This report is authored by Tiger Research and presents our market outlook for Bitcoin in Q1 2026, with a target price set at $185,500.

Key Highlights

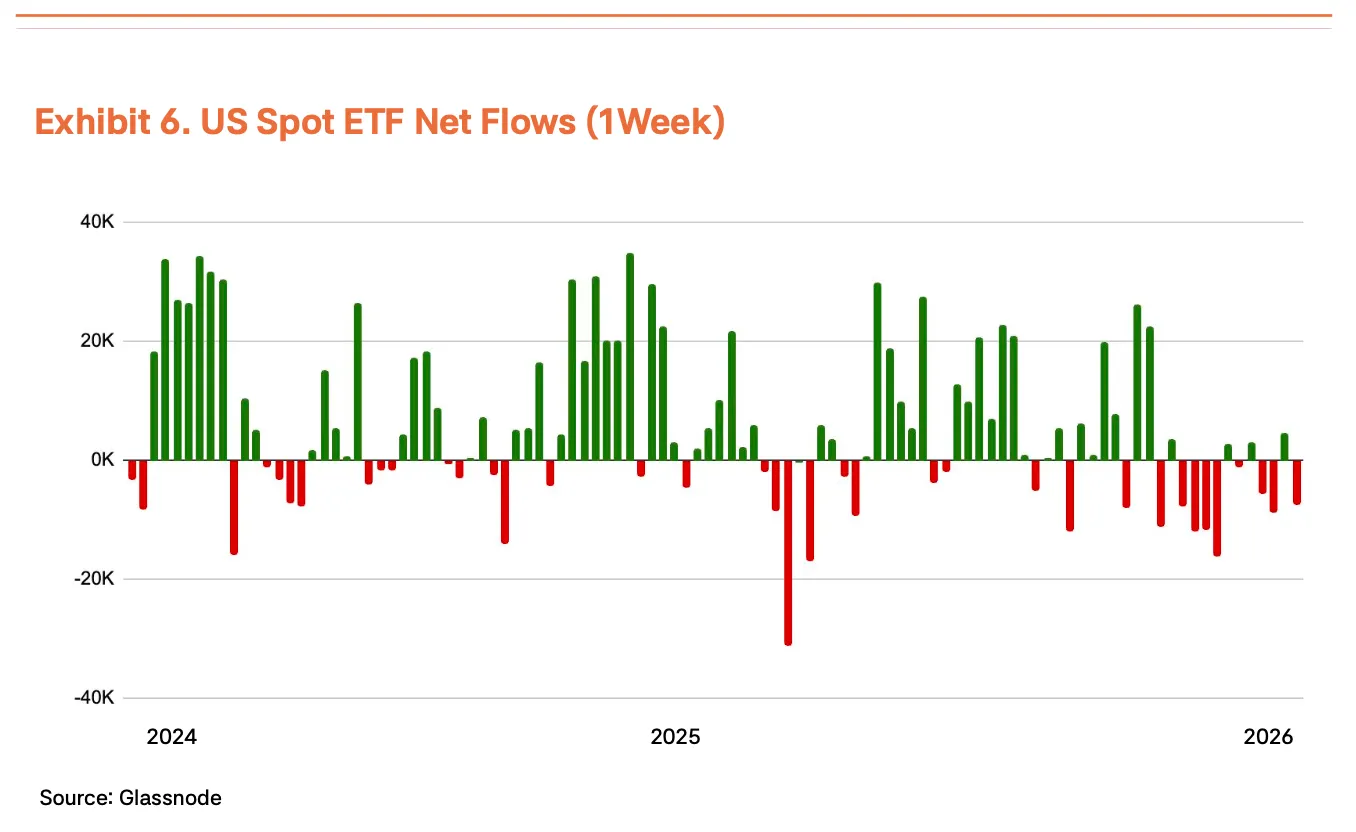

- Macro stability, momentum slowing down: The Federal Reserve’s rate cut cycle and M2 money supply growth remain on track. However, the $4.57 billion ETF fund outflows have impacted the short-term trend. The advancement of the CLARITY Act could become a key factor in attracting large banks into the market.

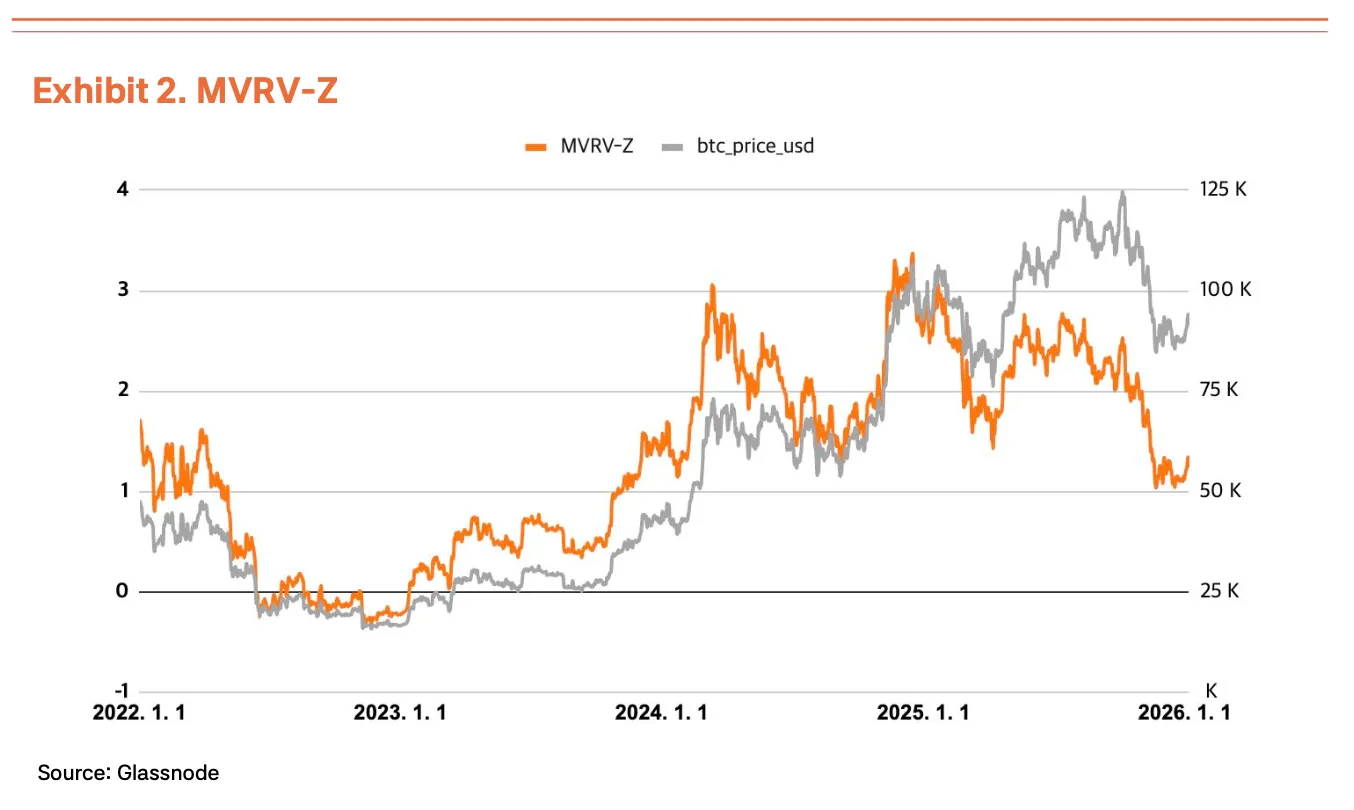

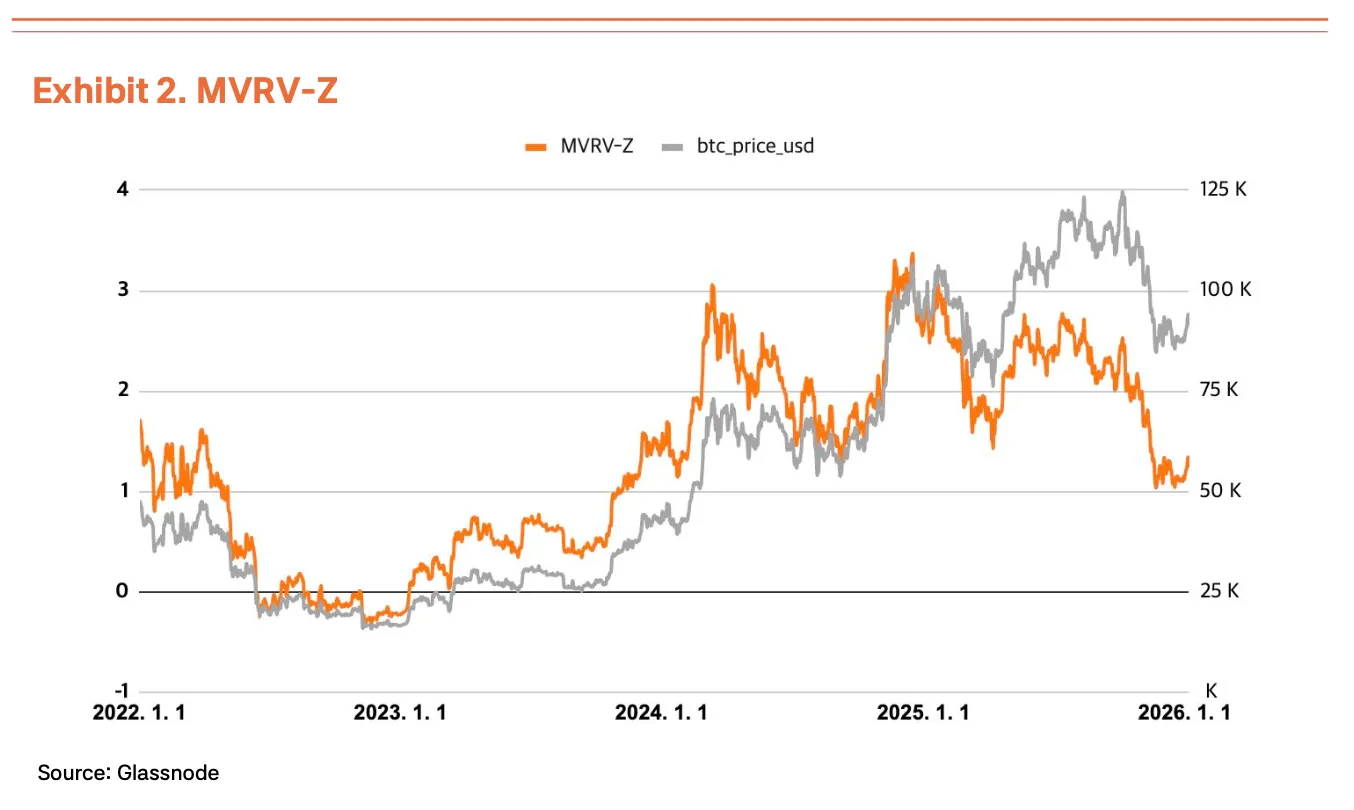

- On-chain indicators turning neutral: Buying demand around $84,000 has formed a solid bottom support; while $98,000, representing the short-term holders’ cost basis, currently acts as a major resistance level. Key indicators like MVRV-Z show that the market is currently at fair value.

- Target price $185,500, maintaining bullish outlook: Based on a baseline valuation of $145,000 and a +25% macro factor adjustment, we set the target price at $185,500. This implies approximately 100% upside potential from the current price.

Macro easing persists, growth momentum wanes

Bitcoin is currently trading near $96,000. Since our previous report published on October 23, 2025, the price has declined by 12%. Despite recent pullbacks, the macro environment supporting Bitcoin remains solid.

Fed path remains dovish

Source: Tiger Research

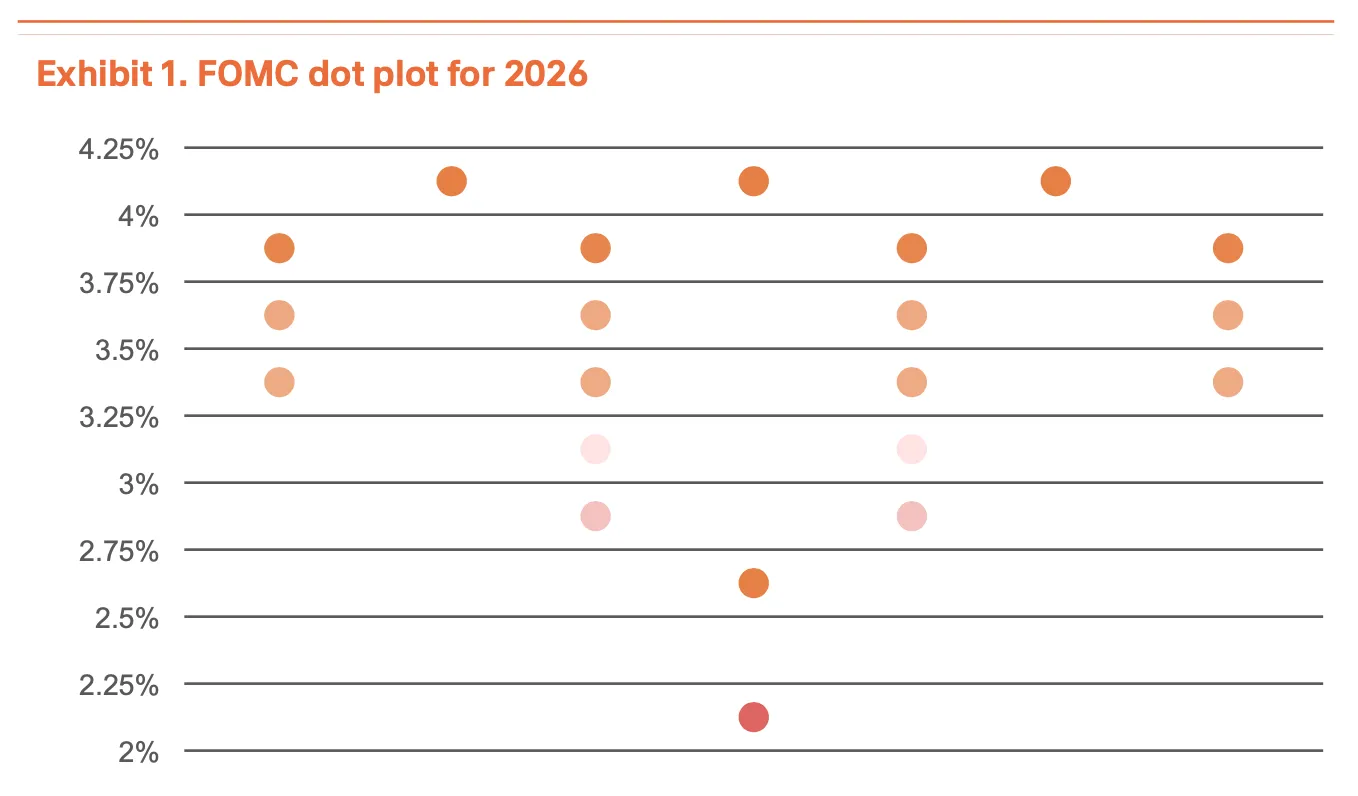

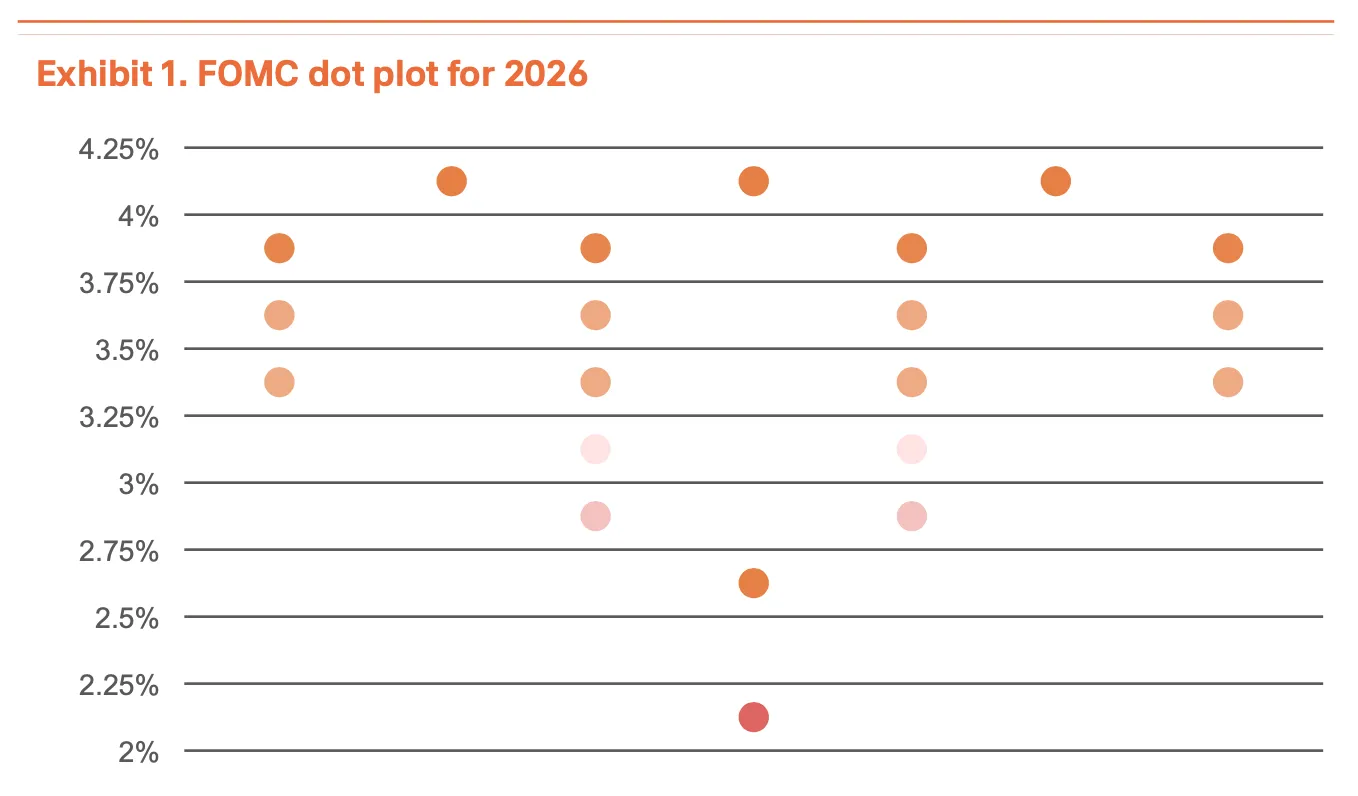

The Federal Reserve has cut interest rates three consecutive times from September to December 2025, totaling a 75 basis point decrease, with current rates in the 3.50%–3.75% range. The December dot plot projects the rate will fall to 3.4% by the end of 2026. While a 50 basis point or larger single rate cut this year is unlikely, with Powell’s term ending in May, the Trump administration may appoint a more dovish successor, ensuring the continuation of monetary easing.

Institutional outflows and corporate accumulation

Source: Tiger Research

The Federal Reserve has cut interest rates three consecutive times from September to December 2025, totaling a 75 basis point decrease, with current rates in the 3.50%–3.75% range. The December dot plot projects the rate will fall to 3.4% by the end of 2026. While a 50 basis point or larger single rate cut this year is unlikely, with Powell’s term ending in May, the Trump administration may appoint a more dovish successor, ensuring the continuation of monetary easing.

Institutional outflows and corporate accumulation

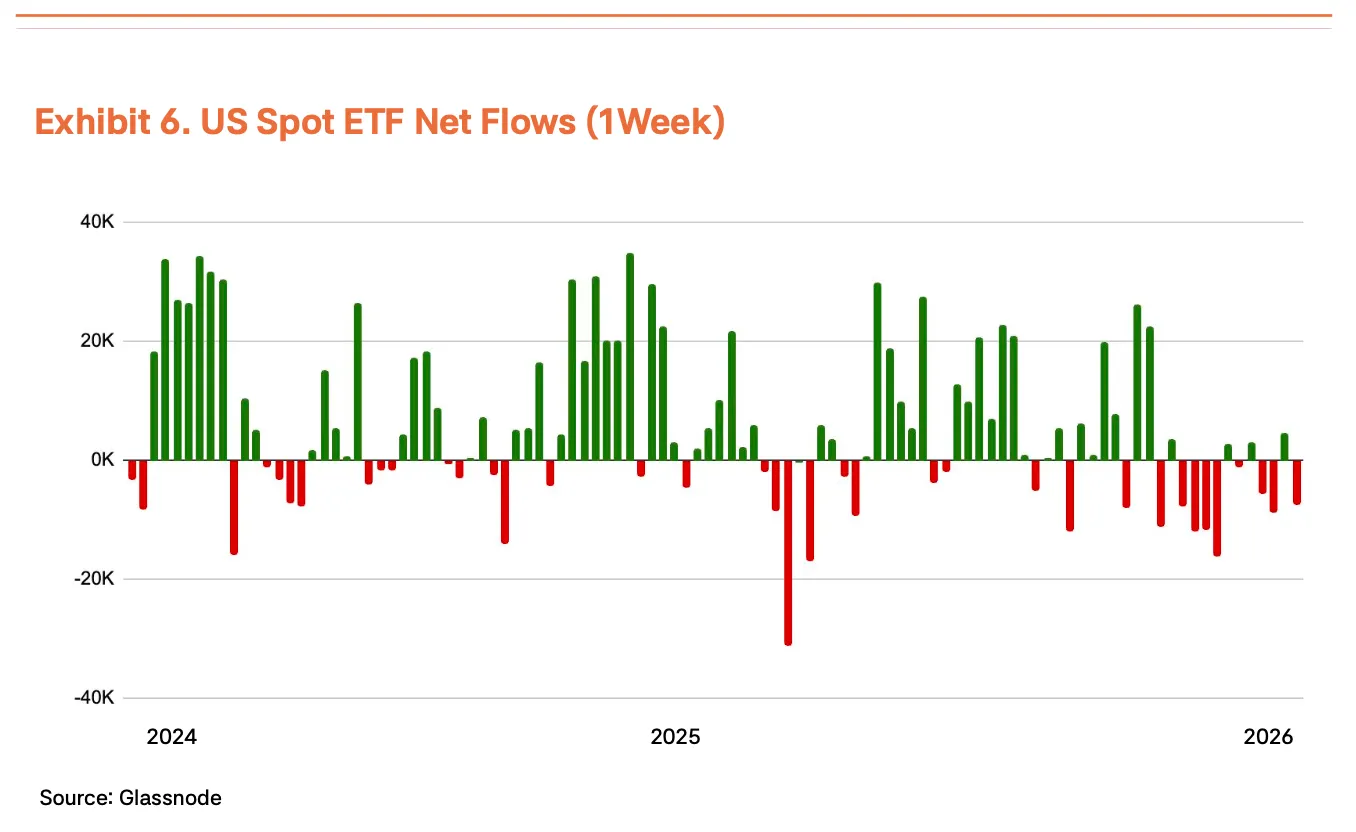

Despite a favorable macro environment, institutional demand has recently been subdued. Spot ETF funds saw outflows of $4.57 billion in November and December, the largest since product launch. The annual net inflow was $21.4 billion, down 39% from last year’s $35.2 billion. Although asset rebalancing in January brought some inflows, the sustainability of the rebound remains uncertain. Meanwhile, companies like MicroStrategy (holding 673,783 BTC, about 3.2% of total supply), Metaplanet, and Mara continue to increase their holdings.

CLARITY Act as a policy catalyst

Amidst stagnant institutional demand, regulatory progress is becoming a potential driver. The House-passed CLARITY Act clarifies jurisdictional boundaries between the SEC and CFTC and allows banks to provide digital asset custody and staking services. Additionally, the bill grants CFTC regulatory authority over the spot digital commodities market, providing a clear legal framework for exchanges and brokers. The Senate Banking Committee is scheduled to review on January 15, and if approved, it could prompt long-term traditional financial institutions to enter the market.

Ample liquidity, Bitcoin lagging

Liquidity is another key variable besides regulation. The global M2 supply hit a record high in Q4 2024 and continues to grow. Historically, Bitcoin tends to lead the liquidity cycle, often rising before M2 peaks and consolidating during the peak phase. Current signs indicate further liquidity expansion, suggesting Bitcoin still has upside potential. If stock market valuations appear excessive, capital is likely to rotate into Bitcoin.

Macro factors lowered to +25%, outlook remains robust

Overall, the macro trend of rate cuts and liquidity expansion remains unchanged. However, due to slowing institutional inflows, leadership changes at the Fed, and rising geopolitical risks, we have adjusted the macro factor from +35% down to +25%. Despite the reduction, this weight remains in the positive range, and we believe regulatory progress and ongoing M2 expansion will provide core support for medium- to long-term growth.

$84,000 support and $98,000 resistance levels

On-chain indicators provide auxiliary signals for macro analysis. During the November 2025 correction, buy-the-dip funds concentrated around $84,000, forming a clear support zone. Bitcoin has now broken through this zone. The $98,000 level corresponds to the average cost basis of short-term holders and acts as a recent psychological and technical resistance.

Despite a favorable macro environment, institutional demand has recently been subdued. Spot ETF funds saw outflows of $4.57 billion in November and December, the largest since product launch. The annual net inflow was $21.4 billion, down 39% from last year’s $35.2 billion. Although asset rebalancing in January brought some inflows, the sustainability of the rebound remains uncertain. Meanwhile, companies like MicroStrategy (holding 673,783 BTC, about 3.2% of total supply), Metaplanet, and Mara continue to increase their holdings.

CLARITY Act as a policy catalyst

Amidst stagnant institutional demand, regulatory progress is becoming a potential driver. The House-passed CLARITY Act clarifies jurisdictional boundaries between the SEC and CFTC and allows banks to provide digital asset custody and staking services. Additionally, the bill grants CFTC regulatory authority over the spot digital commodities market, providing a clear legal framework for exchanges and brokers. The Senate Banking Committee is scheduled to review on January 15, and if approved, it could prompt long-term traditional financial institutions to enter the market.

Ample liquidity, Bitcoin lagging

Liquidity is another key variable besides regulation. The global M2 supply hit a record high in Q4 2024 and continues to grow. Historically, Bitcoin tends to lead the liquidity cycle, often rising before M2 peaks and consolidating during the peak phase. Current signs indicate further liquidity expansion, suggesting Bitcoin still has upside potential. If stock market valuations appear excessive, capital is likely to rotate into Bitcoin.

Macro factors lowered to +25%, outlook remains robust

Overall, the macro trend of rate cuts and liquidity expansion remains unchanged. However, due to slowing institutional inflows, leadership changes at the Fed, and rising geopolitical risks, we have adjusted the macro factor from +35% down to +25%. Despite the reduction, this weight remains in the positive range, and we believe regulatory progress and ongoing M2 expansion will provide core support for medium- to long-term growth.

$84,000 support and $98,000 resistance levels

On-chain indicators provide auxiliary signals for macro analysis. During the November 2025 correction, buy-the-dip funds concentrated around $84,000, forming a clear support zone. Bitcoin has now broken through this zone. The $98,000 level corresponds to the average cost basis of short-term holders and acts as a recent psychological and technical resistance.

On-chain data shows market sentiment shifting from short-term panic to neutrality. Key indicators like MVRV-Z (1.25), NUPL (0.39), and aSOPR (1.00) have exited the undervalued zone and entered the equilibrium zone. This suggests that while the likelihood of panic-driven explosive rallies has decreased, the market structure remains healthy. Combined with macro and regulatory backgrounds, the statistical basis for medium- to long-term price appreciation remains strong.

It is noteworthy that the current market structure differs significantly from previous cycles. The increased share of institutional and long-term capital reduces the probability of panic sell-offs driven by retail investors. Recent pullbacks are more of a gradual rebalancing. Although short-term volatility is inevitable, the overall upward structure remains intact.

Target price revised to $185,500, bullish outlook remains firm

Using the TVM valuation framework, we derive a neutral baseline valuation of $145,000 for Q1 2026 (slightly below the previous report’s $154,000). Combining a 0% fundamental adjustment and a +25% macro adjustment, we set the revised target price at $185,500.

We have increased the fundamental adjustment factor from -2% to 0%. While network activity changes are minimal, renewed market attention to the BTCFi ecosystem has offset some bearish signals. Additionally, due to the aforementioned slowdown in institutional inflows and geopolitical factors, we have lowered the macro adjustment factor from +35% to +25%.

This downward revision of the target price should not be seen as a bearish signal. Even after adjustment, the model still indicates about 100% upside potential. The lower baseline price mainly reflects recent volatility, while Bitcoin’s intrinsic value is expected to continue rising in the medium to long term. We believe that recent pullbacks are part of a healthy rebalancing process, and the medium- to long-term bullish outlook remains unchanged.

On-chain data shows market sentiment shifting from short-term panic to neutrality. Key indicators like MVRV-Z (1.25), NUPL (0.39), and aSOPR (1.00) have exited the undervalued zone and entered the equilibrium zone. This suggests that while the likelihood of panic-driven explosive rallies has decreased, the market structure remains healthy. Combined with macro and regulatory backgrounds, the statistical basis for medium- to long-term price appreciation remains strong.

It is noteworthy that the current market structure differs significantly from previous cycles. The increased share of institutional and long-term capital reduces the probability of panic sell-offs driven by retail investors. Recent pullbacks are more of a gradual rebalancing. Although short-term volatility is inevitable, the overall upward structure remains intact.

Target price revised to $185,500, bullish outlook remains firm

Using the TVM valuation framework, we derive a neutral baseline valuation of $145,000 for Q1 2026 (slightly below the previous report’s $154,000). Combining a 0% fundamental adjustment and a +25% macro adjustment, we set the revised target price at $185,500.

We have increased the fundamental adjustment factor from -2% to 0%. While network activity changes are minimal, renewed market attention to the BTCFi ecosystem has offset some bearish signals. Additionally, due to the aforementioned slowdown in institutional inflows and geopolitical factors, we have lowered the macro adjustment factor from +35% to +25%.

This downward revision of the target price should not be seen as a bearish signal. Even after adjustment, the model still indicates about 100% upside potential. The lower baseline price mainly reflects recent volatility, while Bitcoin’s intrinsic value is expected to continue rising in the medium to long term. We believe that recent pullbacks are part of a healthy rebalancing process, and the medium- to long-term bullish outlook remains unchanged.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Analyst: Macro Expansion and Fed Rate Cuts Could Drive Bitcoin to New Highs in 2026

Sykodelic argues Bitcoin’s selloff reflects a mid-cycle reset, with macro shifts and chart signals pointing to new highs.

Bitcoin may have already passed a critical turning point in its current cycle, according to market commentator Sykodelic. In a recent post, the analyst said the OG coin’s r

LiveBTCNews5m ago

BTC Breaks Through 69,000 USDT

Gate News bot message, Gate market display, BTC breaks through 69,000 USDT, current price 69,019.8 USDT.

CryptoRadar14m ago

Bitcoin Falls Below $69K Whale Realized Price

Bitcoin's price has fallen below the $69K realized price for whales holding 100-1,000 BTC, signaling a potential market shift. This decline raises concerns about investor sentiment and risks of further downturns unless Bitcoin recovers above this threshold.

BlockChainReporter16m ago

Binance Buys 4,225 BTC for SAFU Fund in $300M Asset Conversion

Binance converted $300 million in stablecoins into 4,225 BTC for its Secure Asset Fund, raising its Bitcoin holdings to 10,455 BTC. Interest also surrounds its relationship with Trump-linked USD1 stablecoin, which has a $5 billion supply, primarily held on Binance.

CryptoNewsFlash21m ago

7-Year Dormant Bitcoin Whale Wakes Up, Moves 2,043 BTC - U.Today

A dormant Bitcoin whale, inactive for over seven years, has moved 2,043 BTC as prices dip below $70,000. This activity raises concerns about potential sell-offs amid ongoing market struggles, although some investors continue accumulating.

UToday26m ago

If Bitcoin drops below $66,000, the total liquidation strength of long positions on mainstream CEXs will reach 538 million.

According to Coinglass data, if Bitcoin drops below $66,000, the liquidation strength of long positions on mainstream exchanges will reach $538 million; if it breaks through $70,000, the liquidation strength of short positions will reach $449 million. The liquidation chart shows the impact of price movements on liquidation strength.

GateNewsBot28m ago