"Things are really different this time"! K33: The four-year Bitcoin cycle is dead and will not crash by 80% anymore.

K33 believes that Bitcoin will not repeat the 80% crash associated with the four-year cycle. Research director Lunde points out that Bitcoin has fallen about 40% from October, similar to the declines in 2018 and 2022, but current conditions differ due to increased institutional adoption, inflows into regulated products, and loose interest rate policies. On February 2, trading volume at the 90th percentile exceeded $8 billion, with derivatives liquidations totaling $1.8 billion, but confirming a bottom requires reaching the 95th percentile.

K33 Denies the Four-Year Cycle but Acknowledges Similarities

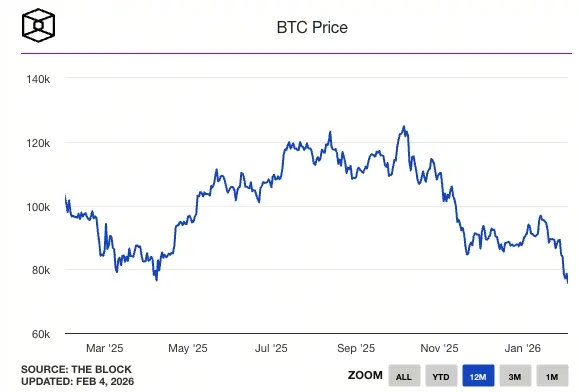

(Source: The Block)

In a report released late Tuesday, K33 research director Vetle Lunde stated that Bitcoin has dropped approximately 40% from its October peak, falling 11% just last week, mainly driven by heightened global risk-off sentiment. Although Lunde has long denied that Bitcoin remains subject to strict four-year cycles—declaring in October that “the four-year cycle is dead, long live the king”—he notes that recent price movements show “disturbing similarities” to the deep sell-offs in 2018 and 2022, with market behavior rather than fundamentals increasingly driving prices.

This similarity manifests in several ways. First, the magnitude of the decline: a 40% retracement from a high typically signals the mid-stage of a bear market. In 2018, Bitcoin dropped from a $20,000 high to about $12,000 (a 40% decline), then continued down to $3,200. In 2022, from a $69,000 peak, a 40% drop brought it to around $41,000, eventually bottoming at $15,500. If the current pattern follows, a 40% decline from $126,000 would bring it down to approximately $75,600, with potential further declines into the $25,000–$40,000 range.

Second, market sentiment indicators—such as the fear and greed index, social media discussion intensity, and retail investor participation—show patterns similar to past bear markets. Long-term holders are beginning to take profits, new capital hesitates to enter, and selling pressure continues to build. Lunde believes that fears of cycle repetition could become a self-fulfilling prophecy—because market participants believe cycles will repeat, their actions (selling early, refusing to buy) reinforce the cycle.

However, Lunde insists “this time is different.” He expects no scenario where prices fall 80% from peak to trough within 365 days like previous cycles, citing the current environment of low interest rates and the absence of forced deleveraging events such as GBTC, Luna, 3AC, BlockFi, Genesis, or FTX. The severe crash in 2022 was largely driven by a chain reaction of these credit events, with each collapse triggering panic selling. While the market is currently weak, it has not yet experienced systemic risk events of similar magnitude.

Three Major Differences Between 2026 and 2018/2022 Bear Markets

- Institutional Infrastructure: ETFs and custody services are mature, leading to more stable institutional holdings.

- Interest Rate Environment: Currently in a rate-cutting cycle, whereas 2018 and 2022 experienced rate hikes.

- Systemic Risk: No collapses comparable to FTX or Luna, and the overall market structure is healthier.

Bottom Signal Emerges but Requires Extreme Confirmation

Lunde states that some indicators typically associated with market bottoms are beginning to appear. On February 2, Bitcoin spot trading volume reached the 90th percentile, with over $8 billion in trading volume, and prices touched the lows of 2025. In derivatives markets, with about $1.8 billion in long liquidations, open interest and financing rates have fallen to very low levels—conditions that in the past have coincided with market reversals.

Lunde notes that when Bitcoin prices remain above key support levels and these two signals occur simultaneously, it may be forming a bottom. Historically, when spot trading volume spikes to extreme levels combined with deleveraging in derivatives markets, it signals the end of panic selling. An $8 billion daily trading volume is an extreme level in Bitcoin markets, indicating large-scale short-term trading activity, often seen at bottoms.

Similarly, $1.8 billion in long liquidations is a significant indicator. When highly leveraged longs are forcibly liquidated, market leverage drops sharply, leaving mostly low-leverage or unleveraged positions, which stabilizes the market and reduces the risk of cascading liquidations. The low open interest and financing rates further confirm that the market has undergone substantial deleveraging.

But Lunde also warns that these signals are not definitive. Similar trading volumes and extreme derivatives conditions have appeared during false starts and mid-trend stagnation, and evidence for a lasting bottom remains inconsistent. Historically, reversals are often accompanied by even more extreme trading volumes, reaching the 95th percentile. While current levels at the 90th percentile are close, they have not yet reached the levels typically seen at historical bottoms. This suggests the market may need to endure more intense panic selling to truly complete the bottoming process.

$74,000 Key Support and Three Scenarios

Lunde considers the $74,000 region as a critical support level. He believes that if this level is broken, it could accelerate the decline toward the late 2021 high near $69,000 or even further, toward the 200-week moving average around $58,000. This tiered support analysis provides a clear risk management framework: $74,000 is the first line of defense, $69,000 the second, and $58,000 the last.

“Over the past two years, Bitcoin’s returns have been nearly flat, and we believe long-term holders do not have an urgent need to sell,” Lunde said. “If the current support is broken, we will react quickly, but we do not expect a repeat of 2018 or 2022. Instead, we believe current prices are very attractive entry points for any long-term investor.”

This judgment is based on the logic of structural change. K33 believes that increasing institutional adoption, inflows into regulated products, and a looser interest rate environment make the current market fundamentally different from 2018 and 2022. Even if prices continue to decline, it is unlikely to see an 80% crash, because institutional buying at higher levels would provide support. This “structural bottom uplift” narrative offers confidence to long-term investors.

However, whether the market ultimately confirms K33’s view remains to be seen. If Bitcoin holds above $74,000 and rebounds, it will prove “this time is truly different.” Conversely, if it breaks below and continues downward below $50,000, the four-year cycle curse remains unbroken.

Related Articles

Here’s What $1,000 Invested in Bitcoin 3 Years Ago Is Worth Today

Kaiko Research: Bitcoin drops to $60,000 may mark the halfway point of the bear market process

Ethereum Super Bull? New Whale Opens 16,270 ETH Long - U.Today

Analysis: Bitcoin's "Mayer Multiple" indicator drops to 2022 levels, and the market may still have room to decline

Gray Scale: Bitcoin is more like tech stocks in the short term; overcoming volatility is necessary to become "digital gold"