Is ShidenNetwork (SDN) a good investment?: A Comprehensive Analysis of Risks, Rewards, and Market Potential in 2024

Introduction: Shiden Network (SDN) Investment Position and Market Outlook

Shiden Network (SDN) is a notable asset in the cryptocurrency sector, operating as a multi-chain decentralized application layer on Kusama Network since its launch in 2021. As of February 2026, SDN has a market capitalization of approximately $1.36 million, with a circulating supply of around 68.23 million tokens, and the current price is around $0.02. With its positioning as a smart contract platform supporting Ethereum Virtual Machine, WebAssembly, and Layer2 solutions, SDN has become a subject of discussion among investors evaluating "Is Shiden Network (SDN) a good investment?" This article will comprehensively analyze SDN's investment value, historical trends, future price outlook, and investment risks to provide reference for investors.

SDN serves as the native token of Shiden Network, which functions as a research and development chain within the Polkadot ecosystem. The network addresses Kusama relay chain's limitation of not supporting smart contract functionality by providing a smart contract layer. The platform enables various applications including DeFi and NFT projects. As of the current date, SDN holds a market ranking of 2306, with approximately 13,108 holders and trading availability on 2 exchanges. The token's circulating supply represents about 83.68% of its total supply of 87.52 million tokens, while the maximum supply remains unlimited. Understanding SDN's market dynamics, technical foundation, and risk factors is essential for evaluating its potential in the evolving blockchain landscape.

I. Coin Price History Review and Investment Value Status

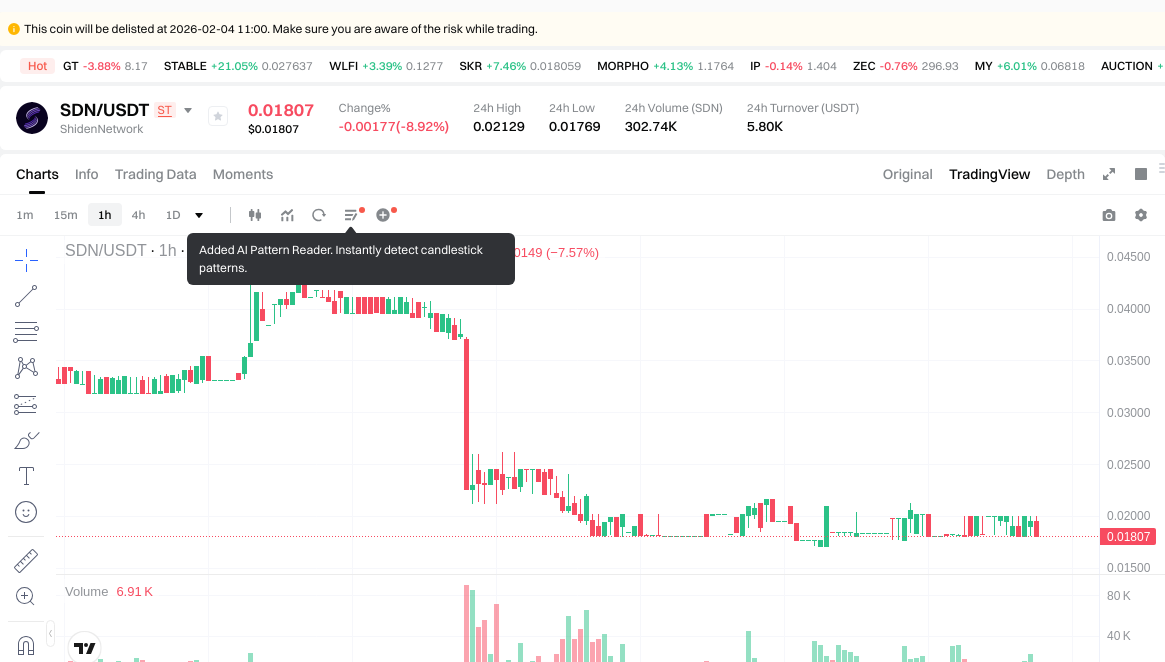

SDN Historical Price Trend and Investment Performance (ShidenNetwork (SDN) Investment Performance)

- 2021: SDN launched on August 30, 2021, with an initial price of $1.4 → Investors experienced significant early volatility as the project established its presence on Kusama Network

- 2021: September market peak → SDN price climbed to $8.36 during the broader crypto market rally, representing substantial gains from the launch price

- 2024-2026: Market correction phase → Price declined from higher levels to around $0.02, reflecting broader market challenges and sector-wide adjustments

Current SDN Investment Market Status (February 2026)

- SDN current price: $0.02

- 24-hour price change: -7.96%

- 24-hour trading volume: $5,766.87

- Market capitalization: $1,364,579.78

- Circulating supply: 68,228,989.24 SDN (83.68% of total supply)

- Total supply: 87,516,822.15 SDN

- Market dominance: 0.000063%

Click to view real-time SDN market price

II. Core Factors Influencing Whether SDN Is a Good Investment (Is ShidenNetwork(SDN) a Good Investment)

Supply Mechanism and Scarcity (SDN investment scarcity)

- Supply structure → influences price and investment value

- ShidenNetwork has a total supply of 87,516,822.15 SDN with a circulating supply of 68,228,989.24 SDN, representing approximately 83.68% of the total supply. The maximum supply is unlimited, which may impact long-term scarcity considerations.

- Historical context: SDN has experienced significant price volatility, with previous price levels recorded at $8.36 in September 2021 and a low of $0.01749167 in February 2026.

- Investment significance: The unlimited maximum supply structure may present considerations for long-term scarcity-based investment theses.

Technology and Ecosystem Development (Technology & Ecosystem for SDN investment)

- Multi-chain decentralized application layer on Kusama Network: ShidenNetwork functions as a smart contract layer for Kusama relay chain, supporting Ethereum Virtual Machine, WebAssembly, and Layer 2 solutions.

- Platform capabilities: The platform supports various applications including DeFi and NFT, which may contribute to ecosystem expansion and potential value propositions.

- Technical infrastructure: As a Canal network serving as a research and development chain for Plasm Network, SDN token holders can claim tokens at a 1:1 ratio, reflecting certain structural integration within the broader network architecture.

- Investment relevance: The technical infrastructure and multi-chain support capabilities may influence the platform's ability to attract developers and applications, which could affect long-term investment considerations.

Market Performance and Volatility

- Current market data: As of February 2, 2026, SDN is trading at $0.02 with a market capitalization of $1,364,579.78 and a 24-hour trading volume of $5,766.87.

- Recent price trends: The token has experienced significant declines across multiple timeframes: -9.55% (1H), -7.96% (24H), -46.81% (7D), -33.41% (30D), and -84.96% (1Y).

- Exchange availability: SDN is currently listed on 2 exchanges, with Gate.com being one of the trading platforms.

- Holder base: The token has approximately 13,108 holders, which may provide insights into distribution and community engagement levels.

- Investment significance: The substantial volatility and negative price trends across various timeframes represent important considerations for risk assessment and investment timing strategies.

III. SDN Future Investment Prediction and Price Outlook (Is ShidenNetwork(SDN) worth investing in 2026-2031)

Short-term Investment Prediction (2026, short-term SDN investment outlook)

- Conservative Forecast: $0.0097578 - $0.01807

- Neutral Forecast: $0.01807 - $0.0191542

- Optimistic Forecast: $0.0191542 - $0.0202384

Mid-term Investment Outlook (2027-2029, mid-term ShidenNetwork(SDN) investment forecast)

- Market Stage Expectation: The token may experience moderate volatility with gradual recovery patterns, influenced by ecosystem development and broader market conditions.

- Investment Return Prediction:

- 2027: $0.018388032 - $0.021835788

- 2028: $0.01393659592 - $0.02520884262

- 2029: $0.0217093223945 - $0.027422301972

- Key Catalysts: Multi-chain application layer expansion, smart contract adoption, and integration with DeFi and NFT ecosystems.

Long-term Investment Outlook (Is SDN a good long-term investment?)

- Baseline Scenario: $0.020494994 - $0.025137110141 (assuming steady ecosystem growth and moderate market conditions)

- Optimistic Scenario: $0.02840493445933 - $0.035506168074162 (assuming accelerated adoption and favorable market environment)

- Risk Scenario: Below $0.01332266837473 (under extreme market downturns or ecosystem setbacks)

Click to view SDN long-term investment and price prediction: Price Prediction

2026-02-02 - 2031 Long-term Outlook

- Baseline Scenario: $0.020494994 - $0.025137110141 (corresponding to steady progress and gradual mainstream application enhancement)

- Optimistic Scenario: $0.02840493445933 - $0.035506168074162 (corresponding to large-scale adoption and favorable market environment)

- Transformational Scenario: Above $0.035506168074162 (such as breakthrough ecosystem developments and mainstream popularization)

- 2031-12-31 Predicted High: $0.035506168074162 (based on optimistic development assumptions)

Disclaimer: The above predictions are for reference only and do not constitute investment advice. Cryptocurrency markets are highly volatile and subject to various risks. Please conduct thorough research and consider your risk tolerance before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0202384 | 0.01807 | 0.0097578 | -9 |

| 2027 | 0.021835788 | 0.0191542 | 0.018388032 | -4 |

| 2028 | 0.02520884262 | 0.020494994 | 0.01393659592 | 2 |

| 2029 | 0.027422301972 | 0.02285191831 | 0.0217093223945 | 14 |

| 2030 | 0.03167275877766 | 0.025137110141 | 0.01332266837473 | 25 |

| 2031 | 0.035506168074162 | 0.02840493445933 | 0.024428243635023 | 42 |

IV. SDN Investment Strategy and Risk Management (How to invest in ShidenNetwork)

Investment Methodology (SDN investment strategy)

Long-term Holding (HODL SDN)

For conservative investors seeking stability, a long-term holding strategy may be considered. This approach involves:

- Accumulating SDN tokens during market corrections

- Holding through market cycles to potentially benefit from ecosystem development

- Monitoring Shiden Network's progress on Kusama parachain functionality

- Evaluating the platform's adoption rate for DeFi and NFT applications

Active Trading

For investors with technical analysis capabilities:

- Utilizing chart patterns and technical indicators to identify entry and exit points

- Monitoring 24-hour trading volume ($5,766.87 as of February 2, 2026)

- Tracking price movements within the daily range ($0.01769 - $0.02129)

- Implementing stop-loss orders to manage downside risk

Risk Management (Risk management for SDN investment)

Asset Allocation Ratios

- Conservative investors: Limit SDN exposure to 1-3% of total crypto portfolio

- Moderate investors: Allocate 3-7% to SDN within diversified holdings

- Aggressive investors: May consider up to 10-15% allocation with proper risk controls

Risk Hedging Approaches

- Diversify across multiple blockchain ecosystems beyond Kusama

- Consider stablecoin positions to hedge against volatility

- Balance SDN holdings with established cryptocurrencies

- Monitor correlation with broader market movements

Secure Storage Solutions

- Hot wallets: For active trading purposes only, with minimal balances

- Cold wallets: Hardware wallets (Ledger, Trezor) for long-term storage

- Multi-signature wallets: For institutional or large holdings

- Regular security audits and backup procedures

V. SDN Investment Risks and Challenges (Risks of investing in ShidenNetwork)

Market Risk

- High volatility: SDN experienced a 7.96% decline in 24 hours and 46.81% decline over 7 days

- Price fluctuations: Trading between $0.01769 and $0.02129 within a single day

- Limited liquidity: Trading volume of $5,766.87 may result in slippage for larger orders

- Market capitalization: Relatively small market cap of $1,364,579.78 increases vulnerability to price swings

Regulatory Risk

- Evolving regulatory frameworks across different jurisdictions may impact trading availability

- Potential restrictions on parachain projects in certain regions

- Compliance requirements that could affect platform operations

- Uncertain treatment of multi-chain decentralized applications by regulatory bodies

Technical Risk

- Network security: Smart contract vulnerabilities in EVM and WebAssembly implementations

- Upgrade complications: Potential issues during protocol updates or parachain slot renewals

- Dependency risk: Reliance on Kusama Network infrastructure and governance decisions

- Layer 2 integration: Technical challenges in maintaining seamless Layer 2 solution compatibility

- Competition: Increasing number of smart contract platforms on Kusama and other networks

VI. Conclusion: Is ShidenNetwork a Good Investment?

Investment Value Summary

SDN presents opportunities within the Kusama ecosystem as a multi-chain decentralized application layer supporting Ethereum Virtual Machine, WebAssembly, and Layer 2 solutions. The platform's focus on DeFi and NFT applications positions it within growing sectors. However, investors should note the substantial price volatility, with 84.96% decline over one year and recent sharp downward movements. The relatively small market capitalization and trading volume suggest limited liquidity compared to larger projects.

Investor Recommendations

✅ Beginners:

- Consider dollar-cost averaging to mitigate timing risk

- Use hardware wallets for secure storage

- Start with minimal allocation (1-2% of portfolio)

- Thoroughly research Kusama parachain mechanics before investing

✅ Experienced Investors:

- Employ technical analysis for short-term trading opportunities

- Maintain diversified portfolio across multiple blockchain ecosystems

- Monitor Shiden Network development updates and ecosystem growth metrics

- Set clear profit targets and stop-loss levels

✅ Institutional Investors:

- Conduct comprehensive due diligence on platform security and governance

- Evaluate strategic alignment with multi-chain infrastructure thesis

- Consider gradual position building with appropriate risk management frameworks

- Assess regulatory implications across operating jurisdictions

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk. This content is for informational purposes only and does not constitute investment advice. Past performance does not guarantee future results. Investors should conduct independent research and consult financial advisors before making investment decisions.

VII. FAQ

Q1: What is Shiden Network (SDN) and what makes it unique in the cryptocurrency market?

Shiden Network (SDN) is a multi-chain decentralized application layer operating on Kusama Network that serves as a smart contract platform supporting Ethereum Virtual Machine (EVM), WebAssembly, and Layer 2 solutions. Launched in August 2021, SDN addresses the limitation of Kusama relay chain's inability to support smart contracts by providing a dedicated smart contract layer. What makes SDN unique is its positioning as a Canal network and research and development chain within the Polkadot ecosystem, enabling various applications including DeFi and NFT projects while functioning as a testing ground for innovations that may later be implemented on Polkadot's Astar Network.

Q2: What is the current market performance of SDN and how has it performed historically?

As of February 2, 2026, SDN trades at approximately $0.02 with a market capitalization of $1,364,579.78 and 24-hour trading volume of $5,766.87. The token has experienced significant volatility, declining 7.96% in 24 hours, 46.81% over 7 days, and 84.96% over one year. Historically, SDN launched at $1.4 in August 2021 and reached a peak of $8.36 in September 2021 during the broader crypto market rally. The substantial price decline from historical highs reflects broader market corrections and sector-wide challenges affecting smaller-cap cryptocurrency projects.

Q3: What are the main risks associated with investing in Shiden Network?

The primary risks include high market volatility (with daily price swings between $0.01769 and $0.02129), limited liquidity with a relatively small trading volume of $5,766.87, and a small market capitalization of approximately $1.36 million that increases vulnerability to price manipulation. Technical risks involve potential smart contract vulnerabilities in EVM and WebAssembly implementations, dependency on Kusama Network infrastructure and governance decisions, and competition from increasing numbers of smart contract platforms. Additionally, regulatory uncertainty around multi-chain decentralized applications and parachain projects poses jurisdiction-specific compliance challenges.

Q4: What is the price outlook for SDN in the short-term and long-term?

Short-term outlook for 2026 suggests a conservative forecast range of $0.0097578 to $0.01807, with neutral predictions between $0.01807 and $0.0191542, and optimistic scenarios reaching $0.0202384. For long-term investment through 2031, baseline scenarios project prices between $0.020494994 and $0.025137110141 assuming steady ecosystem growth. Optimistic scenarios forecast $0.02840493445933 to $0.035506168074162 with accelerated adoption and favorable market conditions. However, these predictions carry significant uncertainty due to market volatility, ecosystem development variables, and broader cryptocurrency market dynamics.

Q5: What investment strategies are recommended for different types of SDN investors?

For beginners, a conservative approach is recommended with dollar-cost averaging, minimal allocation (1-2% of portfolio), hardware wallet storage, and thorough research on Kusama parachain mechanics before investing. Experienced investors should employ technical analysis for short-term trading opportunities, maintain diversified portfolios across multiple blockchain ecosystems, monitor ecosystem growth metrics, and implement clear profit targets and stop-loss levels. Institutional investors should conduct comprehensive due diligence on platform security and governance, evaluate strategic alignment with multi-chain infrastructure thesis, consider gradual position building with appropriate risk management frameworks, and assess regulatory implications across operating jurisdictions.

Q6: How does SDN's supply mechanism affect its investment value?

Shiden Network has a total supply of 87,516,822.15 SDN with a circulating supply of 68,228,989.24 SDN (approximately 83.68% of total supply). Importantly, the maximum supply is unlimited, which presents considerations for long-term scarcity-based investment theses. Unlike cryptocurrencies with fixed maximum supplies that create deflationary pressure, SDN's unlimited supply structure may impact long-term value appreciation dynamics. Investors should consider this inflationary characteristic when evaluating SDN's potential for scarcity-driven price appreciation compared to tokens with capped supplies.

Q7: What role does Shiden Network play in the broader Polkadot and Kusama ecosystem?

Shiden Network serves as a critical infrastructure component within the Polkadot ecosystem by functioning as a research and development chain and testing ground for innovations. As a Canal network, SDN token holders can claim tokens at a 1:1 ratio, reflecting structural integration with Plasm Network (now Astar Network on Polkadot). The platform addresses Kusama relay chain's limitation of not supporting smart contract functionality, enabling developers to build and test DeFi and NFT applications in a live environment before potentially deploying to Polkadot. This positioning as a parachain on Kusama Network provides both developmental utility and potential value proposition tied to the broader ecosystem's growth.

Q8: What factors should investors monitor when evaluating SDN's investment potential?

Key factors include ecosystem development metrics such as the number of DeFi and NFT applications deployed on Shiden Network, developer activity and smart contract deployments, adoption rates for EVM and WebAssembly capabilities, and parachain slot renewal outcomes on Kusama Network. Market-related indicators include trading volume trends, holder base expansion (currently 13,108 holders), exchange listing additions beyond the current 2 exchanges, and correlation with broader Kusama and Polkadot ecosystem performance. Technical considerations involve monitoring protocol upgrades, Layer 2 solution implementations, security audit results, and competitive positioning against other smart contract platforms within the multi-chain landscape.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is ETHS: A Comprehensive Guide to Ethereum Staking and Its Impact on the Blockchain Ecosystem

What is LVVA: A Comprehensive Guide to Low-Voltage Variable Architecture in Modern Electrical Systems

What is LN: A Comprehensive Guide to the Lightning Network and Its Impact on Bitcoin Transactions

2026 TEVA Price Prediction: Expert Analysis and Market Forecast for Teva Pharmaceutical Industries Stock

2026 IRIS Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Blockchain Adoption