Singlehood is Hell 5 Lee Sung-hoon earns $500,000 annually! Jump Trading quantitative trader background revealed

“Single Is Hell 5” contestant Samuel Lee’s background revealed. Graduated from UC Berkeley with a degree in Computer Science and Mathematics, he previously worked on Amazon Alexa AI and Google TensorFlow TPU teams. Currently a quantitative trader at Jump Trading, with an annual salary of approximately $500,000.

From UC Berkeley to Google: The Path of AI Elite Development

Samuel Lee graduated from the University of California, Berkeley, majoring in Computer Science and Mathematics. UC Berkeley is one of the world’s top computer science institutions, with its CS department leading in artificial intelligence, machine learning, and theoretical computer science. Graduating with a double major from this school demonstrates strong academic ability and a solid technical foundation.

He has interned as an AI research intern at the well-known consulting firm Accenture, worked on Amazon’s Alexa AI deep learning platform team, and interned at the well-known startup Snowflake. These experiences show he was recognized by top tech companies during his student years, able to stand out in highly competitive internship applications. Amazon’s Alexa AI team develops core algorithms for voice assistants, while Snowflake is a unicorn in cloud data warehousing. These internships provided him with valuable industry experience.

Even more impressive is his previous role at Google, working on expanding machine learning infrastructure and the TensorFlow TPU team. He contributed to the development of TensorFlow, a large-scale machine learning framework optimized for TPU/GPU acceleration. Google’s TPU (Tensor Processing Unit) is a chip designed specifically for AI computations, and TensorFlow is one of the most popular ML frameworks worldwide. Participating in such core infrastructure development indicates Lee’s top-tier technical skills.

Samuel Lee’s Career Path

Education: UC Berkeley, double major in Computer Science and Mathematics

Internships: Accenture AI researcher, Amazon Alexa AI, Snowflake

Previous Role: Google TensorFlow TPU team, involved in large model development

Current Role: Quantitative trader at Jump Trading, with an annual salary of about $500,000

Transitioning from Google’s AI infrastructure team to Jump Trading’s quantitative trading is not uncommon in Silicon Valley. Many top engineers gain experience at tech giants and are then headhunted with high salaries by fintech or quant trading firms. Companies like Jump Trading are willing to pay significantly above tech salaries to attract the best algorithm and AI talent, because in high-frequency trading and quantitative strategies, even tiny algorithmic advantages can translate into hundreds of millions of dollars in profit.

Jump Trading’s Key Role in the Crypto Sector

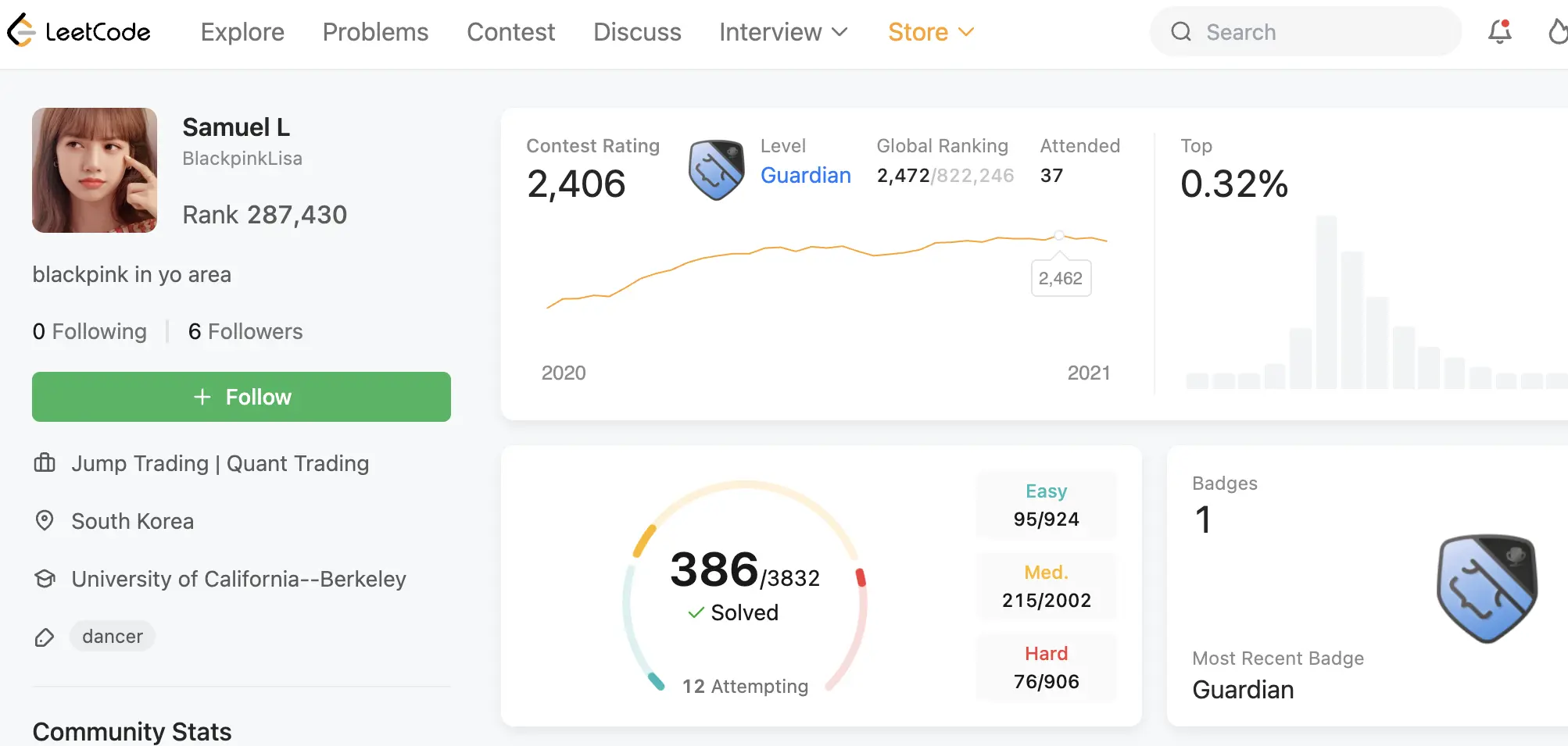

(Source: Leetcode)

He revealed he is a quantitative trader at a hedge fund in New York, which led to his Leetcode account being uncovered. It turns out his employer is Jump Trading, a firm well-known in the crypto community. Based on his background, his annual salary is likely around $500,000. Jump Trading is one of the top high-frequency trading and quantitative investment firms globally, holding a significant position in the cryptocurrency space.

Through its crypto division, Jump Crypto, the firm actively participates in market making, investing, and infrastructure development in crypto markets. It is a core market maker on several major exchanges, providing liquidity for Bitcoin, Ethereum, and other mainstream cryptocurrencies. During the 2021-2022 bull market, Jump Crypto invested in multiple DeFi and Layer1 projects, including Pyth Network and Wormhole cross-chain bridges.

However, Jump Trading has also been involved in controversies. During the Terra/Luna collapse in 2022, Jump Crypto attempted to stabilize the market but ultimately failed, suffering heavy losses. Additionally, in 2023, Jump Trading was investigated by US regulators for suspected market manipulation. Despite these issues, Jump Trading remains one of the most influential institutions in the crypto market, with significant trading volume and influence.

Quant traders at Jump Trading face highly challenging work. They develop and optimize trading algorithms, analyze market data to find arbitrage opportunities, manage risk and liquidity, and maintain the stability of high-frequency trading systems. This requires top mathematical skills, programming expertise, and a deep understanding of financial markets. While a $500,000 annual salary is impressive, in top-tier quant firms like Jump Trading, it is considered entry to mid-level; senior traders and strategy developers can earn millions annually.

Looking at his Leetcode profile, he has participated in 37 coding competitions, achieving a very high global ranking (Top 0.32%), with a contest rating of around 2,400 points (generally, a large company SWE rating of 1,800+ is already quite good). Leetcode is a primary platform for coding competitions and interview prep. Being in the top 0.32% globally means he ranks among the top few thousand out of millions of Leetcode users worldwide. A contest rating of 2,400 is extraordinary, typically only ACM-ICPC World Finals contestants or Google Code Jam high scorers reach that level.

The Trend of Top AI Talent Moving into Crypto Quantitative Industries

Samuel Lee’s career trajectory exemplifies a broader industry trend: top AI and engineering talent are shifting from tech giants to fintech and crypto quant firms. The main driver is salary disparity. At Google or Amazon, even senior AI engineers earn around $200,000–$400,000 annually (excluding stock and bonuses). In contrast, at Jump Trading and similar top quant firms, the same level of talent can command $500,000–$1,000,000, with top performers earning several million dollars in bonuses.

This salary premium is driven by the high profitability of quantitative trading. Firms like Jump Trading generate billions in annual profits through high-frequency trading and arbitrage strategies. They are willing to pay sky-high salaries to attract top talent because even tiny algorithmic advantages can yield enormous profits. A skilled quant trader’s developed strategy might bring in tens of millions of dollars annually, making a $500,000 salary a worthwhile investment.

More broadly, Lee’s case reflects the maturing and professionalization of the crypto industry. Early crypto markets were dominated by tech geeks and libertarians, but now more Wall Street and Silicon Valley elites are entering. These professionals bring traditional finance risk management techniques, quantitative models, and compliance experience, pushing crypto markets from a wild west era toward institutional maturity.

Three Main Motivations for Top AI Talent to Enter Crypto Quant

Salary Premium: Quant firms pay far more than tech giants; $500,000 is just the entry point

Technical Challenge: 24/7 trading, high volatility in crypto demands more sophisticated algorithms

Financial Freedom: High salaries combined with potential token rewards enable rapid wealth accumulation

However, this talent movement also raises concerns about technological innovation. When the best AI talent moves from Google’s TensorFlow team (driving AI progress) to Jump Trading’s trading desks (simply making money for the company), does society benefit? This is a question worth pondering. While financial engineering creates enormous private wealth, its contribution to society is far less than breakthroughs in AI or medical innovation. When top talent is attracted by high salaries to zero-sum financial markets rather than positive-sum technological innovation, it may be a societal loss.

For viewers of “Single Is Hell 5,” the exposure of Samuel Lee’s background adds a topical element. A $500,000-a-year UC Berkeley graduate who previously worked at Google as an AI elite—why participate in a dating reality show? The contrast itself is highly entertaining. For crypto industry insiders, this case offers an interesting perspective, showing outsiders the high salaries and attraction of crypto quant trading to top talent.