Fartcoin (FARTCOIN) To Rebound? This Key Emerging Harmonic Pattern Suggest Yes!

Key Takeaways

-

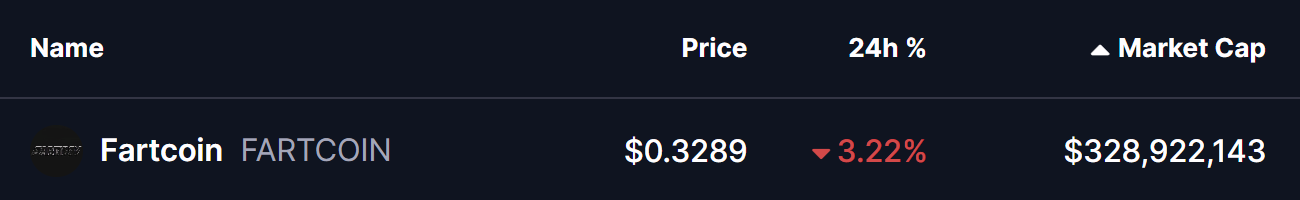

Fartcoin (FARTCOIN) is trading near $0.33 amid a broader crypto market sell-off driven by macro uncertainty.

-

The 4H chart shows a Bullish Bat harmonic pattern, often associated with short-term trend reversals.

-

Price has reacted positively from the D-point support near $0.288, hinting at seller exhaustion.

-

A breakout above the 50-period moving average around $0.374 could confirm bullish momentum.

-

Harmonic targets point toward $0.404 and $0.476 if the pattern plays out successfully.

-

A breakdown below $0.288 would invalidate the bullish setup.

As of January 19, 2026, Fartcoin (FARTCOIN) is trading slightly lower around $0.33, moving in line with the broader crypto market pullback. The sell-off was triggered by escalating US–EU trade tensions, which sparked nearly $875 million in long liquidations and pushed major assets like Bitcoin (BTC) and Ethereum (ETH) down more than 2% over the past 24 hours.

While FARTCOIN is down over 3% at the time of writing, the price action beneath the surface tells a more interesting story. The latest chart structure is now flashing a potential bullish harmonic setup, suggesting the current dip could be more of a setup than a breakdown.

Source: Coinmarketcap

Harmonic Pattern Signals a Possible Reversal

On the 4-hour timeframe, Fartcoin is forming a well-defined Bullish Bat harmonic pattern, a structure often associated with short-term reversals after corrective phases.

The pattern began with the X point near $0.258, followed by a strong impulsive rally toward point A. Price then retraced to point B, rebounded to point C, and finally completed the structure at point D near $0.288. This D zone typically acts as the potential reversal area for the Bat pattern.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

Following the completion of point D, FARTCOIN has already shown early signs of stabilization, bouncing back toward $0.3285. This initial reaction suggests that sellers may be losing momentum at current levels.

Key Levels That Could Decide the Move

One key level now in focus is the 50-period moving average, currently hovering around $0.3743. This level has acted as dynamic resistance in recent sessions and will likely determine whether the rebound gains traction or fades.

If buyers manage to push FARTCOIN above the 50 MA with improving volume, the harmonic projection opens the door for upside targets around:

-

$0.404 (0.618 Fibonacci extension)

-

$0.476 (1.0 Fibonacci extension)

This zone historically represents the area where Bat-pattern-driven moves tend to pause or face profit-taking.

On the flip side, the bullish setup remains valid only as long as price holds above the D-point support near $0.288. A decisive breakdown below this level would invalidate the harmonic structure and could expose FARTCOIN to deeper downside before any meaningful recovery attempt.

Bottom Line

Despite the ongoing market-wide weakness, Fartcoin’s chart is showing early signs of a technical rebound setup. The completion of a Bullish Bat harmonic pattern, combined with a developing bounce from key support, puts FARTCOIN at an important inflection point.

A breakout above the 50 MA could shift short-term momentum back in favor of the bulls, while failure to hold the D-point support would keep bears in control. For now, traders will be watching closely to see whether this harmonic signal translates into a sustained recovery or turns out to be another false start in a volatile market.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Interest in "Bitcoin to 0" hits a peak on Google Trends

Kevin O’Leary Explains How Institutions Respond to Bitcoin’s Brutal Crash and Quantum Threat

Last Dip Before Liftoff? Top 5 Altcoins That Could Explode 50%–300% by Mid-2026

Pi Network (PI) falters at the critical resistance level, with selling pressure mounting.

Ethereum falls below realized price: Where are ETH's support levels and reversal points?

The tortoise and hare race of value preservation: which will win, gold or Bitcoin?