2026 SWGT Price Prediction: Expert Analysis and Market Forecast for Swingby Token's Future Value

Introduction: SWGT's Market Position and Investment Value

SmartWorld Global Token (SWGT), positioned as a utility token designed to unlock a blockchain-based product ecosystem, has been developing its presence since its launch in 2024. As of February 2026, SWGT maintains a market capitalization of approximately $1.59 million, with a circulating supply of around 96.5 million tokens and a current price hovering near $0.01648. This asset, developed by SWG Global Ltd and backed by applications in transportation, logistics, and a decentralized work marketplace, is exploring its potential in bridging blockchain technology with real-world use cases.

This article will comprehensively analyze SWGT's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies.

I. SWGT Price Historical Review and Current Market Status

SWGT Historical Price Evolution Trajectory

- 2024: SWGT launched on Gate.com at an initial offering price of $0.17, reaching its peak of $0.577 on August 16, 2024, representing a substantial increase from the launch price

- 2025-2026: The token experienced a significant correction period, with price declining considerably from previous levels

- 2026: On February 1, 2026, SWGT recorded its lowest price point at $0.01593

SWGT Current Market Status

As of February 2, 2026, SWGT is trading at $0.01648, showing a modest hourly increase of 2.94%. The 24-hour trading range spans from $0.01593 to $0.01786, with total trading volume reaching $42,175.23.

The token has experienced notable short-term fluctuations, with a 7.89% decline over the past 24 hours and a 3.46% decrease over the past week. Monthly performance indicates a 17.52% drop, while the one-year trajectory shows a substantial 93.15% decrease from previous levels.

SWGT currently maintains a circulating supply of 96.5 million tokens out of a maximum supply of 1 billion tokens, representing 9.65% circulation. The circulating market capitalization stands at approximately $1.59 million, while the fully diluted market capitalization is calculated at $16.48 million. Market share remains at 0.00060%.

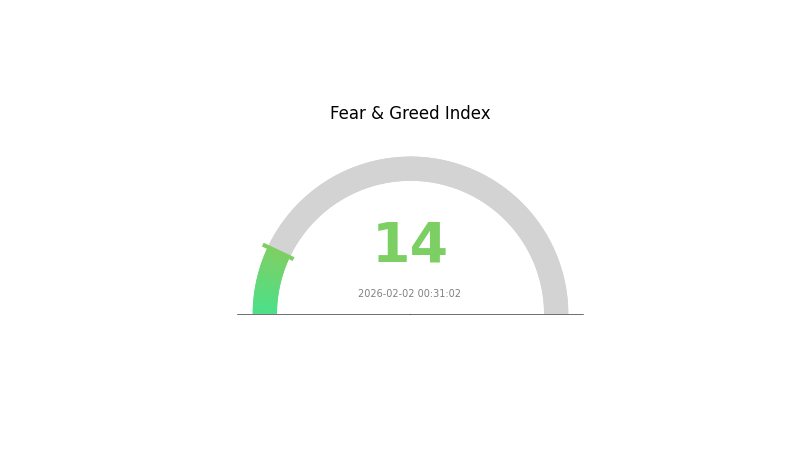

The token ranks 2191 in the cryptocurrency market and is held by 2,789 addresses. Trading activity is available across 3 exchanges. The current market sentiment index registers at 14, indicating extreme fear conditions in the broader cryptocurrency market.

Click to view current SWGT market price

SWGT Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the SWGT index reading at 14. This exceptionally low level signals intense market pessimism and widespread investor anxiety. During such periods, asset prices often reach attractive levels for contrarian investors. However, extreme fear also reflects heightened volatility and uncertainty. Market participants should exercise caution while considering that historically, extreme fear phases have preceded significant recovery opportunities. Prudent risk management and thorough analysis remain essential when navigating such volatile market conditions.

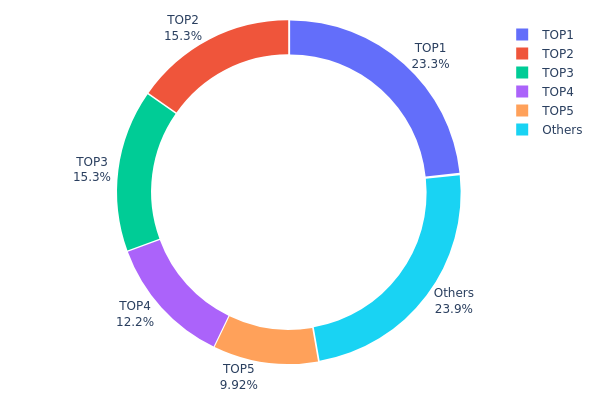

SWGT Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses, serving as a key indicator of market structure and potential decentralization. Based on the current on-chain data, SWGT exhibits a relatively high concentration pattern. The top five addresses collectively hold approximately 76.05% of the total supply, with the largest address alone controlling 23.32% (228,600K tokens), followed by the second and third addresses holding 15.30% and 15.29% respectively. This distribution pattern indicates that a significant portion of SWGT's circulating supply is concentrated among a small number of major holders.

Such concentration levels present both structural characteristics and potential risks for the market. The dominance of top addresses suggests that SWGT may still be in an early stage of distribution, or that strategic holders and project-related entities maintain substantial control. This concentration can amplify price volatility, as large holders possess the capability to influence market dynamics through significant buy or sell actions. Additionally, the relatively small "Others" category (23.95%) indicates limited dispersion among retail participants, which may constrain organic trading activity and liquidity depth.

From a decentralization perspective, SWGT's current holding structure reveals moderate centralization risk. While not uncommon for emerging tokens, this distribution pattern necessitates close monitoring of top address activities, as their trading behaviors could have outsized impacts on market stability. The concentration among the top five addresses creates potential vulnerability to coordinated movements or single-entity decisions, which could affect price discovery and market confidence. As SWGT matures, a gradual redistribution toward broader holder participation would generally indicate healthier market development and reduced manipulation risk.

Click to view current SWGT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x271d...ce5abc | 228600.00K | 23.32% |

| 2 | 0x543c...107c58 | 149986.50K | 15.30% |

| 3 | 0x0f55...47dd89 | 149848.98K | 15.29% |

| 4 | 0xd425...f4c52c | 119945.05K | 12.23% |

| 5 | 0x5733...92cd45 | 97169.29K | 9.91% |

| - | Others | 234450.18K | 23.95% |

II. Core Factors Influencing SWGT's Future Price

Supply Mechanism

- Supply and Demand Balance: The supply-demand relationship serves as a fundamental determinant of SWGT price movements. When demand increases while supply remains limited, prices tend to rise, and conversely, prices may decline when supply exceeds demand.

- Current Circulation Data: Market data indicates that SWGT maintains a controlled supply mechanism, which could potentially support price stability during periods of increased adoption.

- Supply Impact: Limited supply combined with growing market interest may create favorable conditions for price appreciation, though actual outcomes depend on broader market dynamics.

Institutional and Major Holder Dynamics

- Institutional Participation: The materials reference institutional engagement and participation as factors affecting SWGT's price outlook, though specific institutional holdings were not detailed in the provided sources.

- Adoption Trends: Market sentiment around SWGT adoption and technological breakthroughs directly influences price movements, with positive developments potentially driving increased investor confidence.

Macroeconomic Environment

- Market Demand Factors: SWGT's price prospects are influenced by market demand patterns, adoption trends, and broader economic conditions that affect cryptocurrency markets generally.

- Economic Influences: Various macroeconomic factors play a role in shaping SWGT's investment landscape, though the materials did not specify particular monetary policies or inflation dynamics.

Technology Development and Ecosystem Building

- Technological Innovation: Continuous innovation in SWGT's underlying technology may enhance token value over time, with technical breakthroughs serving as potential catalysts for price appreciation.

- Market Sentiment: Investor confidence responds to news regarding technological advancements and widespread adoption, which can create positive momentum for price movement.

- Growth Projections: Some analyses suggest potential annual growth rates, though such projections remain subject to market conditions and should be viewed as estimates rather than guarantees.

III. 2026-2031 SWGT Price Prediction

2026 Outlook

- Conservative Prediction: $0.01436 - $0.0165

- Neutral Prediction: Around $0.0165

- Optimistic Prediction: Up to $0.02343 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: SWGT is anticipated to enter a gradual growth phase, with price volatility potentially stabilizing as the project matures and gains wider recognition in the crypto market.

- Price Range Prediction:

- 2027: $0.01537 - $0.02476, with an average around $0.01997, representing approximately 21% growth

- 2028: $0.01431 - $0.02706, with an average around $0.02236, showing approximately 35% cumulative increase

- 2029: $0.01705 - $0.02669, with an average around $0.02471, reflecting approximately 49% growth from baseline

- Key Catalysts: Potential drivers include ecosystem expansion, strategic partnerships, technological developments, and broader cryptocurrency market trends that could positively influence SWGT's valuation.

2030-2031 Long-term Outlook

- Base Scenario: $0.02004 - $0.0257 (assuming steady market conditions and consistent project development)

- Optimistic Scenario: $0.02467 - $0.03084 (contingent upon successful platform upgrades and increased user engagement)

- Transformative Scenario: Up to $0.03598 (under exceptionally favorable conditions including mainstream adoption and significant technological breakthroughs)

- 2026-02-02: SWGT trading within the initial prediction range, establishing a foundation for potential mid-term appreciation

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.02343 | 0.0165 | 0.01436 | 0 |

| 2027 | 0.02476 | 0.01997 | 0.01537 | 21 |

| 2028 | 0.02706 | 0.02236 | 0.01431 | 35 |

| 2029 | 0.02669 | 0.02471 | 0.01705 | 49 |

| 2030 | 0.03598 | 0.0257 | 0.02004 | 55 |

| 2031 | 0.03207 | 0.03084 | 0.02467 | 87 |

IV. SWGT Professional Investment Strategies and Risk Management

SWGT Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to blockchain-based logistics and decentralized marketplace solutions

- Operational Recommendations:

- Consider gradual accumulation during price corrections to average entry costs

- Monitor project development milestones and ecosystem expansion updates

- Secure storage using Gate Web3 Wallet for long-term holdings with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $42,175.23) to identify liquidity trends and potential breakout signals

- Price Range Indicators: Track the 24-hour range ($0.01593 - $0.01786) to establish support and resistance levels for entry and exit points

- Swing Trading Key Points:

- Set stop-loss orders below recent low levels to manage downside risk

- Consider taking partial profits during short-term rallies given recent volatility patterns

SWGT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Active Investors: 3-7% portfolio allocation

- Professional Investors: 5-10% portfolio allocation

(II) Risk Hedging Solutions

- Position Sizing: Limit individual position size to control exposure relative to overall portfolio volatility

- Diversification Strategy: Balance SWGT holdings with established cryptocurrencies and different sector tokens

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and quick access

- Cold Storage Solution: Hardware wallets for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, maintain backup recovery phrases in secure offline locations, and verify contract addresses (0xc8bf8bc34874e07f6a0d4abc8be22ba9e372631b) before transactions

V. SWGT Potential Risks and Challenges

SWGT Market Risks

- Price Volatility: SWGT has experienced significant price fluctuations, with 1-year performance showing -93.15% change, indicating substantial downside risk exposure

- Limited Liquidity: With 24-hour trading volume of $42,175.23 and availability on only 3 exchanges, liquidity constraints may impact execution of larger orders

- Circulating Supply Dynamics: Current circulating supply represents only 9.65% of total supply, suggesting potential future supply releases could affect price stability

SWGT Regulatory Risks

- Jurisdictional Compliance: Regulatory approaches to blockchain-based logistics and decentralized work marketplaces vary across jurisdictions, potentially affecting project operations

- Token Classification Uncertainty: Evolving regulatory frameworks may impact SWGT's classification as a utility token and its permitted use cases

- Cross-border Transaction Oversight: International logistics applications may face enhanced regulatory scrutiny regarding cross-border payment mechanisms

SWGT Technical Risks

- Smart Contract Dependencies: As an ERC-20 token, SWGT relies on Ethereum network security and performance characteristics

- Project Execution Risk: Successful implementation of promised logistics and marketplace solutions requires ongoing technical development and adoption

- Market Competition: The blockchain logistics and decentralized work marketplace sectors face competition from established platforms and emerging projects

VI. Conclusion and Action Recommendations

SWGT Investment Value Assessment

SWGT represents an early-stage blockchain project targeting logistics and decentralized work marketplace solutions. While the project addresses potentially significant use cases, current market performance indicates elevated risk levels, with limited liquidity and substantial price decline over the past year. The low circulating supply ratio (9.65%) presents both opportunity for scarcity-driven appreciation and risk from future supply releases. Investors should carefully weigh the project's developmental stage against their risk tolerance and investment timeframe.

SWGT Investment Recommendations

✅ Beginners: Consider monitoring project development and market stabilization before committing significant capital; start with minimal position sizes if entering ✅ Experienced Investors: Evaluate SWGT as a small speculative position within a diversified portfolio, focusing on project milestone achievements and ecosystem growth metrics ✅ Institutional Investors: Conduct thorough due diligence on project fundamentals, team capabilities, and partnership developments; consider staged entry strategies aligned with measurable progress indicators

SWGT Trading Participation Methods

- Spot Trading: Purchase and hold SWGT through Gate.com spot markets with appropriate position sizing relative to risk tolerance

- Dollar-Cost Averaging: Establish regular, fixed-amount purchases to mitigate timing risk and smooth entry prices over extended periods

- Limit Order Strategy: Use limit orders to target specific price levels based on technical analysis and support/resistance zones

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SWGT token? What is its project background and purpose?

SWGT token, developed by SWG Global Ltd, powers a decentralized freelance marketplace. It's a blockchain-based utility token designed to provide real-world applications within an innovative product ecosystem.

What are the main factors affecting SWGT price?

SWGT price is primarily influenced by market demand and supply dynamics, project development progress, overall crypto market sentiment, trading volume, and macroeconomic conditions. Regulatory changes and technological innovations also significantly impact price movements.

How to conduct SWGT price prediction? What are the analysis methods?

Use technical analysis like moving averages and RSI indicators. Apply fundamental analysis to assess project potential. Monitor market trends, trading volume, and key resistance levels for prediction signals.

How has SWGT performed historically? What is the recent trend?

SWGT is currently trading at US$0.01798, showing a 0.89% increase over the last 24 hours and a 2.02% rise over the past week. The token demonstrates slight upward momentum with steady trading activity.

What are the risks of investing in SWGT? What should I pay attention to?

SWGT investment carries market volatility risks. Prices fluctuate significantly based on market conditions and sentiment. Investors should assess their risk tolerance carefully, conduct thorough research, and only invest what they can afford to lose. Consider consulting financial advisors before investing.

What are the advantages and disadvantages of SWGT compared to similar tokens?

SWGT offers lower costs and supports dungeon farming efficiency. However, it may face market liquidity challenges. Its main advantage is affordability, while limited liquidity remains its primary disadvantage.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Newbie Must Read: How to Formulate Investment Strategies When Nasdaq Turns Positive in 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

TapSwap Listing Date: What Investors Need to Know in 2025

Is Loulou (LOULOU) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Is ShidenNetwork (SDN) a good investment?: A Comprehensive Analysis of Risks, Rewards, and Market Potential in 2024

Is Terrace (TRC) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Growth Potential, and Risk Factors

Who Is Vitalik Buterin? The Story of Ethereum’s Co-Founder