Cryptocurrency mining machine Canaan's revenue hits a three-year high! However, the stock price plummets and faces delisting

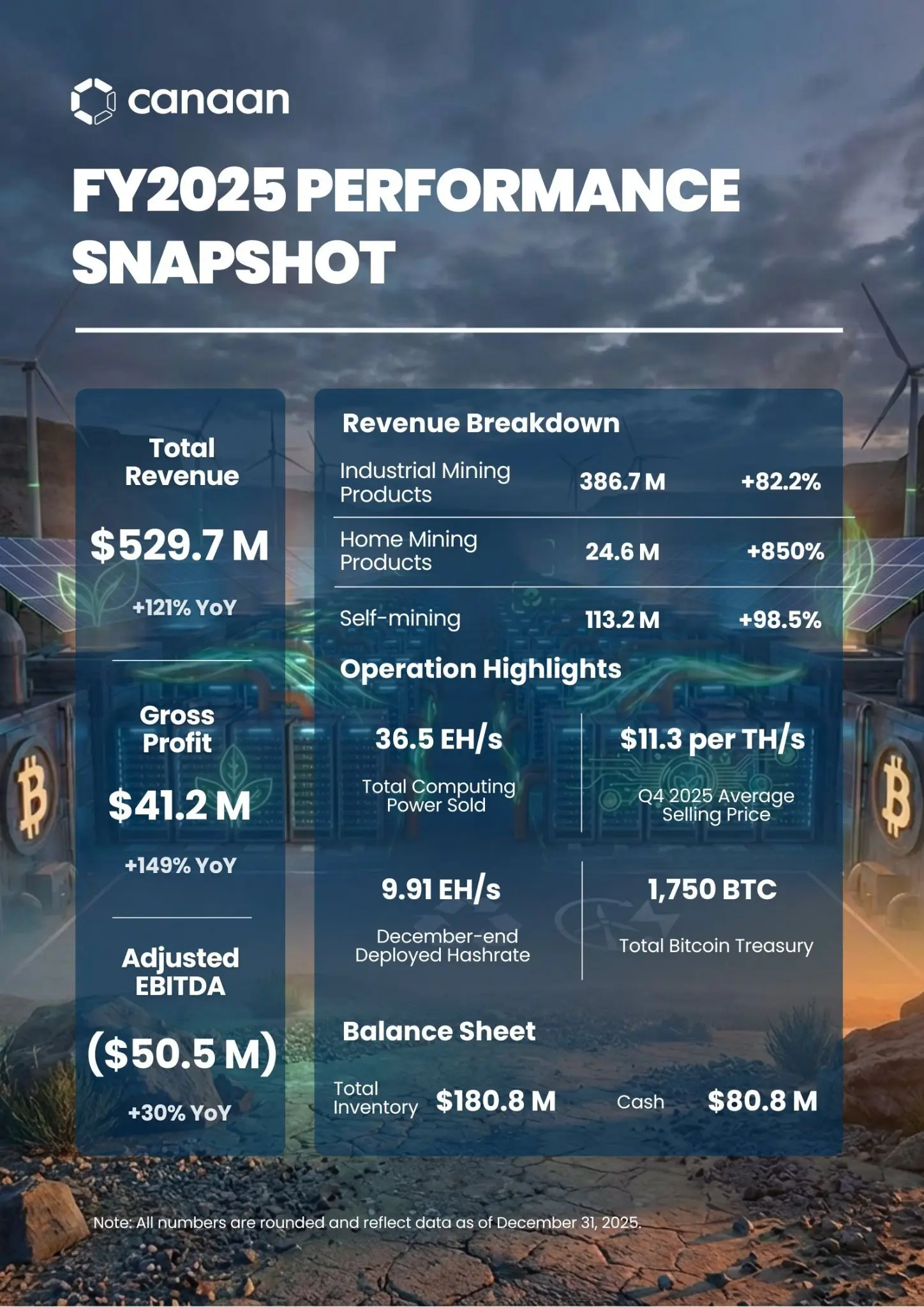

Cryptocurrency mining hardware manufacturer Canaan’s Q4 revenue surged 121% to $196.3 million, reaching a three-year high, but its stock price fell 6.9% to $0.56. Bitcoin-related income increased 98.5%, with reserves of 1,750 BTC valued at nearly $120 million. Hashrate delivered reached a record 14.6 EH/s. Nasdaq warned that the stock must close above $1 for 10 consecutive days before July 13, or it will be delisted.

Contradiction: Revenue Soars 121% but Stock Crashes

(Source: Canaan)

Despite the cryptocurrency mining hardware manufacturer Canaan announcing on Tuesday that its Q4 revenue increased 121.1% year-over-year to $196.3 million—mainly driven by hardware sales growth and improved mining performance—its stock still declined 6.9% on Nasdaq. This extreme contradiction of “performance surging, stock price collapsing” is rare in capital markets and suggests underlying deep reasons.

This quarter’s revenue was the highest in three years for Canaan, also benefiting from Bitcoin mining machine sales, with the company delivering a record 14.6 EH/s of computing power in the quarter. Canaan stated that the sales of computing power were boosted by a “milestone order” from an American institutional miner, helping set a new quarterly record and achieving 60% year-over-year growth.

Canaan reported Bitcoin mining revenue up 98.5% YoY to $30.4 million, helping its Bitcoin reserves reach a record 1,750 BTC, worth nearly $120 million; simultaneously, the company increased its Ethereum holdings to $39.507 million. In terms of mining, the Singapore-based company said its installed hash rate has expanded to 9.91 EH/s, with operational hash rate for the quarter at 7.65 EH/s.

Highlights from Canaan Q4 Financials

Revenue: $196.3 million (up 121.1% YoY), highest in three years

Bitcoin mining income: $30.4 million (up 98.5% YoY)

Hashrate delivered: 14.6 EH/s (record)

Bitcoin reserves: 1,750 BTC (worth $120 million)

Under normal circumstances, these figures should have driven the stock price higher, but the opposite happened. Possible reasons include: investors losing confidence in the long-term prospects of the mining industry, concerns that Q4’s strong performance is unsustainable, and most critically, delisting risks deterring investors. When a stock faces potential delisting, even excellent results often lead to institutional selling, as their investment policies typically prohibit holding delist-threatened stocks.

0.56 vs 1.00 USD: The 180-Day Deadline

The stock currently trades at $0.56, down 18.1% this year and 70.2% over the past 12 months. According to Google Finance data, Canaan (CAN) fell another 6.87% to $0.56, ranking among the worst performers of the top 15 Bitcoin miners by market cap. On Tuesday, the stock dropped to $0.56, still far from the $1 target it must reach before July, or it risks being delisted from Nasdaq.

On January 16, Canaan announced receiving a letter from Nasdaq warning that the company must raise its stock price above $1 to comply with the exchange’s minimum bid price rule, or face delisting. Nasdaq gave the Singapore-based company 180 days, until July 13, to regain compliance. The rule requires the stock to close at or above $1 for at least 10 consecutive trading days. The last time Canaan closed above $1 was November 28, 2025.

Rising from $0.56 to $1.00 requires approximately a 79% increase, a challenging feat in five months. For a company with solid performance, such a rally in a bull market is not impossible. But with the overall crypto market depressed—Bitcoin dropping from 126,000 to 69,000—the demand for mining equipment and mining revenues are under pressure. In this environment, nearly doubling the stock price in a short period would require a strong catalyst.

Potential rescue measures include: a reverse stock split (e.g., 1-for-5 split, boosting the share price to about $2.80), but this dilutes existing shareholders; share buybacks to push up the price, which require substantial cash and uncertain effects; or attracting large institutional buying, though the delisting risk itself deters institutions. This “death spiral” makes Canaan’s situation extremely precarious.

Bitcoin Hashrate Decline: A Fatal Blow to Miners

As miners shut down unprofitable machines and shift toward AI and high-performance computing, Bitcoin network hashrate has fallen from a record 1,150 EH/s in mid-October to 980 EH/s. This systemic decline in hashrate is a core reason behind Canaan’s stock plunge. Even with strong financials, if the entire mining industry is shrinking, the outlook remains bleak.

Bitcoin’s price has dropped from 126,000 to 69,000, a roughly 45% decline, severely reducing mining profitability. At current prices, many miners are operating at or below break-even. Older models like the S19 Pro are losing money on electricity costs and are being shut down. Even newer models like the S21 have razor-thin margins. In this environment, demand for new mining machines and capital expenditure to expand capacity have plummeted.

More critically, the shift of miners toward AI is accelerating. When mining becomes unprofitable, some miners are leasing out their power contracts and data center space to AI data centers, transforming their business models. Major miners like Hut 8 and Core Scientific pivoting to AI could cause companies like Canaan to lose key customers.

Canaan’s strong Q4 performance may reflect more of a “last hurrah” than sustainable growth. The “milestone order” from a US institutional miner might be a final large-scale purchase before transitioning to AI, or a speculative bottom-fishing buy betting on Bitcoin rebound. Such one-off orders do not guarantee ongoing demand; future quarters may see significant order declines.

For investors, Canaan exemplifies a “value trap.” On the surface, its valuation appears extremely low (market cap only a few hundred million, P/E possibly single digits), and financials are decent, seeming like a bargain. But industry contraction, imminent delisting risk, uncertain future orders—these factors make it highly risky. Only highly risk-tolerant speculators might consider it; typical investors should steer clear of this “cheap junk stock.”

Related Articles

Former PayPal President Drops a Big Statement: Bitcoin Is Better Than Gold

Bitcoin ETF capital inflow slows down, with the main reason being the narrowing of the basis

Bitcoin drops below $67,000 as hawkish Federal Reserve expectations pressure the crypto market