BitMine Buys the Dip Against the Trend! Sweeps $83 million worth of ETH in a single day to become the largest corporate holder

BitMine holds 4.326 million ETH, accounting for 3.6% of the circulating supply, making it the largest corporate holder. On-chain data shows a single-day purchase of 40,000 ETH worth $83.4 million on Monday. Tom Lee states that Ethereum’s price does not reflect its utility, with nearly 2.9 million ETH staked.

4.32 Million ETH Holdings: BitMine Controls 3.6% of Circulating Supply

BitMine Immersion Technologies owns 4.326 million ETH, approximately 3.6% of ETH’s circulating supply. In a recent press release, BitMine, chaired by Tom Lee, disclosed that its holdings solidify its position as the known largest corporate Ethereum holder. Along with Bitcoin and cash reserves, BitMine’s total crypto and cash holdings are valued at about $10 billion.

A 3.6% share of circulating supply is an extremely significant figure. With current circulating ETH around 120 million, 4.326 million ETH means BitMine controls over 1/27 of the market’s ETH. Such concentration is rare among corporate holdings. By comparison, MicroStrategy holds about 500,000 BTC, roughly 2.5% of the 20 million BTC circulating supply. BitMine’s control over the Ethereum market surpasses MicroStrategy’s influence over Bitcoin.

From a market impact perspective, when a single entity controls 3.6% of circulating supply, its buying and selling decisions can have systemic effects on the price. If BitMine were to sell large quantities, the market might struggle to absorb such volume without a price crash. Conversely, its ongoing purchases provide structural support to ETH’s price, reducing available tradable supply and increasing scarcity.

With a total holding of $10 billion, BitMine ranks among top enterprise crypto holders. This scale exceeds the total assets of many professional crypto funds and hedge funds. Not only is BitMine the largest corporate ETH holder, but its overall crypto asset size also places it among industry leaders. This financial strength grants it market influence and pricing power.

BitMine’s holdings are also noteworthy for their diversification. The company owns ETH, Bitcoin, and cash reserves, reducing risk from single-asset volatility. However, ETH remains its core allocation—at current prices around $2,300, 4.326 million ETH is valued at approximately $99.5 billion, constituting the majority of its assets. This concentration demonstrates strong confidence in Ethereum.

$83.4 Million Daily Buy: Tom Lee’s Contrarian Accumulation Logic

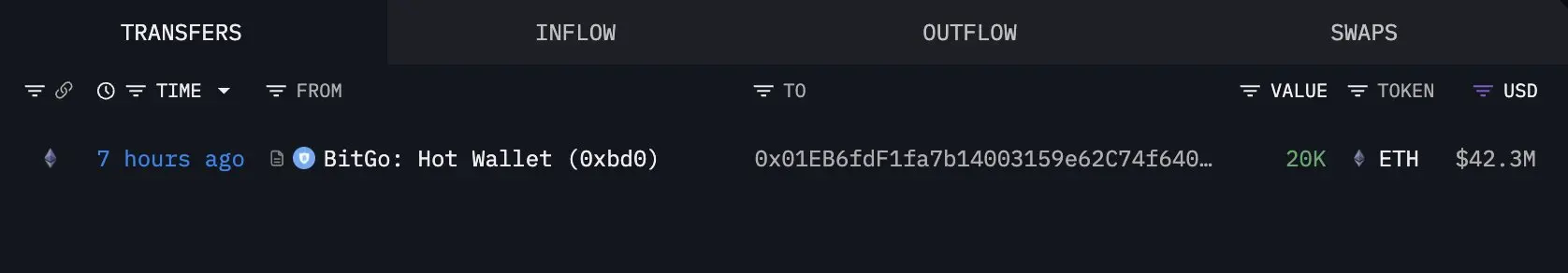

(Source: Arkham)

On-chain data flagged by Lookonchain shows that BitMine significantly increased its holdings on Monday. According to analysis accounts, the company purchased 20,000 ETH worth about $42.3 million from BitGo, having previously bought the same amount. Lookonchain tweeted: “Tom Lee (@fundstrat)’s BitMine appears to have bought 20,000 ETH (worth $42.3 million) from BitGo about 7 hours ago. Today alone, it has purchased 40,000 ETH (worth $83.4 million).”

An $83.4 million purchase in a single day is rare among institutional investors. This volume of 40,000 ETH, with Ethereum’s daily trading volume around $15 billion, accounts for about 0.56% of daily volume. While seemingly small, most trading volume is driven by high-frequency trading and arbitrage; actual directional buying is much less. BitMine’s $83.4 million likely represents 5-10% of true net buying that day, exerting notable influence on the price.

The timing of the buy is particularly striking. Monday’s ETH price experienced a deep correction amid extreme market pessimism. Making such a large purchase in this environment requires strong conviction and discipline. Tom Lee, Chairman of BitMine, states: “Given the strong fundamentals of Ethereum, we see this correction as attractive, so BitMine has been steadily accumulating ETH. We believe ETH’s price does not reflect its high utility and its role in future finance.”

Tom Lee is a well-known Wall Street crypto bull, founder of research firm Fundstrat Global Advisors, with a long-term bullish outlook on Bitcoin and Ethereum. His reputation and research credibility add weight to BitMine’s investment decisions. Lee believes Ethereum’s role as a smart contract platform, its expanding DeFi ecosystem, and upcoming upgrades support its long-term value. The current price weakness is seen as a short-term market sentiment issue, not a fundamental deterioration.

Three Strategic Reasons for BitMine’s Daily Purchases

Buying the dip in panic: Capitalizing on market pessimism to lower average cost

Gradual accumulation strategy: Two purchases of 20,000 ETH each reflect planned, disciplined buying rather than impulsive moves

Advantage of BitGo’s institutional platform: Ensuring security and compliance through trusted custody

From a trading execution perspective, purchasing ETH via BitGo underscores a focus on security and compliance. BitGo is a leading digital asset custodian offering multi-signature wallets, cold storage, and insurance. Transactions through BitGo mean the ETH is protected at an institutional level from the start, reducing theft and loss risks.

290,000 ETH Staked: Long-term Yield Strategy

BitMine reports that nearly 2.9 million ETH are currently staked, generating yield through its expanding Ethereum infrastructure operations. The company emphasizes that its ETH-centric strategy aims at long-term value creation rather than short-term price speculation. The 2.9 million ETH staked represent about 67% of its total holdings, indicating it is a long-term investor rather than a short-term trader.

Since Ethereum’s Beacon Chain launched in December 2020, staking has become a key income source for ETH holders. Stakers lock ETH into validator nodes, securing the network and earning staking rewards. The current annualized staking yield is around 3-4%, meaning BitMine’s 2.9 million staked ETH can generate approximately 87,000 to 116,000 ETH annually in passive income, valued at roughly $2-2.7 billion at current prices.

Staking also locks liquidity. While technically unstaking is possible, it involves waiting days for unbonding, and large-scale unstaking can signal market sentiment. By staking 67% of its holdings, BitMine signals a commitment that these ETH will not be sold in the short term, providing price stability support.

Chairman Tom Lee describes recent price weakness as an opportunity, citing Ethereum’s rapid rebound after sharp declines and noting staking yields as an additional return. This “price appreciation + staking yield” dual-reward model enhances the risk-reward profile of ETH investments. Even during sideways price action, staking rewards accumulate, lowering effective holding costs.

Tactically, BitMine’s large-scale buying during dips and immediate staking exemplify a “DCA (dollar-cost averaging) + staking” approach. This smooths purchase costs and avoids trying to time bottoms. Staking yields also provide cash flow for reinvestment or operational expenses.

Despite overall crypto market risk-off sentiment, ETH struggles to regain upward momentum. Nonetheless, BitMine’s consistent buying underscores increasing institutional interest in ETH as a reserve asset, even amid short-term price uncertainty. This institutional-level conviction offers confidence to retail investors.

BitMine’s Ethereum Thesis: Infrastructure for Future Finance

Tom Lee’s core argument is: “Ethereum’s price does not reflect its high utility and its role as future financial infrastructure.” This challenges the market’s current valuation. Lee sees ETH not just as a speculative token but as the foundational layer of global digital finance.

As the largest smart contract platform, Ethereum supports a DeFi ecosystem valued over $100 billion. From decentralized exchanges (Uniswap, Curve) to lending protocols (Aave, Compound), stablecoin issuance (USDC, DAI), and NFT marketplaces (OpenSea), nearly all major crypto applications are built on or compatible with Ethereum. The depth and breadth of this ecosystem are unmatched by other blockchains.

Furthermore, Ethereum is becoming the preferred platform for tokenizing traditional assets. Major financial firms like BlackRock and Fidelity are launching tokenized funds on Ethereum. As RWA (real-world asset) tokenization accelerates, Ethereum’s value as the “future financial backbone” will become more apparent. Lee’s thesis is rooted in this long-term vision.

Related Articles

Hong Kong Virtual Asset Regulation: Three Arrow Measures Announced! Margin, Perpetual Contracts, and Market Makers to be Opened

Hyperliquid's largest ETH long position increased by 5,000 ETH, with an overall unrealized loss of $10.43 million.

Ethereum Co-Founder Vitalik Buterin Sells 2,961 ETH Over Three Days for Planned Initiatives

Arkham: Trend Research's final loss on ETH in this round is $869 million

Buy more as it dips! Ethereum falls below the ETF entry price, with whales contrarily accumulating 40,000 coins