BC vs ETH: A Comprehensive Comparison of Bitcoin and Ethereum's Market Performance and Technological Innovation

Introduction: BC vs ETH Investment Comparison

In the cryptocurrency market, the comparison between BC vs ETH remains a topic that investors cannot avoid. The two differ significantly in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape. BC (Blood Crystal): Launched in March 2024, it has gained market recognition as a blockchain game token that merges the classic Wizardry franchise with blockchain gaming concepts, emphasizing usability and strategic gameplay mechanics. ETH (Ethereum): Since its launch in July 2014, it has been recognized as the leading smart contract platform, ranking among the highest in global trading volume and market capitalization among cryptocurrencies. This article will provide a comprehensive analysis of the investment value comparison between BC vs ETH, covering historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

BC (Blood Crystal) and ETH (Ethereum) Historical Price Trends

- 2024: BC experienced significant volatility, with its all-time high of $0.095102 recorded in December 2024. Following this peak, the token entered a downward trend.

- 2025: ETH reached its all-time high of $4,946.05 in August 2025, driven by continued adoption in decentralized finance and smart contract applications. However, the token subsequently faced market corrections.

- Comparative Analysis: During the recent market cycle, BC declined from its peak of $0.095102 to a low of $0.000901 (recorded in December 2025), representing a substantial decrease. In contrast, ETH demonstrated relatively stronger price resilience, though it also experienced notable corrections from its peak levels.

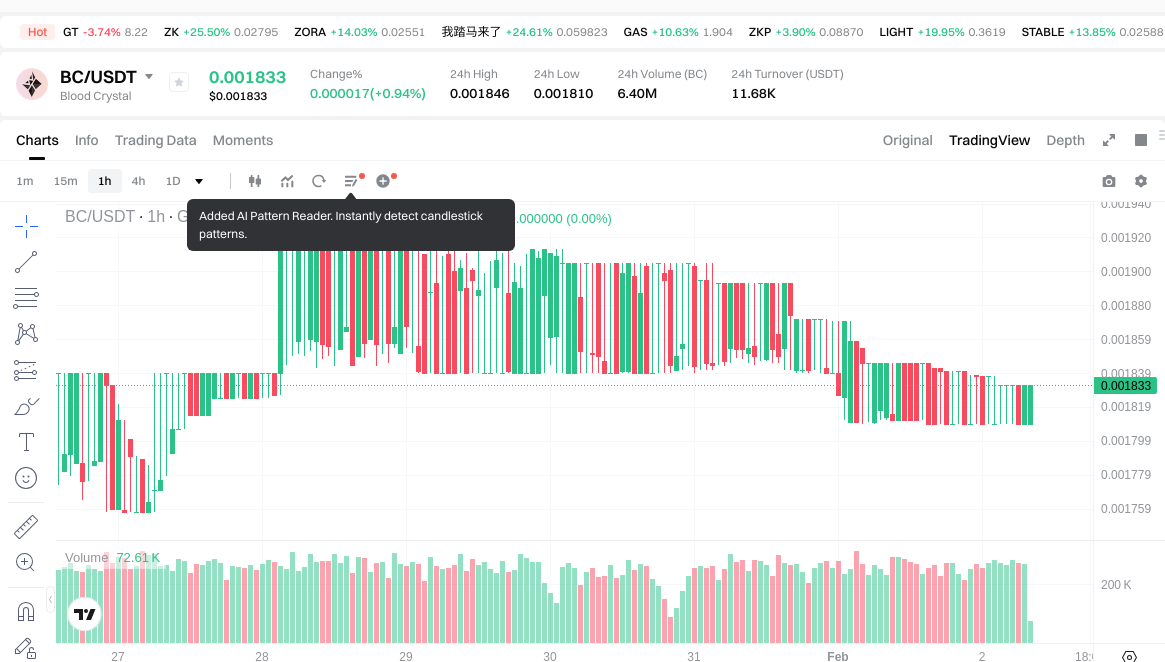

Current Market Status (2026-02-02)

- BC Current Price: $0.00181

- ETH Current Price: $2,270.41

- 24-Hour Trading Volume: BC recorded $11,629.41 compared to ETH's $599,113,832.82

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View real-time prices:

- View BC current price Market Price

- View ETH current price Market Price

II. Core Factors Influencing BC vs ETH Investment Value

Tokenomics Comparison

-

Bitcoin (BTC): Features a fixed maximum supply of 21 million coins, with the supply schedule programmed into the code and maintained through social consensus and network participation. This scarcity model is considered a fundamental value proposition.

-

Ethereum (ETH): Derives value from its utility as Layer 1 transaction gas fees and Layer 2 data publishing fees, as well as its role in DeFi applications. The platform's overall usage rate may transfer value to token holders, potentially leading to ETH appreciation.

-

📌 Historical Pattern: Supply mechanisms influence price cycles through their impact on market availability and perceived scarcity dynamics.

Institutional Adoption and Market Applications

-

Institutional Holdings: Bitcoin attracts deeper capital pools and is typically the preferred choice for investors adding crypto exposure through ETFs. Ethereum has experienced greater volatility, making it suitable for smaller, more strategic allocations.

-

Enterprise Adoption: Bitcoin is increasingly viewed as a core asset in the crypto market, while Ethereum's price tends to fluctuate with network activity and risk appetite changes.

-

Regulatory Environment: ETF vehicles have simplified the investment pathway for both assets, allowing investors to gain exposure through regulated fund structures without managing wallets or direct cryptocurrency transactions.

Technical Development and Ecosystem Building

-

Bitcoin Technical Development: Reports examine decentralized finance on Bitcoin through capital efficiency improvements, institutional adoption drivers, and technical infrastructure development.

-

Ethereum Technical Evolution: Distinguished by its smart contract functionality, enabling transactions and applications without intermediaries. This supports the construction of decentralized applications including DeFi, NFTs, and GameFi.

-

Ecosystem Comparison: Ethereum's ecosystem has matured considerably, spanning DeFi, NFTs, and various Layer 2 solutions, with ETH's value as underlying infrastructure repeatedly validated by the market. Bitcoin maintains focus as a store of value asset.

Macroeconomic Factors and Market Cycles

-

Performance in Inflationary Environments: Both assets serve different roles in portfolio construction, with Bitcoin often positioned for stability in volatile markets, while Ethereum may move more actively with market momentum.

-

Monetary Policy Impact: Price volatility and drawdowns directly reflect the performance of the underlying assets, influenced by broader macroeconomic conditions.

-

Geopolitical Factors: Market demand and technological development remain key factors affecting both assets' trajectories in the evolving digital asset landscape.

III. 2026-2031 Price Forecast: BC vs ETH

Short-term Forecast (2026)

- BC: Conservative $0.00126-$0.00183 | Optimistic $0.00183-$0.00233

- ETH: Conservative $1,326-$2,286 | Optimistic $2,286-$2,812

Medium-term Forecast (2028-2029)

- BC may enter a gradual growth phase, with estimated price range of $0.00155-$0.00365

- ETH may enter a consolidation and expansion phase, with estimated price range of $2,602-$4,138

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- BC: Baseline scenario $0.00257-$0.00321 | Optimistic scenario $0.00321-$0.00425

- ETH: Baseline scenario $2,724-$3,837 | Optimistic scenario $3,837-$5,789

Disclaimer

BC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00232791 | 0.001833 | 0.00126477 | 1 |

| 2027 | 0.0024133278 | 0.002080455 | 0.00168516855 | 14 |

| 2028 | 0.003280461444 | 0.0022468914 | 0.001550355066 | 24 |

| 2029 | 0.00364805287704 | 0.002763676422 | 0.00237676172292 | 52 |

| 2030 | 0.003590568407462 | 0.00320586464952 | 0.002564691719616 | 77 |

| 2031 | 0.004247770660614 | 0.003398216528491 | 0.002582644561653 | 87 |

ETH:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 2811.8538 | 2286.06 | 1325.9148 | 0 |

| 2027 | 3721.477074 | 2548.9569 | 1809.759399 | 12 |

| 2028 | 4138.48642284 | 3135.216987 | 2602.23009921 | 38 |

| 2029 | 4036.9053924612 | 3636.85170492 | 2618.5332275424 | 60 |

| 2030 | 4374.041545507284 | 3836.8785486906 | 2724.183769570326 | 68 |

| 2031 | 5788.69866640950822 | 4105.460047098942 | 2299.05762637540752 | 80 |

IV. Investment Strategy Comparison: BC vs ETH

Long-term vs Short-term Investment Strategies

- BC: May appeal to investors with higher risk tolerance seeking exposure to blockchain gaming tokens and speculative growth opportunities in emerging gaming ecosystems

- ETH: May suit investors seeking exposure to established smart contract infrastructure, DeFi applications, and broader institutional adoption trends

Risk Management and Asset Allocation

- Conservative Investors: BC: 5-10% vs ETH: 15-25%

- Aggressive Investors: BC: 15-25% vs ETH: 30-40%

- Hedging Instruments: Stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- BC: Characterized by substantial price volatility, as evidenced by historical price movements from peak levels. Trading volume remains relatively limited at $11,629.41, which may impact liquidity during market stress

- ETH: Experiences market-wide volatility correlated with broader cryptocurrency market cycles. Current market sentiment (Fear & Greed Index at 14) indicates heightened risk aversion affecting price stability

Technical Risk

- BC: Scalability and network stability considerations remain relevant for blockchain gaming tokens. Limited historical data on technical infrastructure resilience

- ETH: Ongoing development in Layer 2 scaling solutions and network upgrades. Smart contract security considerations and potential vulnerabilities in decentralized applications built on the platform

Regulatory Risk

- Global regulatory frameworks continue to evolve, with potential differential impacts on established platforms versus emerging gaming tokens. ETF availability has created regulated exposure pathways for both assets, though regulatory clarity varies by jurisdiction

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- BC Characteristics: Positioned in the blockchain gaming sector with significant volatility profile. Current price of $0.00181 represents substantial decline from historical peak levels

- ETH Characteristics: Established smart contract platform with institutional adoption, extensive ecosystem spanning DeFi and NFTs, current price of $2,270.41 with relatively stronger market resilience

✅ Investment Considerations:

- New Investors: May consider starting with established platforms that demonstrate broader institutional adoption and ecosystem maturity before exploring specialized tokens

- Experienced Investors: Could evaluate portfolio diversification across different cryptocurrency categories based on individual risk tolerance and investment timeframes

- Institutional Investors: May prioritize assets with deeper liquidity, regulatory clarity through ETF structures, and established market infrastructure

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility. This content does not constitute investment advice. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between BC and ETH in terms of use cases?

BC (Blood Crystal) is a blockchain gaming token launched in March 2024, focusing on the integration of classic gaming franchises with blockchain mechanics and strategic gameplay. ETH (Ethereum), launched in July 2014, serves as the foundation for smart contract functionality, enabling decentralized applications across DeFi, NFTs, and Layer 2 solutions. While BC targets the specialized blockchain gaming sector, ETH functions as comprehensive infrastructure for the broader decentralized application ecosystem.

Q2: How do the supply mechanisms of BC and ETH differ?

BC and ETH employ distinct tokenomics models that influence their value propositions. ETH derives value from its utility as Layer 1 transaction gas fees and Layer 2 data publishing fees, with its supply model designed to support platform operations and DeFi applications. The platform's usage rate may transfer value to token holders through network demand dynamics. These supply mechanisms directly impact market availability and perceived scarcity, which historically influence price cycles and long-term valuation patterns.

Q3: What is the current market status comparison between BC and ETH?

As of February 2, 2026, BC trades at $0.00181 with 24-hour trading volume of $11,629.41, while ETH trades at $2,270.41 with significantly higher trading volume of $599,113,832.82. BC has experienced substantial volatility, declining from its December 2024 peak of $0.095102 to a low of $0.000901 in December 2025. ETH demonstrated relatively stronger price resilience, though it also faced corrections from its August 2025 all-time high of $4,946.05. The current market sentiment index stands at 14 (Extreme Fear), indicating heightened risk aversion across the cryptocurrency market.

Q4: What are the price forecasts for BC and ETH through 2031?

For 2026, BC's conservative forecast ranges from $0.00126-$0.00183, with an optimistic scenario of $0.00183-$0.00233. ETH's conservative forecast for 2026 ranges from $1,326-$2,286, with an optimistic scenario of $2,286-$2,812. By 2031, BC's baseline scenario projects $0.00257-$0.00321 with an optimistic scenario of $0.00321-$0.00425, while ETH's baseline scenario estimates $2,724-$3,837 with an optimistic scenario of $3,837-$5,789. Key drivers include institutional capital inflows, ETF developments, and ecosystem growth, though these forecasts carry significant uncertainty given cryptocurrency market volatility.

Q5: How should investors allocate between BC and ETH based on risk tolerance?

Conservative investors may consider allocating 5-10% to BC and 15-25% to ETH, while aggressive investors might allocate 15-25% to BC and 30-40% to ETH. BC may appeal to investors with higher risk tolerance seeking exposure to blockchain gaming tokens and speculative growth opportunities in emerging gaming ecosystems. ETH may suit investors seeking exposure to established smart contract infrastructure, DeFi applications, and broader institutional adoption trends. Risk management strategies should include stablecoin allocation, options strategies, and cross-asset portfolio diversification to mitigate cryptocurrency market volatility.

Q6: What are the primary risks associated with investing in BC versus ETH?

BC faces substantial price volatility, limited liquidity with trading volume at $11,629.41, and uncertainties regarding blockchain gaming token scalability and network stability. ETH experiences market-wide volatility correlated with broader cryptocurrency cycles, ongoing technical considerations related to Layer 2 scaling solutions, and smart contract security vulnerabilities in decentralized applications. Both assets face evolving global regulatory frameworks, though ETF availability has created regulated exposure pathways. The current Fear & Greed Index of 14 indicates heightened market risk aversion affecting both assets.

Q7: Which asset is more suitable for institutional investors?

Institutional investors may prioritize ETH due to its deeper liquidity (24-hour trading volume of $599,113,832.82), established market infrastructure, and regulatory clarity through ETF structures. ETH's extensive ecosystem spanning DeFi, NFTs, and Layer 2 solutions provides broader institutional adoption pathways and infrastructure maturity. BC's limited trading volume and specialized focus on blockchain gaming may present liquidity challenges for larger institutional allocations. However, institutions seeking diversified cryptocurrency exposure might evaluate both assets within broader portfolio strategies based on allocation size and risk management frameworks.

Q8: How do macroeconomic factors affect BC and ETH differently?

Both assets serve different roles in portfolio construction during varying macroeconomic conditions. Bitcoin (as a reference point for store of value assets) is often positioned for stability in volatile markets, while Ethereum may move more actively with market momentum due to its utility-driven value proposition. ETH's price tends to fluctuate with network activity and risk appetite changes, making it more sensitive to broader market cycles. BC, as an emerging blockchain gaming token, may exhibit amplified volatility during macroeconomic uncertainty. Monetary policy impacts, inflationary environments, and geopolitical factors influence both assets, though their responses may differ based on their distinct positioning within the cryptocurrency landscape.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Comprehensive Guide to Harmonic Patterns for Trading

Ultimate Guide to Dogelon Mars Trading

2026 ZULU Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Digital Assets

2026 LANDSHARE Price Prediction: Analyzing Growth Potential and Market Trends for the Next Generation of Real Estate Tokenization

2026 1DOLLAR Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for Digital Currency Growth