Only 2 Taiwanese legislators hold Bitcoin! Ge Rujun has 6 million, Liao Weixiang has 7.38 million

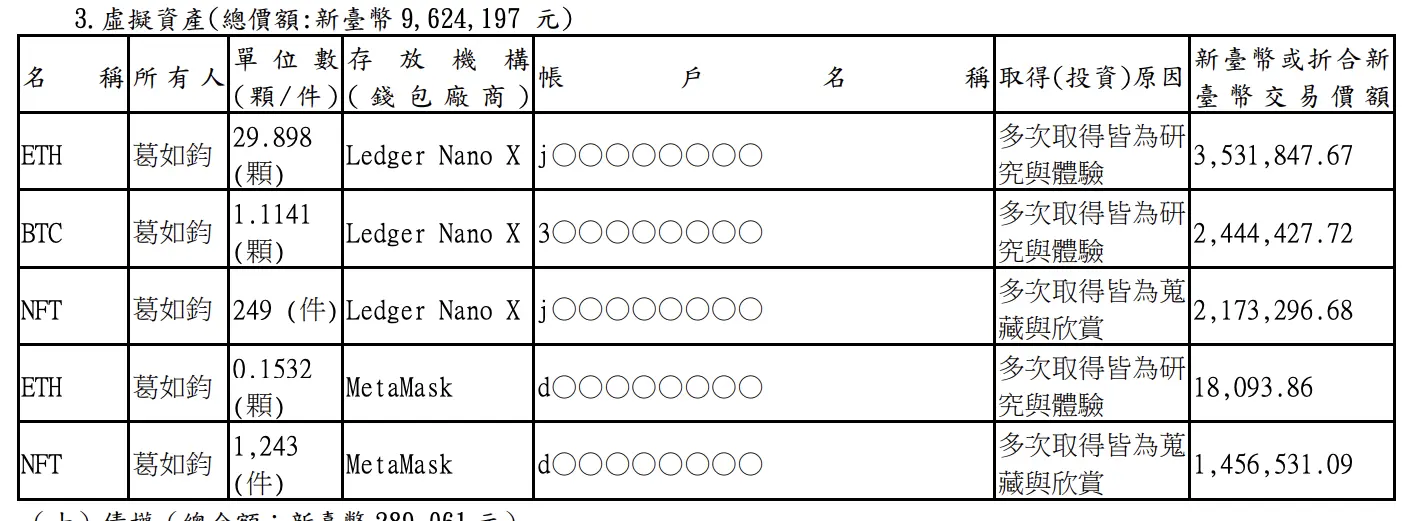

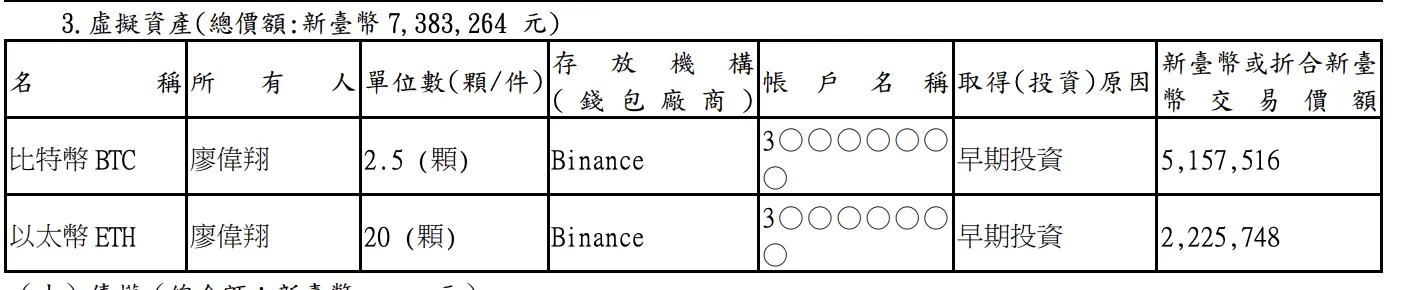

Only 2 Taiwanese legislators hold Bitcoin. 葛如鈞 has NT$9.62 million in virtual assets stored in a cold wallet. 廖偉翔 has NT$7.38 million stored on Binance. 葛如鈞 bought his first Bitcoin in 2014 for $600, while 廖偉翔 initially lost money through speculation in 2016, then shifted to long-term holding in 2018.

Only 2 out of 113 Taiwanese Legislators Hold Bitcoin

Legislator 葛如鈞 stated at the XREX Academy’s second anniversary event on February 1 that the internet will be filled with countless AI agents for booking tickets, working, and negotiations, which can directly automate small service payments between AI and AI using stablecoins and other virtual assets. As money becomes “softwareized,” the demand for microtransactions will showcase the strengths of stablecoins and cryptocurrencies, making traditional physical cash or bank transfers appear cumbersome and inefficient.

He also revealed that two Taiwanese legislators have declared holdings of Bitcoin, including himself, and hinted at the identity of the other. This disclosure immediately sparked discussions online, with netizens searching through legislator asset declarations to identify the other “crypto legislator.” Out of 113 seats in Taiwan’s 11th Legislative Yuan, only 2 legislators have declared Bitcoin holdings, less than 2%, reflecting Taiwan’s highly conservative stance toward crypto assets.

This conservatism is not without reason. Taiwan’s political culture demands high transparency of assets, and any potentially controversial holdings can become targets for political attacks. Cryptocurrencies are still viewed by some in Taiwanese society as speculative tools or even as a breeding ground for scams. Politicians holding large amounts of crypto assets may be accused of “speculation,” “neglecting duties,” or even “money laundering.” Under such public opinion, most legislators who privately hold crypto assets choose not to declare them publicly, instead holding through family members or avoiding them altogether.

葛如鈞 and 廖偉翔’s willingness to publicly declare their holdings demonstrates their confidence in crypto assets and their lack of concern over public scrutiny. 葛如鈞, with a background in technology, aligns with the “tech innovation supporter” persona. Although 廖偉翔 comes from a traditional political party, his public declaration also shows a certain openness and foresight. Their presence provides concrete examples and policy advocates for the discussion of crypto assets within Taiwan’s political sphere.

International Comparison of Legislator Crypto Holdings

Taiwan: 2 out of 113 legislators (~1.77%)

USA: Several members of Congress openly hold crypto or promote crypto legislation

El Salvador: President actively promotes Bitcoin as legal tender

South Korea: Multiple lawmakers hold crypto and promote crypto-friendly policies

葛如鈞: The Journey of Faith Starting with $600

葛如鈞 revealed that in 2014, while studying at Singularity University in Silicon Valley, he bought his first Bitcoin for $600 through a friend who was an engineer at NASA. Two weeks later, Bitcoin dropped to $200, but he chose to hold on, witnessing the growth trajectory of blockchain technology.

This experience is highly inspiring. Buying at $600 and seeing the price fall to $200, resulting in a paper loss of over 66%, is a significant psychological challenge for any investor. Most would sell to cut losses, but 葛如鈞 chose to hold. His persistence stems from a deep understanding of Bitcoin’s technological logic and a firm belief in its long-term value. As a tech scholar, he sees not short-term price fluctuations but the revolutionary potential of blockchain to transform the financial system.

From 2014’s $600 to the 2021 high of $69,000, 葛如鈞’s Bitcoin investment has yielded over 115 times returns. Even at the current price of around $60,000, the return remains at 100 times. This astonishing return demonstrates the value of long-term holding and technological faith. However, 葛如鈞 has not sold all at the peak; he still holds 1.1141 BTC, indicating his continued optimism about Bitcoin’s long-term prospects.

According to public asset declarations, 葛如鈞’s total declared virtual assets amount to NT$9.62 million, including 30.15 ETH and 1.1141 BTC. Most are stored in cold wallets, valued at about NT$5.99 million at the time of declaration. If calculated at current prices (1 BTC=NT$2,410,978, 1 ETH=NT$71,942), the total would be about NT$4.85 million, a decrease of roughly 19%. He also owns 1,492 NFTs, with a declared total value of about NT$3.63 million.

葛如鈞 stores most of his assets in cold wallets, reflecting a focus on security. Cold wallets are offline hardware devices that cannot be hacked remotely, making them the safest way to store large amounts of crypto assets. This choice also indicates a long-term holding strategy; short-term traders typically keep assets on exchanges for quick buying and selling.

廖偉翔: From Speculation to Value Investing

“Chain News” traced another legislator, 廖偉翔. Unlike 葛如鈞, who approaches from a tech perspective, 廖偉翔’s crypto journey is closer to that of an average investor. He admitted in an interview that around 2016, influenced by friends in the startup scene, he first encountered virtual currencies. Initially, he was highly speculative, “entering, losing money, rushing to sell,” even trying contract trading and experiencing liquidation, which led him to distance himself from high-risk operations.

The turning point came in 2018. 廖偉翔 began systematically studying the crypto market, reading analyses from blockchain data analytics firm Glassnode and Ark Invest, founded by Cathie Wood, and started writing his own analyses. He gradually shifted to long-term holding of spot assets, using “fundamentals” and “market sentiment” as his main criteria. This transition from speculation to value investing is common among successful crypto investors.

In his asset declaration, 廖偉翔 disclosed holdings of about 2.5 Bitcoin and 20 Ethereum, with an estimated total market value of NT$7.38 million at the time of declaration. Unlike 葛如鈞, he stores his crypto on Binance, reflecting different risk preferences and usage habits. Holding on an exchange allows for immediate trading and adjustments but carries risks of exchange failure or hacking (such as the FTX collapse).

廖偉翔’s asset structure is also notable. With 2.5 BTC versus 20 ETH, the current price ratio is roughly 2:1, indicating a primary focus on Bitcoin as the main investment, with Ethereum as a complement. This aligns with many institutional investors’ strategies, viewing Bitcoin as “digital gold” for stability and Ethereum as a platform for growth through smart contracts.

Differences in Holdings: 葛如鈞 vs 廖偉翔

Amount: 葛如鈞 NT$9.62 million vs 廖偉翔 NT$7.38 million

Storage: 葛如鈞 Cold Wallet (security first) vs 廖偉翔 Binance (convenience first)

Path: 葛如鈞 Tech Faith and Long-term Holding vs 廖偉翔 Speculation to Value Investment

Assets: 葛如鈞 owns 1,492 NFTs vs 廖偉翔 only spot holdings

The investment paths of these two legislators represent two typical routes for crypto investors. 葛如鈞 embodies “tech believers,” understanding blockchain’s revolutionary potential from a technical perspective, enabling him to hold firmly during price crashes. 廖偉翔 exemplifies “investment reformers,” who, after experiencing speculative failures, learn and research to find suitable investment methods. Despite different approaches, both conclude that long-term holding and risk management are key to success in crypto investing.

For Taiwanese society, the presence of these two legislators has significant symbolic meaning. It shows that crypto assets have entered mainstream consciousness and are no longer underground or gray markets. When public representatives are willing to declare Bitcoin holdings openly, it provides a certain legitimacy to crypto assets. This may encourage more rational views on crypto investment, moving away from the perception of scams or speculation.

Related Articles

Analyst: Macro Expansion and Fed Rate Cuts Could Drive Bitcoin to New Highs in 2026

Binance Buys 4,225 BTC for SAFU Fund in $300M Asset Conversion

If Bitcoin drops below $66,000, the total liquidation strength of long positions on mainstream CEXs will reach 538 million.