ROOT vs XTZ: A Comprehensive Comparison of Two Emerging Blockchain Platforms

Introduction: Investment Comparison Between ROOT and XTZ

In the cryptocurrency market, the comparison between ROOT vs XTZ has consistently been a topic investors cannot avoid. The two differ significantly in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

ROOT (ROOT): Launched in 2023, it positions itself as a Layer 1 network designed as the hub of the open metaverse, prioritizing seamless user experience and enhanced asset interoperability with built-in account abstraction features.

XTZ (XTZ): Since its launch in 2017, Tezos has been recognized as a self-amending blockchain that simplifies formal verification, ensuring transaction code accuracy and enhancing smart contract security through its mathematical guarantees.

This article will comprehensively analyze the investment value comparison of ROOT vs XTZ across historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

ROOT (Coin A) vs XTZ (Coin B) Historical Price Trends

- 2024: ROOT experienced significant volatility, reaching a historical high of $0.132045 in March 2024, reflecting early market interest in its Layer 1 network designed for the open metaverse.

- 2021: XTZ saw notable price movement, with its historical high of $9.12 recorded in October 2021, driven by increased adoption and partnerships within the blockchain ecosystem.

- Comparative Analysis: During the broader market correction from 2021 to early 2025, ROOT declined from its March 2024 peak of $0.132045 to a historical low of $0.0001854 in December 2025, while XTZ fell from its October 2021 high of $9.12 to $0.350476 in December 2018, demonstrating different volatility patterns across market cycles.

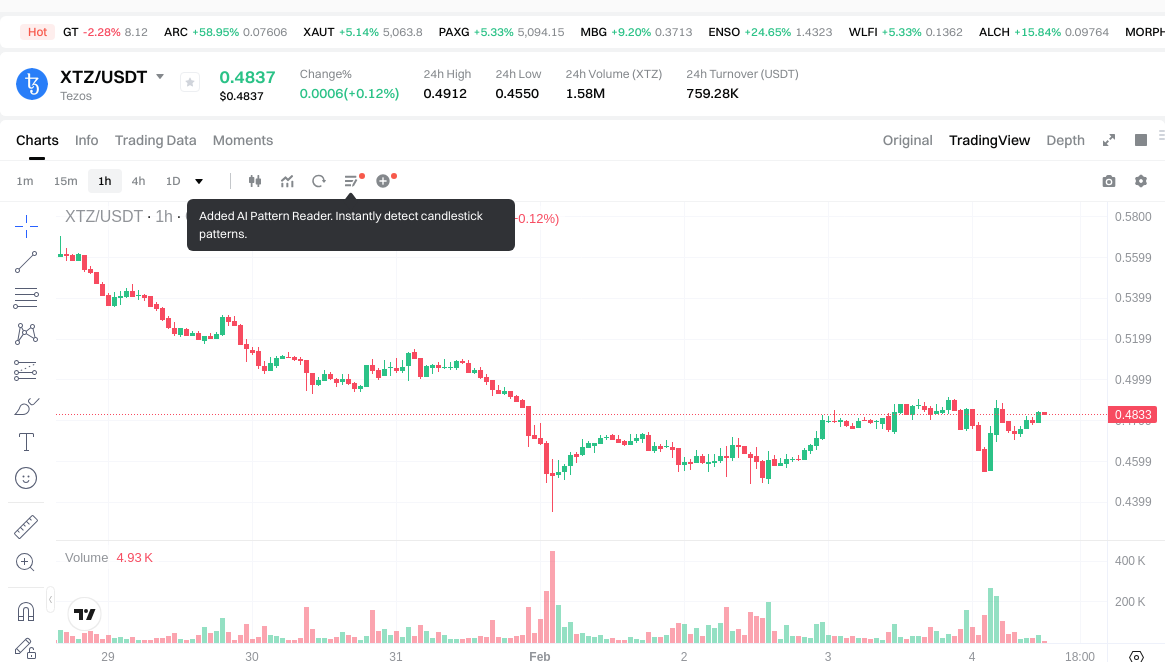

Current Market Status (2026-02-04)

- ROOT Current Price: $0.0002579

- XTZ Current Price: $0.4837

- 24-Hour Trading Volume: ROOT at $20,772.69 vs XTZ at $772,606.58

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

Click to view real-time prices:

- View ROOT Current Price Market Price

- View XTZ Current Price Market Price

II. Core Factors Influencing ROOT vs XTZ Investment Value

Supply Mechanism Comparison (Tokenomics)

- ROOT: The reference materials do not provide specific information regarding ROOT's supply mechanism or tokenomics model.

- XTZ: The reference materials do not provide specific information regarding XTZ's supply mechanism, inflation model, or token distribution structure.

- 📌 Historical Pattern: Supply mechanisms may influence price cycles through factors such as token release schedules, staking rewards, and network inflation rates, though specific historical data for these assets is not available in the provided materials.

Institutional Adoption and Market Application

- Institutional Holdings: The reference materials do not contain comparative data on institutional preference between ROOT and XTZ.

- Enterprise Adoption: Information regarding ROOT or XTZ adoption in cross-border payments, settlement systems, or institutional investment portfolios is not available in the provided materials.

- National Policies: The reference materials mention that regulatory environment represents a scrutiny factor for both projects, though specific jurisdictional stances toward ROOT or XTZ are not detailed.

Technical Development and Ecosystem Building

- ROOT Technical Upgrades: According to the reference materials, ROOT focuses on decentralized finance applications, though specific technical upgrade details are not provided.

- XTZ Technical Development: The reference materials note that XTZ is known for its efficient blockchain technology, though particular upgrade timelines or technical specifications are not included.

- Ecosystem Comparison: The reference materials do not provide detailed comparisons of DeFi integration, NFT support, payment applications, or smart contract deployment between ROOT and XTZ ecosystems.

Macroeconomic Environment and Market Cycles

- Performance in Inflationary Environments: The reference materials do not contain data comparing the inflation-hedging properties of ROOT versus XTZ.

- Macroeconomic Monetary Policy: The reference materials do not discuss how interest rate changes or US dollar index movements specifically affect ROOT or XTZ valuations.

- Geopolitical Factors: While the reference materials note that market demand and regulatory environment influence investment value, specific geopolitical impacts on cross-border transaction demand for either asset are not detailed.

III. 2026-2031 Price Forecast: ROOT vs XTZ

Short-term Forecast (2026)

- ROOT: Conservative $0.00021 - $0.00026 | Optimistic $0.00026 - $0.00032

- XTZ: Conservative $0.42 - $0.48 | Optimistic $0.48 - $0.66

Mid-term Forecast (2028-2029)

- ROOT may enter a consolidation phase, with estimated price range between $0.00023 - $0.00046

- XTZ may enter an expansion phase, with estimated price range between $0.46 - $1.02

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- ROOT: Baseline scenario $0.00023 - $0.00043 | Optimistic scenario $0.00044 - $0.00067

- XTZ: Baseline scenario $0.79 - $0.88 | Optimistic scenario $0.96 - $1.28

Disclaimer

ROOT:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000324954 | 0.0002579 | 0.00020632 | 0 |

| 2027 | 0.00037594083 | 0.000291427 | 0.00028268419 | 13 |

| 2028 | 0.0004604838027 | 0.000333683915 | 0.00023024190135 | 29 |

| 2029 | 0.000468558953443 | 0.00039708385885 | 0.000234279476721 | 53 |

| 2030 | 0.000618934610789 | 0.000432821406146 | 0.000229395345257 | 67 |

| 2031 | 0.000673123850839 | 0.000525878008468 | 0.000436478747028 | 103 |

XTZ:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.662121 | 0.4833 | 0.415638 | 0 |

| 2027 | 0.692979705 | 0.5727105 | 0.383716035 | 18 |

| 2028 | 0.8353555353 | 0.6328451025 | 0.506276082 | 30 |

| 2029 | 1.020399443271 | 0.7341003189 | 0.455142197718 | 51 |

| 2030 | 1.043927358491745 | 0.8772498810855 | 0.78952489297695 | 81 |

| 2031 | 1.277582864318867 | 0.960588619788622 | 0.797288554424556 | 98 |

IV. Investment Strategy Comparison: ROOT vs XTZ

Long-term vs Short-term Investment Strategies

- ROOT: May suit investors with higher risk tolerance interested in emerging Layer 1 networks and metaverse infrastructure development, though the project's early stage presents elevated uncertainty.

- XTZ: May appeal to investors seeking exposure to established blockchain platforms with formal verification capabilities and smart contract security features, potentially offering relatively lower volatility compared to newer projects.

Risk Management and Asset Allocation

- Conservative Investors: ROOT 10-15% vs XTZ 85-90%

- Aggressive Investors: ROOT 30-40% vs XTZ 60-70%

- Hedging Instruments: Stablecoin allocation for liquidity management, options strategies for downside protection, cross-asset portfolio diversification across multiple blockchain protocols

V. Potential Risk Comparison

Market Risk

- ROOT: Significant price volatility evidenced by the decline from $0.132045 in March 2024 to $0.0002579 currently, reflecting heightened sensitivity to market sentiment shifts and lower trading volume at $20,772.69.

- XTZ: Historical volatility demonstrated by the movement from $9.12 in October 2021 to current levels around $0.4837, though benefits from higher liquidity with 24-hour trading volume of $772,606.58.

Technical Risk

- ROOT: As a newer Layer 1 network launched in 2023, the platform faces potential challenges related to network stability, scalability testing under higher transaction volumes, and the maturation of its account abstraction features.

- XTZ: While offering formal verification capabilities that enhance smart contract security, considerations include network upgrade coordination through its self-amending mechanism and maintaining validator participation across its consensus infrastructure.

Regulatory Risk

- Global regulatory developments may impact both assets differently based on their functional classification: ROOT's positioning within metaverse infrastructure may face scrutiny regarding virtual asset regulations, while XTZ's smart contract platform characteristics may encounter evolving frameworks for decentralized applications and DeFi protocols across various jurisdictions.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ROOT Advantages: Early-stage positioning in Layer 1 infrastructure for the open metaverse with built-in account abstraction features, potential for growth if ecosystem adoption accelerates.

- XTZ Advantages: Established blockchain platform since 2017 with formal verification capabilities, self-amending protocol design, mathematical guarantees for transaction accuracy, and relatively higher market liquidity.

✅ Investment Recommendations:

- Novice Investors: Consider starting with XTZ due to its longer operational history and higher trading volume, allocating a smaller portion to ROOT only if comfortable with elevated volatility and early-stage project risks.

- Experienced Investors: May evaluate a balanced approach with heavier XTZ weighting while maintaining selective ROOT exposure for potential upside, implementing strict position sizing and stop-loss disciplines.

- Institutional Investors: Conduct comprehensive due diligence on governance structures, technical audits, and regulatory compliance frameworks for both assets, with particular attention to liquidity considerations and custodial solutions availability.

⚠️ Risk Warning: The cryptocurrency market exhibits extreme volatility. This analysis does not constitute investment advice. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between ROOT and XTZ in terms of technology and use cases?

ROOT is a Layer 1 network launched in 2023, designed as the hub of the open metaverse with built-in account abstraction features prioritizing seamless user experience and enhanced asset interoperability. In contrast, XTZ (Tezos), operational since 2017, is a self-amending blockchain that simplifies formal verification through mathematical guarantees, ensuring transaction code accuracy and enhancing smart contract security. ROOT focuses on decentralized finance applications within metaverse infrastructure, while XTZ is known for its efficient blockchain technology supporting secure smart contract deployment across various applications.

Q2: Which cryptocurrency has better liquidity for trading: ROOT or XTZ?

XTZ demonstrates significantly better liquidity, with 24-hour trading volume of $772,606.58 compared to ROOT's $20,772.69 as of February 4, 2026. This substantial difference in trading volume indicates that XTZ offers easier entry and exit positions with potentially tighter bid-ask spreads, making it more suitable for investors requiring immediate liquidity. ROOT's lower trading volume reflects its early-stage status and may result in higher price slippage during transactions.

Q3: How have ROOT and XTZ performed historically during market corrections?

Both assets experienced significant declines during market corrections but exhibited different volatility patterns. ROOT fell from its March 2024 peak of $0.132045 to a historical low of $0.0001854 in December 2025, representing an approximately 99.86% decline. XTZ declined from its October 2021 high of $9.12 to $0.350476 in December 2018, approximately a 96.16% correction. ROOT's shorter operational history shows more concentrated volatility, while XTZ's longer timeline demonstrates cyclical price movements across multiple market phases.

Q4: What allocation strategy should investors consider between ROOT and XTZ?

Conservative investors may consider a 10-15% ROOT allocation versus 85-90% XTZ allocation, emphasizing the established platform's relative stability and higher liquidity. Aggressive investors with higher risk tolerance might allocate 30-40% to ROOT and 60-70% to XTZ, balancing exposure to emerging metaverse infrastructure with established blockchain technology. Both strategies should incorporate risk management tools including stablecoin reserves for liquidity, options strategies for downside protection, and cross-asset diversification across multiple blockchain protocols.

Q5: What are the key regulatory risks facing ROOT and XTZ?

Both assets face evolving regulatory scrutiny, though potentially in different areas. ROOT's positioning within metaverse infrastructure may encounter regulations specifically targeting virtual assets, digital property rights, and metaverse-related financial activities. XTZ, as a smart contract platform, may face regulatory frameworks addressing decentralized applications, DeFi protocols, and blockchain-based financial services. Global regulatory developments vary across jurisdictions, and both projects must navigate compliance requirements that could impact their operational models and market accessibility.

Q6: Which factors could drive price appreciation for ROOT versus XTZ through 2031?

ROOT's potential price drivers include ecosystem adoption acceleration within the open metaverse sector, successful implementation of account abstraction features attracting developers, and growing demand for metaverse infrastructure solutions. XTZ's appreciation factors may include institutional capital inflows recognizing its formal verification capabilities, potential ETF developments providing traditional investment access, expanded enterprise adoption leveraging its self-amending protocol, and continued ecosystem growth in DeFi and NFT applications. Both assets remain sensitive to broader cryptocurrency market cycles and macroeconomic conditions.

Q7: Is ROOT or XTZ more suitable for beginners entering cryptocurrency investment?

XTZ is generally more suitable for beginners due to its longer operational history since 2017, established track record, higher trading volume providing better liquidity, and relatively lower volatility compared to ROOT. The platform's seven-year operational history offers more historical data for analysis and demonstrates sustained network functionality. Beginners should start with smaller allocations, implement strict risk management protocols, and consider ROOT exposure only after gaining experience with cryptocurrency market dynamics and understanding the elevated risks associated with early-stage blockchain projects.

Q8: How do the current market conditions affect short-term investment decisions for ROOT vs XTZ?

With the current Market Sentiment Index at 14 (Extreme Fear) as of February 4, 2026, both assets face challenging near-term conditions. XTZ's higher liquidity and established market position may provide better resilience during extreme fear periods, while ROOT's lower trading volume could amplify downside volatility. Short-term investors should exercise heightened caution, consider dollar-cost averaging strategies to mitigate timing risk, maintain adequate stablecoin reserves for potential opportunities, and avoid overleveraged positions given the prevailing market uncertainty affecting the broader cryptocurrency sector.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Are Cryptocurrency Forks? How Do They Work?

Web2 vs Web3: What Are the Key Differences?

Comprehensive Guide to Swing Trading vs Scalping Trading

Six Cryptocurrencies That Have Achieved Over 1,000x Total Growth

What is OOE: A Comprehensive Guide to Object-Oriented Engineering and Its Applications in Modern Software Development