Signals about the Altcoin season have appeared, but this cycle is not a strong bullish rally.

Altcoin season has once again become a hot topic in the cryptocurrency markets. Volatility charts show sharp fluctuations, social media posts are increasing, and many investors are hopeful for a broad rally. However, the current cycle shows different signs. While some altcoins are experiencing outstanding gains, the majority still haven’t broken out.

Market data reflects a clear selectivity, rather than a widespread rally across all altcoins. This has important implications for investment strategies during this period.

Partial Emergence of Altcoin Season

Typically, “altcoin season” is understood as a period when altcoins rise simultaneously, even surpassing Bitcoin in ROI(ROI). However, current data does not support this.

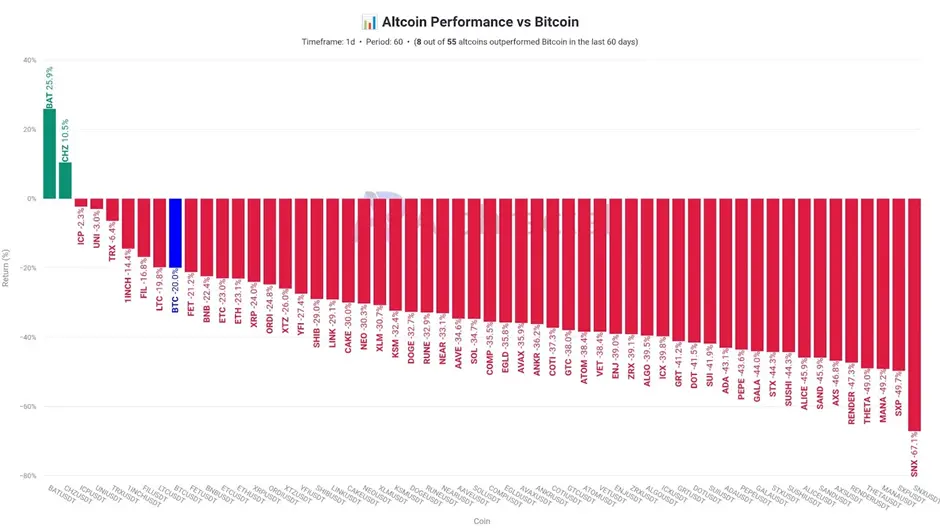

According to performance comparison charts between altcoins and Bitcoin, only 8 out of 55 major altcoins have outperformed Bitcoin in the past 60 days. This is a modest number, while most altcoins are still declining, even as Bitcoin mostly moves sideways.

Notable Altcoins in this season | Source: XNotably, BAT has increased about 25% and CHZ nearly 10% compared to Bitcoin during the same period. These movements indicate individual strength, but not widespread. Most altcoins still show negative returns, confirmed by the Altcoin Season Index.

Notable Altcoins in this season | Source: XNotably, BAT has increased about 25% and CHZ nearly 10% compared to Bitcoin during the same period. These movements indicate individual strength, but not widespread. Most altcoins still show negative returns, confirmed by the Altcoin Season Index.

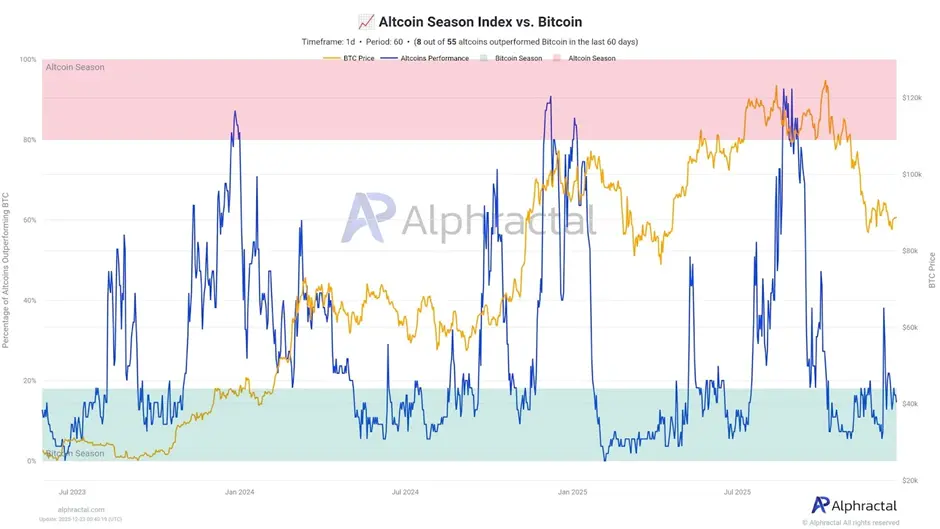

Altcoin Season Index vs. Bitcoin | Source: XThis index measures the number of altcoins outperforming Bitcoin. A high index indicates strong altcoin momentum. Conversely, a low index suggests Bitcoin dominance. Currently, this index remains low, even though it has stopped declining, reflecting stability in altcoins but no broad breakout.

Altcoin Season Index vs. Bitcoin | Source: XThis index measures the number of altcoins outperforming Bitcoin. A high index indicates strong altcoin momentum. Conversely, a low index suggests Bitcoin dominance. Currently, this index remains low, even though it has stopped declining, reflecting stability in altcoins but no broad breakout.

Therefore, calling this a “comprehensive altcoin season” remains risky. The market is favoring certain tokens, but not the entire altcoin ecosystem.

Bitcoin Dominance Explains the Weak Altcoin Season Theory

Bitcoin dominance index reflects Bitcoin’s market value share within the total cryptocurrency market. When this index is high, capital mainly flows into Bitcoin. When it decreases, new funds tend to shift toward altcoins.

Currently, Bitcoin’s dominance remains around 60%, indicating Bitcoin still holds a commanding position. This confirms that capital has not fully spread to all altcoins; investors remain cautious and selective.

In previous cycles, altcoin season usually begins after Bitcoin has experienced a strong growth phase and starts to plateau. At that point, new capital shifts broadly into altcoins.

Relationship between BTC and the story of altcoin season | Source: XHowever, in this cycle, despite Bitcoin’s growth, capital rotation remains uneven. Some altcoins receive early attention, but most have not shown clear changes.

Relationship between BTC and the story of altcoin season | Source: XHowever, in this cycle, despite Bitcoin’s growth, capital rotation remains uneven. Some altcoins receive early attention, but most have not shown clear changes.

This explains the hesitation among many traders: They see strong upward charts on social media, but their own portfolios show little movement.

Why does Raoul Pal warn against chasing altcoin trends this season?

Market polarization causes experienced investors to adopt a cautious approach. Notably, Raoul Pal, a former hedge fund manager and founder of Real Vision—a global macro and crypto research platform.

With over 35 years of experience in finance, Raoul Pal focuses on long-term cycles rather than short-term trades. He often warns that altcoin season is the period when most retail investors are most likely to incur losses.

The reason is simple: When altcoin season occurs, social media is flooded with posts boasting “huge” profits, leading many to fall into FOMO(fear of missing out) and enter the market too late, when prices have already surged.

Raoul Pal still recommends investors hold quality assets like Bitcoin or Ethereum, rather than chasing short-term volatility. He especially emphasizes avoiding leverage in trading, particularly in the crypto market—where rapid price swings and high risks of loss are common.

In this cycle, this warning becomes even more critical. In reality, altcoin season is selective, with some tokens rising while most remain weak. This means patience and careful selection are more important than speed.

Altcoin season may continue to develop, but current data shows movement is limited to a small group, not a widespread wave across the entire market. This is not yet a season where all coins can rise together.

Related Articles

Fidelity Sees 'Hopeful Sign' in Bitcoin Price Performance - U.Today

Ionic Digital: In January, mining output was 34.68 BTC, with total holdings increasing to 2,754.8 BTC.

Simon Gerovich Defends Bitcoin Treasury Strategy as Metaplanet Shares Slide

Data: The current mainstream CEX and DEX funding rates indicate that the market is once again turning fully bearish

Whale "0x049" Closes Leveraged Positions on ETH and BTC with $598,369 Loss