ZRO defies the trend and surges! Price skyrockets 22% in a single day, trading volume soars by 410%

LayerZero Launches Zero Blockchain, ZRO Surges 22% Against the Market to $2.42, a Four-Month High. Zero Achieves 2 Million Transactions Per Second at a Cost of $0.000001. Citadel and ARK Strategically Buy, Trading Volume Soars 410%. Tether, DTCC, ICE, and Google Cloud Explore Collaboration Applications.

Institutional Support Drives ZRO to Jump 22% Against the Market

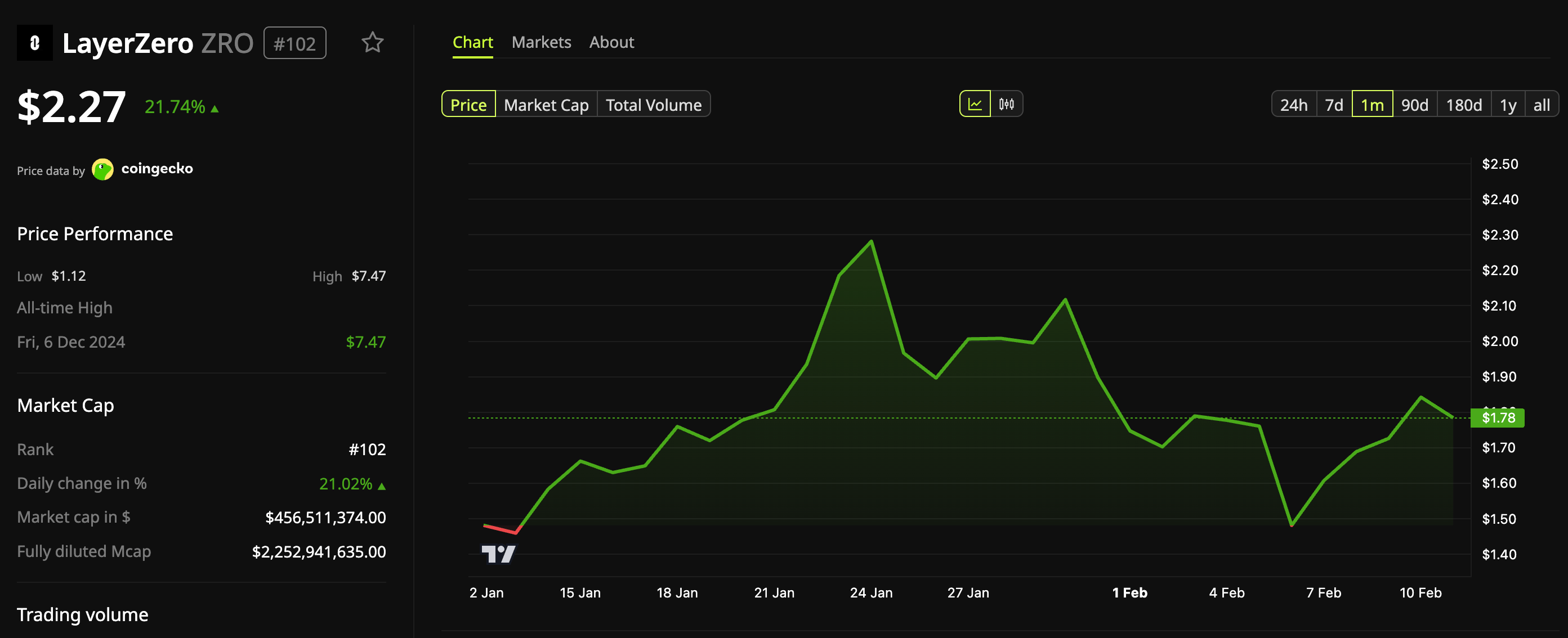

(Source: BeInCrypto Markets)

Data shows that after losing $19 billion in market capitalization yesterday, the cryptocurrency market continued its decline today. Over the past 24 hours, total market cap has fallen more than 2%, reflecting ongoing risk-off sentiment in major digital asset markets. Despite the overall market correction, some altcoins have risen against the trend, with ZRO being one of them.

During Asian morning trading hours, ZRO briefly rose to a daily high of $2.42 on Binance. The last time this level appeared was in early October 2025. At press time, ZRO was trading at $2.27, up nearly 22% from the previous day. The token ranks third among the top 300 daily gainers on CoinGecko. Trading activity has also increased significantly, with 24-hour trading volume reaching $491 million, a rise of 410.60%.

This contrarian performance is extremely rare. When the overall market drops 2%, individual tokens rising 22% implies a relative increase of 24 percentage points. Such strong relative performance usually occurs under conditions such as major positive news, large institutional buy-ins, or technical breakthroughs of key resistance levels. ZRO’s case combines all three: LayerZero’s launch of the Zero blockchain provides a fundamental catalyst, Citadel and ARK’s purchases offer capital backing, and the $2.42 level breaks through the upper boundary of previous consolidation.

This rally stems from LayerZero launching a new blockchain supported by Citadel Securities and ARK Invest. Both firms have made strategic investments by purchasing ZRO. Citadel Securities is one of the world’s largest market makers, handling over 25% of US stock trading volume. ARK Invest, led by Cathie Wood, is a well-known tech-focused investment firm famous for heavy holdings in disruptive companies like Tesla and Coinbase. Their simultaneous bets on ZRO lend significant weight to the project.

From an institutional investment perspective, Citadel and ARK’s involvement is noteworthy. They are not only financial investors but have also established strategic partnerships with LayerZero. Citadel is evaluating Zero’s potential applications in trading, clearing, and settlement workflows, indicating ZRO could enter core infrastructure of traditional finance. Cathie Wood will join the project’s advisory board, providing strategic guidance and market insights.

Zero Blockchain: A Technical Breakthrough of 2 Million TPS

LayerZero Labs’ Zero is a new blockchain network designed to address long-standing scalability issues in decentralized systems. According to the company, Zero introduces a heterogeneous architecture that separates transaction execution from validation using zero-knowledge proofs, eliminating the need for replication.

Traditional blockchains face scalability bottlenecks because each node must replicate and verify all transactions. Ethereum currently processes about 15-30 transactions per second, while Solana theoretically reaches 65,000 TPS but often slows down due to network congestion. Zero’s heterogeneous architecture separates transaction execution and validation into different layers: the execution layer focuses on fast processing, while the validation layer uses zero-knowledge proofs to ensure correctness.

LayerZero claims that each region of the network can scale to 2 million transactions per second, with transaction costs as low as $0.000001. Achieving 2 million TPS is extraordinary, potentially making Zero the fastest blockchain in the world in theory. For comparison, Visa’s peak capacity is around 65,000 TPS. If Zero can truly deliver on these performance claims, it could handle all global financial transactions.

The transaction cost of $0.000001 is also revolutionary. Ethereum’s gas fees during congestion can reach dozens of dollars, even Layer-2 solutions typically cost between $0.01 and $0.1. Zero’s low cost could enable micro-payments, unlocking numerous new applications such as high-frequency microtransactions between AI agents, pay-per-read content, and machine-to-machine payments in IoT.

The blockchain is scheduled to launch in fall 2026. With about 6-8 months from now (February to fall), LayerZero will conduct testnet operations, security audits, and ecosystem preparations. For ZRO holders, this period is critical for managing expectations. If testing proceeds smoothly and mainnet launches on schedule, ZRO could continue to rise. Conversely, technical issues or delays could quickly reverse market sentiment.

Three Major Technological Innovations of Zero Blockchain

Heterogeneous Architecture: Separates transaction execution from validation, increasing efficiency by eliminating node replication

Zero-Knowledge Proofs: Ensures transaction correctness while protecting privacy and reducing validation costs

Regional Scalability: Each region independently scales to 2 million TPS, with total capacity potentially unlimited

LayerZero Labs CEO Bryan Pellegrino states: “Zero’s architecture pushes the industry roadmap forward by at least ten years. We believe this technology can truly bring the entire global economy on-chain. Our mission is to build permissionless infrastructure for a better world—and this is just the beginning.” While this grand vision is ambitious, it still requires validation through actual performance.

Deep Logic Behind Citadel and ARK’s Strategic Deployment

As part of the promotion plan, Citadel Securities is collaborating with LayerZero to evaluate potential applications in trading, clearing, and settlement workflows. The firm has also made strategic investments in ZRO. Citadel’s involvement is highly significant, as it is a core player in global financial markets. If Zero is adopted into Citadel’s trading processes, it would validate blockchain’s feasibility in high-frequency trading and financial clearing.

ARK Invest will also become a stakeholder in LayerZero, having purchased ZRO. Cathie Wood will join the project’s advisory board. Known as the “Queen of Disruptive Innovation,” Wood’s portfolio includes Tesla, SpaceX, Coinbase, and other transformative companies. Her participation brings not only capital but also strategic vision and market influence.

The announcement states: “ZRO is the network’s token, and LayerZero will provide interoperability between regions and over 165 connected blockchains.” This positioning reveals ZRO’s value capture logic. Every cross-chain transaction executed via LayerZero protocol requires ZRO as a fee. As the Zero blockchain launches and more blockchains connect, cross-chain transaction volume will grow, increasing demand for ZRO.

This development is also closely linked to Tether’s strategic investment through its investment arm Tether Investments. As the world’s largest stablecoin issuer, Tether’s investment decisions are typically long-term. Tether’s optimism about LayerZero likely stems from its cross-chain interoperability supporting USDT’s multi-chain deployment. Thus, strategic capital and institutional cooperation seem to have sparked investor interest in ZRO, even amid ongoing market sell-offs.

DTCC, ICE, and Google Cloud Explore Collaboration

Beyond investments, LayerZero states it is working with the Depository Trust & Clearing Corporation (DTCC) to explore improving tokenized securities infrastructure, including scalability enhancements for its DTC tokenization services. DTCC is a core infrastructure for the US financial markets, handling nearly all US securities’ clearing and settlement. Its exploration of Zero suggests blockchain technology could penetrate the most critical segments of traditional securities markets.

Intercontinental Exchange (ICE), operator of the NYSE, is researching potential applications involving 24/7 trading and tokenized collateral integration. ICE is one of the world’s largest exchange operators, including NYSE and ICE Futures. Their interest indicates traditional exchanges are seriously evaluating blockchain’s potential to improve trading efficiency and expand trading hours.

Google Cloud is also collaborating with LayerZero to explore infrastructure enabling AI agents to autonomously perform micro-payments. This forward-looking initiative aligns with the rapid rise of AI agent economies, where high-frequency microtransactions are essential. Zero’s low cost and high throughput make it an ideal foundation for AI-driven payment infrastructure.

Overall, the cooperation with DTCC, ICE, and Google Cloud spans traditional finance, exchanges, and cloud computing, providing strong institutional backing for ZRO’s long-term value.

Related Articles

TerraFlow TOF Blind Box launches globally on February 12, 2026: Computing power assetization, Web3 enters the era of engineering value

Has Shytoshi Kusama Finally Abandoned Shiba Inu for Another Project?

Polymarket faces regulatory crackdown but continues to expand! In March, it partnered with Kaito to launch the Attention Market

Bank of Malaysia tests stablecoin in 2026! Standard Chartered and Maybank explore linking the Ringgit to the blockchain

Spark推出Spark Prime和Spark Institutional,为对冲基金等机构提供借贷服务

Spark bridges the gap between DeFi and TradFi, with $9 billion in stablecoin liquidity directly connected to institutional capital