What is PYUSD: Understanding PayPal's New Stablecoin and Its Impact on Digital Payments

PayPal USD's Positioning and Significance

In 2023, PayPal introduced PayPal USD (PYUSD), aiming to address payment inefficiencies and contribute to stablecoin opportunities.

As a stablecoin backed by U.S. dollar deposits and short-term U.S. Treasuries, PayPal USD plays a crucial role in the payment and digital currency sectors.

As of 2025, PayPal USD has become a significant player in the stablecoin market, with a market cap of $1,348,119,671 and an active user base. This article will analyze its technical structure, market performance, and future potential.

Origin and Development History

Background

PayPal USD was created by PayPal in 2023, aiming to solve payment inefficiencies and expand stablecoin opportunities.

It was born in the context of growing digital payment adoption and increasing interest in stablecoins, with the goal of providing a secure and stable digital currency for payments.

PayPal USD's launch brought new possibilities for both individual users and businesses seeking reliable digital payment solutions.

Important Milestones

- 2023: Launched, offering 1:1 redemption for U.S. dollars and 100% backing by cash equivalents.

- 2023: Adopted by PayPal's extensive user base, driving widespread acceptance.

- 2025: Ecosystem expansion, with integration into various payment platforms and DeFi protocols.

With support from PayPal and Paxos Trust Company, PayPal USD continues to optimize its stability, security, and real-world applications.

How Does PayPal USD Work?

Centralized Control

Unlike traditional cryptocurrencies, PayPal USD operates under a centralized model, with PayPal and Paxos Trust Company overseeing its issuance and management.

This centralized approach ensures regulatory compliance and maintains the stability of the token's value.

Blockchain Core

PayPal USD utilizes blockchain technology to record transactions, ensuring transparency and immutability.

While specific details about the blockchain used are not provided, it likely leverages existing blockchain infrastructure for efficient and secure transactions.

Ensuring Fairness

PayPal USD maintains its 1:1 peg to the U.S. dollar through full backing by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents.

This backing mechanism ensures that each PYUSD token is always redeemable for one U.S. dollar, providing stability and trust for users.

Secure Transactions

PayPal USD employs robust security measures:

- Backed by PayPal's existing security infrastructure

- Regulatory compliance ensures adherence to financial standards

- Transactions likely utilize encryption technologies for user protection

While specific privacy details are not provided, PayPal's involvement suggests a focus on secure and compliant transactions.

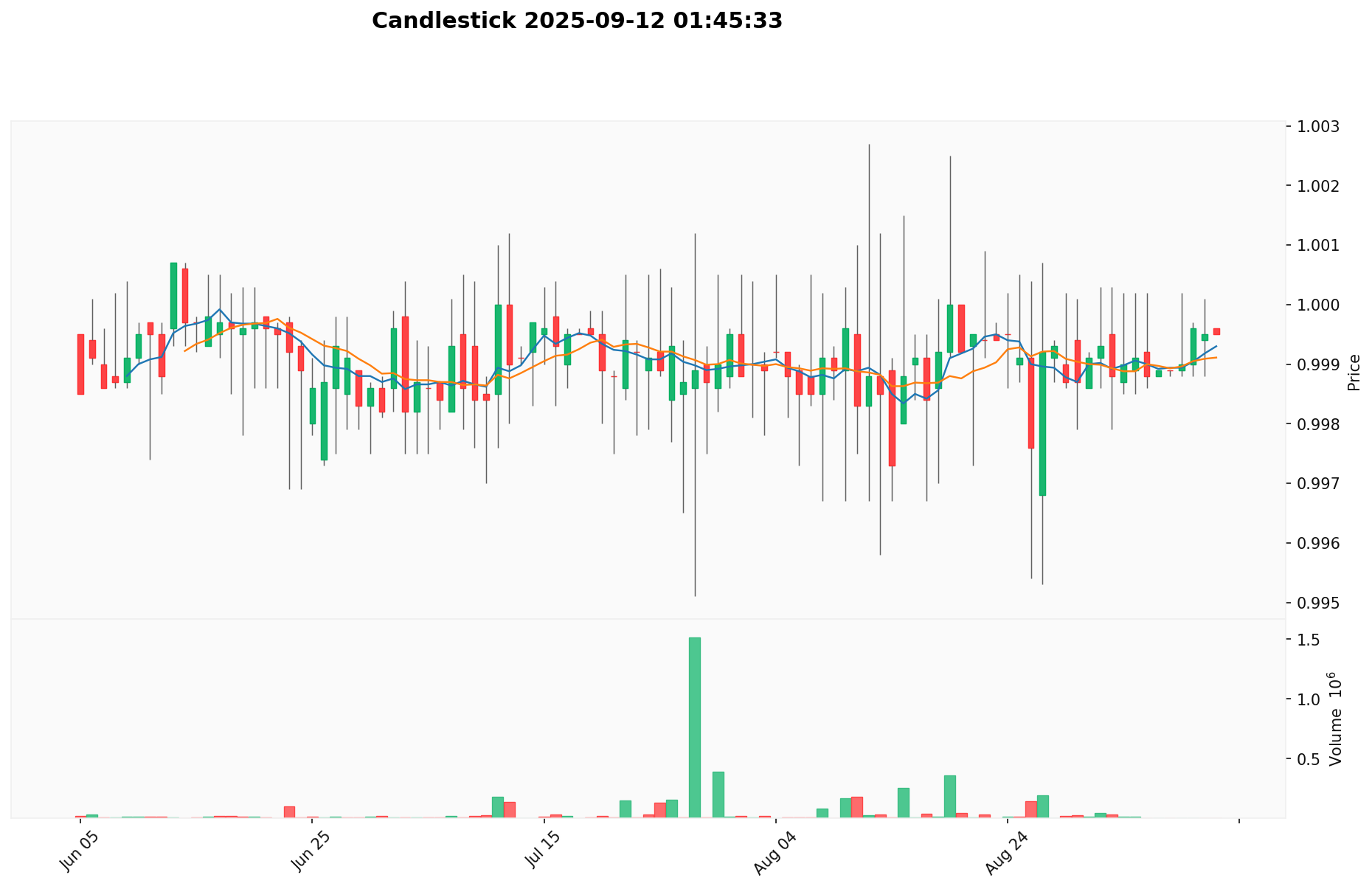

PYUSD's Market Performance

Circulation Overview

As of September 12, 2025, PYUSD has a circulating supply of 1,348,659,134.84973 tokens, with a total supply of 967,614,865.

Price Fluctuations

PYUSD reached its all-time high of $1.2 on September 12, 2023. Its lowest price was $0.833, recorded on August 22, 2023. These fluctuations reflect market sentiment, adoption trends, and external factors.

Click to view the current PYUSD market price

On-Chain Metrics

- Number of Holders: 41,809 (indicating user participation)

PYUSD Ecosystem Applications and Partnerships

Core Use Cases

PYUSD's ecosystem supports various applications:

- Payments: PayPal's platform, enabling fast and secure digital transactions.

- Stablecoin: Contributes to the stablecoin market, offering stability in cryptocurrency payments.

Strategic Collaborations

PYUSD has established partnerships with Paxos Trust Company, enhancing its technical capabilities and market influence. These partnerships provide a solid foundation for PYUSD's ecosystem expansion.

Controversies and Challenges

PYUSD faces the following challenges:

- Regulatory scrutiny: Potential oversight from financial regulators

- Market competition: Competition from other established stablecoins

- Adoption barriers: Convincing users to switch from traditional payment methods

These issues have sparked discussions within the community and market, driving continuous innovation for PYUSD.

PYUSD Community and Social Media Atmosphere

Fan Enthusiasm

PYUSD's community is growing, with 41,809 holders as of September 12, 2025.

On social media platforms, related posts and hashtags (such as #PYUSD) occasionally gain traction.

PayPal's established user base has contributed to community interest.

Social Media Sentiment

Social media sentiment shows mixed reactions:

- Supporters praise PYUSD's stability and integration with PayPal's ecosystem, viewing it as a "bridge between traditional finance and cryptocurrencies".

- Critics focus on centralization concerns and competition from other stablecoins.

Recent trends indicate cautious optimism as the stablecoin market evolves.

Hot Topics

Users discuss PYUSD's regulatory compliance, integration with PayPal services, and potential for wider adoption, highlighting both its transformative potential and the challenges in mainstream acceptance.

More Information Sources for PYUSD

- Official Website: Visit PYUSD official website for features, use cases, and latest updates.

- White Paper: PYUSD's technical details and vision can be found in its official documentation.

- Social Media: PayPal's official channels provide updates on PYUSD, engaging thousands of followers with posts about adoption, partnerships, and use cases.

PYUSD Future Roadmap

- Ecosystem goals: Expand integration with PayPal services and third-party platforms

- Long-term vision: Become a leading stablecoin for e-commerce and digital payments

How to Participate in PYUSD?

- Purchase channels: Buy PYUSD on Gate.com

- Storage solutions: Use PayPal's wallet or other compatible wallets for secure storage

- Usage: Utilize PYUSD for payments within PayPal's ecosystem and supported platforms

Summary

PYUSD redefines digital currency through blockchain technology, offering stability, integration with PayPal services, and efficient payments. Its growing user base, backed by PayPal's established infrastructure, sets it apart in the cryptocurrency realm. Despite facing regulatory scrutiny and market competition, PYUSD's integration with a major payment platform and clear roadmap position it as a significant player in the future of decentralized finance. Whether you're a newcomer or an experienced user, PYUSD is worth watching and engaging with in the evolving landscape of digital payments.

FAQ

What is the point of pyusd?

PYUSD aims to provide a stable digital dollar for everyday transactions, remittances, and Web3 applications, offering a reliable alternative to traditional currencies backed by PayPal.

Can I convert pyusd to USD?

Yes, you can convert PYUSD to USD at a 1:1 ratio. PYUSD is designed to maintain parity with the US dollar.

Is pyUSD safe to use?

Yes, pyUSD is considered safe. Backed by PayPal's reputation and regulatory compliance, it combines USD stability with blockchain technology for secure digital payments.

Can you make money with pyusd?

Yes, you can make money with PYUSD by earning 4% rewards on your holdings. As a stablecoin pegged to USD, PYUSD offers stability and potential returns without fees for buying, holding, or transferring.

Why stablecoin is important: A deep dive into the stable assets of crypto assets

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

Exploring Stablecoins: How They Drive the Development of the Encryption Economy

Stablecoin analysis: Crypto Assets solution to mitigate Fluctuation

How to Buy USDC in 2025: A Complete Guide for Newbie Investors

USDC Price Prediction: Trends and Investment Prospects in the Stablecoin Market for 2025

How Will Bitcoin Change the World in the Next 10 Years?

What is NFT minting and how much does it cost to mint tokens

Cloud Mining: Top Platforms Guide

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

Cryptocurrency Exchanges: An In-Depth Guide to Leading Trading Platforms