-2029 Outlook

- Market stage expectation: TEN may enter a gradual growth phase as the cryptocurrency market matures and adoption expands

- Price range forecast:

- 2027: $0.00959 - $0.0146 (approximately 13% growth)

- 2028: $0.00682 - $0.01881 (approximately 34% growth)

- 2029: $0.01132 - $0.01949 (approximately 67% growth)

- Key catalysts: Increased market adoption, technological advancements, and potential ecosystem expansion could drive price appreciation during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.0132 - $0.02517 (assuming continued market development and sustained interest)

- Optimistic scenario: $0.01604 - $0.02545 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Potential to reach upper targets if TEN achieves significant breakthrough in utility or partnerships

- 2026-02-03: TEN trading within early 2026 predicted range, establishing foundation for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01192 | 0.00939 | 0.00582 | 0 |

| 2027 | 0.0146 | 0.01065 | 0.00959 | 13 |

| 2028 | 0.01881 | 0.01263 | 0.00682 | 34 |

| 2029 | 0.01949 | 0.01572 | 0.01132 | 67 |

| 2030 | 0.02517 | 0.0176 | 0.0132 | 87 |

| 2031 | 0.02545 | 0.02139 | 0.01604 | 127 |

IV. TEN Professional Investment Strategy and Risk Management

TEN Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Privacy-focused blockchain enthusiasts and investors seeking exposure to Layer 2 infrastructure with programmable privacy features

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) approach to mitigate entry point risk given TEN's relatively early stage (launched in late 2025)

- Monitor development milestones related to TEE technology implementation and ecosystem growth across gaming, DeFi, AI, and institutional finance sectors

- Storage Solution: Utilize Gate Web3 Wallet for secure self-custody with multi-signature capabilities, or hardware wallet solutions for larger holdings

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track 24-hour trading volume (currently $22,387) relative to market cap ($1.26M) to identify liquidity patterns and potential breakout signals

- Support and Resistance Levels: Monitor the 24-hour low ($0.009163) and high ($0.009494) as short-term trading boundaries

- Swing Trading Considerations:

- TEN demonstrated 71.95% growth over 30 days, suggesting potential continuation patterns for medium-term position entries

- Given limited exchange availability (3 exchanges), be mindful of liquidity constraints when executing larger orders

TEN Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation to speculative Layer 2 privacy solutions

- Aggressive Investors: 5-8% allocation with recognition of early-stage project volatility

- Professional Investors: Up to 10% allocation with active monitoring of technology development and competitive landscape

(II) Risk Hedging Approaches

- Position Sizing: Limit TEN exposure to amounts comfortable for potential drawdowns, noting the -49.84% decline over the past year

- Diversification Strategy: Balance TEN holdings with established Layer 2 solutions and privacy-focused protocols to reduce concentration risk

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access and decentralized application interactions

- Cold Storage Approach: Hardware wallet storage for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, maintain secure backup of recovery phrases in multiple physical locations, and verify contract address (0xea9bb54fc76bfd5dd2ff2f6da641e78c230bb683 on Ethereum) before any transactions

V. TEN Potential Risks and Challenges

TEN Market Risks

- Limited Liquidity: With availability on only 3 exchanges and 24-hour volume of approximately $22,000, large position entries or exits may experience significant slippage

- Price Volatility: Historical data shows substantial price movement, including a decline from ATH of $0.11662 (November 2025) to current levels around $0.009396

- Market Cap Position: Ranked #2358 with market dominance of 0.00033%, indicating limited mainstream adoption and susceptibility to broader market sentiment shifts

TEN Regulatory Risks

- Privacy Technology Scrutiny: TEE-based privacy solutions may face evolving regulatory frameworks as authorities assess programmable privacy features in blockchain applications

- Institutional Adoption Barriers: Despite targeting institutional finance, regulatory clarity regarding privacy-preserving smart contracts remains uncertain in multiple jurisdictions

- Compliance Requirements: Future regulatory developments may require modifications to protocol design or operational parameters, potentially impacting functionality

TEN Technical Risks

- TEE Dependency: The protocol's reliance on Trusted Execution Environments introduces potential vulnerabilities if security issues are discovered in underlying TEE implementations

- Early-Stage Protocol: As a recently launched project (late 2025), the protocol may encounter unforeseen technical challenges during scaling and adoption phases

- Competition Landscape: Multiple Layer 2 solutions and privacy-focused protocols compete for similar use cases, creating uncertainty around long-term market share capture

VI. Conclusion and Action Recommendations

TEN Investment Value Assessment

TEN Protocol presents an innovative approach to blockchain privacy through its Layer 2 solution combining Trusted Execution Environments with programmable transparency controls. The founding team's proven track record with Corda (over $10 billion in on-chain assets) and backing from established institutions including Republic Capital, R3, and DWF Labs provide credibility to the project's long-term vision. However, investors should recognize the early-stage nature of the protocol, limited current market presence (market cap of $1.26 million), and significant price volatility. The 71.95% monthly gain suggests growing interest, yet the -49.84% yearly performance indicates substantial risk. Long-term value proposition depends on successful execution of technical roadmap and adoption across targeted sectors including gaming, DeFi, AI, and institutional finance.

TEN Investment Recommendations

✅ Beginners: Allocate only a small experimental portion (1-2% of crypto portfolio) to gain exposure to privacy Layer 2 technology while focusing learning efforts on understanding TEE technology and smart contract privacy models ✅ Experienced Investors: Consider 3-5% allocation with active monitoring of development progress, ecosystem growth metrics, and exchange listing expansions; implement staged entry strategy to average price points ✅ Institutional Investors: Conduct thorough due diligence on TEE security models and regulatory implications; consider pilot allocations (2-4%) while engaging with project team regarding institutional-grade privacy requirements and compliance frameworks

TEN Trading Participation Methods

- Spot Trading: Access TEN through available centralized exchanges with current trading pairs, noting liquidity conditions before order execution

- Gate.com Platform: Utilize Gate.com's trading interface for spot transactions with access to advanced charting tools and order types

- Self-Custody Options: Transfer holdings to Gate Web3 Wallet or compatible ERC-20 wallets for participation in potential ecosystem applications requiring wallet connectivity

Cryptocurrency investment carries extreme risk, and this content does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TEN token? What are its uses and application scenarios?

TEN token serves as the network's fee settlement unit, used to pay for transaction execution, smart contract deployment, and data storage costs. It functions as the pricing mechanism for network resource consumption and governance participation.

What are the main factors affecting TEN price?

TEN price is influenced by network adoption, developer activity, exchange listings, market sentiment, and Ethereum ecosystem growth. Trading volume and technological upgrades also play significant roles in price movements.

What is the historical price trend of TEN tokens?

TEN token has shown volatility in recent months. As of December 2025, prices ranged from ¥0.05736 to ¥0.06684, with trading activity reflecting market dynamics. Current momentum suggests potential upward trajectory in the near term.

What is the price prediction for TEN in 2024-2025?

TEN price predictions for 2024-2025 suggest potential growth driven by market expansion and adoption trends. Based on industry analysis, TEN could experience significant appreciation, with potential targets influenced by overall crypto market momentum and platform development milestones during this period.

What advantages does TEN have compared to other mainstream cryptocurrencies?

TEN offers enhanced scalability, lower transaction costs, and faster settlement speeds compared to mainstream cryptocurrencies. Its innovative blockchain architecture prioritizes efficiency and user accessibility, making it an attractive alternative for decentralized applications and high-frequency transactions.

What are the risks to consider when investing in TEN tokens?

Key risks include market volatility, regulatory uncertainty, and technical security vulnerabilities. Price fluctuations can be significant, and the token may be subject to market manipulation. Conduct thorough research before investing.

What are the circulating supply and total supply of TEN?

TEN Protocol has a maximum supply of 1 billion tokens and a total supply of 1 billion tokens. The current circulating supply is not yet publicly disclosed.

Where can I buy TEN?

TEN can be purchased on centralized exchanges where it is listed, as well as through decentralized exchanges and Web3 wallets. You can acquire TEN on multiple platforms that support this token.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

HELLO vs DOGE: Which Meme Coin Will Dominate the Crypto Market in 2024?

LIKE vs LRC: Understanding the Key Differences Between Two Popular Lyric Formats

FIR vs FIL: Understanding the Key Differences Between Finite Impulse Response and Finite Impulse Length Filters

SMURFCAT vs LINK: Which Token Will Dominate the DeFi Market in 2024?

Non-verification cryptocurrency exchanges: up-to-date alternatives