2026 PZP Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Cryptocurrency Innovation

Introduction: PZP's Market Position and Investment Value

PlayZap Games (PZP), as a mobile-first gaming platform token, has been developing since its launch in April 2023. As of February 2026, PZP maintains a market capitalization of approximately $369,931, with a circulating supply of around 82.8 million tokens, and the price hovering at approximately $0.004468. This gaming-focused asset is playing an increasingly important role in the competitive casual gaming ecosystem.

This article will comprehensively analyze PZP's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PZP Price History Review and Market Status

PZP Historical Price Evolution Trajectory

- 2023: Initial trading phase following April launch at $0.12, price experienced significant volatility and reached a notable level of $0.569705 in November

- 2024-2025: Extended market adjustment period with substantial downward pressure

- 2026: Continued price decline with recent levels approaching $0.00418514 in early February

PZP Current Market Situation

As of February 6, 2026, PZP is trading at $0.004468, reflecting a 4.39% increase over the past 24 hours. The token has shown mixed short-term performance, with a slight decline of 0.04% in the past hour and a 0.44% decrease over the past week. The 30-day performance indicates a 10.96% reduction, while the annual comparison shows an 84.04% decline.

The current 24-hour trading range spans from $0.004213 to $0.00448, with total trading volume reaching $27,993.21. The circulating supply stands at 82,795,701 PZP tokens, representing approximately 55.2% of the maximum supply of 150,000,000 tokens. The market capitalization is $369,931.19, with a fully diluted valuation of $670,200.

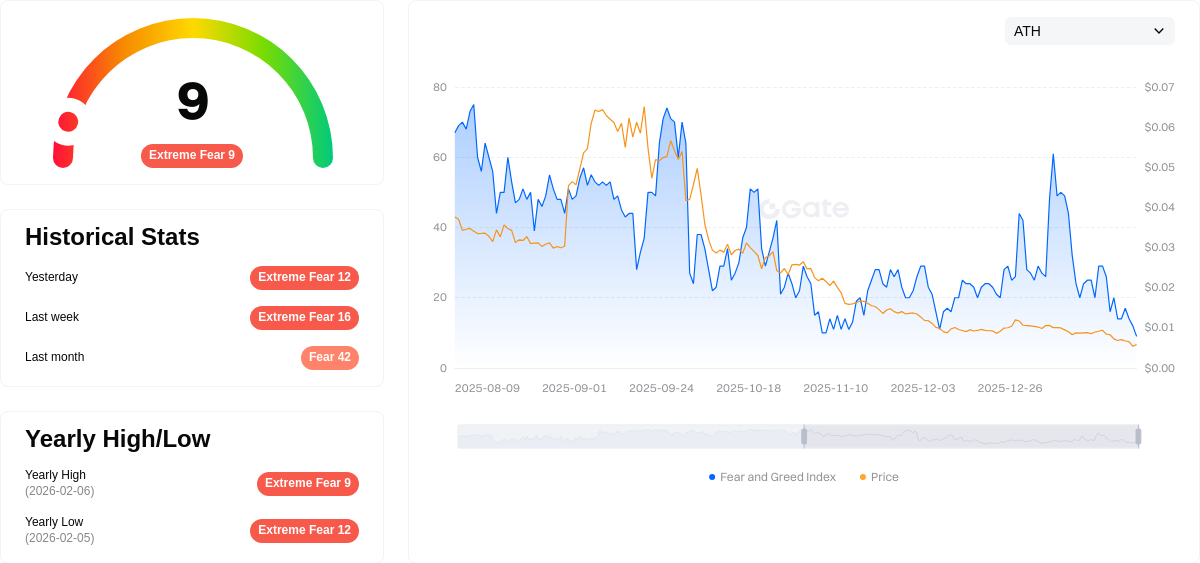

The token's market dominance remains minimal at 0.000028%. The current market sentiment index indicates a score of 9, suggesting extreme fear conditions in the broader market environment. The holder count has reached 8,037 participants.

Click to view current PZP market price

PZP Market Sentiment Indicator

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 9. This exceptionally low reading indicates heightened investor anxiety and widespread bearish sentiment across the market. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors, as excessive pessimism may have already priced in worst-case scenarios. Market participants should exercise caution while monitoring key support levels and fundamental developments. This sentiment reading reflects significant market uncertainty and the need for careful risk management in current trading conditions.

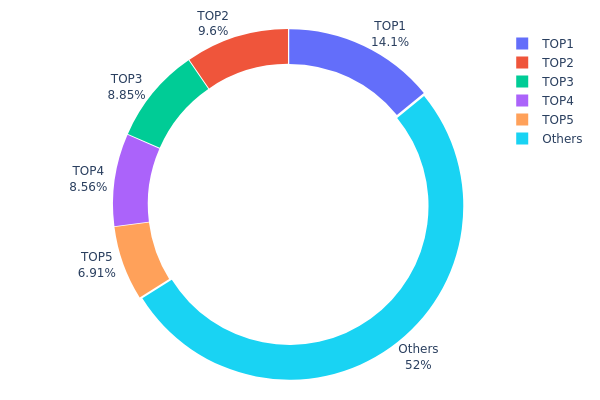

PZP Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. Based on the current data, the top 5 addresses collectively hold approximately 48% of the total PZP supply, with the largest single address controlling 14.09% (20.4M tokens). This concentration level suggests a moderately centralized ownership structure that warrants careful monitoring.

From a market structure perspective, this distribution pattern presents both stability factors and potential volatility risks. The relatively balanced holdings among the top addresses—ranging from 6.91% to 14.09%—indicate that no single entity possesses overwhelming control over the token supply. However, the combined influence of these major holders remains significant enough to impact price movements, particularly during periods of low liquidity. The remaining 52% distributed among other addresses provides some cushion against coordinated selling pressure, though the effectiveness of this distribution depends heavily on whether these smaller holdings represent genuine retail participation or fragmented whale positions.

The current holding structure reflects a transitional phase in PZP's on-chain governance, where the token has achieved partial decentralization but has not yet reached the broader distribution typical of mature crypto assets. This configuration suggests that while the risk of single-party manipulation is contained, collective actions by top holders could still significantly influence market dynamics and price discovery mechanisms.

Click to view the current PZP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x256d...34a2e3 | 20400.00K | 14.09% |

| 2 | 0x4982...6e89cb | 13894.26K | 9.60% |

| 3 | 0x53f7...f3fa23 | 12801.68K | 8.84% |

| 4 | 0x69be...6ee5e0 | 12386.79K | 8.56% |

| 5 | 0xe268...3e3dc9 | 10000.00K | 6.91% |

| - | Others | 75208.27K | 52% |

II. Core Factors Influencing PZP's Future Price

Supply Mechanism

- Token Economics Structure: PZP operates within a structured tokenomics framework that governs its circulation and distribution. The token's supply dynamics are designed to balance ecosystem growth with scarcity considerations.

- Historical Patterns: Historical data suggests that token supply adjustments and unlock events have previously influenced price volatility, with controlled releases generally supporting more stable price trajectories.

- Current Impact: Future token unlock schedules and supply expansion rates may create periodic pressure on price movements, particularly if ecosystem adoption does not keep pace with circulating supply increases.

Institutional and Major Holder Dynamics

- Institutional Holdings: Available information indicates potential whale accumulation patterns, though specific institutional holdings data remains limited in the provided materials.

- Enterprise Adoption: The materials do not provide specific information regarding known enterprises adopting PZP, making this aspect difficult to assess at the current stage.

- National Policy: Regulatory environment considerations remain relevant, as broader cryptocurrency regulations could impact PZP's operational framework and market accessibility.

Macroeconomic Environment

- Monetary Policy Impact: Global monetary policy trends, including interest rate adjustments by major central banks, tend to influence overall cryptocurrency market sentiment and capital flows, which can indirectly affect PZP's price performance.

- Inflation Hedge Characteristics: While traditional cryptocurrencies are sometimes considered inflation hedges, PZP's specific performance in inflationary environments requires further observation as the project matures.

- Geopolitical Factors: International market dynamics and regulatory developments across different jurisdictions may influence investor confidence and market participation levels.

Technology Development and Ecosystem Building

- Platform Development Progress: The project's technological advancement and feature implementations contribute to its fundamental value proposition, though specific technical upgrade details were not extensively covered in the reference materials.

- Ecosystem Applications: The development and adoption of decentralized applications (dApps) within the PZP ecosystem represent important growth indicators. User engagement levels and daily transaction volumes serve as key metrics for ecosystem health.

- Exchange Listings: Availability on reputable cryptocurrency exchanges enhances token accessibility and liquidity, potentially supporting price stability and discovery. Gate.com and similar platforms provide crucial infrastructure for PZP trading activities.

The interplay between these factors creates a complex environment where adoption rates, market sentiment, technological progress, and broader economic conditions collectively shape PZP's price trajectory. Investors should monitor these elements holistically when evaluating the token's potential.

III. 2026-2031 PZP Price Prediction

2026 Outlook

- Conservative Forecast: $0.00376 - $0.00448

- Neutral Forecast: Around $0.00448

- Optimistic Forecast: Up to $0.00663 (contingent on favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: PZP may enter a gradual growth phase as the cryptocurrency market matures and project fundamentals strengthen

- Price Range Forecast:

- 2027: $0.00367 - $0.006, with an average around $0.00556

- 2028: $0.00312 - $0.00786, averaging approximately $0.00578

- 2029: $0.00464 - $0.01016, with potential average of $0.00682

- Key Catalysts: Market recovery cycles, technological developments within the PZP ecosystem, and broader cryptocurrency market sentiment may serve as primary drivers for price appreciation

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00747 - $0.00849 in 2030 (assuming steady market conditions and moderate adoption growth)

- Optimistic Scenario: $0.00786 - $0.00925 in 2031 (predicated on enhanced network utility and sustained investor interest)

- Transformative Scenario: Potential to reach $0.0124 by 2031 (under exceptionally favorable conditions including significant technological breakthroughs and widespread market adoption)

- 2026-02-06: PZP is positioned at the beginning of its forecast period, with baseline expectations suggesting moderate price stability

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00663 | 0.00448 | 0.00376 | 0 |

| 2027 | 0.006 | 0.00556 | 0.00367 | 24 |

| 2028 | 0.00786 | 0.00578 | 0.00312 | 28 |

| 2029 | 0.01016 | 0.00682 | 0.00464 | 52 |

| 2030 | 0.01002 | 0.00849 | 0.00747 | 89 |

| 2031 | 0.0124 | 0.00925 | 0.00786 | 106 |

IV. PZP Professional Investment Strategies and Risk Management

PZP Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in the long-term potential of blockchain gaming platforms and are willing to hold through market volatility

- Operational Recommendations:

- Consider accumulating positions during market downturns, given the current price of $0.004468 represents a significant discount from historical levels

- Monitor PlayZap Games platform development progress and user adoption metrics as key indicators for long-term value

- Storage Solution: Use Gate Web3 Wallet for secure storage with multi-layer security features, enabling both cold and hot wallet management options

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 7-day and 30-day moving averages to identify trend reversals, particularly noting the recent 7-day decline of 0.44%

- Volume Analysis: Track the 24-hour trading volume of $27,993.21 to gauge market interest and liquidity conditions

- Swing Trading Key Points:

- The 24-hour range between $0.004213 and $0.00448 provides opportunities for short-term trading with approximately 6% price fluctuation

- Set stop-loss orders below recent support levels to manage downside risk in volatile conditions

PZP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio allocation

- Aggressive Investors: 5-8% of cryptocurrency portfolio allocation

- Professional Investors: Up to 10% based on comprehensive due diligence and diversification across multiple blockchain gaming projects

(2) Risk Hedging Solutions

- Diversification Strategy: Spread investments across multiple blockchain gaming tokens to reduce concentration risk

- Position Sizing: Given the 24-hour volatility of 4.39%, use smaller position sizes to manage exposure during active trading

(3) Secure Storage Solutions

- Mobile Wallet Recommendation: Gate Web3 Wallet offers seamless integration for BSC-based tokens with user-friendly interface for mobile gaming platform investors

- Hardware Wallet Solution: For larger holdings, consider transferring to hardware wallets supporting BEP20 standard tokens

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication; regularly update wallet software; be vigilant against phishing attempts targeting gaming platform users

V. PZP Potential Risks and Challenges

PZP Market Risks

- High Volatility: PZP has declined 84.04% over the past year, reflecting substantial market volatility and potential for significant price swings

- Limited Liquidity: With a 24-hour trading volume of approximately $27,993 and a market cap of $369,931, liquidity remains relatively low, which may impact order execution

- Market Cap Concentration: The current circulating supply represents 55.2% of total supply, with potential dilution risk as more tokens enter circulation

PZP Regulatory Risks

- Gaming Sector Scrutiny: Blockchain gaming platforms may face evolving regulatory frameworks regarding digital asset integration in gaming applications

- Token Classification: Regulatory authorities may review gaming tokens under securities laws, potentially impacting trading and distribution

- Cross-border Compliance: Mobile gaming platforms operating across multiple jurisdictions must navigate varying regulatory requirements for digital assets

PZP Technical Risks

- Smart Contract Vulnerabilities: BEP20 token contracts may contain undiscovered vulnerabilities that could be exploited

- Platform Dependency: PZP's value is closely tied to PlayZap Games platform performance and user adoption rates

- Blockchain Infrastructure: Reliance on BSC network means exposure to network congestion, potential outages, or security issues affecting the underlying blockchain

VI. Conclusion and Action Recommendations

PZP Investment Value Assessment

PlayZap Games (PZP) presents opportunities within the blockchain gaming sector as a mobile-first platform offering competitive gaming experiences. The current price of $0.004468 reflects a substantial decline from historical highs, potentially presenting entry opportunities for risk-tolerant investors. However, the limited trading volume, relatively small market capitalization, and year-over-year decline of 84.04% underscore significant volatility and execution risks. Long-term value depends heavily on PlayZap's ability to expand user adoption, enhance platform features, and maintain competitiveness in the evolving blockchain gaming landscape. Short-term risks include continued price volatility, liquidity constraints, and broader market conditions affecting gaming tokens.

PZP Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) to understand blockchain gaming tokens; use Gate Web3 Wallet for secure storage; focus on learning about the PlayZap platform and gaming ecosystem before increasing exposure ✅ Experienced Investors: Consider strategic accumulation during market weakness with strict position sizing; monitor platform development milestones and user metrics; implement stop-loss mechanisms given high volatility ✅ Institutional Investors: Conduct comprehensive due diligence on PlayZap platform technology, team, and competitive positioning; evaluate liquidity constraints for larger position sizes; consider phased entry strategies to manage market impact

PZP Trading Participation Methods

- Spot Trading: Direct purchase of PZP tokens through Gate.com with support for multiple fiat and cryptocurrency pairs

- Gate Web3 Wallet Integration: Store and manage PZP tokens with integrated wallet functionality for seamless platform interaction

- Portfolio Diversification: Combine PZP holdings with other blockchain gaming projects to spread sector-specific risks

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PZP? What are its main uses and characteristics?

PZP is a innovative cryptocurrency token designed for decentralized price prediction ecosystem. It enables users to participate in prediction markets, earn rewards through accurate forecasts, and govern protocol decisions. Known for transparency, security, and community-driven features.

How to predict PZP price? What analysis methods and tools are available?

PZP price prediction uses technical analysis via candlestick charts and trading volume indicators, combined with fundamental analysis of blockchain network activity and market sentiment. Monitor on-chain metrics and community engagement for comprehensive forecasting.

What is the historical price performance of PZP? What are the past price trends?

PZP has experienced significant price volatility over time, with notable peaks and troughs. Historical data reveals dynamic market movements influenced by market sentiment and trading activity. Detailed price charts show clear trend patterns that help traders identify potential opportunities and market cycles.

What are the risks of investing in PZP? What should I pay attention to?

PZP investment carries platform risk, liquidity risk, and market volatility. Verify platform credentials and regulatory compliance before investing. Start with small amounts and diversify your portfolio.

What factors influence PZP price? Market sentiment, policies, technology, etc.?

PZP price is influenced by market sentiment, regulatory policies, technology developments, and trading volume. These factors collectively drive market dynamics and price movements.

What are PZP's competitive advantages compared to similar tokens?

PZP offers superior payment efficiency with fast transaction speeds and low costs through blockchain technology. It provides enhanced security, trustworthiness, and deep integration with traditional banking systems, delivering better value than comparable tokens.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

What is MASA: A Comprehensive Guide to the Multi-Agent System Architecture

What is WBAI: A Comprehensive Guide to Understanding Weighted Bias and Artificial Intelligence Applications

What is HARD: Understanding the Challenges of Achieving Excellence in Modern Work Environments

What is NC: A Comprehensive Guide to Numerical Control Technology in Modern Manufacturing

What is ANLOG: A Comprehensive Guide to Analog Signal Processing and Its Modern Applications